Lido is a well-known liquid staking solution for ETH 2.0 and is backed by several leading blockchain staking providers. The platform lets users stake their assets for daily crypto staking rewards. In this Lido Review, we will look at all the features and components that the platform offers its users.

Table of Contents

Summary

- Lido lets you use your staked assets to gain yield on top of yield and use your tokens as collateral for yield farming, lending, and more.

- Lido DAO is a known community that builds staking services for Ethereum.

- Lido Wallet lets users stake their ETH without locking their assets or maintaining infrastructure.

- Lido further allows staking users to earn rewards on as small a deposit as they want without restriction on the number of Ether they deposit.

What is Lido?

Lido is a staking solution for ETH 2.0 that is backed by several industry-leading staking providers. Users will receive a token when using Lido to stake their ETH on the Ethereum beacon chain. The Lido website is designed to solve problems mainly associated with initial ETH 2.0 staking – inaccessibility, illiquidity, and immovability. It helps make staked ETH liquid and allows participation with any amount of ETH. Users can stake their ETH without even locking their assets while participating in on-chain activities such as lending.

Also Read: Coinbase Staking – Earn staking rewards on your Crypto [2021]

How does Lido work?

Lido allows its users to earn crypto staking rewards without even locking their assets or maintaining staking infrastructure. Instead, users will receive stETH tokens on a 1:1 basis representing their staked ETH. stETH balances are updated daily to reflect your ETH staking rewards and can be used as a regular ETH to earn yields and lending rewards. Moreover, there are no lock-ups or minimum deposits when staking with Lido. While using Lido, users will receive secure staking rewards in real-time, further securing Ethereum without the downside potential and associated risks. These rewards are then updated daily at 12 PM UTC.

Lido Review: Features

- Lido users can get daily staking rewards by staking their assets. There is no limit on the minimum amount of tokens that users can stake.

- The platform lets all its users use their tokens as collateral for yield farming, lending, and more. Moreover, these assets can be used to gain yield on top of yield.

- Lido also has an LDO token which is available on various exchanges such as SushiSwap, Uniswap, Hoo, 1inch, Hotbit, DeversiFi, and Bilaxy.

- They have smart contracts that Sigma Prime and Quantstamp audit.

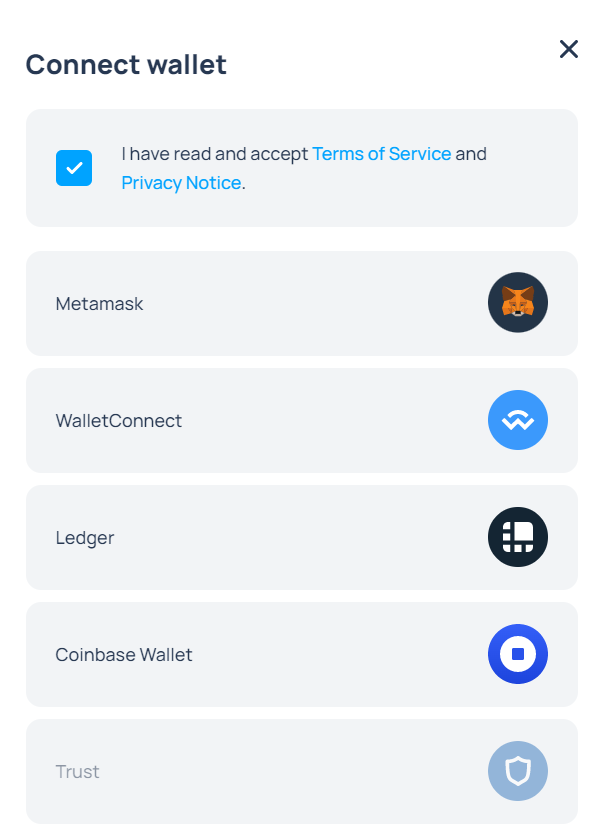

- Lido doesn’t have its wallet but allows users to use some of the most popular wallets present in the market, such as TrustWallet, Metamask, etc.

