This article will discuss the staking service provided by Bitfinex exchange. We will also go through all the cryptocurrencies supported by Bitfinex for crypto staking, staking reward, etc. Before ending this article, we will also discuss the risks of staking on Bitfinex.

Table of contents

Summary (TL;DR)

- Proof-of-Work and Proof-of-Stake are considered as two most commonly used consensus protocols. Cryptocurrency staking emerged from the PoS consensus protocol.

- Bitfinex launched a cryptocurrency staking service on 7th April 2020 and allowing users to earn passive income by holding specific digital tokens.

- Users can earn rewards weekly by holding some crypto token that supports staking on Bitfinex exchange, excluding ethereum.

- If you want to stake any tokens other than ethereum, you don’t need to opt-in manually to get the benefits of the staking service.

- To stake ethereum on Bitfinex, you have to convert ETH to ETH2Pending. When the staking period ends, it will be converted to ETH2, and rewards will be added as ETH2.

- Risks involved in staking on Bitfinex – Freezing of account if you breach terms and services, liquidity and volatility of the market, delisting of any digital token, etc.

What is Staking?

Before diving into cryptocurrency staking, first, we will briefly discuss how staking comes into existence. As we already discussed in the staking guide, a consensus protocol is a set of rules that governs how nodes sign/ validate transactions that will be added to the blockchain and which node will do it. Each blockchain follows any of the available consensus algorithms. Proof-of-Work and Proof-of-Stake are the two most commonly used consensus protocols.

What is Proof-of-Work?

Proof-of-Work(PoW) is the first consensus algorithm, many cryptocurrencies, such as Bitcoin, Litecoin, Ethereum, and Dogecoin use PoW. Furthermore, in accordance with the Proof of Work consensus algorithm, mining is generating a new block in the blockchain network.

In PoW consensus protocol, few people(Miners) verify transactions. Furthermore, they create a new block through an energy-intensive process by solving a computational math puzzle. The miner with more computational power has a high chance of adding a block and updating the ledger. This process is known as mining. Miner receives rewards for the successful creation of blocks and updates the ledger.

Also, read Top 7 profitable mining pools for beginners.

What is Proof-of-Stake?

The process of the creation of blocks is entirely different in Proof-of-Stake. Proof-of-Stake(PoS) blockchains use a network of validator nodes that work together to agree on whether the transactions are valid or not. These all nodes are responsible for building blocks of transactions. In addition, however, the validator nodes need to stake coins as collateral to ensure honesty.

PoS is an alternative to mining. It requires staking (locking) your coins instead of more resource power. Once you stake your coins on your node, you enter into the contest where nodes having more staked coins have a high chance to be selected as a validator node to forge the next new block. Once the validator node successfully forges a new block, it receives a reward. However, if a validator node wrongly signs transactions, it can lose all the staked coins.

Cryptocurrency staking emerged from the PoS consensus protocol.

Bitfinex Staking

Bitfinex launched a cryptocurrency staking service on 7th April 2020. In addition, Bitfinex provides a staking service that allows users to earn passive income by holding specific digital tokens.

To learn more about Bitfinex, read our Bitfinex review.

You can earn rewards weekly by just holding some crypto token that supports staking on Bitfinex exchange. And on the other side, you can trade them as well. Moreover, there are no such restrictions from Bitfinex that you need to hold those tokens for a specific period.

Although some staked tokens are locked for some time, depending on the token protocol—for example, Ethereum. If you stake ethereum, you won’t be able to withdraw or sell your staked ethereum because this is how the ethereum protocol works. Otherwise, you are free to trade them anytime. Rewards will continue until you sell or withdraw those tokens.

