Extended is a Starknet-based perpetuals exchange built by an ex-Revolut team, designed to feel as fast as a CEX while keeping self-custody and on-chain settlement. Its core idea is unified margin—one collateral engine that can power perps now and, over time, spot and lend—so your capital works harder. In this article we will explore Extended Review

What is Extended?

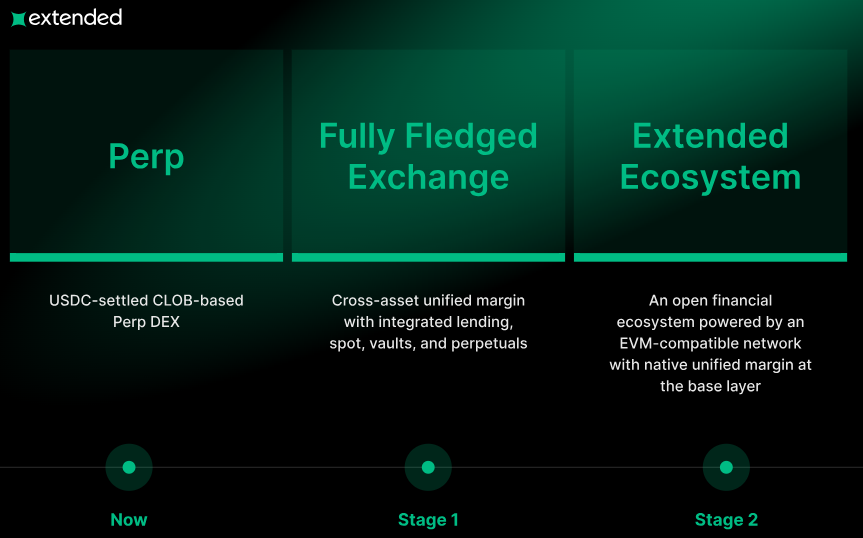

Extended is a next-generation perpetual DEX on Starknet (Ethereum L2) built by an ex-Revolut team. It aims to unify perpetuals, spot, and lending under one margin system, so you can use multiple assets—including yield-bearing tokens—as collateral while trading USDC-settled perps (up to 100× leverage on selected markets). The long-term vision is bigger than a single DEX: Extended wants to become an open financial network where unified margin is embedded at the protocol layer, enabling shared liquidity and a single account across many dApps.

Extended Review: Features

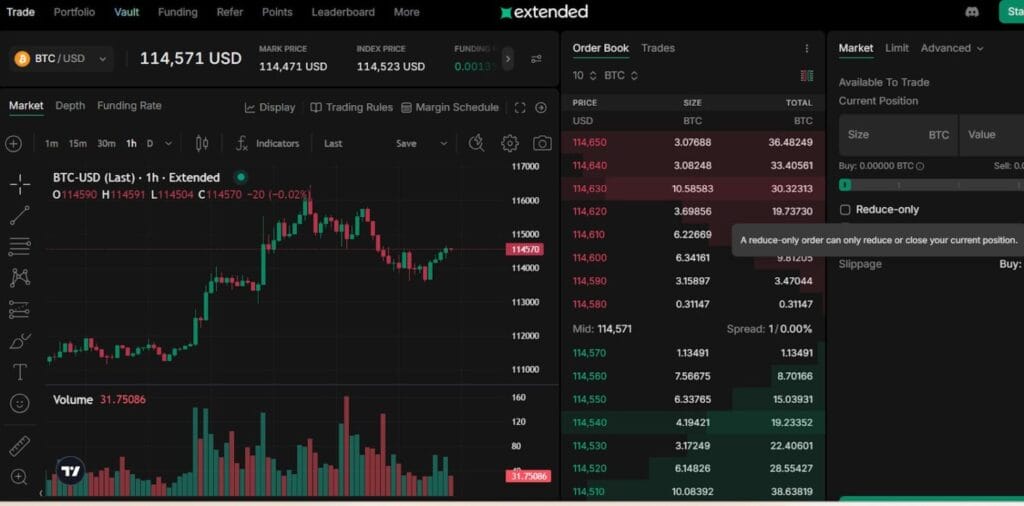

- Perpetual futures on Starknet: Trade USDC-settled perps on majors (and curated indices) with high leverage, CEX-style order books, and on-chain settlement. Matching feels fast and familiar, while Starknet preserves self-custody and verifiable records for every executed trade.

