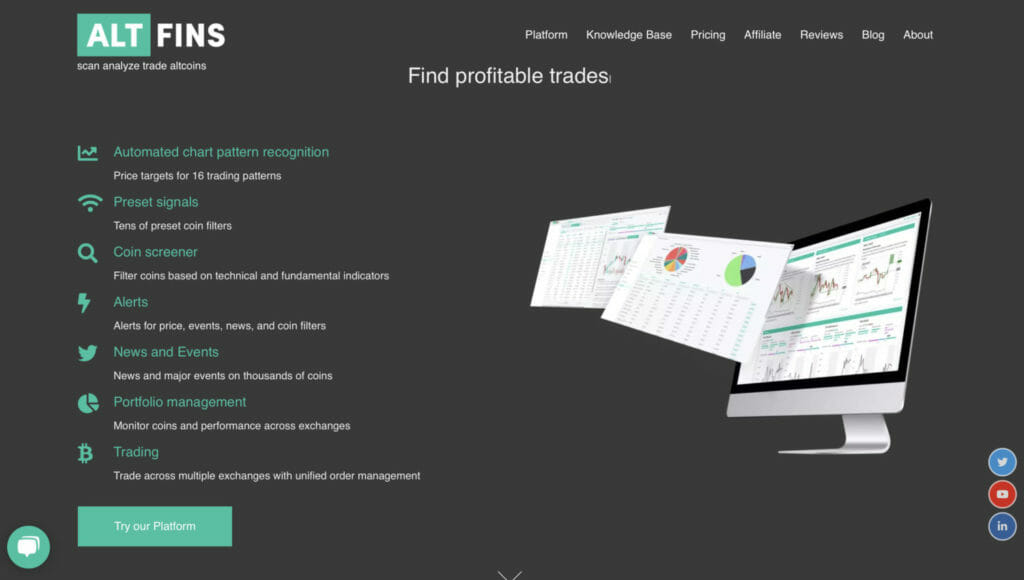

altFINS is a platform developed to make your trading easy and safe with exciting and modern technical tools. With altFINS, you can avail trading chart patterns and cryptocurrency patterns to generate ideas for free. Furthermore, in this altFINS review, we’d discuss the ways a beginner can benefit from the platform.

Summary

- altFINS is a comprehensive platform for cryptocurrency traders and investors.

- Founded by Richard Fetyko, a Wall Street analyst and trader, altFINS provides robust tools for the crypto market.

- The platform offers features such as portfolio tracking, trade management, and open order management.

- Users can access in-depth research reports on undervalued coins and Coin Picks with 10x profit potential.

- altFINS provides educational resources, including a complete Trading Course with 10 lessons, catering to both beginners and experienced traders.

- The platform has a user-friendly interface and a wide array of features, making it efficient and effective for navigating the cryptocurrency market.

- The altFINS team, led by Richard Fetyko, brings expertise from years of experience in equity research on Wall Street.

- The altFINS crypto screener is a valuable tool for traders of all levels, helping them find trading opportunities based on various chart patterns.

- The platform offers a DEX aggregator for trading with the best prices across multiple decentralized exchanges, as well as support for trading on centralized exchanges through APIs.

- altFINS provides comprehensive market insights, including data aggregation, technical analysis, trading signals, and on-chain data, empowering traders to make informed decisions.

What is altFINS?

It is a platform where investors can analyze and look at altcoin trading strategies through technically advanced tools. The platform offers several tools to help investors generate ideas, suggestions, alerts and monitor their investment portfolio. Anyone new to cryptocurrency trading can make use of such a medium to generate revenue easily.

Likewise, experts run the forum in the field of finance and technology. Team members like Richard Fetyko, Tomas Fecko, Daniela Hajnikova, Marek Urban, and Jozef Korcak use their best capabilities in giving out the best platform for better suggestions in finance, development, and technical aspects in the cryptocurrency market, helping you further.

