Meet two friends, Harry and Ron, and start with their life’s journey. Harry had an expense card, a magical tool that made managing money like a feather. He easily swiped, tracked, and budgeted, enjoying a smooth financial adventure. Ron, however, relied on old-fashioned methods, struggling to keep tabs on his spending. We’ll see how Harry’s financial path, paved with convenience, differs from Ron’s more challenging journey. It’s a tale of how simple tools can make a difference in the quest for financial stability. This article explores how expense card providers, like modern-day wizards, have transformed money management.

Table of Contents

What is an expense card?

An expense card is a credit card or debit card that is issued to employees for the purpose of making business-related purchases. Expense cards are typically linked to a corporate account, so the employee does not have to pay for the purchases out of their own pocket.

Why use an expense card?

There are many reasons why businesses use expense cards. Here are a few of the most common reasons:

- Convenience: Expense cards make it easy for employees to track and reimburse business expenses. Employees can swipe the card for all of their business-related purchases, and the expenses will be automatically tracked and categorized.

- Security: Expense cards can help to protect businesses from fraud. Businesses can set spending limits and restrictions on the cards, and they can also track the location of the cards in real-time.

- Compliance: Expense cards can help businesses to comply with accounting regulations. Businesses can use expense cards to track their spending and generate accurate expense reports.

What are the benefits of using an expense card?

There are many benefits to using an expense card, including:

- Convenience: Expense cards make it easy for employees to track and reimburse business expenses.

- Security: Expense cards can help to protect businesses from fraud.

- Compliance: Expense cards can help businesses to comply with accounting regulations.

- Control: Businesses can set spending limits and restrictions on the cards and track the cards’ location in real-time.

- Data insights: Expense cards can provide businesses with valuable data about their spending habits. This data can be used to improve budgeting and decision-making.

Also Read- Secure Crypto Transactions with the Top VPN Services

TOP 7 EXPENSE CARDS PROVIDERS

Now, let’s delve into the list of the best expense card providers that will make your financial journey smooth, like Harry.

