Key Takeaways

- BlockFi lost over US$285,000,000 in the last two years of the bull market.

- Out of the total loss, $221 million was lost during the 2021 bull run when Bitcoin price reached up to $69k.

- BlockFi was also among the companies that liquidated at least some of their positions with 3AC which recently crashed

On 16th June crypto lending platform, BlocFi’s CEO Zac Prince confirmed that the firm liquidated a large client after it failed to meet the needed obligations on an overcollateralized margin loan.

Prince, however, didn’t mention the client. His confirmation comes after crypto hedge fund Three Arrows Capital (3AC) failed to meet margin calls from its lenders following this week’s crash. According to a Financial Times report, BlockFi was among the companies that liquidated at least some of their positions with 3AC. All of this has increased speculations and rumors of BlockFi following Celsius’s footsteps. Celsius, now rumored to be insolvent recently stopped all withdrawals citing “market condition.”

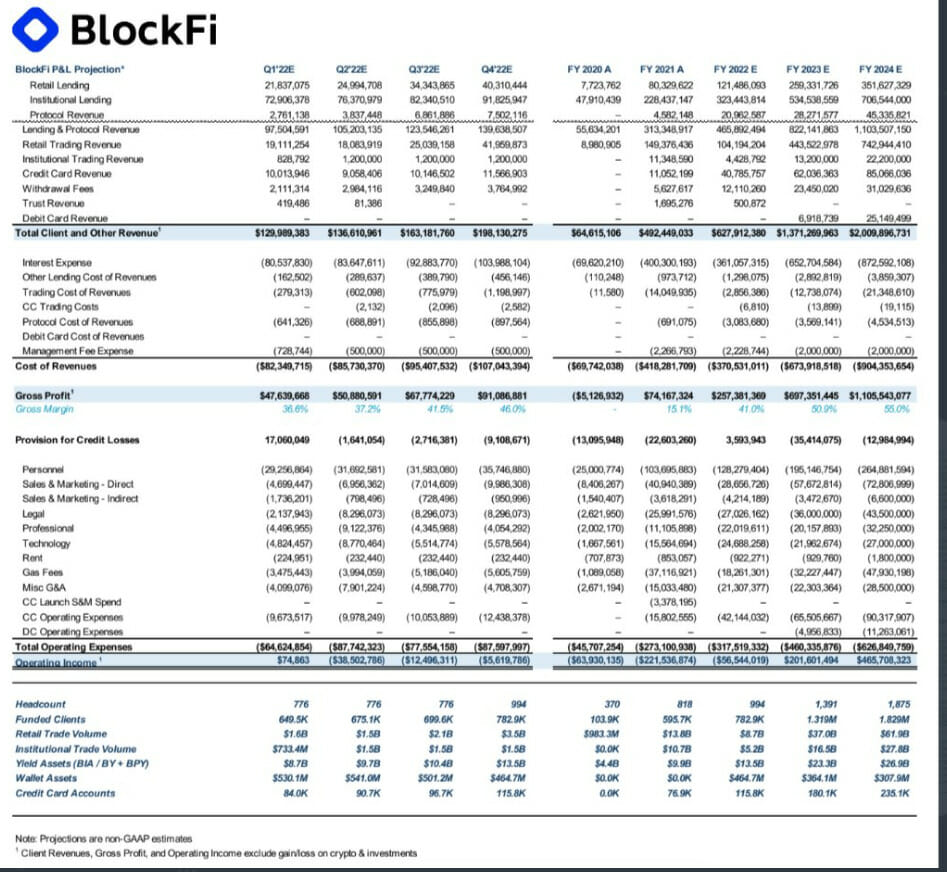

To top all of this, our sources state that BlockFi wasn’t in a good position even during the bull market. BlockFi lost over US$285,000,000 in the last two years of the bull market. The most striking part is that out of the total loss, $221 million was lost during the massive 2021 bull run when Bitcoin rallied up to $69k. Currently, BTC has dropped below $20,000 for the first time since December 2020. BlockFi couldn’t make any profit when BTC was at its highest, and with Bitcoin plummeting to new lows, how will BlockFi sustain remains to be known.

According to sources, BlockFi had $467 million in wallet assets and $13,500 Million in yield assets in 2021. This indicates that towards 2021 end, BlockFi only had 3.4% of its funds in its wallet and the rest has either been loaned or invested out. BlockFi trading volume breakdown in Retail was 70% and for institutions was 30%. Even though institutions’ assets are 30% of BlockFi’s books, it only provided 3% of the revenue. The low revenue from institutions stems from either the firm overcharging retail clients or it just not being a preferred place by institutions.

In 2021, BlockFi paid out $400m interest to users & institutions that has lent their coins to BlockFi. However, their lending & protocol revenue was $313m. This means that BlockFi’s daily loss was an astounding $240,000 a day.

BlockFi has the same model as Celsius, and its institutional business does not make it any more secure, as evident from the above-mentioned numbers. The company’s rather questionable decision to withdraw $3.5 Million from the credit loss provision fund when the market is crashing like never before is likely to put them in a more vulnerable state than they already are in. The deepening stress within the crypto industry keeps piling up, and the answer to whether BlockFi will be the next Celsius remains to be seen.