Navigating the financial world can be difficult, particularly for people with bad credit. Traditional lending banks sometimes reject applicants with low credit scores, making it difficult to obtain the necessary finances. However, the increasing number of online lenders and loan matching services has provided a lifeline for people with bad credit. These firms provide no credit check loans, which are intended to allow quick access to cash while avoiding the burdensome credit requirements of traditional loans. These loans help you meet unforeseen expenses or manage a financial emergency. This article looks Best 5 No Credit Check Loans Guaranteed Approval from Personal Bad Credit Direct Lenders!

What do you mean by Bad Credit?

Bad credit occurs when an individual’s credit history demonstrates major indicators of financial mismanagement, such as late payments, defaults, or high debt levels relative to credit limits. This is usually represented in a low credit score, which is a numerical measure of a person’s creditworthiness.

Bad credit has a huge impact on various aspects of financial life, frequently posing considerable restrictions and raising costs for borrowers. Individuals with bad credit frequently have difficulties obtaining permission for numerous types of loans, such as mortgages, auto loans, and personal loans. Lenders see bad credit as a sign of high risk, which leads to greater loan refusal rates.

Furthermore, creditors and lenders may provide lesser loan limits to people with bad credit. This restricted borrowing ability may limit financial flexibility and make it more difficult to manage major expenses.

Also, you may read about Introduction to Flash Loans: What is a Flash Loan Attack?

Best 5 No Credit Check Loans

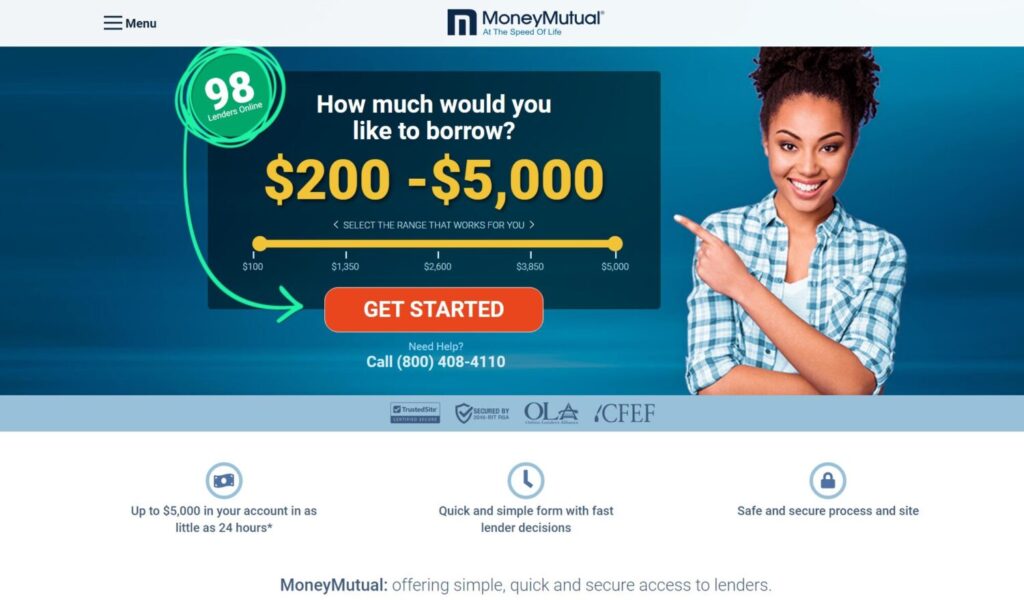

1. MoneyMutual

MoneyMutual is a well-known loan matching organization that connects borrowers to a network of lenders who provide payday loans, installment loans, and cash advances. The platform is intended to enable quick and easy access to short-term lending for people with a variety of credit profiles, including those with bad credit.

MoneyMutual does not do a hard credit check during the first application procedure, therefore applying will not harm the borrower’s credit score. Instead, it depends on the individual lenders in its network to decide whether to undertake a credit check and what loan terms to issue based on the borrower’s financial profile.

However, it is vital to remember that payday loans, which account for a substantial portion of MoneyMutual’s loans, frequently include costly interest rates and charges. These loans are primarily meant for short-term use and can be expensive if not paid off quickly.

- Loan Amount: $250 to $5,000

- Interest Rate: Varies by lender

- Loan Term: Typically short-term for payday loans, longer for installment loans

Also, you may read about BEST Crypto Friendly Banks | SWITCH NOW!