1. Ramp

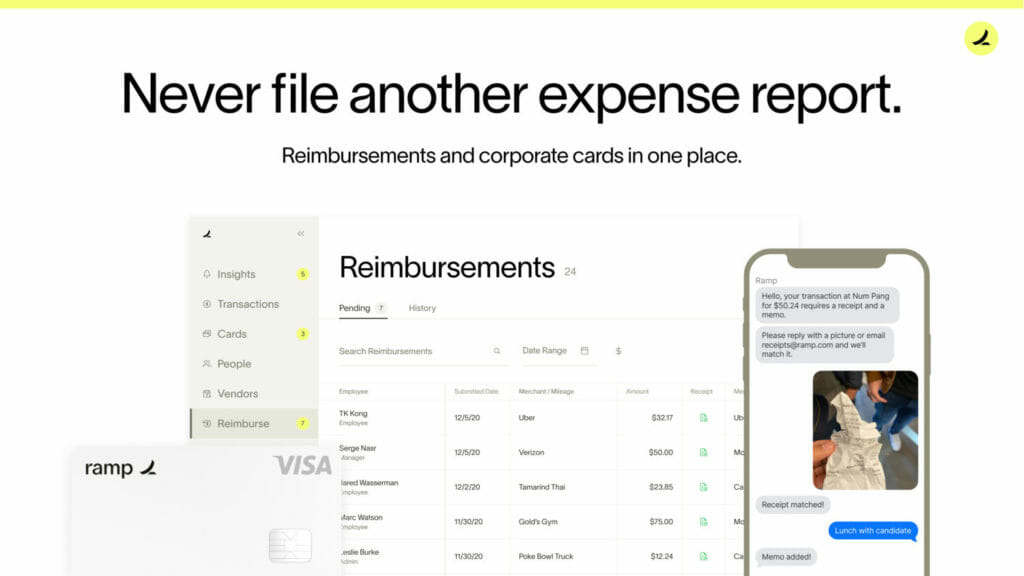

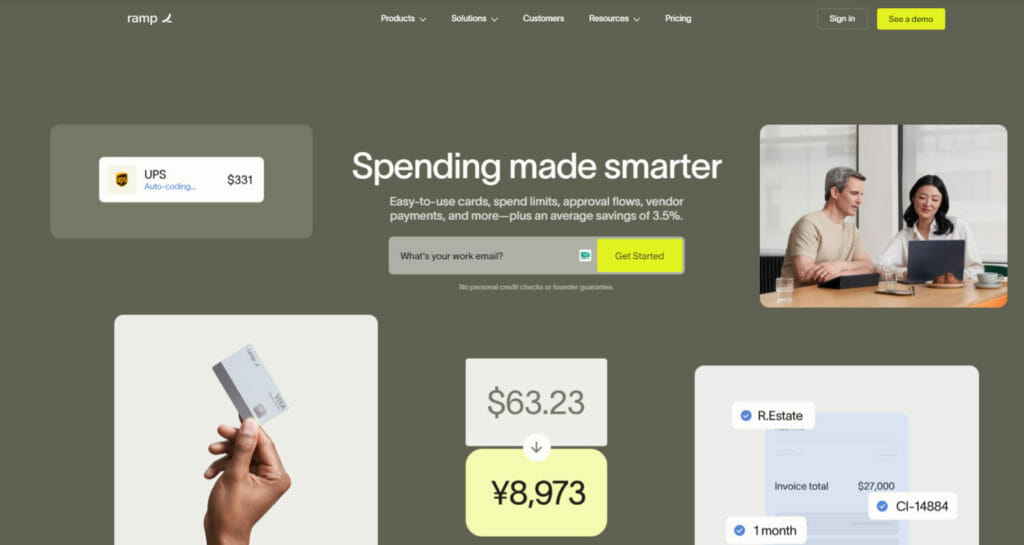

Ramp is a modern expense card that makes expense reporting easy with receipt automation, global reimbursements, and AI-powered reconciliation. It is a great option for businesses of all sizes that are looking for a way to streamline their expense management process.

Here are five of the key features of Ramp:

- Receipt automation: Employees can submit receipts on the go via SMS or the Ramp mobile app. Ramp’s AI automatically categorizes and matches receipts, eliminating submission errors. This saves businesses time and money, as employees no longer have to manually enter receipt data.

- Global reimbursements: Ramp supports reimbursements in 40+ currencies. This is helpful for businesses that operate internationally, as it allows them to reimburse employees in the local currency.

- AI-powered reconciliation: Ramp’s AI automatically reconciles expenses with bank statements. This saves businesses time and money, as they no longer have to manually reconcile their expenses.

- Automated expense policies: Ramp’s automated expense policies ensure that employees only spend money on approved items. This helps to prevent fraud and misuse of company funds. Businesses can create custom expense policies that are specific to their needs.

- Detailed reporting: Ramp provides detailed reports on spending. This helps businesses to track their expenses and make informed decisions. Businesses can customize their reports to see the data that is most important to them.

- Integrations: Ramp integrates with a number of popular accounting software programs, such as QuickBooks and Xero. This makes it easy for businesses to import expense data into their accounting software.