Tokens you can stake at Bitfinex

As per the current situation, Bitfinex staking supports below listed tokens.

| Staking token | Estimated annual staking rewards |

|---|---|

| TRON Staking (TRX) | 6% – 8% |

| EOS Staking (EOS) | 0% – 3% |

| Tezox Staking (XTZ) | 3% – 5% |

| COSMOS Staking (ATOM) | 1.5% – 3% |

| Algorand Staking (ALGO) | 3% – 5% |

| Cardano Staking (ADA) | 4% – 5% |

| Polkadot Staking (DOT) | Up to 7% |

| Eth 2.0 Staking (ETH 2.0) | Up to 10% |

| Kusama Staking (KSM) | Up to 8% |

The actual payout can differ from estimated because estimation is based on the previous performance of the node. Any change in the node’s performance can affect the actual payout.

Some exchanges have restrictions like you should have a minimum of 100 TRX to earn rewards by staking. However, Bitfinex staking doesn’t have such limits.

Bitfinex staking rewards

The platform pays the staking rewards by the end of every week. In addition, Bitfinex distributes the rewards based on the number of tokens being held by you. Therefore, the more tokens you are holding, the more rewards you will receive.

But here, why is Bitfinex giving you rewards for holding some tokens on their platform? So, let me answer this first.

How do you earn Staking rewards?

For example, Bitfinex is allowing staking for TRON. This means Bitfinex is running its validator node on the TRON blockchain. Consider, User A has staked 1000 TRX, User B has staked 2000 TRX, and User C has staked 3000 TRX on Bitfinex exchange. Bitfinex’s node will stake these 6000 TRXs.

Furthermore, if this node is selected as a validator node by the TRON blockchain network, it will verify the transactions and forge a new block. And will also get rewards to do this job. Further, Bitfinex will deduct some fees from rewards and distribute the remaining rewards to all the stakers, here User A, B, C based on their stake.

Token’s blockchain network calculates and distributes staking rewards to Bitfinex; Bitfinex distributes it in all the stakers. However, the token network does not have a fixed payout timeline. So, Bitfinex does not guarantee that you will receive staking rewards every week or consistently.

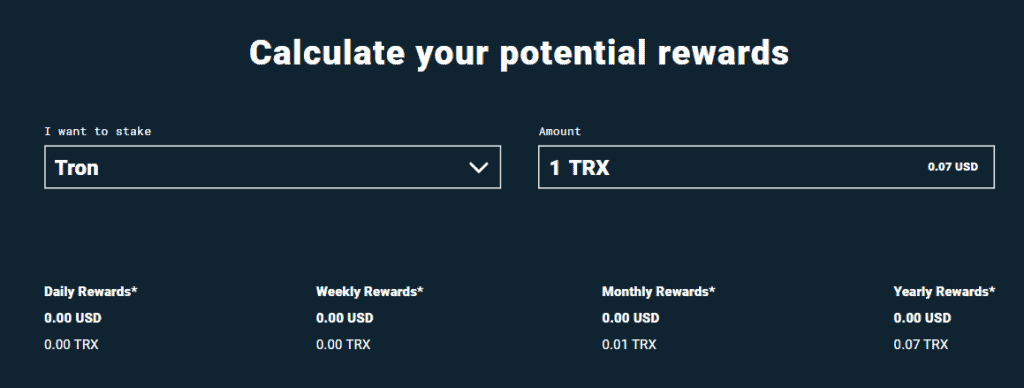

Bitfinex staking rewards calculator

You can calculate estimated staking rewards at Bitfinex.

This can help you to get a view of daily, weekly, monthly, and yearly rewards, which you can get by staking the particular amount of selected token.

