DeFi or Decentralized Finance is one of the biggest trends in the crypto market. Users can use a DeFi app to facilitate payments and other financial transactions without centralized, traditional financial institutions. DeFi started in 2018, but its massive adoption wasn’t apparent until 2021 when its asset value surpassed $100 Billion. This post will help you find all you need to know about decentralized finance with the Best DeFi Apps for 2022.

Table of Contents

Decentralized Finance

Decentralized finance is rapidly becoming one of the popular concepts in the cryptocurrency world. Although the DeFi concept is relatively new, DeFi users utilize it to create a cheaper and faster way of making financial transactions.

Short for decentralized finance, DeFi is an umbrella term for various projects and applications in the public blockchain that disrupts the conventional finance world.

What is DeFi or Decentralized Finance?

DeFi is a blockchain-based financial system that doesn’t depend on a centralized control point, such as brokerages, lenders, banks, and other financial transactions regulated by governmental entities.

DeFi is comparable to our current financial system. Still, it consists of applications and peer-to-peer protocols established on the Ethereum blockchain that require no access rights for easy borrowing, lending, or trading of financial tools.

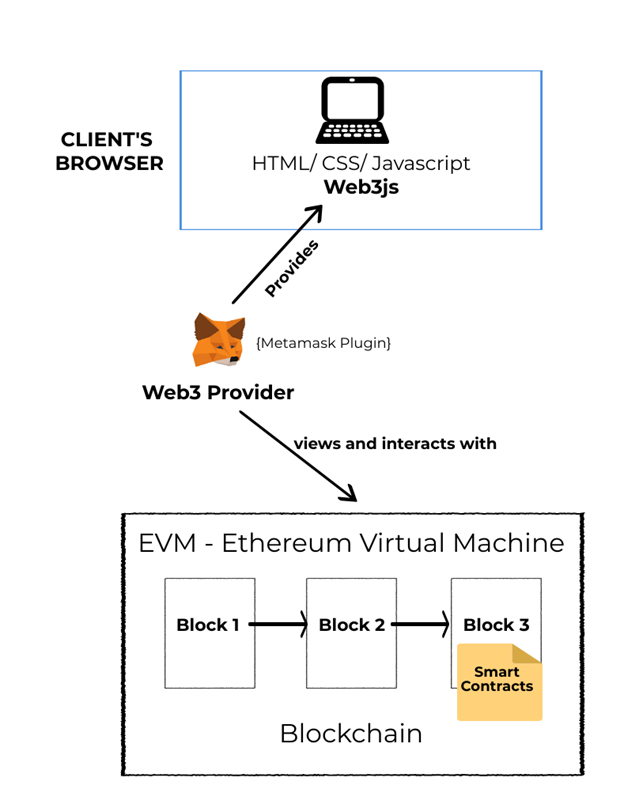

You can refer to DeFi as financial applications built on blockchain technology generally using smart contracts, DApps function on smart contracts used to execute transactions between two users. As such, you don’t have to fill out a form to buy or sell your crypto assets on a DeFi app.