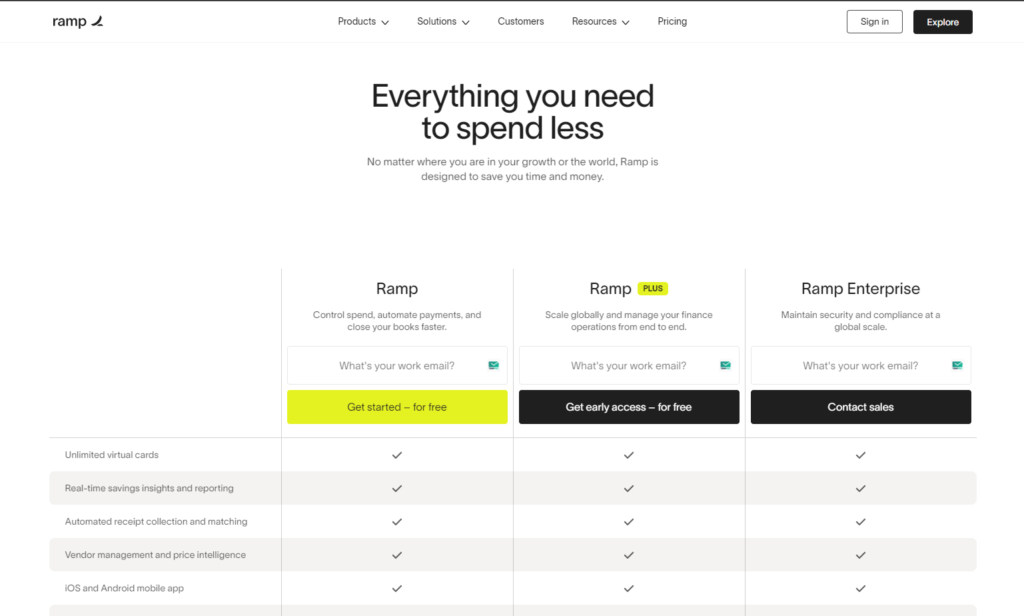

Pricing – Ramp has two plans- one is Ramp, and the other is Ramp Plus. It also has a customized enterprise plan, “Ramp Enterprise”. Click here to know more.

Ramp is a powerful expense management solution that can help businesses save time and money. It offers a variety of features that can help businesses streamline their expense reporting process and prevent fraud. Ramp is a great option if you are looking for a modern expense card that makes expense reporting easy.

Also read – Best VPNs for Crypto Trading

2. Pleo

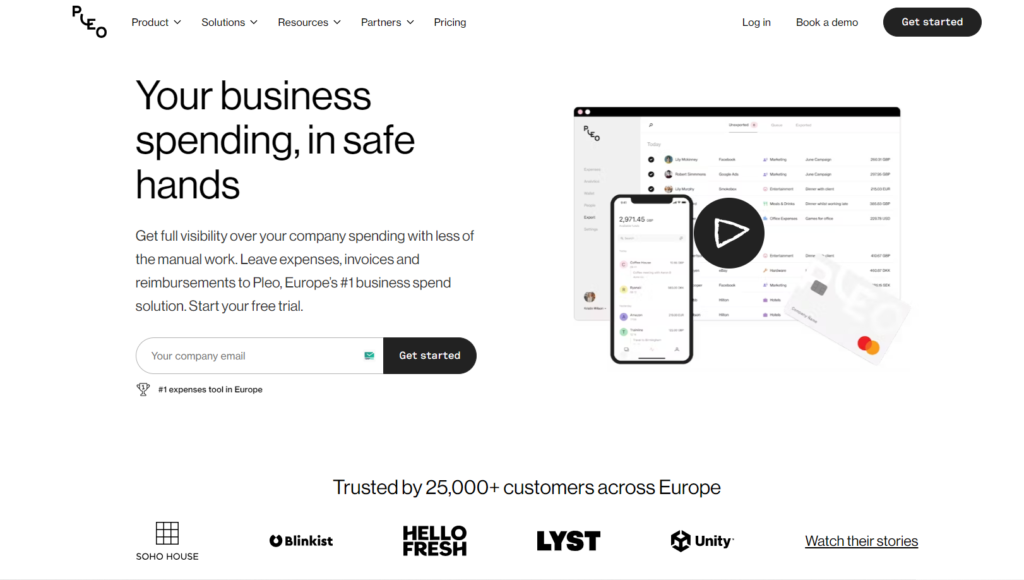

Pleo is a modern expense card that frees your team from admin. It digitizes receipts, automates expenses to invoices, and gives you up to 1% cashback on every transaction. It is a great option for businesses of all sizes that are looking to streamline their expense management process.

