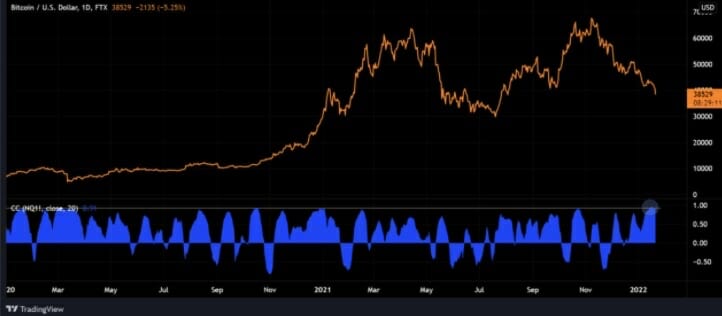

This week Bitcoin’s correlation to the Nasdaq reached an all-time high. With no catalyst to cause idiosyncratic flows to Bitcoin, it is trading in tandem with risk-off behaviour from equities with a high beta. For no catalyst to trigger idiosyncratic flows, Bitcoin is at the mercy of risk-off assets for the time being.

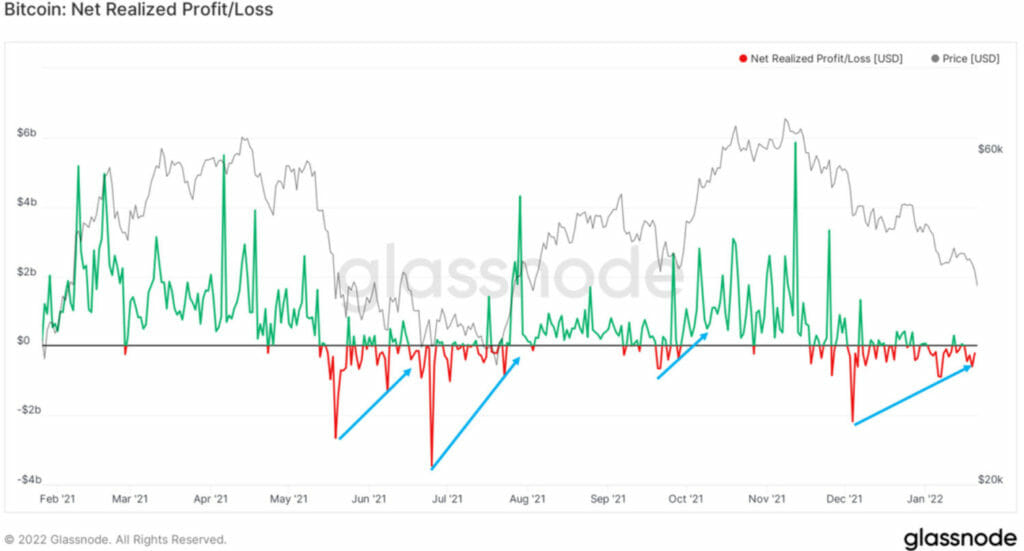

Capitulation seems to be slowing, for now, meaning a decreasing amount of losses is being realised.

This comes as supply in profit is down below 70%, nearing levels at the bottom of the summer correction.

Still a lack of large buyers. This looks at entities with over 1,000 BTC and then filters out exchanges.

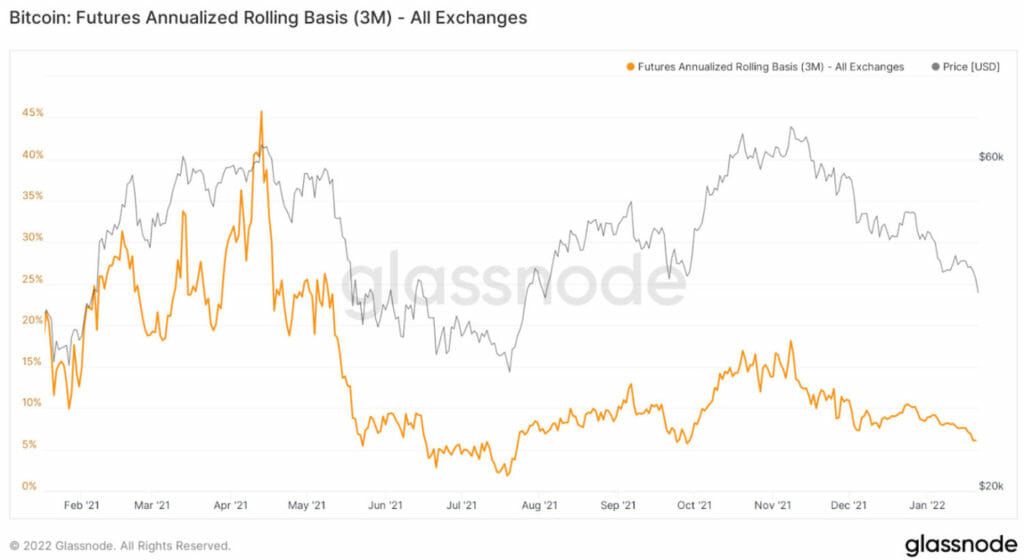

Futures 3M basis is down to roughly 6%. This means you can long spot and short 3 month Bitcoin futures contract and capture a 6% annualized yield.