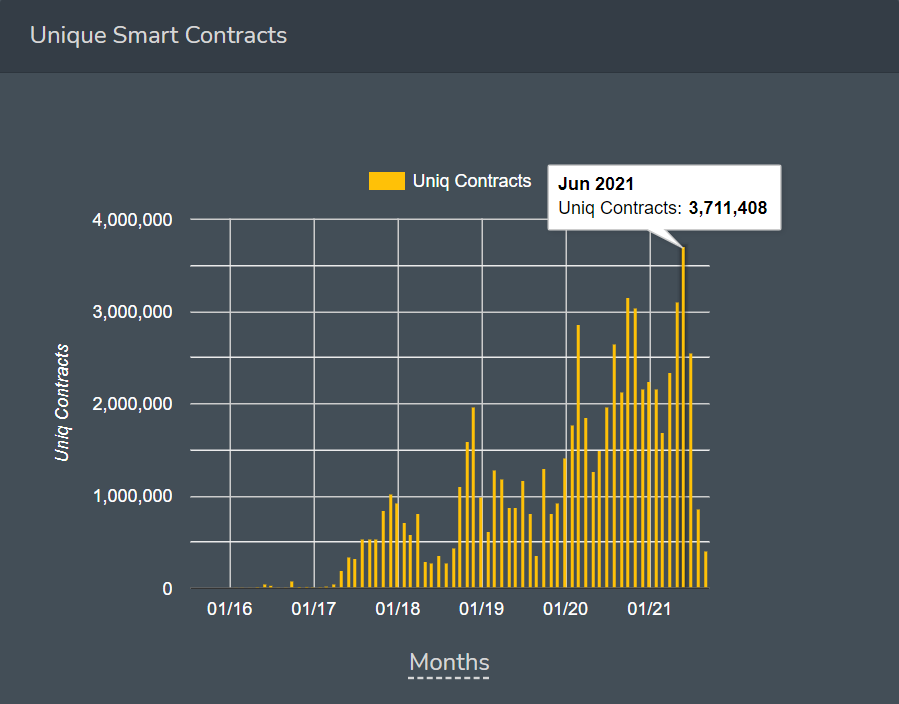

Ethereum is the foundation for the majority of decentralized applications. Today, 214 of 238 DeFi projects in the world run on Ethereum’s Ecosystem. Other cryptos offering these contracts include Solana, Polkadot, Algorand, Cardano, etc.

Also read, A Beginner’s Guide to DeFi (Decentralized Finance)

Smart Contracts/ Dumb Contracts

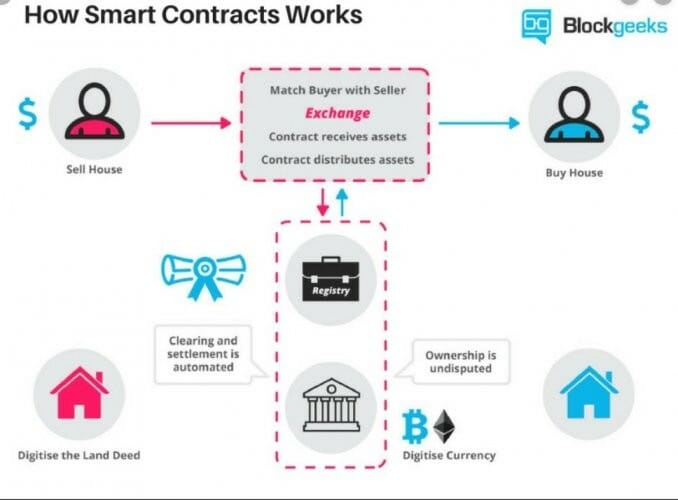

Smart contracts are digital contracts stored on a blockchain that execute immediately participants meet predetermined terms and conditions. Typically, these contracts automate an agreement execution so that all participants can be instantly sure of the outcome without any time loss or intermediaries involvement.

These contracts can also automate a workflow, prompting the following action when users meet the predetermined conditions.

Once a contract is live, no one can alter it, as it will always run according to its programming. In DeFi, these contracts replace the financial institution in a transaction.

These financial institutions are given immense power because your money flows through them. Billions of people worldwide don’t have access to a bank account or use financial services. Lack of financial services can prevent people from being employed.

Dozens of DeFi applications operate on Ethereum, and it is also the basis for cryptocurrency, tokens, and digital assets transference.

Also read, Agreeable Smart Contracts

How do smart contracts work?

A Smart contract works by following the simple “if/when..then..” statements written into code on a blockchain. A system of computers executes the action when the predetermined conditions have been verified and met by users.

These executed actions could include sending notifications, issuing a ticket or, releasing funds to the appropriate parties. When the transaction is complete, the blockchain is then updated. Only parties who have been granted authorization can view the results, and no one can alter the transaction.

There can be as many stipulations as needed within a contract to satisfy participants of the satisfactory completion of the task.

To establish the terms involved, participants must decide how the blockchain will represent their data and transactions, the if/when, then rules that govern these transactions, DeFine a framework for resolving disputes, and explore all possible exceptions.

The contract can then be programmed by a developer- although organizations that use blockchain for business provide web interfaces, templates, and other online tools to simplify structuring a contract.

Also read, Ethereum Smart Contracts and the Oracle Problem

DeFi Protocols

DeFi protocols are essentially autonomous programs tailored to address precise setbacks in the traditional finance sector.

A DeFi protocol is a self-governing program aimed at democratizing finance and replacing traditional centralized financial institutions such as brokerages and banks.