Here are five of the key features of Pleo:

- Receipt digitization: Pleo automatically digitizes receipts when employees swipe their cards. This saves businesses time and money, as they no longer have to enter receipt data manually.

- Expense automation: Pleo automates the entire expense management process, from submitting receipts to getting reimbursed. This saves businesses time and money and eliminates the risk of human error.

- Cashback: Pleo offers up to 1% cashback on every transaction. This can save businesses money on their business spending.

- Spend insights: Pleo provides businesses with detailed insights into their spending habits. This helps businesses to track their expenses and make informed decisions.

- Integrations: Pleo can easily integrate with popular accounting software programs like QuickBooks and Xero.

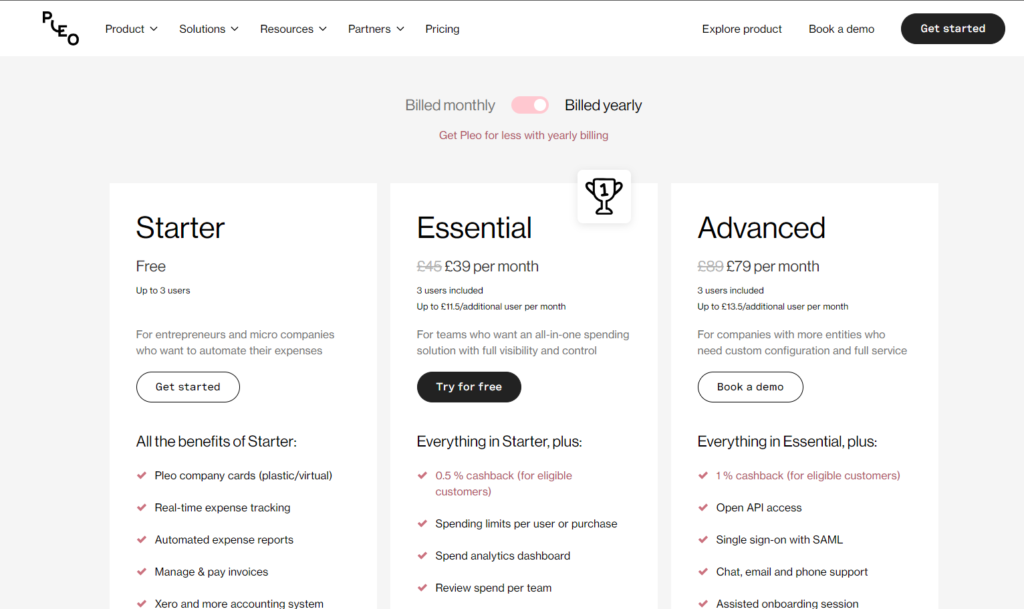

Pricing: Pleo offers three plans: ‘Starter,’ which is free for up to 3 users, and the other two plans, ‘Essential’ and ‘Advanced,’ which cost $39/month and $79/month, respectively. Click here to know more.

Pleo is a powerful expense management solution that can help businesses save time and money. It offers a variety of features that can help businesses streamline their expense reporting process and prevent fraud. If you are looking for a modern expense card that can free your team from admin, Pleo is a great option.

Also read- 8 Best FinTech Apps in India

3. Wallester

Wallester is a modern expense card that simplifies expense management with white-label solutions, KYC/AML compliance, tokenization, 3D Secure, virtual cards, and fraud monitoring. It is a great option for businesses of all sizes looking for a way to streamline their expense management process.

Here are five of the key features of Wallester:

- White-label solutions: Wallester offers a flexible white-label solution that allows businesses to launch branded credit cards specifically for their business. This guarantees a fast time-to-market through simplified integration.

- KYC/AML compliance: Wallester fully complies with all regulations and directives affecting businesses, including KYC and AML requirements. This helps businesses to protect themselves from fraud and financial crime.

- Tokenization: Wallester allows businesses to tokenize any cards to add them to digital wallets, such as Apple Pay, Google Pay, and Samsung Pay. This makes it easy for businesses to make payments and transfers securely and conveniently.

