Key Takeaways:

- Around a year ago, EU citizens reacted to an ECB consultation by stating unequivocally that privacy is the most critical characteristic of any digital euro.

- In the most basic case, digital euro intermediaries (banks, PSPs, and so on) have access to transaction data but the ECB does not.

The presentation, according to Patrick Hansen, Crypto Venture Advisor at Presight Capital, provides two “desirable” privacy possibilities beyond the baseline to be studied. Low-value payments require privacy, as do offline proximity payments, in which transaction data is not visible to both the intermediary and the ECB.

The European Central Bank is the main component of the Eurosystem and the European System of Central Banks, as well as one of the European Union’s seven institutions. It is one of the most important central banks in the world.

The ECB received over 8000 responses to its consultation on the creation of a digital euro, with privacy being cited as the most valuable feature by 43 percent of users. This was followed by security (18%), the ability to pay across the eurozone (11%), no additional costs (9%), and offline usability (3%). (8 percent ).

The ECB’s consultations with citizens and professional groups are part of its efforts to gain help for its attempts to maintain up with the evolving world of digital currencies and payments.

More than two-thirds of respondents value the role of intermediaries in providing innovative services that enable access to a digital euro and believe it should be integrated into existing banking and payment systems. They would like to see additional services offered in relation to basic digital euro payments.

“A digital euro can only be successful if it meets the needs of Europeans,” says Fabio Panetta, a member of the European Central Bank’s executive board. “We will do everything in our power to ensure that a digital euro meets the expectations of citizens expressed in the public consultation.”

Patrick Hansen raised privacy concerns in a tweet. Approximately a year ago, EU citizens responded to an ECB consultation with a clear message: privacy is by far the most important feature of any digital euro.

In a new presentation, the ECB has now published the privacy options on the table.

This presentation explains The baseline alternative for a digital euro is enforced by legislation, and privacy is a fundamental right.

Privacy is a major concern for future consumers, according to the ECB’s research on a digital euro.

By nature, a steady transition to digital payments means less privacy. There is an option to keep some cash-like features.

However, privacy must be considered in the context of other EU policy goals, such as anti-money laundering and counter-terrorist financing.

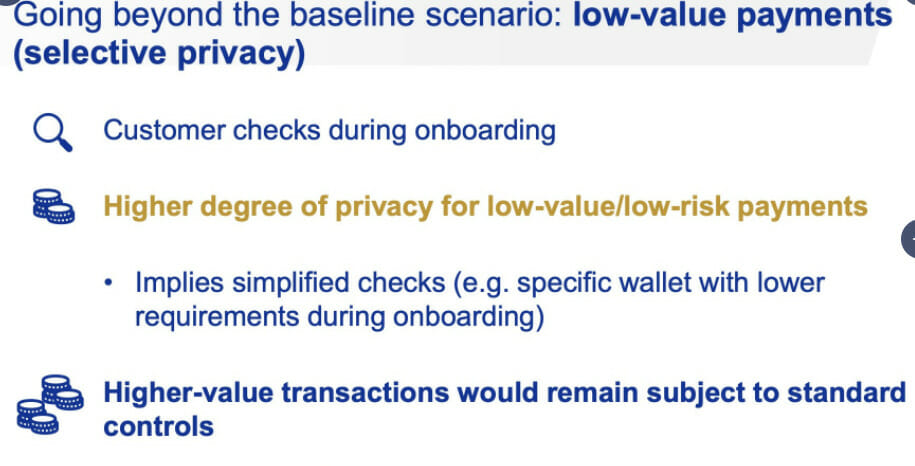

The paper then introduces two “desirable” privacy solutions that will be studied in addition to the baseline.

1. Confidentiality for low-value transactions

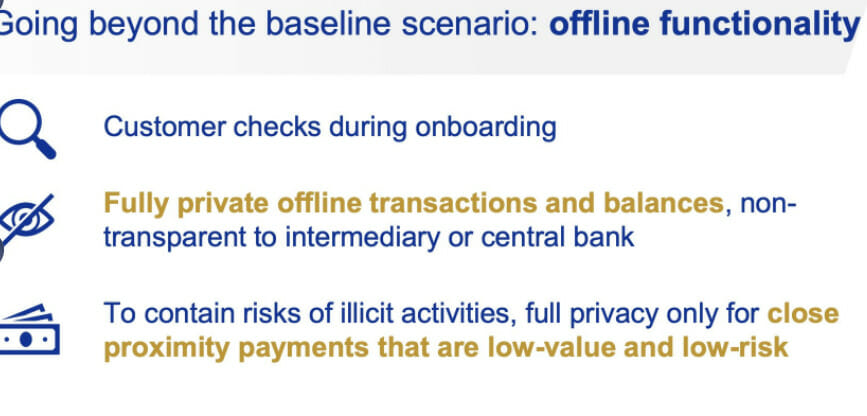

2. Transaction data would be non-transparent to both the intermediary and the ECB for offline proximity payments.

It’s vital to remember that user anonymity isn’t a desirable characteristic because it makes controlling the quantity in circulation and preventing money laundering unfeasible.

Even if it chose to fulfil the settlement role, the Eurosystem should only be allowed to examine the bare minimum of transaction data required to confirm digital euro payments.

Partrick sheds light upon the fact that It’s encouraging to see that the ECB is looking into these possibilities and deeming them desirable.

The offline payment situation might conceivably get close to physical cash payments, depending on how it is implemented.

Offline functionality is a step beyond the standard scenario.

During the onboarding process, customers are checked.

Offline transactions and balances are completely private, and they are not visible to any intermediary or central bank.

To reduce the possibility of illegal actions, full anonymity is only available for low-value, low-risk payments made in close proximity.

The talk also discusses the crucial trade-off between personal privacy and EU financial legislation (esp. AML).

If it is politically desirable, the Eurosystem is committed to enabling high privacy requirements. The legislative framework would need to incorporate greater privacy than present payment systems.

the presentation also poses a question, What is the intended balance between a high degree of privacy in the use of the digital euro and other EU policy objectives

Patrick makes a comment :

• it will cooperate with intermediaries (banks) for digital euro issuance/interface

• it presently cannot, and presumably will not, go beyond a certain level of user privacy

If it can’t precisely replace the qualities of cash in the digital world, it begs the issue, at least for me, of what use/benefit a central bank digital euro gives in comparison to existing digital payment methods. While most respondents prioritized privacy, consumers nonetheless recognize the trade-offs that the introduction of a digital euro will inevitably entail, particularly the need to comply with regulations prohibiting illegal activity such as money laundering and terrorist funding.