Key Takeaways:

- Described Alameda-FTX offer as “not value-maximizing,” adding it could potentially harm customers

- Voyager claims the offer is just a liquidation of Voyager’s assets on the basis that advantages AlamedaFTX

- Under the proposal, Alameda was to acquire all Voyager digital assets and digital asset loans.

- The proposal involved Voyager’s customers being provided with the option to start a new FTC account.

Battered crypto lender Voyager Digital has rejected the buyout offer of Sam Bankman Fried’s FTX and its investment firm Alameda Ventures. The crypto lender has described the offer as “not value-maximizing” and called it a low-ball bid.

On July 22, Sam Bankman-Fried’s FTX and Alameda Ventures offered a joint proposal providing Voyager’s customers an option to start a new FTX account with an opening cash balance funded by an early distribution on a portion of their bankruptcy claims. The joint offer was fueled by Voyager halting withdrawal and later filing for Chapter 11 bankruptcy.

However, in its latest letter, Voyager has not only outrightly declined the offer but also stated that SBF’s announcement of the offer was “laden with misleading or outright false claims”.

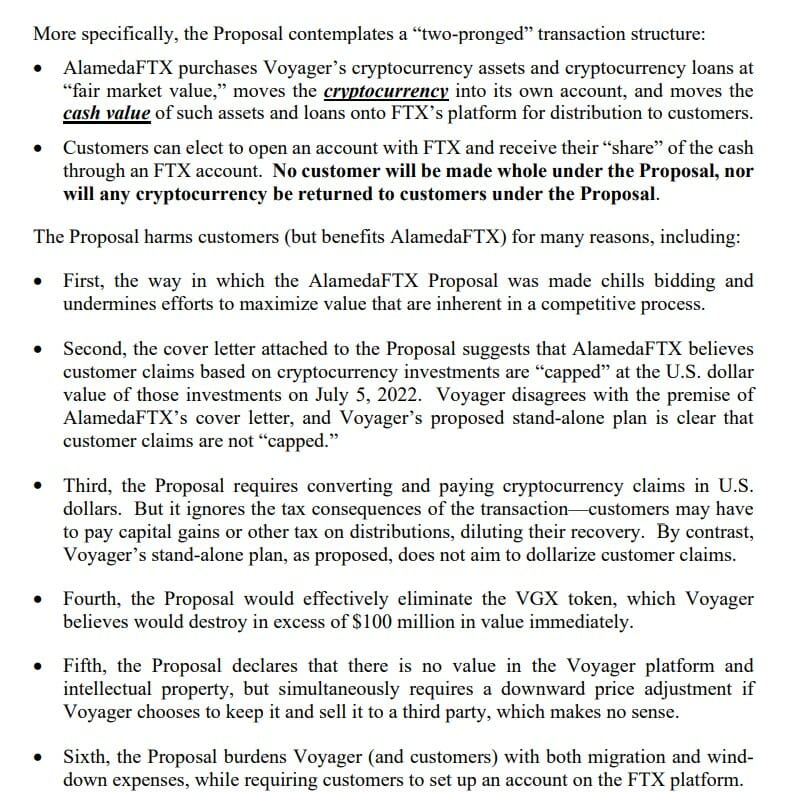

According to Voyager’s lawyers, the offer which involved Alameda inheriting Voyager’s assets is “essentially just a liquidation of Voyager’s assets on the basis that advantages AlamedaFTX.” In the letter, the lender put forth why the reason why the proposal would harm Voyager’s customers but benefit AlamedaFTX.

One of the reasons cited includes the “unfairly capping the value of each Voyager user’s account at their July 5 value”. July 5 was a day prior to when Voyager Digital filed for Bankruptcy.

Voyager states that the Alameda-FTX proposal requires converting and paying cryptocurrency claims in U.S. dollars. “It ignores the tax consequences of the transaction—customers may have to pay capital gains or other tax on distributions, diluting their recovery. By contrast, Voyager’s stand-alone plan, as proposed, does not aim to dollarize customer claims”, the letter announcing their offer rejection reads.

In the strongly worded letter, Voyager goes on to say that the proposal, which was made in contravention of the Bidding procedures, was designed to generate publicity for FTX rather than value for Voyager’s customers. The crypto lender states that under the proposal nor the customer will be made a whole of the proposal, and no crypto will be returned to Voyager’s customers.

When FTX announced the offer, its CEO SBF stated that the goal of the joint proposal was to help establish a better way to resolve an insolvent crypto business.

Following the rejection, SBF took to Twitter to explain why they made the offer to Voyager. Contradictory to contents in Voyager’s rejection letter, SBF states that the joint offer would give Voyager customers back 100% of the remaining assets that Voyager has, including claims on anything recovered in the future.

Voyager Digital was pushed into Bankruptcy after Three Arrows Capital defaulted on a loan comprising $350 million in a USD stablecoin and 15,250 Bitcoins, worth $323 million. FTX has engaged in several crypto buyouts ever since the TeeraUST/LUNA crash in May. Recently FTX provided a $400 million revolving credit facility to troubled BlockFi along with an option to acquire the platform at a variable price of up to $240 million.