There are still 3 days left before this weekly close, but a weekly close below 40K leaves no clear levels of support before the 30K area.

Difficulty All-Time High

Last night, Bitcoin’s network had difficulty adjusting to a new all-time high. This signifies that the network has fully recovered from the China mining ban in the Summer of 2021.

This adjustment was very aggressive (+9.3%), and as difficulty goes up, miners earn less BTC.

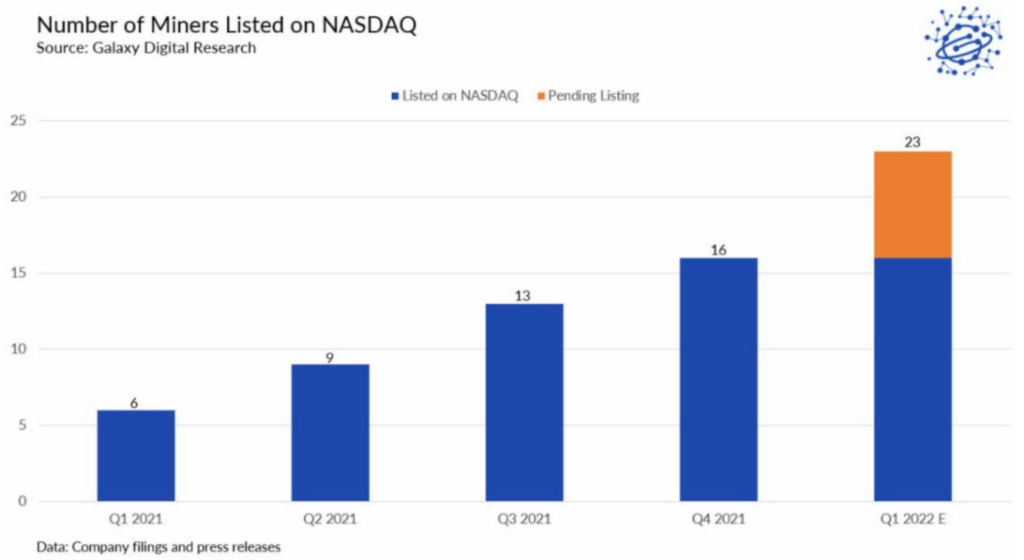

Wall Street + Bitcoin Miners

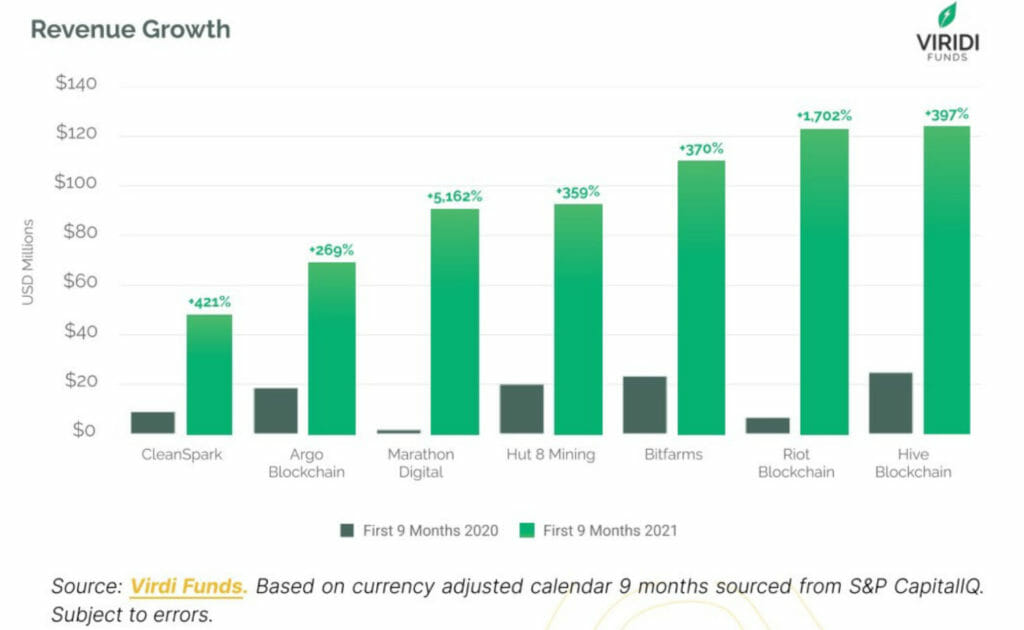

Large-scale public Bitcoin miners are the catalyst for Wall Street to really question their scepticism towards $BTC. It’s hard for Wall Street to deny that Bitcoin mining is currently a financially attractive business. Hence the number of miners tapping into public markets.

This is because these mining companies are an exciting emerging technology, have high growth, and have high margins. Bitcoin miners have growth AND margins.

Bitcoin itself is more of a commodity, and Wall Street focuses on cash flow or revenue growth. They typically don’t like physical goods or commodities.

Bitcoin miners have that cash flow and revenue growth. They’re forcing Wall Street to pay attention by being attractive in the game they usually play. Billion-dollar Bitcoin miners trading in public markets is beginning to force them to pay attention. It shows Bitcoin is real. It’s not dead.

Nothing in this article is financial advice.