Features of altFINS

altFINS Review: Dashboard

altFINS dashboard helps in providing the user with a comprehensive summary of their investment. Moreover, the position in which the investor is currently in and other trading opportunities that he can use to improve.

As known, altFINS is a free platform, the investor does not have to register themselves for using. However, if the user registers themselves, the platform allows extensions to its registered users on dashboards. The extended features include:

- Customization of settings as per your requirements.

- Quick representation of the investor’s portfolio and other trading suggestions is useful.

- The user can create alerts, watchlists, new, in addition to tracking the performances.

- The user gets an exclusive newsletter talking about your portfolio and the market in general

AltFINS Review: Chart Patterns

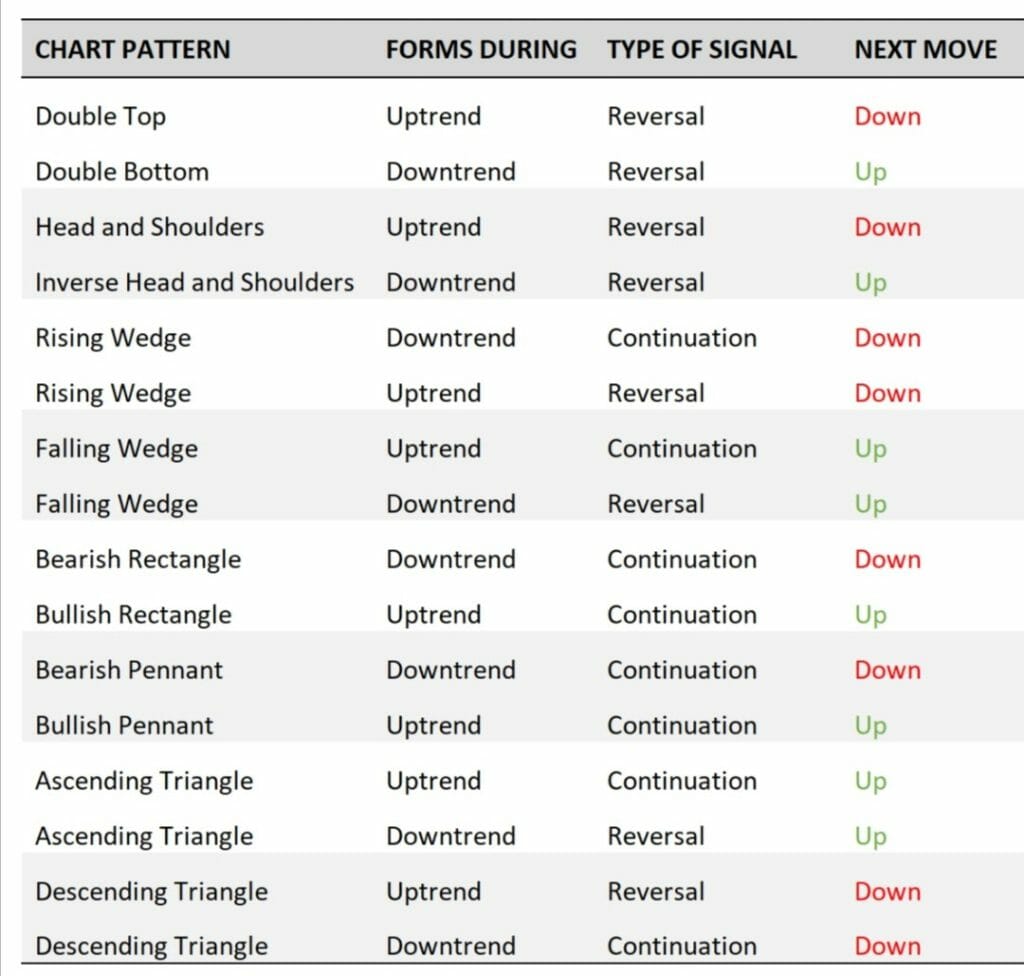

This feature allows the investor to understand the trading pattern in the market every 15 minutes. Furthermore, the platform has 16 such trading patterns indicating the market scenes

altFINS’ automated chart pattern recognition engine identifies 26 trading patterns across multiple time intervals (15 min, 1h, 4h, 1d), saving crypto traders a ton of time.