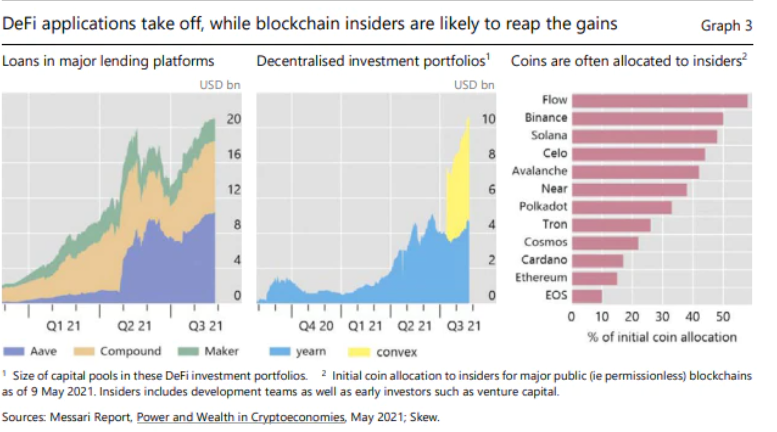

Some of the best protocols have experienced extreme levels of growth in recent years.

The total value locked in DeFi assets is estimated to be worth over $30 billion, making it one of the rapidly growing segments within the Ethereum Blockchain space.

Many protocols have become essential parts of the DeFi ecosystem, with many notable projects and tokens.

Here’s an overview of the most popular protocols and use cases in today’s market:

DeFi lending and borrowing

Finance was given a new direction through DeFi, enabling the lending and borrowing of digital assets.

Decentralized lending platforms offer crypto holders the opportunity to generate passive income by lending out their digital assets as traditional financial services do with fiat currency.

Also read, Top 5 Crypto Lending Platforms in Hong Kong

Decentralized borrowing allows individuals to borrow crypto assets from others at specific Interest rates.

Borrowing and lending digital assets aim to serve financial services use cases while accomplishing the requirements of the cryptocurrency community.

Decentralized platforms employ smart contracts to manage lending and eliminate intermediaries.

Also read, Top 5 DeFi Tokens to Look Out for

Decentralized Exchanges

A Decentralized exchange or DEX is one of the fundamental functions of DeFi, with the maximal amount of capital locked in comparison to other DeFi protocols.

DEXs are popular exchanges that directly link users to one another, so cryptocurrency trade can occur without entrusting their funds to an Intermediary.

Also read, A Guide to Bybit Margin Trading

A Decentralized exchange allows users to swap or exchange tokens with other crypto assets such as Ether (ETH) for Tether (USDT) or USD for BTC, without a Centralized exchange custodian.

Traditional Centralized exchanges offer similar options, but these provided investments are subject to that exchange’s cost and will.

The extra costs on each transaction are Another negative aspect of CEXs, which DEXs address.

Margin trading, perpetual and limit orders, and more are possible on DEXs.

Also read, BitMEX Review – Margin Trading, Fee, Testnet, and Calculator

Stablecoins

The name says it all – stablecoins values are tied to a moderately stable asset like the US dollar, the Euro, Great Britain Pound, or gold to maintain consistency in its price.

Stablecoins are a feasible solution to the volatility issues surrounding cryptocurrencies and are helping DeFi gain prominence.

During risk-off moments in the crypto world, stablecoins provide traders and investors a haven.

Stablecoins stability is one reason why they are a reliable collateral asset.

Stablecoins also play an integral role in liquidity pools -an essential part of the DeFi space and DEXs.

Prediction markets

Prediction markets are platforms where people can predict the outcome of future events, ranging from election results, sports betting, or politics, to prices of various digital assets, stock prices, and many more.

The objective of DeFi versions of prediction markets is to offer the same functionality as conventional prediction markets but without intermediaries.

Developers have long acknowledged the concept of decentralized prediction markets as a possibility through smart contracts.

Asset Management

Asset management is another class of service offered by DeFi. It aspires to make investing more democratized, faster, and less expensive.

Composability, trustlessness, and transparency aspects of the DeFi ecosystem favour asset management.

Composability allows the hyper-customization of portfolios, trustlessness allows access to liquid assets, and management of DeFi investments, regardless of location and transparency, promises to make information secure and accessible.

