Reya Network is a next-generation on-chain trading ecosystem built to merge the best of traditional finance (TradFi) and decentralized finance (DeFi). Designed with traders and builders in mind, Reya aims to create a fully composable, efficient, and liquid trading environment that operates transparently on-chain — without compromising on speed or user experience. In this article, we will explore the Reya Network Review.

Table of Contents

What Is Reya Network?

Reya Network is a next-generation decentralized trading ecosystem designed to deliver exchange-grade performance on-chain.

Built as a Layer-2 blockchain, Reya combines the speed and liquidity of centralized exchanges with the security and transparency of DeFi.

Its goal is simple: let anyone trade perpetual futures, currencies, and digital assets in milliseconds, directly from their own wallet — with no gas fees, no intermediaries, and no custody risk.

At its heart, Reya is powered by a specialized blockchain called ReyaChain and its flagship trading app Reya DEX. Together, they form a complete financial layer for decentralized trading, settlement, and liquidity management.

Features and Products

Reya’s ecosystem is divided into three main parts: Reya DEX, Reya Network, and its rUSD / srUSD stablecoin system.

Here’s a breakdown of each — explained in beginner-friendly terms:

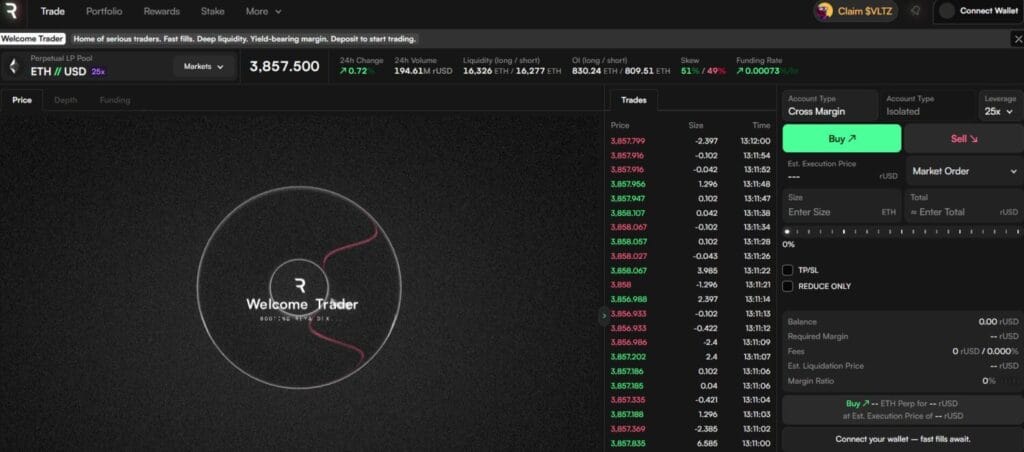

Reya DEX

Perpetual Futures

- Trade perpetual contracts — assets that don’t expire — on crypto pairs, indices, or commodities.

- You can go long or short, use leverage, and stay in control of your funds while trading in real time.

- Designed for high-speed execution and low fees, making it ideal for both pros and beginners.

Margin Trading

- Reya DEX offers a unified margin account: all your positions share one pool of collateral.

- You can use multiple assets as margin, including stablecoins or yield-bearing tokens.

- This system boosts capital efficiency, letting you do more with less locked capital.

Auto-Exchange and Liquidation

- If your margin drops too low, the system can auto-exchange assets or partially liquidate positions to protect your account.

- Instead of full liquidation, Reya aims for graceful recovery, preserving user balances and system stability.

Conditional Orders

- Set up stop-loss or take-profit orders that trigger automatically.

- Useful for hands-off traders who want automation and protection in volatile markets.

Collateral Liquidations & Settlement

- Liquidations are handled transparently on-chain using Reya’s smart contracts.

- Settlement happens in rUSD, ensuring speed, stability, and consistent pricing across all trades.

Cross-Collateralization

- Use multiple assets as trading collateral.

- Your profits and losses are managed across all open positions — a system that reduces liquidation risk and maximizes efficiency.

Reya Network

The Structure of Reya Network

- Reya is structured as a Layer-2 trading-optimized blockchain, with dedicated components for trading, clearing, and liquidity.

- It’s built for sub-second block times (~100 ms) and thousands of transactions per second, all anchored to Ethereum’s security.

The Liquidity Layer

- All markets draw from a shared liquidity pool instead of isolated ones.

- This ensures deep markets, minimal slippage, and better pricing for everyone.

- Liquidity providers (LPs) can deposit funds that automatically flow to where trading demand is highest.

Derivatives Clearing

- Reya’s clearing engine ensures fair settlement and transparent accounting for all traders.

- It tracks open positions, profit/loss, and collateral — like a traditional clearinghouse, but fully automated through smart contracts.