Types of trading chart patterns

Different types of trading chart patterns include

- Ascending/descending triangle patterns indicate an uptrend (bullish triangle) and downtrend (bearish triangle).

- A symmetrical triangle indicates an unclear direction, thus showing a period of indecision.

- Head and shoulders (from bullish to bearish), Inverse head and shoulder (from bearish to bullish) indicate an uptrend and downtrend. This pattern is supposedly the most trusted indicator.

- Channel down and channel up indicates the chances of reversal in the current market trend.

- Bullish (ascending flags) and bearish (descending flags) signal changes and trends that are here to stay in a brief period though. Investors often trust this signal as it helps in entering the direction.

- Falling wedge and rising wedge both can appear in either uptrend or downtrend. However, the Falling wedge is a more reliable one.

- Double bottom/ double top indicates minor short-term changes in the market. Either they suggest the market will go uptrend from a downtrend or downtrend from an uptrend.

- Triple bottom/ triple top indicates minor short-term changes similar to double bottom and double top. Though they may initially look like double bottom and double top, they later represent the failure to enter an area of support and resistance.

- Bullish and bearish pennant is a short-term pattern that follows advanced bullish and bearish triangles for minor changes and forms a pennant, narrowing down the process further.

- Further, rectangle indicates a price consolidation for a short period.

Here are some tips for using automated chart patterns on altFINS effectively:

- Use multiple time intervals to confirm the pattern.

- Look for patterns with high volume.

- Consider the overall market sentiment.

- Do your own research to confirm the validity of the pattern.

Note: The platform offers created trading pattern cheat sheets to help users and investors remember these chart patterns.

AltFINS Review: Portfolio Balance and Porfolio Management

The portfolio allows you to have a summarised look at your position. By adding a filter to your portfolio, you can check your balance for specific coins and exchanges. While on the other hand, there is a summary view of your position, which shows your complete balances of currencies. You can use the feature of the filter with a credit of less than $1. It also shows your top 10 coin positions for a better understanding.

Track the value of your portfolio per exchange, review past trade details, and manage open orders.

AltFINS Review: Research Hub

Fundamental research is the core of any long-term crypto investment strategy. altFINS research identifies coins and trends with massive long-term upside potential. By analyzing a wide range of fundamental factors such as user adoption, value proposition, tokenomics, and competition, the altFINS team can identify investments that have strong growth potential. Based on these analyses, altFINS experts identify coins with an attractive investment profile.

AltFINS Review: Education

altFINS offers a variety of educational resources to help users learn about cryptocurrency trading and investing. These resources include:

- Crypto Trading Course: This course covers the basics of cryptocurrency trading, including technical analysis, chart patterns, and risk management.

- Academy: The Academy is a collection of articles and videos that cover a wide range of topics related to cryptocurrency trading and investing.

- Trading Videos: altFINS regularly publishes trading videos that provide analysis of the cryptocurrency market and offer trading tips.

Knowledge Base: The Knowledge Base is a searchable library of articles that cover a variety of cryptocurrency topics, including technical analysis, trading strategies, and platform features.

AltFINS Review: Trade on altFINS

altFINS DEX aggregator enables traders to trade with best prices across multiple DEXs (Decentralized Exchanges) including Uniswap, Curve, Balancer using a Metamask wallet. altFINS also supports trading on multiple centralized crypto exchanges through APIs (Binance, Bitfinex, Bittrex, Kraken, HitBTC, Poloniex). altFINS provides tools and resources that make it easier to trade crypto and monitor users portfolio across multiple exchanges. The platform is designed to help you easily and securely buy, sell and trade all the top digital currencies from a single user-friendly interface.