Also, read Top 5 Crypto Management Platforms

“Wrapped” Bitcoins (WBTC)

Wrapping transfers Bitcoin to the Ethereum network to be utilized directly by the Ethereum DeFi’s mechanism.

WBTC enables users to earn interest on the bitcoin they lend out through decentralized lending platforms.

Participants must consider protocols as fundamental prerequisites for operating in the DeFi space.

DeFi protocols provide liquidity in the DeFi world while also guaranteeing interoperability. Multiple entities can use the most popular DeFi protocols for building a service or an app.

Liquidity pools

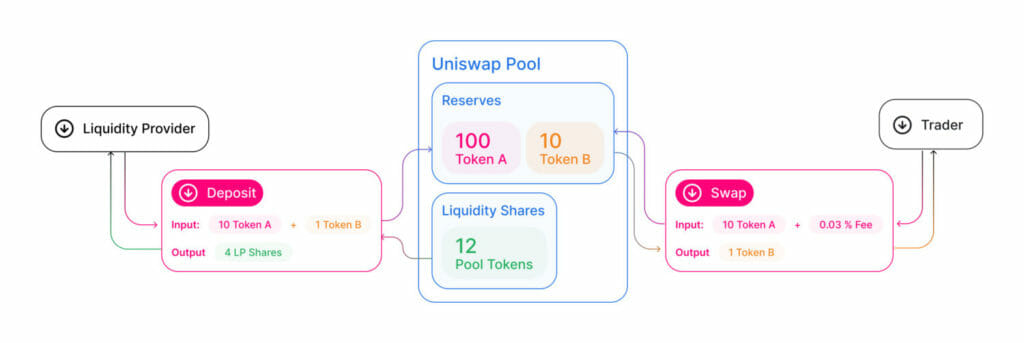

You can DeFine liquidity pools as one of the structural technologies behind the current DeFi ecosystem.

They are an integral part of automated market makers (AMM), yield farming, synthetic assets, borrow-lend protocols, blockchain gaming, on-chain insurance – the list is endless.

In itself, the idea behind liquidity pools is profoundly simple.

Liquidity pools are funds amassed in a big digital pile locked in a smart contract, allowing investors to receive a return on their holdings while expediting efficient asset trading.

In DeFi, traders provide liquidity to DEXs (Decentralized exchanges). They function like centralized exchanges but are not affected by their shortcomings, such as high gas fees, slippage, and length transactions.

When traders lock their digital assets in a smart contract, a liquidity pool is created; This DeFines a ‘pool” as the sum of at least two DeFi tokens locked.

Related read DeFi Yield Farming and Liquidity Mining

To create a market, users called liquidity providers (LP) add an equal value of two tokens in a pool. In exchange for providing funds, these liquidity providers earn interest and trading fees proportional to their share of the total liquidity from the trades in their pool.

Automated money makers have made markets more accessible, as anyone can be a liquidity provider.

Liquidity providers can earn high yields through transaction fees and native tokens and lending cryptocurrencies, especially stablecoins.

Liquidity mining is when DeFi applications entice users to their network by giving them free tokens. Liquidity mining is the most popular method of yield farming so far.

Yield farming has the possibility for more significant returns. Still, with significantly higher risks, this means users can leverage the lending aspects of a DeFi app by putting their crypto to work, generating the best returns possible.

A genuine financial revolution will be created by connecting tangible world assets with DeFi liquidity pools.

How liquidity pools work?

Automated market makers (AMM) are a significant innovation that allows for on-chain trading without an order book.

An order book is a collection of currently open orders in a given market.

As no direct counterparty is required to execute trades, traders can change positions on token pairs that are likely to be highly liquidated on order book exchanges.

You can consider order book exchanges as peer-to-peer, as the order book connects buyers and sellers.

Trading with an AMM is significantly different. You can consider trading on an AMM as peer-to-contract instead of peer-to-peer.

When you execute a trade on an AMM, you don’t have a counterparty in the traditional sense. Instead, you complete the transaction against the liquidity in the liquidity pool.

When the trade takes place, only sufficient liquidity in the pool is required for buyers to buy; a seller’s presence is not a requirement for the transaction.

An algorithm governs what happens in the pool and also manages your activity. In addition, pricing is determined based on trades happening in the pool.