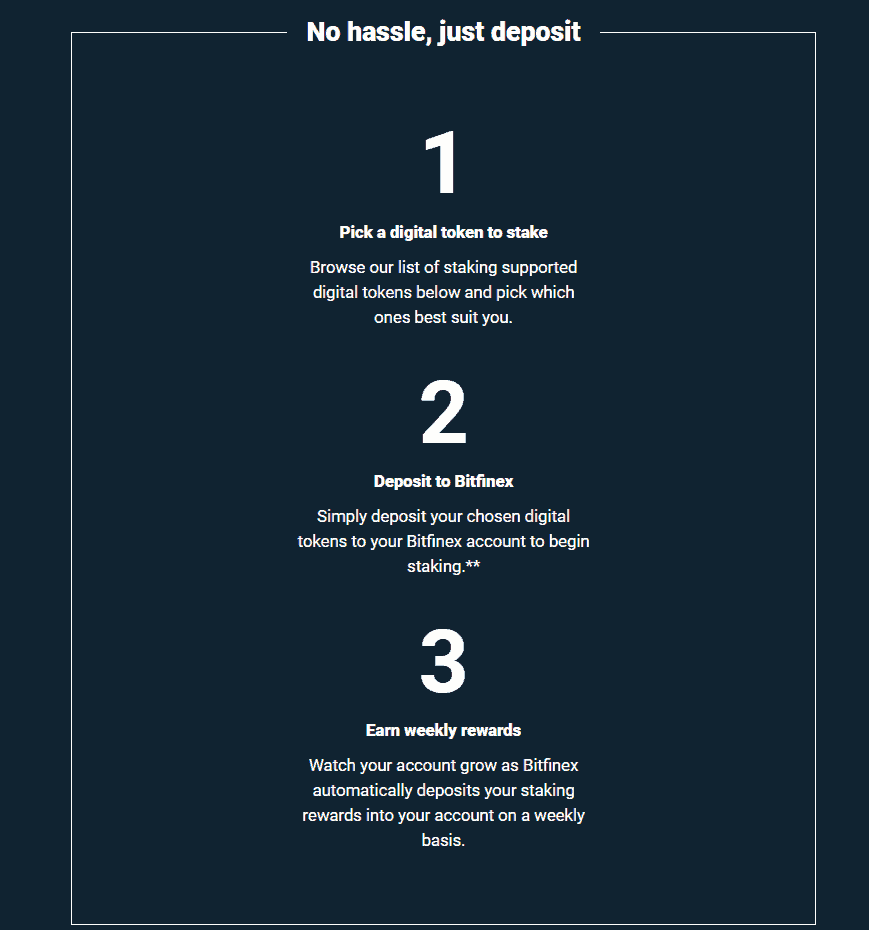

How to start staking on Bitfinex?

- Sign up on Bitfinex

- Get your account verified.

- Buy/ deposit tokens supporting staking on Bitfinex.

And it’s done! Bitfinex staking doesn’t require any more steps. It automatically deposits staking rewards in your account each week. So you don’t need to opt-in manually to get the benefits of staking service.

But for ETH 2.0 staking, you have to opt-in. We will discuss ETH 2.0 staking in-depth later in this article.

Also, read Binance ETH 2.0 Staking.

How to stake ethereum (ETH 2.0)?

Bitfinex is providing ETH 2.0 staking service to their customers who are holding ethereum in their Bitfinex wallet. Moreover, you first need to opt-in to stake ETH, and also, you do not require a minimum amount of ETH to participate in staking on Bitfinex. Therefore, as a user, you can stake any amount of ETH you would like to stake.

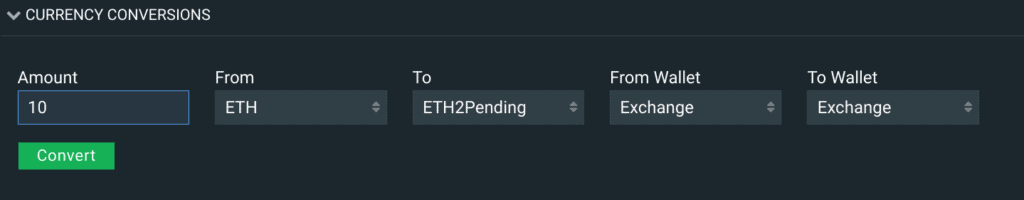

ETH to ETH2Pending

- Go to the Bitfinex wallet page.

- In the currency conversion tool, Enter Amount (Number of ETH you would like to stake)

- Select ETH as the “From” currency.

- Select ETH2Pending as the “To” currency.

- “From Wallet” and “To Wallet” will be exchange only.