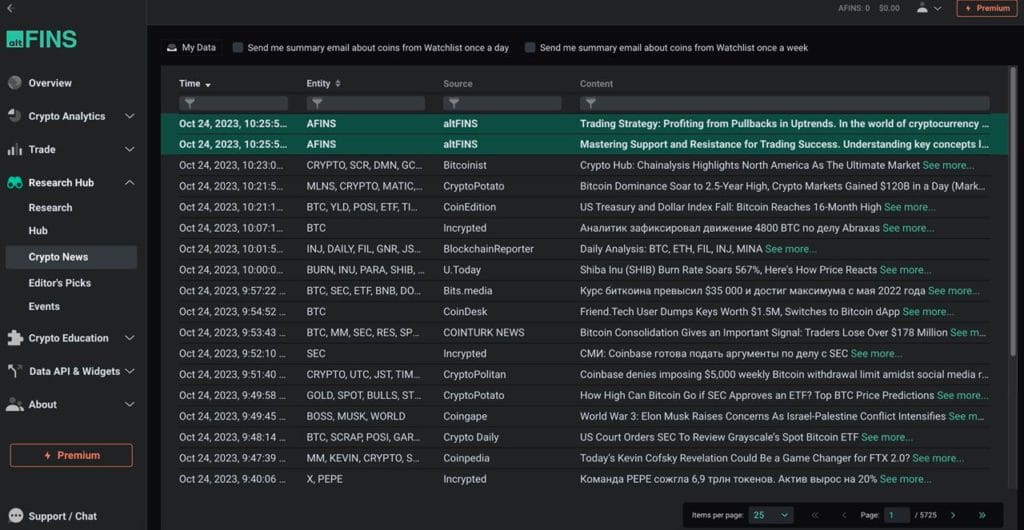

AltFINS Review: Crypto News and Events

altFINS aggregates the most important crypto news from over 40 trusted sources including Twitter announcements from thousands of crypto projects. In one single newsfeed, you get all the latest crypto news and updates on topics related to cryptocurrency, blockchain. metaverse, DeFi and web3. Whether you’re looking for breaking crypto news stories or insightful analyses on leading trends, you will find it here.

altFINS helps you monitor upcoming crypto events that could move coin prices. Search for crypto events such as airdrops, new coin listings, AMAs, conferences, partnerships and releases focused on a variety of topics related to the cryptocurrency market.

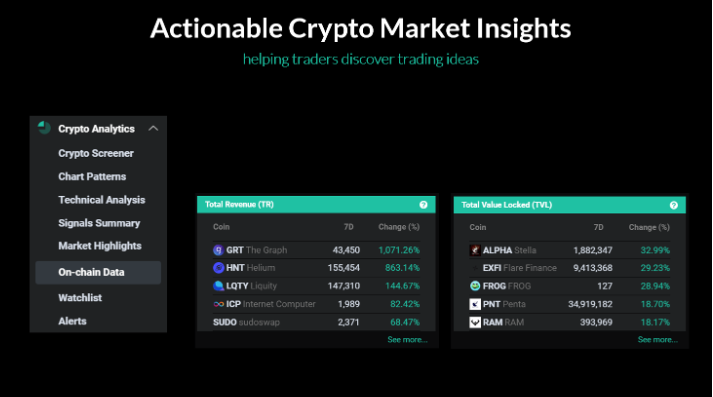

AltFINS Review: Crypto Market Highlights

Crypto Market Highlights is a quick summary of trading strategies and tips in the crypto market. It includes several crypto market screens that form the basis of trend- or swing trading strategies such as: bullish breakouts, coins in a strong uptrend, pullback in uptrend, momentum upswing or coins that are extremely oversold near support. Each widget represents a specific market scan and you can use them as building blocks for your trading strategies. Traders can click on the question marks to learn about specific trading strategies.

AltFINS Review: Portfolio DEX+CEX

The portfolio feature on altFINS allows users to track their cryptocurrency holdings across multiple exchanges and wallets. It provides a real-time overview of the user’s portfolio.

