DeFi or Decentralised Finance had performed superbly well in 2020-21. Moreover, they sort of had their own bull run or the DeFi Summer, where we saw new all-time-highs created and broken. Further, the era of new financial instruments have started booming around the same. And you can get the key to own a part of these financial instruments using the platforms governance tokens. Therefore, in this article we’d be going through some of the best DeFi tokens to keep an eye out for.

Table of Contents

DeFi On Chain Metrics

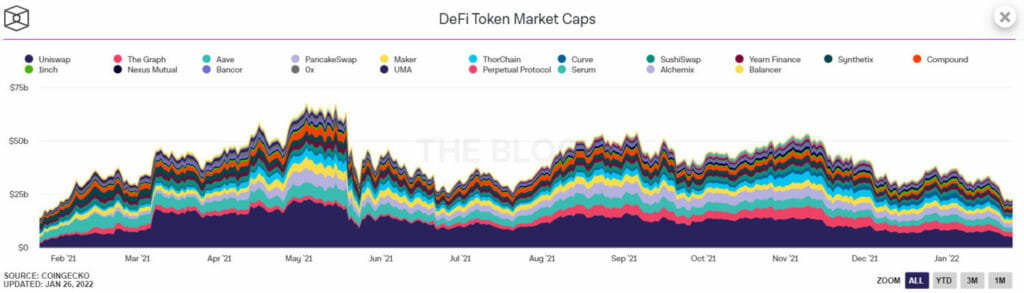

The Market caps of DeFi tokens has fallen down significantly in recent weeks. Further, after the more present crash on 23rd, the total DeFi market is almost one-third when compared to May 2021.

For more in-depth analysis, head to CoinCodeCap Markets.

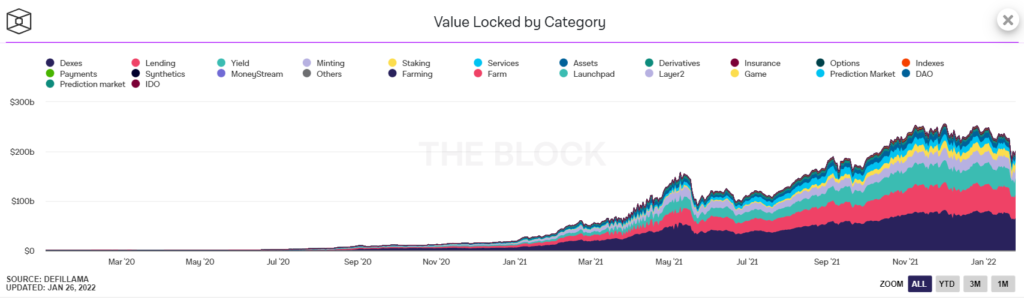

Moving on, the Total Value Locked or TVL in the DeFi projects has risen significantly, growing as much as 5x in the last 8 months. The value locked in DeFi projects signifies the trust of investors in a particular projects and can in a way indicate the path ahead for that project.

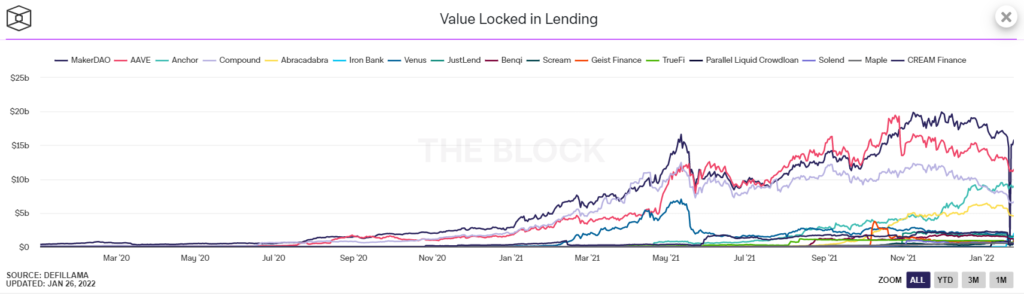

Finally, having a look at the total value Locked in Lending projects, it is evident that we’ve seen a stagnant growth in lending projects recently. However, things were going fine until more recently, when the TVL of MakerDAO was almost flushed out to 15 Million dollars from approximately $15 Million. If we go deeper in the past, the TVL of most of the lending projects has risen by more than 5x.

