Vishnu: 1953) Many people think of the Cardano and Polkadot blockchains as Ethereum Killers, but little do they know that Cardano could’ve been the one, but is not efficient, and according to some rumours it also has incomplete smart contracts. Whereas, Polkadot is a completely different blockchain. So to help us understand better, here’s a brief Cardano vs Polkadot comparison:

| Characteristics | Cardano | Polkadot |

|---|---|---|

| Token | ADA | DOT |

| Created by | Charles Hoskinson | Gavin Wood |

| Year of Emergence | 2015 | 2017 |

| Transactions per second | 257 | 164 |

| Layers of Processing | Two-layered | Single layered |

Table of Contents

What is Cardano?

Cardano (ADA) is an open-source blockchain with a proof of stake consensus algorithm. Ethereum co-founder Charles Hoskinson announced it as a blockchain that outperforms Ethereum’s proof of work (PoW) technique. Created back in September 2015, this blockchain is built around peer-reviewed papers such as Hydra. Cardano mines blocks with Ouroboros. It is an algorithm that employs the Proof of Stake protocol.

What is Polkadot?

Polkadot bills itself as the next-generation blockchain protocol. With the ability to link numerous specialized chains into a single global network. Known as DOT, it serves as the network token, and Polkadot is a project of the Web3 Foundation, which is led by Gavin Wood, to disrupt internet monopolies and empower individual users. Polkadot is predicted to be able to manage over 1,000,000 TPS once fully operational.

Cardano vs Polkadot: Working

How does Cardano work?

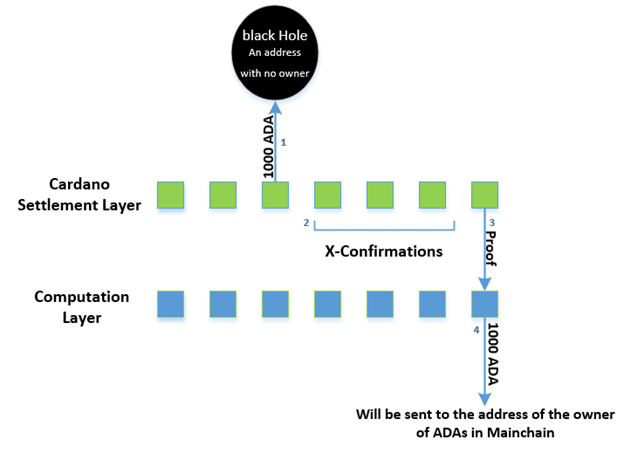

Cardano is built in two layers, one of which is the Ledger of Account Values, and the other is the Reason why values transfer from one account to another. This split allows the platform’s smart contracts to be flexibly designed. It also gives users the option of customizing any contract’s appearance, privacy, and execution to meet their individual needs better.

1. Cardano Settlement Layer (CSL)

CSL is the first layer of Cardano architecture where peer-to-peer transactions like token transfers between users are handled. It is in charge of the chain’s security, serves as a launchpad for smart contracts, and serves as a regulatory compliance framework for various jurisdictions.

Plutus and Marlowe are two specific scripting languages used by the CSL to move value and improve compatibility for the overlay network protocol. Cardano uses the Ouroboros consensus method, which is different from prior blockchain generations.

2. Cardano Computation Layer (CCL)

The Cardano Computation Layer assists Cardano in replicating the Rootstock smart contract platform from the Bitcoin ecosystem. The decision to deploy CCL was based on its capacity to help scale specific protocols over time. As technology progresses, this entails adding hardware security modules (HSM) to the existing stack of protocols.

Solidity, the programming language powering Ethereum Smart Contracts, is supported by the CCL for low-security applications on the platform. Because the CCL and CSL are separated, smart contracts can execute independently without worrying about transaction verification. Furthermore, this allows different users to establish various conditions for the transaction assessment.

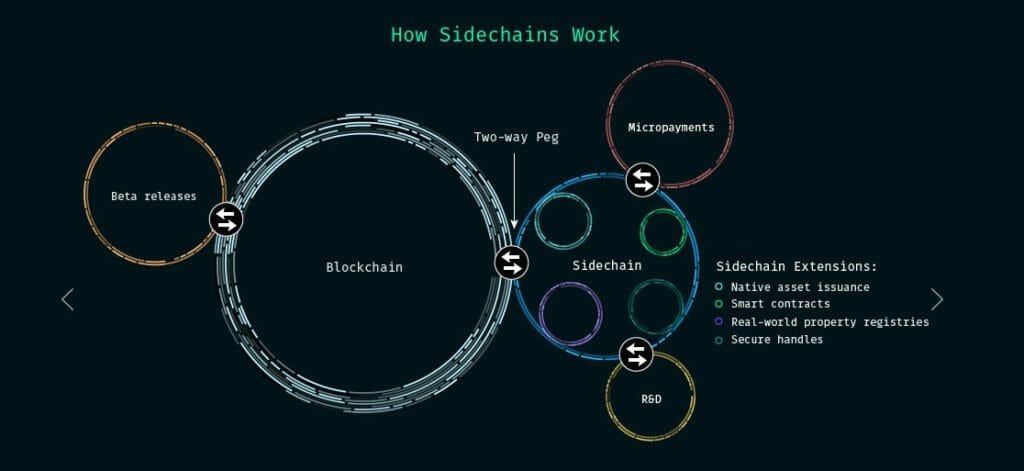

3. KMZ side chains

The KMZ sidechain protocol easily allows people to bridge Cardano and other cryptocurrencies or convert them to other similar blockchains. This protocol enables ledgers to interact with the CSL in compliance with specific regulatory standards without having to share sensitive data.