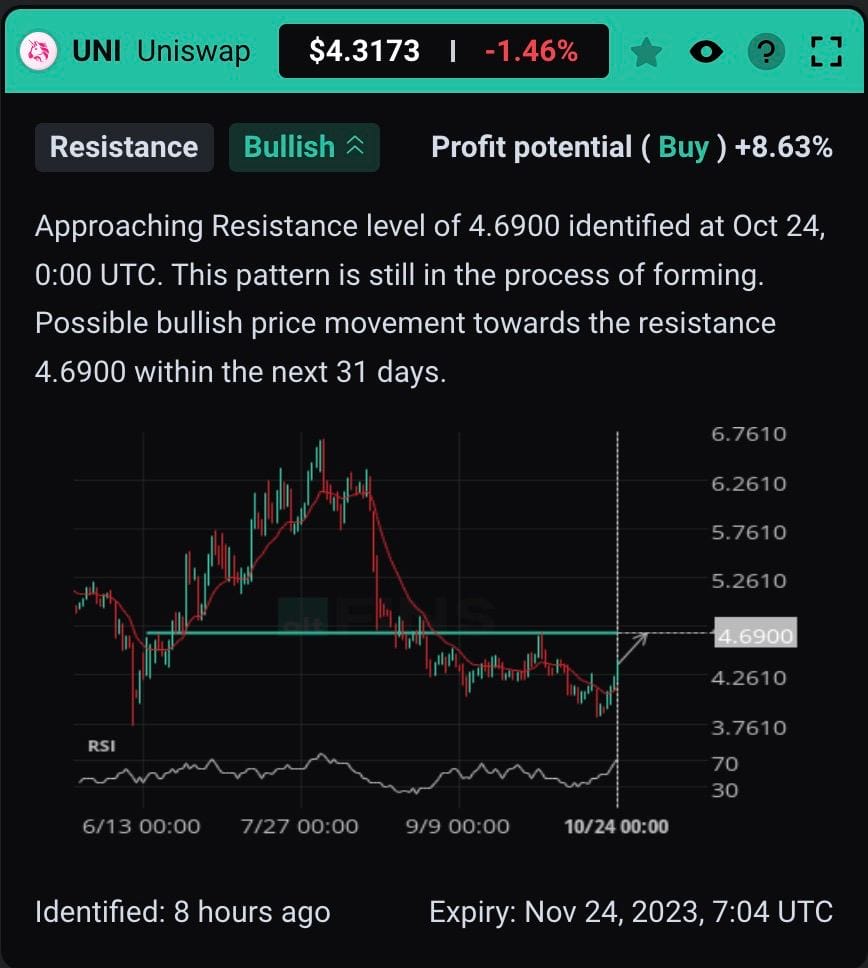

AltFINS Review: Curated Charts

The platform offers a curated chart of the top 30 cryptocurrencies. The chart is straightforward to understand as it follows the concepts of Technical Analysis. The curated chart shows the downward and upward trend charts. These are also known as bullish(upward) and bearish(downward) chart patterns. In addition to this momentum, volume, patterns, support, and resistance chart is also available. Furthermore, users will see the support and resistance indicators as well.

So now the question comes down to how to find support and resistance levels?

The answer to this is that the platform automatically identifies the resistance or support area every time there is a minimum touching point at a specific price level the system recognizes. Thus, the more touching moments, the more significant the level. These concepts help the user understand the principles of technical analysis. This, in turn, helps them in improving their trading.