- Unified Margin (core design): One collateral engine aims to power perps, spot, and lending together. Post diversified collateral—including yield-bearing assets like wstETH—to back positions, reuse capital across products, and simplify management with a single risk view instead of siloed balances.

- Cross margin + isolated sub-accounts: Use cross margin for capital efficiency across correlated strategies, or spin up isolated sub-accounts (up to ten per wallet) to ring-fence experiments. A mistake in one sandbox won’t automatically endanger your entire main account.

- Current product (today’s experience): USDC-collateralized perps live on Starknet mainnet with native wallet support (MetaMask, WalletConnect, Starknet wallets). You get a CEX-like ticket, order book, health panels, funding timers, and clear liquidation distance to manage risk confidently.

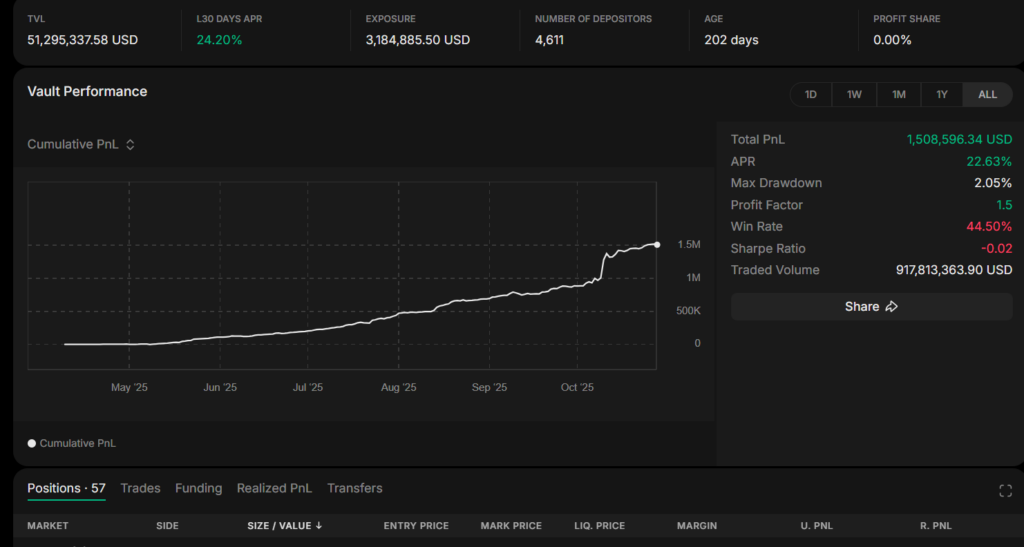

- Vault (passive liquidity participation): Deposit funds that quote across supported markets, accruing net fees after maker/referral rebates. Understand the 24-hour deposit lock, pro-rata withdrawal mechanics, exposure limits, and strategy risk during volatile periods before allocating meaningful size.

- Multi-chain deposits & withdrawals: Fund from popular EVM chains (Ethereum, Arbitrum, Base, BSC, Avalanche, Polygon) and withdraw back along documented routes. Review limits, expected timings, and bridge liquidity so funding and settlements align with your trading cadence and risk needs.

- Transparent Maker Program (no side deals): Market-making incentives follow published rules rather than private arrangements. Activity and rebates are tracked openly to keep liquidity competition fair, letting new or smaller teams participate without negotiating bespoke terms behind closed doors.

- Roadmap toward a financial network: After stabilizing unified margin and adding native lending plus spot, Extended plans an EVM-compatible network on Starknet. Unified margin would become protocol-level, enabling shared liquidity and one margin account accessible across many integrated dApps.

- Testnet (Sepolia): Try Extended safely at sepolia.extended.exchange. You can claim $1,000 test USDC per day per L1 wallet—shared across all linked trading accounts. Claiming test collateral is the only way to fund testnet and practice orders, margin, and withdrawals.