For more in-depth analysis, head to CoinCodeCap Markets.

Curve (CRV) Price Prediction 2022

The Curve is a cryptocurrency exchange that has no intermediaries and does not compromise the security of your funds or data. All of the transactions on Curve happen peer-to-peer without any middlemen. CRV is an Ethereum token that powers a decentralized exchange and automated market maker protocol that supports the tokens of other projects. Curve goal is to make it easy for users to trade cryptocurrencies with low fees and remain unaffected by price volatility.

Its native coin, CRV, powers the Curve. It is currently trading at $3.22 with a market cap of 1.4 billion dollars and has a max supply of 3,303,030,299 coins, currently ranking at #61 on CoinMarketCap.

On the one-day time frame, the price of CRV formed out from a head and shoulder formation before breaking down the neckline. It then reached its target.

For more in-depth analysis, head to CoinCodeCap Markets.

MakerDAO (MKR) Price Prediction 2022

MKR is a blockchain-based cryptocurrency that can be used for various purposes. These include acting as a utility token, being used for governance, and being the base resource of the Maker system. Maker is also a DeFi lending platform, using Ethereum-based smart contracts to create Maker’s stable coin, DAI. The Maker’s goal is to create a decentralized and autonomous organization that governs the Dai Credit System.

Its native coin, MKR, powers the Maker. It is currently trading at $1,846.71 with a market cap of 1.8 billion dollars and has a max supply of 1,005,577 coins, currently ranking at #55 on CoinMarketCap.

On a daily timeframe, MKR’s price action is forming out the Bullish Harmonic Crab pattern, where it is breaking down the 1.272 Fibonacci retracements and heading towards let’s see further.

Aave (AAVE) Price Prediction 2022

Aave is a decentralized, peer-to-peer money market that runs on the Ethereum blockchain. It offers users the ability to borrow or lend crypto assets. It has a wide variety of cryptocurrencies to choose from, and the lenders can get passive income on the funds they lend out to borrowers. Aave aims to increase liquidity by creating a loan market where investors can pool their money together. This way, users will invest and participate in the ecosystem and lend.

Its native coin, AAVE, powers the Aave. It is currently trading at $161.15 with a market cap of 2.1 billion dollars and has a max supply of 16,000,000 coins, currently ranking at #50 on CoinMarketCap.

On a 1-week timeframe, the AAVE formed a bullish shark pattern, which is currently at the potential reversal zone level. This is good news for traders looking to buy the current trend.

For more in-depth analysis, head to CoinCodeCap Markets.

Uniswap (UNI) Price Prediction 2022

Uniswap is a blockchain-powered trading network for ERC20 tokens. Compared to other exchanges, where trading charges are the norm, Uniswap strives to impact society positively. Users can use this platform to conduct trades without paying platform charges or using an intermediary. Uniswap aims to be the world’s first cross-blockchain exchange, to make the profitability from the system’s side while providing liquidity for the providers.

Its native coin, UNI, powers the Uniswap. It is currently trading at $11.31 with a market cap of 7 billion dollars and has a max supply of 1,000,000,000 coins, currently ranking at #24 on CoinMarketCap.

In 1 Week timeframe, UNI has formed a descending triangle, and the price action broke down the support level that it is now retesting.

Compound (COMP) Price Prediction 2022

The compound is an easy way to get involved in cryptocurrency lending. You can deposit your holdings into peer-to-peer lending pools to earn higher interest rates on them. It supports the borrowing and lending of a set of cryptocurrencies between users. The compound is based on the Ethereum blockchain and is reliable, tested, and trusted.

Its native coin, COMP, powers the compound. It is currently trading at $135.29 with a market cap of 884 million dollars and has a max supply of 110,000,000 coins, currently ranking at #87 on CoinMarketCap.

On the 1 Week timeframe, COMP formed out the Descending triangle, and it got rejected again and again from the resistance line, and the price action also broke down the support key level.

For more in-depth analysis, head to CoinCodeCap Markets.

Closing Thoughts

The most important part of trading is discipline and patience. So, according to the above analysis, the coins we just spoke about might see some decent gains. Again, it’s your hard-earned money you’ll be investing, so Do Your Own Research before investing.

Also, read