2. SoLo Funds

SoLo Funds is an innovative peer-to-peer lending network that offers microloans to people in need of immediate, short-term financial support. Unlike traditional lenders, SoLo Funds connects borrowers directly with community members who are prepared to support their loan requests.

One of the primary characteristics of SoLo Funds is the absence of interest rates. Instead, borrowers can provide a voluntary tip to the lender as a gesture of appreciation. The application process for SoLo Funds is basic.

Borrowers submit a loan request describing their requirements and preferred terms. Lenders in the community can then fund the loan depending on the borrower’s profile and loan terms. Once funded, the loan amount is rapidly disbursed, frequently within a day, giving immediate financial relief in case of emergencies.

- Loan Amount: $20 to $575

- Interest Rate: No interest, but borrowers can offer a voluntary tip

- Loan Term: Up to 35 days

Also, you may read about 8 Best Finance Newsletters

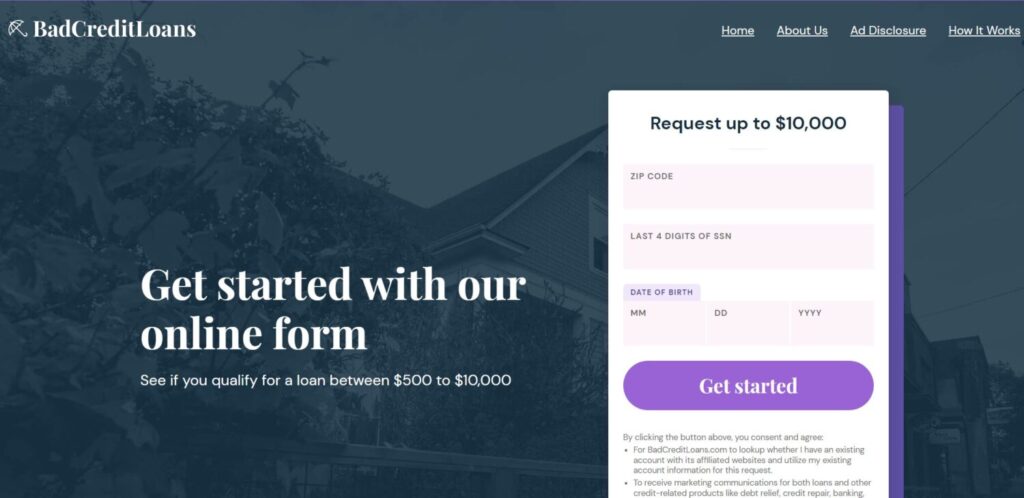

3. BadCreditLoans

Bad Credit Loans is not a lender and does not issue unsecured loans; however, it does provide your loan request information to the lenders and lending partners in their network, allowing them to decide whether to grant you a loan.

The platform uses strong encryption technology to protect your information and is available to its customers 24 hours a day, seven days a week.

Borrowers should be aware of the potentially high interest rates associated with some loan offers, especially those with very bad credit. To minimize further financial burden, thoroughly analyze the terms and conditions and ensure that the repayment plan is affordable.