- 3D Secure: Wallester supports 3D Secure, which makes e-commerce particularly secure by requesting an additional verification step with the card issuer at the time of the transaction. This helps to prevent fraud and protect businesses from financial losses.

- Virtual cards: Wallester allows businesses to issue instant personalized virtual cards for various purposes. Virtual cards enable businesses to make instant payments, transfers, and online purchases securely and reliably.

- Fraud monitoring: Wallester offers a fraud monitoring service that provides payment transaction monitoring to detect and prevent payment card fraud. This helps businesses to protect themselves from financial losses.

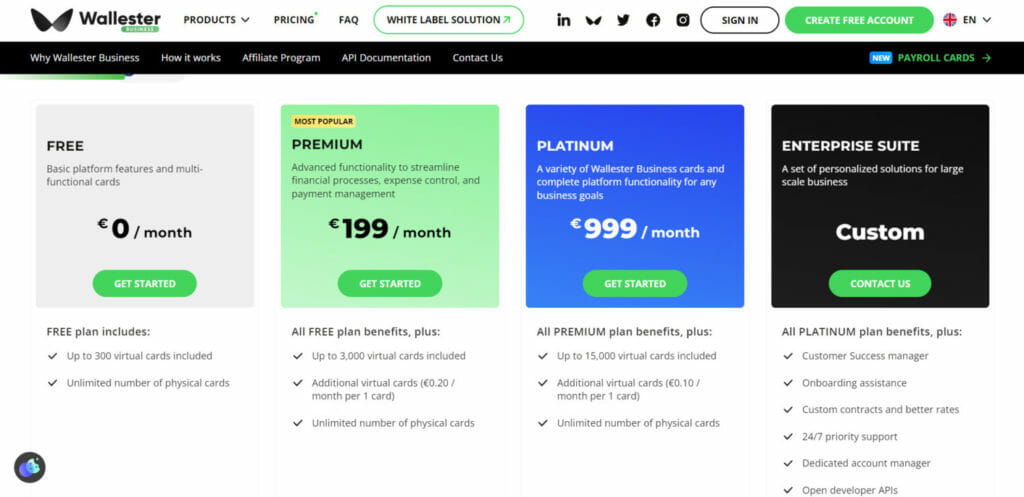

Pricing– Wallester offers different types of plans such as Free, Premium, Platinum. It also has an enterprise plan which is customizable. Click here to know more.

Wallester is a powerful expense management solution that can help businesses save time and money. It offers a variety of features that can help businesses streamline their expense reporting process and prevent fraud. If you are looking for a modern expense card that makes expense management easy, Wallester is a great option.

Also read- 7 Best FREE AI Chatbots That Will Blow Your Mind

4. Pex

Pex is a leading provider of commercial cards and spend management solutions for businesses. With over 10 million cards issued, Pex aims to help companies take control of their expenses.

Here are 5 key features of Pex’s offerings:

- PEX Visa Commercial Cards – Pex offers instant-issue Visa corporate cards that provide businesses with flexibility and transparency for managing employee spending. Key benefits include 1% cashback on purchases and easy program management.

- Prepaid Cards – Besides corporate cards, Pex provides customizable prepaid card solutions. These allow for strict spending control and oversight when issuing funds for specific uses like vendor payments or employee stipends.

- Virtual Vendor Cards – Pex offers virtual one-time-use cards to streamline vendor payments. Businesses can set specific usage limits and parameters on virtual cards issued to vendors and service providers.

- Grants and Incentives Cards – The Pex platform enables seamless disbursement of funds for grant programs, promotional giveaways, and employee rewards. Businesses can instantly issue prepaid cards and manage detailed reporting.

- Integration and Automation – Pex cards and platform integrate with popular accounting, ERP, and T&E systems. This allows for smooth data transfer and automated reconciliation. Customizable rules and controls provide oversight while reducing manual work.

Pex aims to simplify corporate spending with smart cards tailored for distinct needs. The platform provides oversight along with flexibility and automation to optimize expense management.