- Leaderboard (transparent performance tracking): A public leaderboard highlights top traders and market makers by PnL, volume, and other metrics over different time windows. It encourages healthy competition, lets newcomers study successful styles, and helps teams benchmark strategies without relying on private, unverifiable claims.

- Funding (keeps perps near spot): Perpetuals charge or pay funding between longs and shorts based on market skew and index price. Funding is separate from trading fees, can change each interval, and materially impacts multi-day PnL—plan entries, exits, and sizing with expected funding in mind.

Extended Review: Fees

- Flat trading fees today: Extended charges 0.025% taker and 0.000% maker. This means crossing the book costs a small fee, while resting limit orders that get hit are free. The team may update fees in the future.

- Maker rebates (earn back on volume): If your 30-day maker market share crosses a threshold, you automatically earn a rebate on your maker volume: 0.0025% (≥0.5%), 0.005% (≥1%), 0.01% (≥2.5%), 0.02% (≥5%).

- No signup needed: There’s no enrollment for rebates. Extended tracks your rolling 30-day maker share platform-wide and accrues rebates automatically for eligible makers based on that share and your executed maker volume.

- Payout cadence and minimum: Rebates pay daily at 00:00 UTC for the prior 24 hours into your Extended account, provided the daily rebate ≥ $10. Smaller accruals roll forward until the minimum is met.

- Good to know: Fee schedules and rebate logic can change; always check the live table before sizing strategies around them. Questions about maker rebates? Email: [email protected] for clarifications or edge cases.

Extended Review: Referrals & Rewards

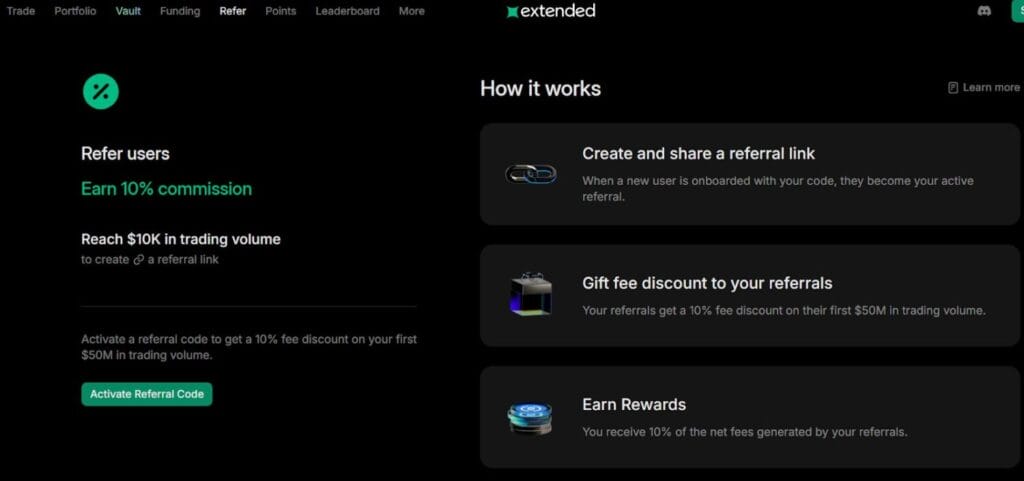

- Referral program (start here): Trade $10,000+ on Extended, then create your own link (e.g., app.extended.exchange/join/CODE). Your CODE can be up to 15 letters/numbers, and you can generate multiple links for different audiences.

- Referral benefits: As a referrer, you earn points + 10% of the fees paid by your referees, with no volume cap per referral. Your invited users get a 10% commission discount on their first $50M of total trading volume.

- Affiliates (for larger creators/teams): If you have 4,000+ followers on one platform or referred $10M+ volume in the last 30 days, you can apply. Affiliates receive boosted points and fee rebates on all referred volumes, with no caps.

- Automatic user giveback: The affiliate program auto-redistributes 50% of an affiliate’s earned referral points back to their users—so people who join via an affiliate get extra upside. Even after sharing, affiliates still net more points than regular referrers.