- The platform also shares a great feature where users can switch between the day-night mode and work according to their needs and liking.

Also read, Trust Wallet vs MetaMask – Which is the Best Crypto Wallet?

Components of Lido

1. Lido DAO

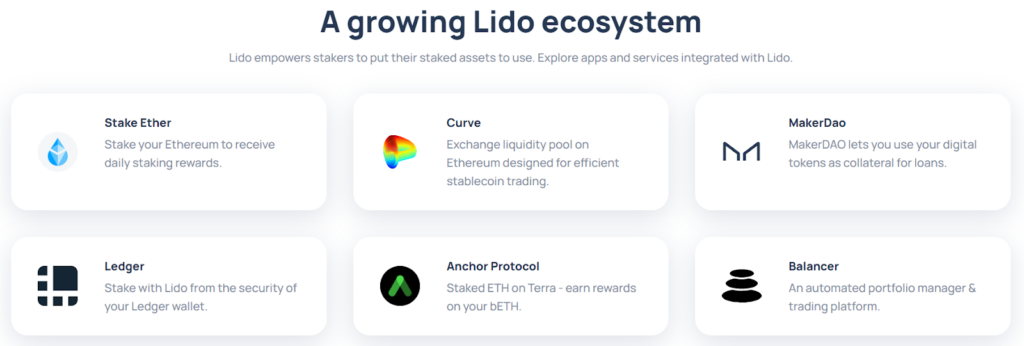

It builds a liquid staking protocol for Ethereum. Competitors are well-known providers in the case of liquid stakings, such as centralized exchanges and other decentralized protocols like RocketPool. Lido DAO consists of many members with different backgrounds such as Semantic VC, Terra, Libertus Capital, Bitscale Capital, P2P Capital, StakeFish, StakingFacilities, ParaFi Capital, Chorus, and KR1.

2. Lido Tokens

Lido offers its users two tokens:

i) Liquid stETH token

The stETH token represents Lido users’ deposits, slashing penalties, and the corresponding staking rewards. This is a liquid alternative for the staked Ether and could be transferred, traded, or used in DeFi applications. It can also be used in various decentralized financial products like it could be used as collateral.

ii) LDO token

Lido’s mission with the Lido DAO is to distribute all decision-making to create a trustless staking service built around community growth and self-sustainability. Users can buy this token from various popular exchanges such as Uniswap, DeversiFi, SushiSwap, Hotbit, Hoo, and Bilaxy.

