Key Takeaways

- According to sources, DeFiance Capital was incubated by Three Arrows Capital.

- 3AC and DeFiance has indulged in various co-investment deals in the past.

- DeFiance had earlier tried to distance itself from 3AC after news of the crypto hedge fund’s rumored insolvency became public in mid-June.

Three Arrows Capital-one of the biggest names in the crypto market is currently insolvent. As unfortunate as it is,3AC’s slow demise has triggered bankruptcies and restructurings within the crypto ecosystem. The leading crypto hedge fund has defaulted on its loans to various crypto lenders in the market, forced them towards the brink of bankruptcy.

According to sources, DeFiance Capital — a venture capital firm was incubated by Three Arrows. Reports suggest that DeFiance might be considering legal action against Three Arrows Capital. The legal action can be in the form of arbitration, a lawsuit or an amendment to the bankruptcy proceeding seeking repayment as a creditor.

Reportedly,3AC and DeFiance indulged in various co-investment deals together, including stakes in decentralized exchange dYdX and Solana-based smart contract specialist Orca. In September 2021, Orca raised $18 Million in Series A Funding from 3AC, DeFiance, Solana, among others.

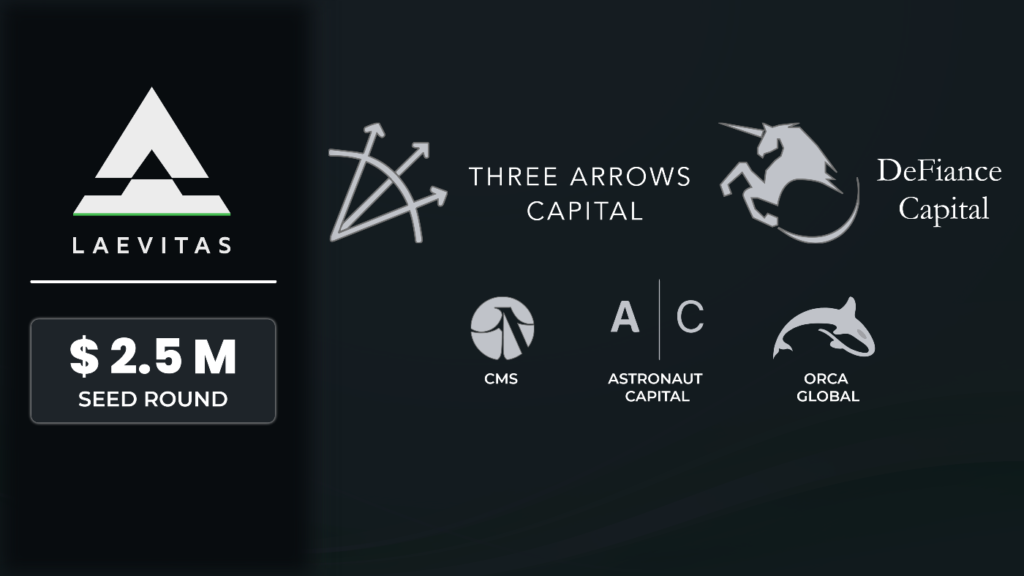

In June 2, Laevitas, a data analytics platform focused on crypto derivatives, announced the closing of a $2.5m seed round co-led by Three Arrows Capital and DeFiance Capital. Apart from investing alongside each other in promising projects the camaraderie shared between DeFiance Capital, and 3AC is unclear.

Reportedly, 3AC played a significant role in the launch of DeFiance in September 2020, providing back and middle office support. It also provided access to deal flow and consultations on hiring. It is unclear whether 3AC firm seeded the startup or bought a part of the general partnership.

When Three Arrows Capital’s descent to bankruptcy became public in Mid-June, DeFiance Capital founder Arthur Cheong put out a tweet stating that the firm was “not done” and was “actively working to resolve the situation.” Cheong’s tweet came hours after Messari founder Ryan Selkis said 3AC faced liabilities of over $1 billion and that funds like DeFiance “may be done”.

During Mid-June, when enquired about 3AC’s prospects and DeFiance’s relationship with the crypto hedge fund, Cheong reportedly stated DeFiance always operates independently. This was a clear indication that DeFiance was trying to excuse itself from the 3AC.

3AC currently has a bunch of counterparties knocking at its door seeking debt repayment. In June, 3AC was issued a default notice by the now-bankrupt Voyager after the exchange failed to make payments on a loan of 15,250 Bitcoins. The crypto hedge fund filed for Chapter 15 bankruptcy to protect U.S. assets from foreign creditors and had as much as US$10 billion under management at one stage.

The implosion of the Terra stablecoin and Luna pushed 3AC into insolvency. Reportedly, 3AC bought 10.9M locked LUNA for $559.6 million. 3AC’s demise has affected custodians and several exchanges in the crypto market. It is yet to be known how DeFinance was impacted by 3AC’s descent into bankruptcy.