Key Takeaways:

- 3AC’s biggest creditor is Genesis loaning over $2.3 Billion,

- Genesis loan to 3AC had a weighted average margin requirement of over 80%

- 3AC Founders’ location is unknown,

- Reportedly, 3AC Co-founder Zhu Su is on the list of creditors,

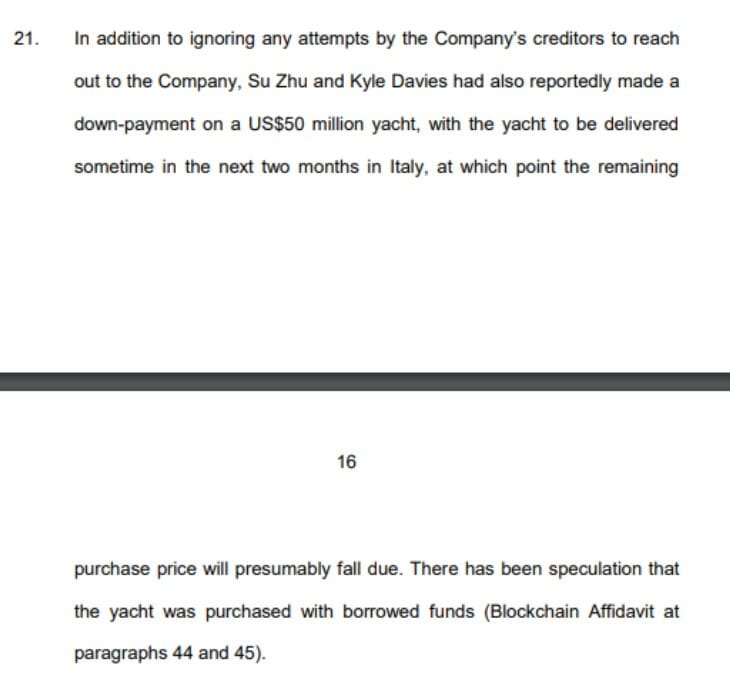

- Court Documents speculate that borrowed money was used to fund a yacht by the founders’.

Crypto hedge Three Arrows Capital(3AC) filed for Chapter 15 bankruptcy on July 2. Ever since then, the firm and its founders have faced the wrath of counterparties knocking on its door seeking debt repayment. The liquidators of 3AC have filed an application in the High Court of Singapore for a stay on claims against 3AC and access to the company’s Singapore headquarters.

The over 1000-page leaked court document reveals some unknown truths about the now insolvent crypto hedge fund. The leaked court filing reveals that 3AC owes over $3 Billion to creditors, and the firm’s biggest creditor is Genesis, a subsidiary of Digital Currency Group that owns Grayscale, loaning around $2.3b. Earlier reports have stated that Genesis faced a potential nine-figure loss from its exposure to 3AC, but the exact size of the debt has not been reported until now.

Genesis CEO Michael Moro said on July 6 said that the firm loans to 3AC had a weighted average margin requirement of over 80%, which 3AC had been unable to meet, prompting Genesis to sell its collateral. Moro added that Digital Currency Group had assumed certain Genesis liabilities to ensure it has the capital “to operate and scale” its business going forward. According to people familiar with the matter, it is now Digital Currency Group — not Genesis — that is exposed to potential losses linked to 3AC’s borrowing.