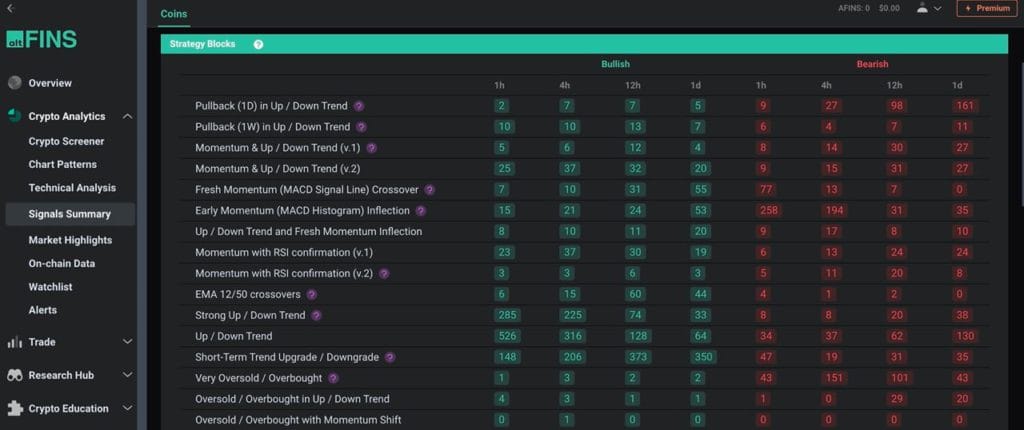

AltFINS Review: Signals and Summary

This feature helps in learning about the opportunities for better trading. It shows all the cryptocurrencies and their pairs that can be utilized at different patterns. They are nothing but technical indicators. If the registered users create screeners, the created screeners appear on top of the signals summary.

AltFINS Review: Screener and Alerts

This feature helps you in watching the predefined alerts. The users can also set up their coin screener and alerts by combining several indicators like SMA, EMA, RSI, MACD, and many more. They can also make use of variables like traded volume, price performance, and market cap. If the investor has registered themselves, they can also save their filters and alerts as per their choice.

AltFINS Review: Data aggregation

altFINS aggregates and analyzes data from 3000 of unique coins across multiple exchanges and wallets.

AltFINS Review: User-Friendly

With over 100 pre-set market scans, it saves traders time by generating signals like uptrends, resistance breakouts, strong momentum, and chart pattern breakouts.

AltFINS Review: Trade Setups

altFINS’ analysts conduct technical analysis of over top 60 coins. The technical analysis is simple and consistent. It follows the key concepts of Technical Analysis (TA): 1) Trend 2) Momentum 3) Volume 4) Chart Patterns 5) Support and Resistance.

AltFINS Review: On Chain Data

On-chain data refer to the transactional data recorded on a blockchain. This data can be used to track the movements of assets, understanding user behavior and measure revenues and Total Asset Locked (TVL). On-chain data analysis on altFINS can help users identify blockchain projects with sound fundamentals (real users, revenue and value proposition).