3. Staking Services

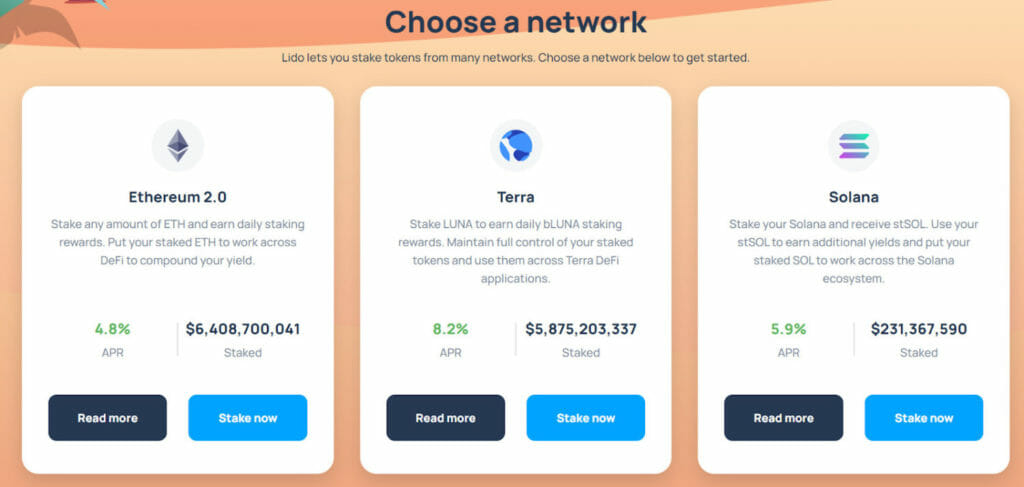

Lido Finance offers staking as a service product to its users and provides a much more flexible solution than self-staking since it avoids freezing assets and maintains a validator node. In addition, Lido allows users to earn various rewards with a deposit as small as they want and even without restriction on the number of Ether deposited. The staking fee charged by the platform is 10%. Furthermore, you can choose to stake tokens from many networks present on the platform at the moment, such as Ethereum 2.0, Terra, and Solana.

Also read, Coinbase Staking – Earn staking rewards on your Crypto

4. Derivative token

You will receive a derivative token in a 1:1 ratio every time you stake a crypto asset on Lido. So, you will receive stETH if you stake ETH token and bLUNA if you stake LUNA on Anchor Protocol. Moreover, unlike staked Ether, the stETH token can be transferred at any time and free from all the limitations associated with a lack of liquidity.

Lido Review: Fee Structure

The fee structure for Lido is not much complicated as it applies a 10% fee split between the DAO treasury, insurance funds, and Lido node operators. However, the DAO can change the fee structure after a successful vote. Lido’s fee level should make it a more profitable staking platform than other exchange staking alternatives in the crypto market.

How to stake Ethereum on Lido?

- Visit the Lido and then press ‘Connect Wallet’ present on the top-right corner of the screen.

- You will be redirected to some of the wallet options where you need to choose a preferred option. Now, you can view your ETH balance within the Lido widget because you have connected your wallet to Lido.

- Enter the amount of ETH you want to stake and then press Stake. Before confirming it, note that you will now be able to view your stETH Balance, Transaction Fee, and the Annual Percentage rate.

- Now, confirm the transaction in your wallet.

- Finally, you will now see the amount of ETH that you staked in stETH. You will be able to see your staking rewards reflected daily as your stETH balance is also updated daily.

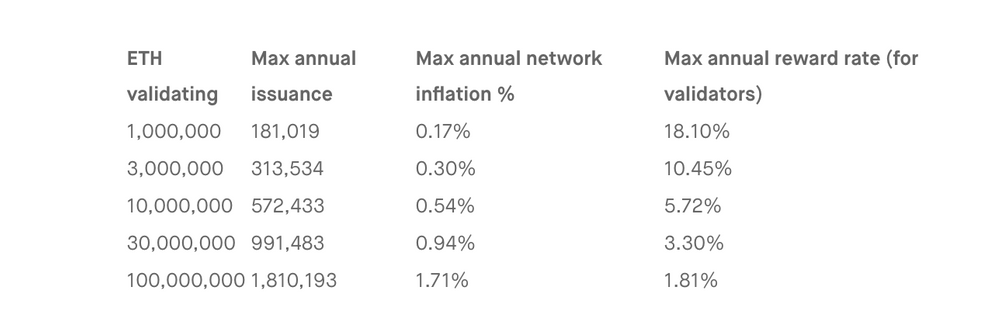

Lido offers Ethereum staking rewards, but the rate can be variable and can change based on the total amount of ETH staked. APR decreases if the total amount of ETH that is staked is increased. It will have a maximum annual reward rate of 18.10%.

Also read, Binance ETH 2.0 Staking – Everything You need to Know

Is Lido safe?

Security remains the most important question for users while choosing the perfect platform. However, with Lido, you all don’t need to be worried as there are several reasons to trust Lido Finance:

- It is an open-source website, and continuous review is done for all code.

- They use DAO to make governance decisions and also to manage risk factors.

- In order to minimize staking-related risks, they have elected a committee of best-in-class validators. Further, Lido lets you stake across many validators, whereas while staking ETH, you can only choose one validator. Hence, the staking risks will be minimized more efficiently.