Who’s Behind Reya Network

- Reya is built by a team of experienced DeFi engineers, quantitative traders, and risk specialists from leading financial and crypto institutions

- It’s supported by top blockchain investors who back its mission to combine traditional finance efficiency with decentralized control.

rUSD / srUSD

rUSD

- rUSD is Reya’s native stablecoin used for all trades and settlements.

- It’s pegged 1:1 to the US dollar, backed by safe collateral reserves, and designed for fast, gas-free transactions.

- All trading, margin, and settlements are denominated in rUSD for simplicity and reliability.

srUSD

- srUSD is a yield-bearing version of rUSD.

- When you stake your rUSD, you receive srUSD — which earns passive yield from trading fees and liquidity activity.

- srUSD can also be used as trading margin or liquidity collateral, allowing you to earn while you trade.

srUSD How-To and FAQs

- You can mint srUSD directly through the Reya DEX interface.

- Rewards accumulate automatically, and you can redeem srUSD back into rUSD anytime.

- The documentation provides clear guidance for minting, staking, and understanding yield mechanics.

ReyaChain

- The entire ecosystem runs on ReyaChain, a custom Layer-2 blockchain optimized for speed, fairness, and liquidity.

- It enables gasless trading, fast settlements, and FIFO (First-In-First-Out) ordering to prevent front-running and MEV exploitation.

- ReyaChain connects all components — from trading and clearing to staking and governance — into one seamless experience.

Rewards and Referrals

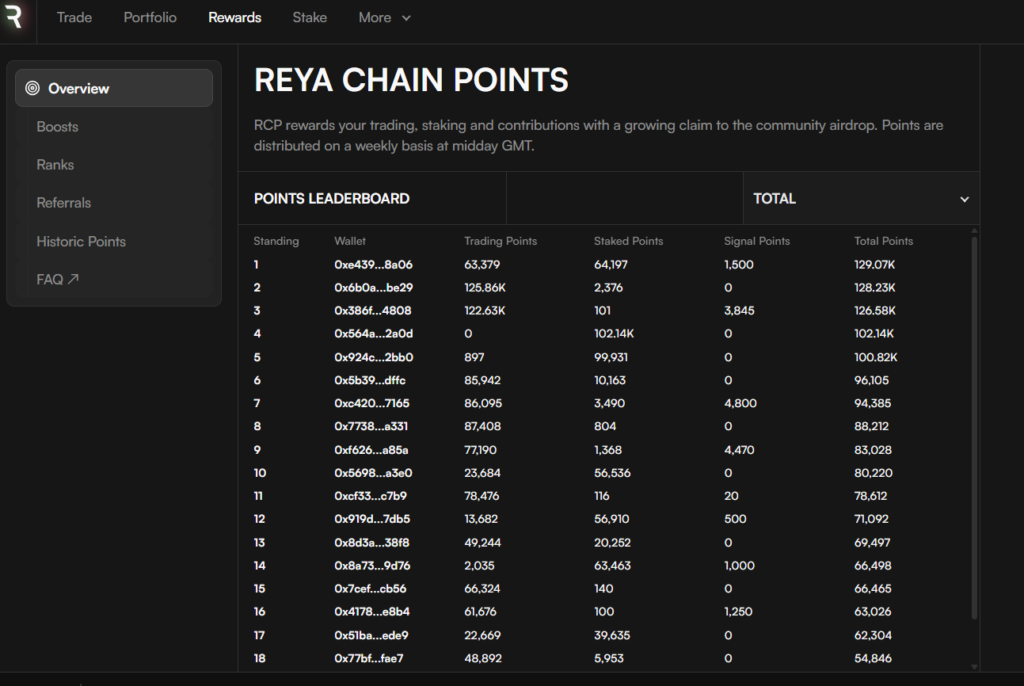

Reya’s incentive system rewards users for trading, staking, and growing the ecosystem.

1. Reya Chain Points (RCP)

- Every action — trading, staking, or providing liquidity — earns Reya Chain Points (RCP).

- These points reflect your contribution and may lead to future token rewards or governance privileges.

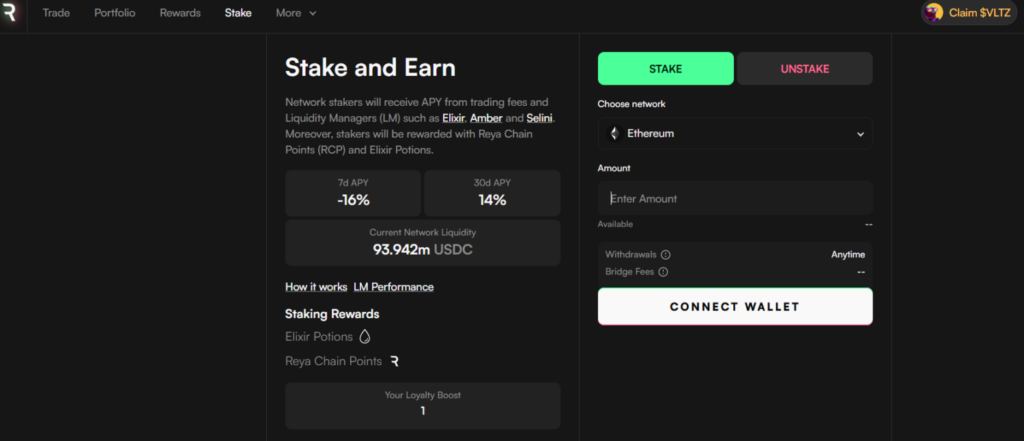

2. Staking and srUSD Rewards

- Staking rUSD to mint srUSD automatically earns yield from protocol revenue and liquidity activity.