AltFINS Review: Technical Analysis

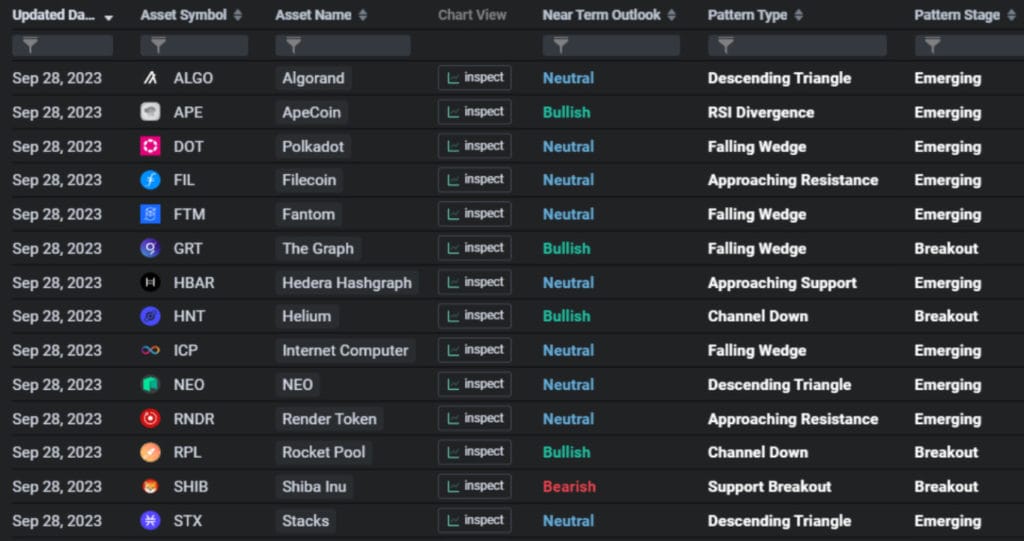

altFINS’ analyst team maintains Technical Analyses with actionable trade setups for over 60 major coins. These can serve as a great starting point for trading plans as well as a useful learning tool. Technical Analysis section shows the date of the analysis, asset symbol, near-term outlook, pattern type and pattern stage, breakout or emerging.

You can filter by Near Term outlook (Bullish, Neutral or Bearish), by Pattern Type or Pattern Stage. Drill in to read the details of the trade setup and Technical Analysis, including major support and resistance zones, trading patterns, momentum indicators, and what action to take. Technical analyses are also available in the Screener section. Watch this intro video to learn more.

AltFINS Review: Watchlist

This feature allows you to create a watchlist for yourself. This helps you when you wish to monitor certain specific coins, assets, or pairs. It will enable you to have a column of your custom coins and investments so that you can analyze them separately. The user can directly add their preferences to the watchlist from the screen results or simply click on the watchlist tab. By clicking on the star icon, the user can remove the coins from their watchlist.

Is altFINS Safe?

What are Crypto Options?

The platform offers two-factor authentication to its users. Indeed, the most secure your account can ever be. The second factor-authentication requires a code that is given on the user’s phone via special security applications. To protect your account, you must do the following:

- As a first step, you must download the “Google Authenticator” app on your phone.

- The next step is to go to the profile tab on the app and then select MFA and get it enabled.

- Once the MFA is enabled, click on the “+” symbol and follow the instructions given on the app.

- Scan the barcode and enter the code.

- Always write the recovery codes somewhere and never share them with anyone.

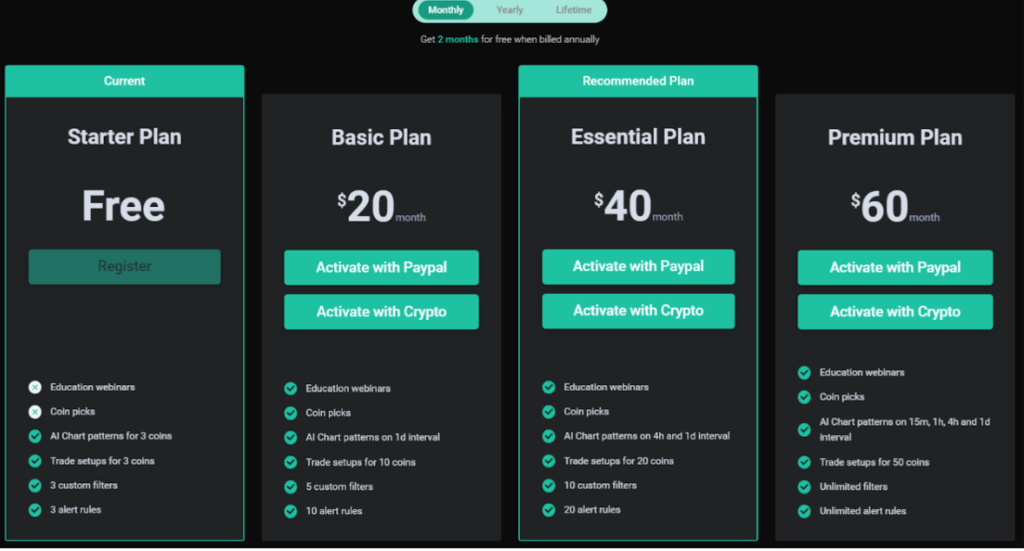

AltFINS Review: Fees

The platform has the most advanced technical tools, which is beneficial to its users. In addition, it has plans for its free users and registered users. Registration is free of cost. Other than these plans, the platform offers basic, essential, and premium subscription plans.