This research-based framework underpins each of Cardano’s development phases, combining peer-reviewed ideas with evidence-based methodologies. This study lays a solid platform for building the blockchain network’s and the ADA token’s futures. Secure fund transfers from the CSL to any CCL or blockchain that uses the KMZ sidechain protocol are possible thanks to the KMZ sidechain protocol.

How does Polkadot work?

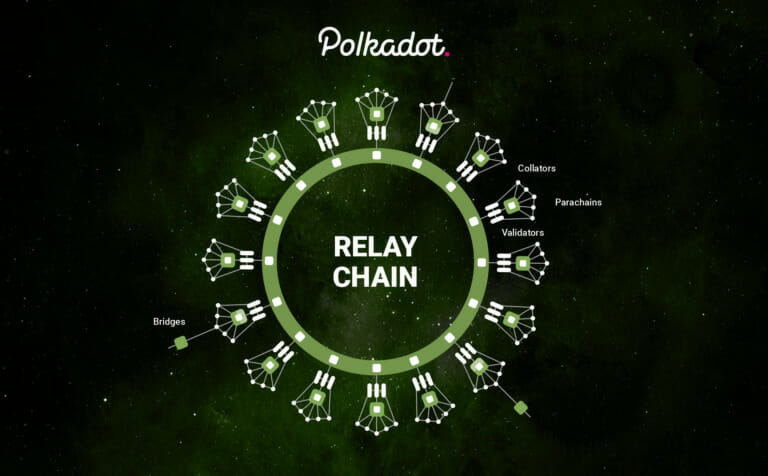

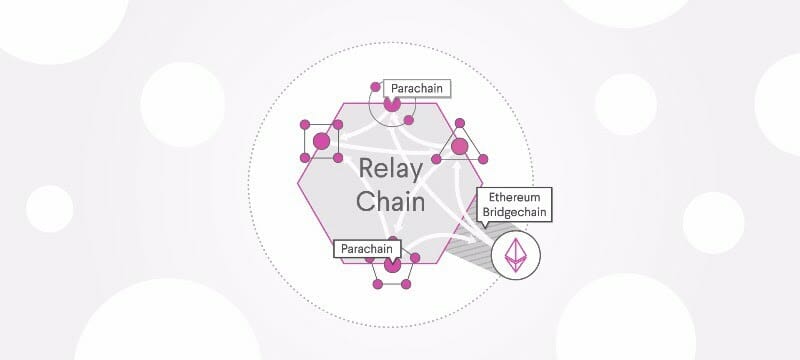

The Polkadot system is unique in that it mixes a network of parachains and parathreads, which are heterogeneous blockchains. The Polkadot relay chain connects these chains and secures them. These chains can also be joined to external networks via bridges in some circumstances. Polkadot now has more flexibility thanks to this design. The network’s primary components are listed below.

A parachain is a single blockchain in the Polkadot ecosystem, while the main chain is the Relay Chain. Parachains and the Relay Chain are supposed to exchange information at all times quickly. Parachains and the Relay Chain are supposed to be able to exchange information at all times rapidly.

1. Relay Chain

Polkadot’s centre chain is known as the Relay Chain. In DOT, all Polkadot validators are staked on the Relay Chain and validated for it. The Relay Chain has a modest number of transaction types, such as ways to engage with the governance process, parachain auctions, and so on.

Validators check the block candidates from parachains and parathreads and play a key role in adding new blocks to the Relay chain and parachains/parathreads. In this way, these are very important for network security and secure cross-chain communication.

2. Parachains and Parathreads

The validators of the relay chain can validate Parachains since they are application-specific data structures that are globally coherent and validatable. They get their name from the parallelized chains that run alongside the Relay Chain. Due to their parallel nature, they are possible to parallelize transaction processing and achieve scalability for the Polkadot system.

Parathreads are chains that can participate in Polkadot’s shared security while not acquiring a complete chain slot. These are suggestions for parachains to participate in Polkadot security temporarily.

Also read, Litecoin vs Ethereum: Who has the Lowest Gas Fees?

3. Bridges

Bridges are another significant component. Parachains and Parathreads may link to and communicate with external networks like Bitcoin using this protocol.

Bridges are available in various flavours, from centralized and trusted to decentralized and untrustworthy. For its ecology, Polkadot prefers the later bridge designs. Bridging can be carried out with the help of Bridge pallets, Smart contracts, and higher-order protocols.