- Loan Amount: $500 to $10,000

- APR: 5.99% to 35.99%

- Loan Term: 3 to 60 months

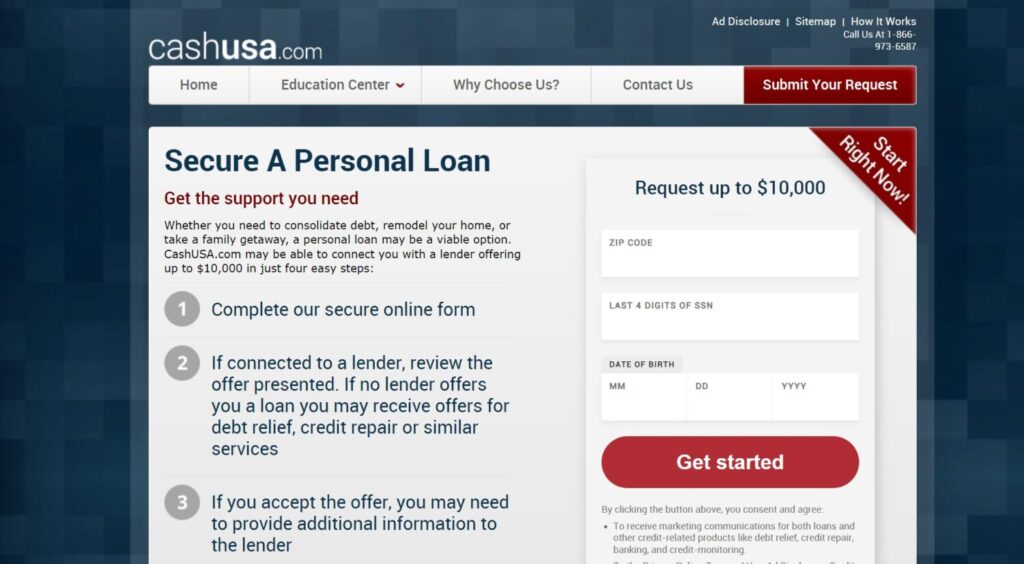

4. CashUSA

CashUSA is another trustworthy loan matching business that provides personal loans to applicants of various credit scores, even those with bad credit. It connects users to a network of lenders who are willing to provide personal loans on flexible conditions.

One of the key benefits of CashUSA is its inclusive approach. The website connects borrowers to lenders who are prepared to work with all credit types, even those with low credit histories.

Furthermore, CashUSA provides educational materials on personal finance, which assist borrowers make informed decisions and enhance their financial health.

- Loan Amount: $500 to $10,000

- APR: 5.99% to 35.99%

- Loan Term: 3 to 72 months

Also, you may read 10 Best Expense Management Software

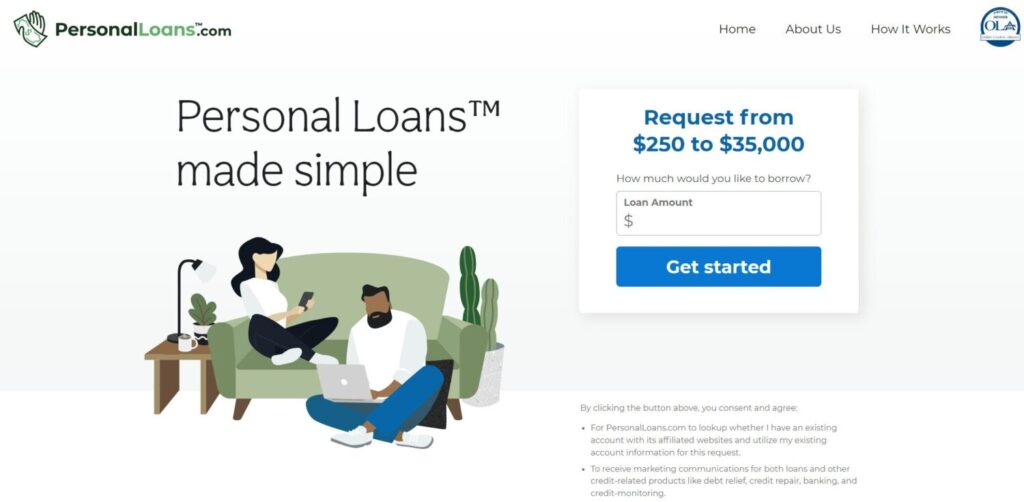

5. PersonalLoans.com

Personal Loan provides a quick and flexible way to link you with a lender and submit an application. There are no hidden fees and no upfront costs. Further, you can review your loan offer before accepting any funds, without difficulty.

If you believe you will be unable to make a payment, call your lender immediately. Their customer service team may be able to provide you a later due date. One of the primary advantages of choosing PersonalLoans.com is its commitment to transparency and borrower education. The portal provides tools and guidance to help users understand the loan process, enhance their financial literacy, and make sound decisions.

- Loan Amount: $500 to $35,000

- APR: 5.99% to 35.99%

- Loan Term: 3 to 72 months

Also, you may read Best Expense Cards for Freelancers

Conclusion

When considering a no credit check loan, it is critical to compare the conditions, interest rates, and fees for each option. While these loans might provide quick access to funds, they are often expensive, especially payday loans. Before committing to a loan, always make sure you understand the terms and conditions, and if possible, seek alternative financing choices. The firms listed above provide a variety of alternatives to assist you manage your finances despite having bad credit.

Frequently Asked Questions

What are no credit check loans guaranteed approval?

These are loans provided by lenders who do not conduct traditional credit checks on borrowers. Instead, they use additional criteria like income verification or collateral. The phrase “guaranteed approval” indicates that practically anyone can be authorized, regardless of credit background.

What are the risks of no credit check loans?

The main risk is the excessive costs. Interest rates on these loans can be costly often reaching triple digits. Failure to repay can result in additional costs and damage to your credit score.

Are these loans safe?

Not necessarily. While they may provide instant access to funds, they frequently come with extremely high interest rates and fees. Borrowers might quickly become locked in a debt cycle.