- The longer you stake, the higher your cumulative rewards can grow.

3. Referral Program

- Users can invite others to trade or stake using their referral link.

- Both referrer and referee get discounts on fees or bonus points, depending on their activity tier.

- This encourages organic community growth while rewarding active contributors.

4. Community and Builder Incentives

- Developers who build tools or integrate with Reya can earn points or grants.

- Active community members, educators, or content creators are often rewarded through campaigns or contests.

Mobile App

- While Reya doesn’t yet have a dedicated mobile app, it’s fully compatible with mobile Web3 wallets like MetaMask, WalletConnect, and Coinbase Wallet.

- Its web interface is optimized for mobile browsers, giving you access to charts, positions, and order management on the go.

- Thanks to ReyaChain’s low latency and gas-free structure, mobile trading feels smooth and responsive — closer to a centralized app experience.

Security

- Self-Custody by Design: You always control your assets through your own wallet. No deposits into centralized accounts.

- Smart Contract Audits: All contracts are independently audited by leading security firms and open-sourced for transparency.

- Anti-Front-Running Technology: FIFO (First-In-First-Out) sequencing ensures fair trade execution and prevents MEV attacks.

- Decentralized Governance: Key protocol changes are approved through multi-signature governance, ensuring checks and accountability.

- Transparent On-Chain Clearing: Every transaction, position, and liquidation is visible and verifiable on-chain — full transparency for users and auditors alike.

Fees

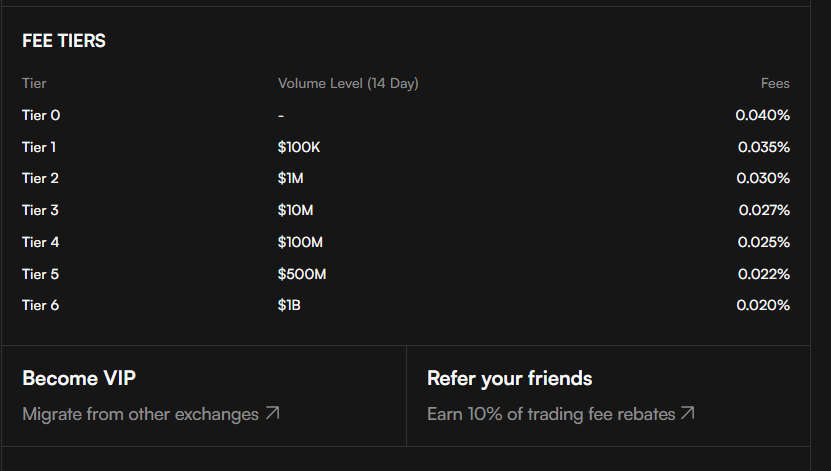

- Trading Fees: Competitive structure averaging around 0.04% per trade (maker/taker), depending on the market.

- Gas Fees: ReyaChain uses a gasless or near-zero gas model, so users don’t pay traditional blockchain fees.

- Withdrawal & Settlement Fees: Minimal, designed to cover network costs only.

- Hidden Costs: None — thanks to shared liquidity and efficient execution, slippage and price impact remain low even for large orders.

Conclusion

Reya Network bridges the gap between traditional exchange performance and DeFi transparency. It gives traders a smooth, professional experience — fast trades, deep liquidity, zero gas — while keeping everything fully decentralized and auditable. For new users, Reya offers simplicity and control: trade, earn yield, and manage risk all in one wallet. For professionals, it delivers the advanced features of a high-frequency exchange — unified margin, portfolio cross-collateralization, and deep liquidity.In short, Reya is not just another DEX — it’s a complete trading layer for the future of DeFi.

What makes Reya different from other DeFi exchanges?

Reya is built as a network, not a single exchange, meaning it allows different dApps and protocols to plug into a shared liquidity layer — offering unified markets and composable trading infrastructure that other DeFi DEXs typically isolate.

Is Reya open to third-party developers?

Yes. The platform is modular and developer-friendly, allowing builders to deploy new trading products, strategies, and integrations using Reya’s liquidity and margin infrastructure. It’s built to be an open ecosystem, not a closed exchange.

What are Reya’s long-term goals?

Reya’s vision is to become the foundational trading layer for on-chain markets — enabling everything from traditional derivatives to tokenized real-world assets (RWAs) to trade in a single, composable network.