Key Takeaways:

- Lido intended to offer Dragonfly Capital 10 million LDO tokens for a fixed price of $1.45 each.

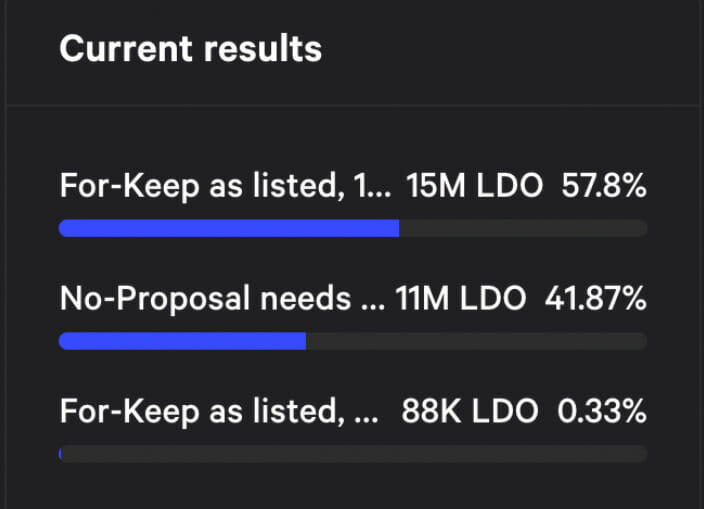

- The proposition was defeated with nearly a two-thirds majority in the final vote.

- With 43M LDO tokens, 600 Lido DAO members voted in favor of the proposal requiring more work, making up around 66.61 percent of the total vote.

In accordance with the liquid staking protocol, the Lido Finance community proposed selling 10 million LDO (Lido DAO) tokens to the cryptocurrency investment firm Dragonfly Capital for $14.5 million. However, the DAO rejected the idea with 66.61 percent of the vote.

In the end, the plan was rejected by nearly 600 DAO users, who together voted with 43 million Lido DAO (LDO) tokens. Only two addresses, totaling 21 million LDO tokens, cast a vote in favor of the token sale in the meantime.

As previously mentioned, Lido’s Head of Business Development, Jacob Blish, proposed a plan to establish a stablecoin “operational runway” for Lido DAO of about two years. The plan sought to exchange algorithmic stablecoin DAI for 2% of the available LDO supply, or about 20 million LDO.

The DAO seeks to raise USD 29m in DAI stablecoin for a price of USD 1.452153 per LDO token. The proposal asks holders of LDO tokens to vote on the following:

- No-Proposal needs more work

- For-Keep as listed, 1 yr lock up

- For-Keep as listed, no lock-up

This token sale represents half of Lido’s projected treasury diversification strategy; 20,000,000 LDO tokens would have been fully sold at a set price of $1.45.

Dragonfly would have received half of this allocation if the vote had been successful. With a combined 43M LDO tokens, 600 DAO members voted against the proposal.

Lido received a lot of backlash for his proposal to sell these currencies to Dragonfly without requiring them to be locked away. There was talk of a potential conflict of interest because of who the whale wallet was that initially supported the proposition.

The most recent vote was just to decide whether to sell LDO 10 million, or half of that sum, to Dragonfly. In the event that it had been approved, the DAO would have received DAI 14,521,530 in exchange for 1% of the LDO supply (or 10M tokens).

The voting process has not been without controversy. A whale address used their LDO 15 million token power to support the proposal in the early voting stages, resulting in a more than 99 percent approval percentage.

The whale address that backed the vote was linked to trading firm Alameda Research, the parent business of the well-known cryptocurrency exchange FTX, according to a screenshot posted by Nansen CEO Alex Svanevik.

Internet users like @HsakaTrades think that the results of DAO voting are frequently predetermined before the proposal is even released.

The Lido team will have to continue working on the project now that Monday’s vote is over. The DAO may put the remaining half of the idea to a vote, although that is not yet known.

Lido Finance stated last month that the exchange rate between stETH: ETH does not represent the underpinning backing of the holder’s staked ETH, but rather a volatile secondary market price. $sETH, Lido Finance’s staked version of $ETH, has recently hit a snag.

Another treasury management-related request from Lido is still unresolved. This one requests that 10,000 ether be converted into stablecoin from the project’s treasury.