Also read- Top ZoomInfo Competitors – Best 7 FREE Alternatives

5. FinlyHQ

FinlyHQ is an expense management platform with over 5,000+ brands, such as Swiggy, Sharechat, etc. they work with. FinlyHQ helps to manage expenses by digitizing the whole process with scalable automation. It provides financial solutions to vendors and businesses.

Here are five key features of FinlyHQ:

- Receipt automation: Employees can submit receipts on the go via the FinlyHQ mobile app. FinlyHQ’s AI automatically categorizes and matches receipts, eliminating submission errors. This saves businesses time and money, as employees no longer have to enter receipt data manually.

- Global reimbursements: FinlyHQ supports reimbursements in 40+ currencies. This is helpful for businesses that operate internationally, as it allows them to reimburse employees in the local currency. Reimbursements are processed in two days or less, so employees don’t have to wait long to get reimbursed for their expenses.

- AI-powered reconciliation: FinlyHQ’s AI automatically reconciles expenses with bank statements. This saves businesses time and money, as they no longer have to reconcile their expenses manually.

- Automated expense policies: FinlyHQ’s automated expense policies ensure that employees only spend money on approved items. This helps to prevent fraud and misuse of company funds. Businesses can create custom expense policies that are specific to their needs.

- Budget Control System: FinlyHQ can help businesses create and manage budgets. This can help businesses to track their spending and to stay on track with their financial goals.

- Detailed reporting: FinlyHQ provides detailed reports on spending. This helps businesses to track their expenses and make informed decisions. Businesses can customize their reports to see the data that is most important to them.

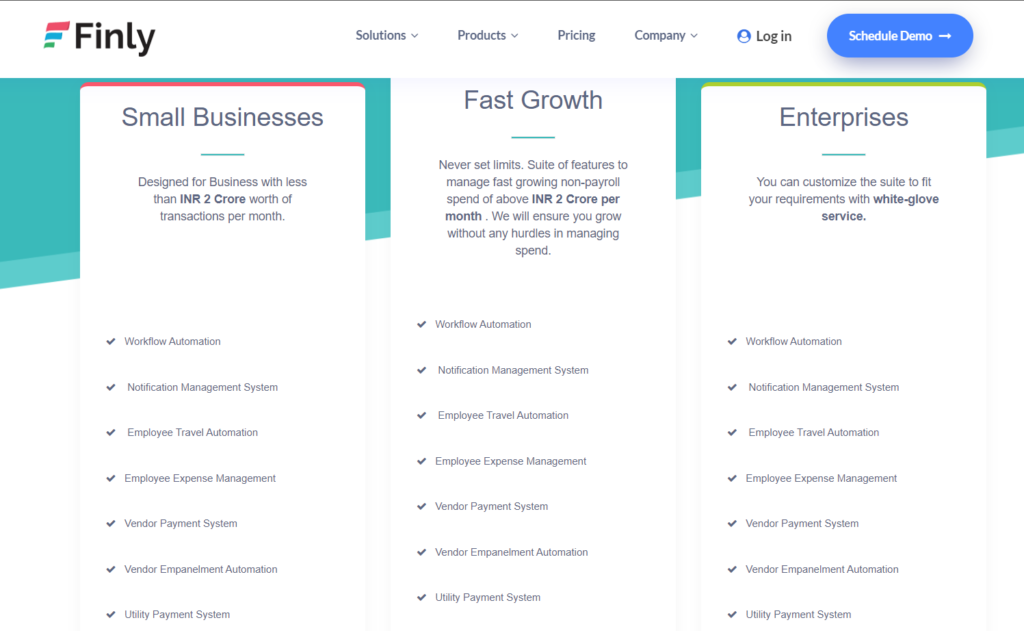

Pricing: FinlyHQ offers plans for different sectors, such as Small Businesses, plans for Fast Growth, and lastly, the customized enterprise-level plan. Click here to know more.