Cardano vs Polkadot: Scalability

Cardano’s Scalability

Cardano ensures that as the number of validators linked to the network grows, their scalability grows. Hoskinson devised the Epochs system, which divides them into blocks and assigns slot leaders to each of them. Slot leaders are those who can mine, validate, and pave transactions to their appropriate blocks.

Cardano could only handle about 257 transactions per second in its early days. With the introduction of Hydra, Cardano’s layer two solutions, Hoskinson claims a transaction rate of 1000 per minute.

Smart contracts, DApps, and other applications can also be created and accessed via Hydra. These services will operate on top of the current Cardano blockchain. In addition, the Hydra layer’s primary goal is to increase market exposure while lowering expenses and insufficient storage.

Furthermore, the Hydra scalability solution includes several additional advantages that appeal to huge consumers. However, Layer 2 addresses concerns such as payments, denial-of-service assaults, identity, and storage in addition to other networks.

Also read, What are Dapps? (An ultimate guide)

Polkadot’s Scalability

Polkadot can handle up to 166 transactions per second thanks to its parachain structure, which is ten times faster than Ethereum. Polkadot joins many blockchains, laying the groundwork for future network growth.

Polkadot functions admirably with the help of parachains and relay chains, which give consensus to the whole platform via several validators.

The Parachain slots will be auctioned and leased in a considerable amount. These Parachains can function in parallel since their unique blockchains are designed for specialized uses. On top of these Parachains, a Polkadot DeFi Parachain will hold DeFi projects, while an NFT Parachain will contain games, digital assets, and so on.

Parathreads come in handy because of the minimal availability of Parachains and due to their economic feasibility. Parathreads have a fixed registration price that is far lower than getting a Parachain slot. Still, they must compete for each block’s inclusion through cost-effective techniques, similar to how Ethereum functions.

Also read, Top 5 DeFi Tokens to Look Out for

Cardano vs Polkadot: Governance

How is Cardano Governed?

Cardano’s governance mechanism is off-chain, similar to Ethereum’s. The Cardano Foundation and IOHK are the governing bodies of the Cardano network. Charles Hoskinson is the CEO of IOHK (Input Output Hong Kong), a research and development company committed to using the peer-to-peer innovations of blockchain to build accessible financial services for all.

Treasury

Cardano maintains a treasury where funds obtained from transaction fees are accumulated. This money is used for effective marketing, customer services, and network maintenance. They are also deflationary – minting a fixed amount of 45 billion ADA coins.

Polkadot’s Governance

Polkadot utilizes an On-chain governance mechanism. The Technical Committee and the Council are two distinct groups on which it is based. They also oversee rare occurrences like protocol updates and corrections. Stakeholders participate in governance and vote on initiatives.

1. Substrate

Polkadot was built from the bottom up to make the most fundamental programming chores in Dapp development as simple as possible. The Substrate was used to construct the platform. Substrate, a framework for developing cryptocurrencies and decentralized systems, allows any developer, corporation, or individual to keep their bespoke para chain.

2. Kusama

Polkadot is also illuminated by a canary network known as Kusama. Kusama’s job is to find any vulnerabilities or flaws in the Polkadot code base. It was developed by Parity Technologies, the same firm that made Polkadot. A significant party does not control the protocol in Kusama. The network is run by a decentralized network of Kusama coin holders who vote.

3. Treasury

To ensure that the teams developing on Polkadot have all of the resources they require, they must be aware of the many funding options available. The Polkadot Treasury, which currently supports a variety of causes, is one viable fundraising alternative. When it comes to promoting organic development and growth in our community, the treasury is critical.

Cardano vs Polkadot: Conclusion

Pointing out a verdict in Cardano vs Polkadot seems complicated because both networks have a lot of promise for integrating blockchains because of their efficient and cheap transaction cost PoS algorithms. Although Polkadot is ahead of Cardano in terms of progress, the other intends to catch up by letting users pay transaction fees in any token being transferred. While both Cardano and Polkadot are very new projects, adoption rates may differ depending on how quickly they manage new challenges. However, both of these networks are away from what could lead us to global adoption in the future. Since we won’t be competing with Ethereum in the long run, they’d have to match the transaction speed of Visa and MasterCard.

Frequently Asked Questions

These blockchains are capable of serving as third-generation blockchain solutions. Cardano’s blockchain infrastructure is superior, with a two-layer design. However, Polkadot’s ecosystem design and development options are more developer-friendly.

Cardano and Ethereum have several similarities. One of Cardano’s main benefits is that it serves as a framework for smart contracts. Cardano also employs a PoS architecture, although Ethereum gradually migrated from a PoW to a PoS network. As a result, it is more eco-friendly and speedier than its competitors.

Kusama (KSM) is a Polkadot public pre-production environment that runs on an unaudited version of the Polkadot blockchain. Kusama is a sandbox that allows developers to test early versions of Polkadot projects in an actual environment.

Also read,