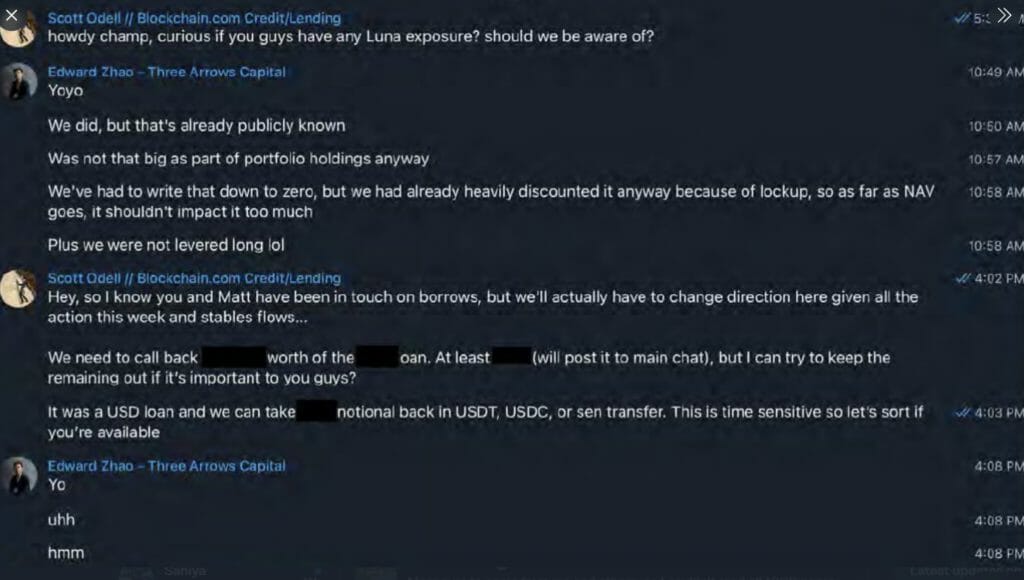

The document further acknowledges that default on debts contributed to the insolvency of Celsius and Voyager Digital. In an earlier affidavit, Blockchain.com’s Chief Strategy Officer Charles McGarraugh revealed that 3AC co-founder Kyle Davies told him earlier that Davies tried to borrow another 5,000 BTC from Genesis, which at that time was valued around $125 million, “to pay a margin call to another lender.”

Much to everyone’s surprise, Twitter user Soldman Gachs who is a creditor to 3AC, revealed that 3AC Co-founder Zhu Su was on the list of creditors. The co-founder reportedly filed a claim for $5 million.

The other notable claimants include Digital Currency Group, CoinList, Algorand, Defiance Capital, BlockFi, Bitgo. ThreeAC Limited, the Investment Manager of the Fund, has also filed a claim for $25 million. Recently it was revealed the troubled Crypto lender Celsius loaned $75 million to Three Arrows Capital.

Founders- Location Unknown and Concerning Purchases

As per the document, the location of Zhu and Davies is currently unknown. Zhu’s latest public interaction involved him taking to Twitter on July 12 accusing liquidators of baiting. Recently, during online liquidation proceedings, Kyle and Su were on a call with cameras off and muted.

The court document further details the founder’s purchases while the firm was on the brink of being insolvent. Between Sep 20 and June 22, Zhu bought two Singapore’ Good Class Bungalows’ and a yacht that has yet to be delivered. The various real estate investments held under the names of 3AC co-founder Su Zhu’s child and wife include two residences in Singapore worth $48.8 million and $28.5 million. The filing speculates that the yacht might have been bought with borrowed funds.

“It is unclear how the assets of the Company were dealt with by its founders and whether the assets of the Company were used toward the purchases that they have been making,” an affidavit from liquidator Russell Crumpler reads.

Unanswered Questions and Surging Speculations

3AC Co-founders now have a lot of clarifications to make before going ahead with their next step. First, why would the co-founder of 3AC add its name under claimants when he himself is shying away from the public and the media? What are the possibilities of Genesis, 3ac’s biggest creditor, becoming insolvent in the future? Genesis so far appears to be solvent.

What is the link between Tai Ping Shan LTD (TPS) and 3AC? Why is TPS trying to distance itself from 3AC despite being earlier referred to as “the official OTC service of Three Arrows Capital” on LinkedIn? Reportedly, the firm recently transferred $31m in stablecoins by a 3AC account.

When will all the claimants come clean about how much they loaned 3AC? What are the possibilities of 3AC’s VC investments negatively affecting projects as token unlocks get sold off by liquidators?

If 3AC had come clean about its expore to TerraUST, how much would the current scenario have changed? Per its liquidation documents, 3AC lost roughly $200 million when UST destabilized from its $1 peg and caused LUNA to crater in value back in May.

As liquidators and creditors corner 3AC seeking their funds, one can only speculate what 3AC’s next move would be.