FinlyHQ is a powerful expense management solution that can help businesses save time and money. It offers a variety of features that can help businesses streamline their expense reporting process and prevent fraud. If you are looking for an expense management solution that can help you save time and money, FinlyHQ is a great option.

Also read- Einstein GPT- The World’s First AI Platform For CRM

6. Wise

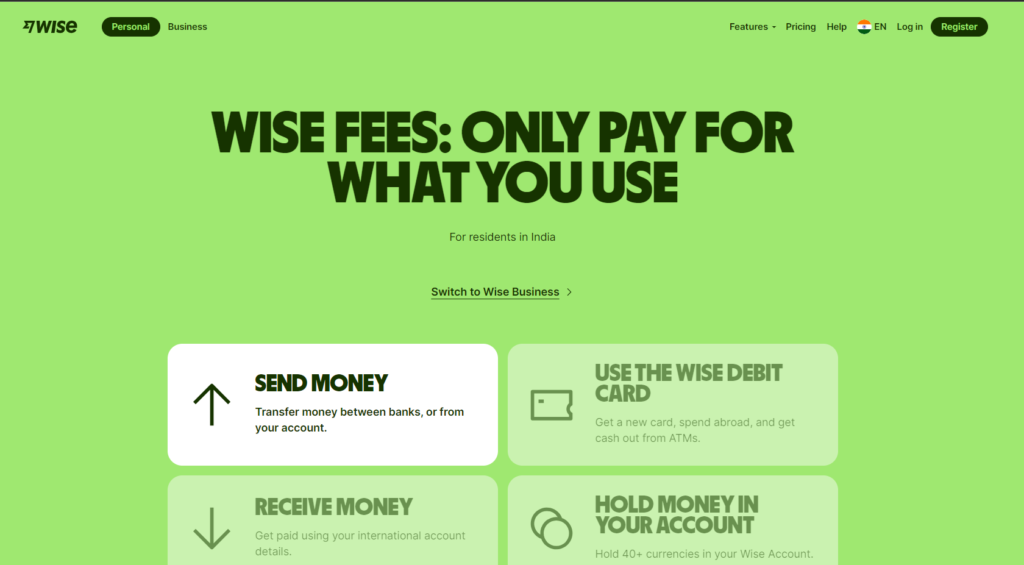

Wise is a financial technology company that allows you to send money internationally at a lower cost than traditional banks. Wise uses the real exchange rate, so you know exactly how much money you send and receive.

Here are five of the key features of Wise:

- Real exchange rate: Wise uses the real exchange rate, the mid-market rate banks and currency exchanges use to trade currencies. This means you get the best possible exchange rate when sending money with Wise.

- Low fees: Wise charges low fees, typically 0.35% to 2.85% of the transfer amount. This is much lower than the fees charged by traditional banks.

- Fast transfers: Wise transfers are typically processed within minutes. This is much faster than traditional bank transfers, which can take days or weeks to complete.

- Transparent pricing: Wise shows you the amount of money you will send and receive before confirming your transfer. This means that there are no hidden fees or surprises.

- Strong security: Wise uses the latest security measures to protect your money. This includes 256-bit encryption and fraud detection.

Pricing: Wise offers plans based on your use case. Click here to know more about pricing.

Wise is a great option for anyone who needs to send money internationally. It offers low fees, fast transfers, and transparent pricing. Wise also uses strong security measures to protect your money.

Also read- Need Global Economic Data? Here are the Top 10 Websites for it!