- Click on “Convert”.

In the above example, 10 ETH tokens will be converted into ETH2Pending tokens. All the converted ETH2Pending tokens will be used for staking. Once the staking period is completed, ETH2Pending tokens will be converted into ETH2 tokens, and also rewards will be added as ETH2 tokens. ETH2 and ETH2 rewards balance can’t be withdrawn, but there may be a market for trading ETH2 on Bitfinex.

Note: You can’t convert ETH2 back to ETH. This process is irreversible.

ETH 2.0 staking is not open for any citizen or resident of Canada also any entity controlled by citizens or residents of Canada. Furthermore, ETH 2.0 staking is also not open for any prohibited person, such as a citizen or resident of the USA.

Risks in staking

Bitfinex staking risks

- Bitfinex gives no guarantee that it will permit trading of any token or if it does, that it will continue to allow trading of any token. Furthermore, Bitfinex may remove the ability to trade any token at any time, with or without any notice, and for some or all users.

- Moreover, Bitfinex can freeze your account anytime if they believe you are involved in any suspicious activity or breach any terms of services. If Bitfinex freezes your account, you won’t access your tokens or staking rewards at all, and all the open orders will be closed.

- Suppose you cease to maintain your account with Bitfinex for any reason, including termination by Bitfinex, while you hold tokens. In that case, you will forfeit any rights you may have according to the Terms of Service to the token.

Generalised staking risks

- You should not invest in the crypto market if you are not prepared to lose entirely because the market prices for digital tokens are volatile.

- Furthermore, the price can go up and down at any time. In some scenarios, when tokens are locked for a specific period, we can’t trade them even if the price goes down. There is a high chance that coins will lose their liquidity and result in a lower price.

- For example, you staked 100 TRX with a APY of 6%. Now, the price of TRX was $1 when you staked. So the total staked amount was $100. After one year, you will get a reward of 6 TRX, but the price dropped to $0.5. So now, the total value after 1 year is 106 TRX * $0.5 = $53. So you are in loss ($100 – $53 = $47). Hence, liquidity and volatility is an important factor for risk assessment.

Also, read Ultimate Guide to Crpto Staking.

Bitfinex Staking: Conclusion

Bitfinex is providing a staking service that allows users to earn passive income by holding specific digital tokens.

Furthermore, Bitfinex staking allows users to get rewards for holding eligible cryptocurrencies (like Tezos (XTZ), Polkadot (DOT), Algorand(ALGO), Cosmos (ATOM), Cardano (ADA), Tron (TRX), etc.) into the Bitfinex wallet.

Bitfinex is also providing ETH 2.0 staking service to their customers who hold ethereum in their Bitfinex wallet.

Frequently Asked Questions

Does the reward rate fixed or variable percentage?

No, the reward rate is based on multiple factors like validator node’s performance, staked amount, cryptocurrency, Bitfinex’s fees, network governance decisions, etc. Hence, it changes over time.

Does Bitfinex guarantee the rewards?

Bitfinex does not give any guarantee that you will receive staking rewards every week or consistently.

Can I trade while staking on Bitfinex?

You can trade your staked tokens. Although some staked tokens are locked for some time, depending on the token protocol—for example, Ethereum. If you stake ethereum, you won’t withdraw or sell your staked ethereum because this is how the ethereum protocol works.

Why do estimated rewards differ from actual payout?

Any change in the validator node’s performance or any change in rewards factors can impact the actual payout.

Is staking on Bitfinex safe?

Nothing comes without risks. Many risks are involved, like freezing of account if you breach terms and services, liquidity and volatility of the market, delisting of any digital token, etc. So, it’s better to assess all the risk parameters and research the token you want to stake because you will get rewards only if the exchange’s validator node gets rewards from the token network.

![Earn Crypto - Passive Income By Staking Coins [Mycontainer Edition] 8 Staking Coins](https://coincodecap.com/wp-content/uploads/2020/02/Earn-passive-income-with-staking-cryptocurrencies-768x432.png)