- Moreover, to eliminate the counterparty risk, they use non-custodial staking services.

Also read, CEX.IO Staking – The Best Way to Earn Passive Income?

Lido Review: Mobile App

Lido provides a mobile version of its platform for users to make judicial use of Lido. Lido Wallet allows users to run multiple cryptocurrency wallets. It is a liquid staking solution for ETH 2.0 backed by industry-leading staking providers. The Lido mobile app users will have access to all its features through their user-friendly interface and the ability to stake and start a Masternode with one click.

Also read, 10 Best Cryptocurrency Blogs [Must Read]

Lido Review: Risks of Staking

Along with many boons of the platform, there also come some banes. While staking ETH using liquid staking protocols, several potential risks exist.

- Smart contract security

There could be a risk of smart contract vulnerability or a bug, but now the code is open-source and regularly audited to minimize the risk.

- ETH 2.0- Technical risk

There is no surety that ETH 2.0 has been developed error-free as it is built atop experimental technology under active development. Therefore, there can be a stETH fluctuation and slashing risk.

- DAO key management risk

Even though Ether staked via the Lido DAO is stored across multiple accounts and backed by a multi-signature to minimize the custody risk, signatories lose their key shares, go rogue, or get hacked can lead funds at significant risk.

- stETH price risk

Due to the withdrawal restrictions on Lido, users risk an exchange price of stETH, which is lower than the inherent value. Thus, this makes risk-free market-making and makes arbitrage impossible. Despite this, Lido is taking care to eliminate them to a possible extent.

Lido Review: Customer Support

Lido provides all its users with good customer support service. If there is any problem you are facing on the platform, you can directly hop on to the Help Center, where you will get an answer to most of your questions. If still not, you can look at their FAQs and get help from there. You can also reach through their blog, where they post detailed articles related to their platform and all the updates. In addition to all these things, they also have Documentation. Furthermore, if any other query is still left, you can directly mail them at [email protected].

Also read, Bitfinex Staking – Earn Passive Income

Lido Review: Pros and Cons

| Pros | Cons |

|---|---|

| Lido provides its stakers liquidity through their derivative tokens. | There is a possibility of hacking smart contracts. |

| The platform provides an easy way to stake crypto assets with a user-friendly interface. | It will be a significant loss of funds to Lido and stakers if there is any hack on the leading network such as Ethereum or Terra. |

| Small investors can also stake their assets as there is no fixed limit of tokens for staking. | |

| By staking Ethereum on Lido, stakers can earn upto 18.10% a year. | |

| Lido allows you to use some popular external wallets such as Metamask, TrustWallet, etc. |

Lido Review: Conclusion

Lido is doing everything right as it offers superior staking services with its simplified user interface, collects competitive fees, provides liquidity to staked ETH, gives out generous referral rewards and is backed by great industry leaders. Although it has staking related risks, it is still working on making it risk-free for every user.

Frequently Asked Questions

What is Liquid Staking?

Liquid staking allows double opportunity; you get your reward on your staked assets, and you can earn the returns from new trading/ investing opportunities that you get. Users receive tradable tokens in return when they deposit tokens.

Who are the team members and founders of Lido?

Lido includes various members with different backgrounds like ParaFi capital, Libertus capital, Semantic VC, Chorus, P2P Capital, etc. The platform is also joined by many key angel investors, including Banteg of Yearn, Julien Bouteloup of Stake Capital, Stani Kulechov of Aave, and Kain Warwick Synthetix.

What is wstETH?

stETH has a wrapped version which is known as wstETH. wstETH helps keep your balance of stETH fixed as some of the DeFi protocols require a constant balance mechanism for tokens; it also uses an underlying share system that will reflect your earned staking rewards.

Also read,

![Earn Crypto - Passive Income By Staking Coins [Mycontainer Edition] 16 Staking Coins](https://coincodecap.com/wp-content/uploads/2020/02/Earn-passive-income-with-staking-cryptocurrencies-768x432.png)