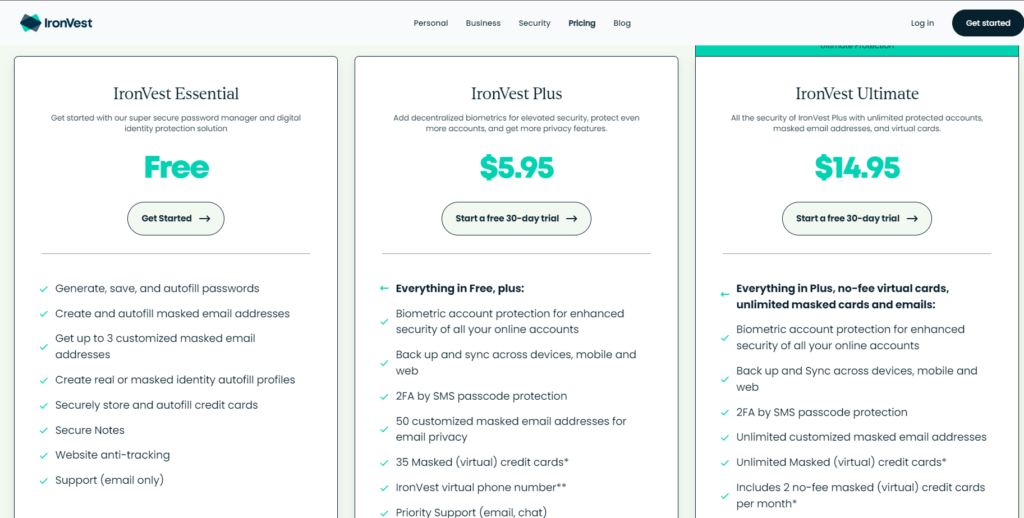

7. Ironvest

IronVest is a secure and reliable expense card that can help businesses protect their finances. It offers a variety of features that can help businesses to prevent fraud and misuse of company funds.

Here are five of the key features of IronVest:

- Strong security: IronVest uses industry-leading security measures to protect your business’s finances. These measures include 256-bit encryption, tokenization, and fraud monitoring.

- Flexible controls: IronVest gives you full control over how your employees use their cards. You can set spending limits, restrict purchases to certain merchants, and require receipts for all transactions.

- Easy reconciliation: IronVest automatically reconciles your expenses with your bank statements. This saves you time and money, as you no longer have to manually reconcile your expenses.

- Detailed reporting: IronVest provides detailed reports on your spending. This helps you to track your expenses and make informed decisions.

- Virtual cards: You can create virtual cards for employees, which can be used for online purchases. This helps to protect your business from fraud.

Pricing: Ironvest offers 3 types of plans based on the needs of the users. Click here to know more.

IronVest is a powerful expense management solution that can help businesses protect their finances. It offers a variety of features that can help businesses to prevent fraud and misuse of company funds. If you are looking for a secure and reliable expense card, IronVest is a great option.

Also read- 11 Hacks to Skyrocket Your Email Open Rates

Conclusion

In summary, expense cards provide a valuable solution for businesses looking to optimize spend management. Key benefits include streamlined tracking and reporting, enhanced oversight and control, integrated accounting, and data-driven insights. Leading providers like Ramp, Pleo, Wallester, Pex, FinlyHQ, Wise, and Ironvest offer robust features tailored to meet distinct business needs. The right expense card can save time, reduce fraud risks, improve compliance, and inform better financial decision-making. Carefully evaluating providers based on specific requirements will ensure finding the ideal expense card to simplify processes and drive ROI. With the convenience and insights they provide, expense cards are an investment worth considering for any growth-focused business.

What is an expense card?

An expense card is a credit or debit card issued to employees to make business-related purchases. The purchases are charged to a corporate account rather than the employee’s personal funds.

Why should businesses use expense cards?

Expense cards offer convenience, security, compliance, control, and data insights. They simplify tracking and reimbursement of business expenses while preventing fraud through spending limits and location tracking.

What are the key benefits of expense cards?

Key benefits include convenience, enhanced security, regulatory compliance, granular spend controls, and data-driven insights to improve budgeting and decision-making.

What are some top expense card providers?

Top providers include Ramp, Pleo, Wallester, Pex, FinlyHQ, Wise and Ironvest. They offer features like receipt digitization, automated reconciliation, customized controls, and detailed analytics.

What accounting integrations are available?

Ramp and Pleo both integrate with QuickBooks, Xero, NetSuite and other accounting platforms.