AltFINS Review: Affiliate

Anyone can become an affiliate at altFINS by simply generating their referral link by signing up. Moreover, you don’t even need to be a user at altFINS. All you have to do is start sharing your referral link on your blogs, sites, and social media. Every time someone follows your referral and makes a payment, you receive a 20% recurring commission, likewise. The amount remains recurring for as long as the user continues to be a subscriber. For joining this affiliate, you don’t have to pay any fees. It is free of cost. The payment is made through PayPal.

Crypto Trading Analytics Web App

An application has been officially launched by altFINS on its web app for crypto technical analysis. This would further help the users get ideas on trading the altcoins by understanding what to buy and sell. Furthermore, they cover almost 5000 digital assets and calculate over one billion performances. The conclusion of these data is then translated for the users to help them in generating ideas and suggestions.

You van also download the mobile app which is available on Google play and Apple Appstore for traders who wish to trade on the go.

AltFINS Review : Pros and Cons

| Pros | Cons |

| altFINS offers a wealth of market data and insights, including data aggregation, technical analysis, trading signals, and on-chain data. | altFINS may require a subscription fee, who are looking for free or lower-cost alternatives. |

| user-friendly interface and pre-set market scans make it accessible to both novice and experienced traders. | Cryptocurrency markets are known for their high volatility, and altFINS, like any other trading platform, cannot eliminate the inherent risks associated with trading. |

| altFINS provides a range of educational resources, including a trading course, videos, and a knowledge base. | altFINS heavily relies on technical analysis, which may not always accurately predict market movements. |

Customer support at altFINS

The platform offers a live chat box to help its customers. The user can add the free live chat on their site and avail its services anytime they want. The reply to any queries is responded to in a few minutes.

AltFINS Review: Conclusion

The platform is perfect for beginners as the features of the product are easy to understand. The site even offers sections like blogs and reviews, to further ease the process. The platform provides a dashboard, curated charts, patterns, screens, signals, and a portfolio of the user’s account.

The best part is it is free of cost and does offer monthly subscription plans for the users to purchase. With the help of altFINS, you can get ideas on trading altcoins, receive alerts, and likewise get reminders through tools that analyze the market for you. The web app is run under the hands of experts in the field of finance and marketing. Hence, making it a safe choice. We hope that we have successfully provided you with all the necessary information in this review to help you analyze this product.

Frequently asked questions

1. What is Bull power?

Bull power calculates the difference between the highest power and 13-period EMA. Bull power has a zero base, and when the Bull power indicator is above zero, it is a positive sign. This means the buyers had successfully maintained the price above the EMA. On the other hand, when the indicator is below zero, it is a negative sign. This means the buyers failed to maintain the price above the EMA, which went below the EMA.

2. What is Market vs. Limit order?

Market and limit are the two market order executions. Market orders indicate the highest market price for the buyers and sellers. The order must be responded to immediately as this will help make the most out of order. Limit orders allow you to set a minimum and maximum selling price. This helps in saving the trader from abrupt exchanges.

3. What is EMA 12?

EMA stands for exponential moving averages, which helps identify price trends and support and resistance levels to the traders. When this identification occurs in twelve(12) days, it is known as short-term EMA or EMA 12.

4. How are support and resistance zones drawn?

Support and resistance are drawn by drawing a horizontal line through significant support and resistance points. Finally, these horizontal lines are drawn through closing prices as nearly all the investors look for the closing prices.

5. What is the difference between SMA and EMA?

There are two types of moving averages: EMA (exponential moving averages) and SMA(simple moving averages). Simple moving averages are more reliable for understanding price trends and support and resistance levels as it calculates the average of closing prices of 5 to 10 periods. At the same time, EMA’s are more towards the recent costs and react quickly to those prices.