- Sub-affiliates: Affiliates can recruit eligible sub-affiliates and earn an additional 10% of the fees paid by the sub-affiliates’ users. This does not reduce what sub-affiliates earn; it’s paid on top of their own rebates.

- Points Program (Season 1): Launched April 29, 2025, with up to 1.2M points distributed weekly (every Tuesday, 00:00 UTC). Earn points by Trading, Providing Liquidity (Vault or tight quotes), and Referring—affiliates earn more than standard referrers.

- Evolving criteria + early rewards: Allocation logic can change weekly as products evolve. Ahead of Season 1, Extended distributed 4.3M Early Participation points on Feb 26 and Apr 28, 2025. For updates, follow X (Twitter) and Discord.

Extended Review: Security

- Hybrid Architecture: Matching and risk engines off-chain for speed; settlement on Starknet for verifiability and self-custody.

- Custody Model: Users retain control; the platform is designed so it cannot take custody of funds.

- Liquidation Stack: Insurance fund, partial liquidation before full, and ADL as a last resort.

- Audits & Bounty: Smart-contract audits and bug-bounty pathways encourage responsible disclosure.

- Policy & Access: Terms, restricted regions, and privacy disclosures are published for clarity.

Extended Review: How to Get Started

- Verify links and open Extended; avoid phishing by using official domains.

- Connect a wallet (MetaMask/WalletConnect/Starknet) and deposit USDC from a supported chain.

- Start tiny: Place a small limit order, attach a stop, and watch margin/liquidation distance.

- Explore risk modes: Try isolated for new markets, cross for hedged strategies.

- Consider the Vault once you understand lockups, fees, and risk. Recheck fee tables and program notes before scaling.

Extended Review: UI & UX

- CEX-style terminal with on-chain guardrails: The public site emphasizes lightning-fast, one-click trading and advanced order types, aiming to feel familiar to CEX users without sacrificing decentralization and transparency.

- Clarity for beginners: The “Trading” docs centralize rules, fees, order types, and risk concepts, making it easier to learn margin mechanics, funding, and liquidation behavior before committing meaningful size.

- Performance cues: Sub-20ms handling targets and low-latency claims suggest responsive order tickets and quick confirmations—helpful during news events when traders must react without wrestling with the interface.

- Operational visibility: “More” includes a platform-outage page and testnet guides, so users can verify status, rehearse workflows safely, and troubleshoot without risking capital during integration or learning periods.

- Accessible market specifics: Per-market “Trading Rules” expose limits and groups by liquidity tier, encouraging informed sizing, slippage control, and realistic leverage choices across pairs with very different depth profiles.

Extended Review: Customer Support

- Docs first: The GitBook organizes core topics—trading rules, fees, order types, liquidation, funding, deposits/withdrawals—so most common questions can be answered without waiting for a ticket.

- Status & outage notes: Dedicated pages indicate platform status and outage communications, helping traders plan around maintenance windows or temporary constraints during volatile sessions.

- Security & audits: Links to audits and bug bounty provide a clear path for reporting issues responsibly, with scope and process documented for researchers and concerned users.

- Community channels: Official site and social accounts post product updates; following them helps verify the correct app links, avoid impostors, and catch feature changes affecting fees, limits, or market coverage. You can explore Telegram, Discord and X.

Conclusion

Extended blends pro-grade execution with on-chain assurances and a credible path to capital efficiency via unified margin. New users can learn with tiny sizes or testnet; advanced users get high-leverage majors, isolated sub-accounts, and open maker rebates. Roadmap success—lending, spot, and network-level unified margin—could unlock shared liquidity and one-account UX across dApps. As always, verify live fees, funding, limits, and vault mechanics before trading size.

Is Extended available to all countries?

Check the restricted-countries list in the legal docs; access may vary by jurisdiction and local regulations.

Which wallets are supported?

Can I deposit from multiple chains?

Yes—Ethereum, Arbitrum, Base, BSC, Avalanche, and Polygon are supported routes; timings and limits depend on bridge liquidity.