As liquidity has to come from somewhere, anyone can become a liquidity provider, so technically, in some sense, a liquidity provider can be viewed as your counterpart. But, as you’re interacting with the contract that governs the pool, it is not the same as the case of the order book model.

DeFi Apps

A DeFi app (DApp) is a financial tool that facilitates the buying, selling, and trading of digital assets, similar to solutions we use today, such as RobinHood or PayPal, but on a decentralized network.

A DeFi app allows users to borrow, lend, invest and trade digital assets and access other financial products and services.No one person controls the network because DApps run on the blockchain.

Users can use a DeFi app to sell, buy and trade cryptocurrency. Not every DeFi app allows cryptocurrency trading – some enable you to lend or borrow money from others and use liquidity pools without difficulties.

DeFi applications replicate financial services users are more familiar with in the traditional finance world.

Decentralized applications can be joined together, like ‘legos’ to build new services and financial products.

Investors can access DApps through a browser extension or an application like the CoinStats app and directly manage their digital assets, i.e., Bitcoin and other altcoins, through a digital wallet.

A digital wallet like the CoinStats Wallet enables DeFi users to exchange crypto immediately after connecting to a DeFi app through plain, easy-to-use user interfaces. All CoinCodeCrypto followers can get 55% off on a 1-year CoinStats premium subscription with our promo code.

Finding a good DeFi app to transact with may be challenging. The TVL is one of the first things to look for in an excellent DeFi app.

TVL refers to the overall value of all the assets reserved in decentralized financial systems. Knowing the TVL in a decentralized finance application is essential because it can yield interests and rewards for you.

However, the TVL is not the only important aspect of a DeFi application. The longevity and platform sustainability to its users is something you should consider.

Also read, 10 Best Decentralized Exchanges (DEX) to Trade Crypto

1st Best DeFi App: GMGN

GMGN is a decentralized yield optimization platform that focuses on providing high-yield farming opportunities. It aggregates yield from various DeFi protocols, helping users maximize their returns while simplifying the complexities of yield farming.

The platform’s core features include automated reinvestment strategies and user-friendly analytics for monitoring performance. GMGN is designed for both beginners and experienced DeFi users looking to increase the profitability of their digital assets.

GMGN Pros

- Automated strategies for passive income.

- Simple interface for tracking yields.

- Supports multiple blockchain ecosystems.

GMGN Cons

- Potential risks with smart contract vulnerabilities.

- Subject to market fluctuations in DeFi yields.

2nd Best DeFi App: Hyperliquid

Hyperliquid is a decentralized trading platform tailored for professional traders. It provides ultra-low-latency trading and advanced order types like limit, stop-loss, and take-profit orders. This makes it a preferred choice for users seeking precise control over their trades.

The platform offers seamless integration with decentralized wallets, allowing users to trade directly without transferring assets to centralized exchanges. Its focus on speed and efficiency makes Hyperliquid stand out among other DeFi trading platforms.

Hyperliquid Pros

- Advanced order types for professional traders.

- Extremely low latency for faster trades.

- High liquidity for efficient trading.

Hyperliquid Cons

- Primarily geared towards experienced traders.

- Limited support for non-trading functionalities.

3rd Best DeFi App: dYdX

dYdX is a leading decentralized trading platform specializing in margin trading and perpetual contracts. It allows users to trade with leverage directly on the Ethereum blockchain while retaining control over their funds.

A key feature of dYdX is its no-gas-fee trading model on its Layer 2 solution, which provides faster and more cost-effective transactions. With robust security and a wide range of supported assets, dYdX has become a top choice for traders seeking a decentralized alternative to traditional platforms.

dYdX Pros

- Zero gas fees on Layer 2.

- Wide range of trading options, including perpetuals and margin trading.

- Strong reputation and trust in the DeFi space.

dYdX Cons

- Complex interface for beginners.

- Risk of high leverage for unexperienced users.

4rth Best DeFi App: GMX

GMX is a decentralized trading platform that specializes in perpetual futures and spot trading. It allows users to trade cryptocurrencies with leverage directly from their wallets.

One of GMX’s standout features is its fee-sharing model, where token holders can earn a share of the platform’s fees. Additionally, GMX utilizes an innovative multi-asset pool for liquidity, which supports seamless trading with low fees and reduced price impact. This makes GMX a user-friendly choice for traders looking for efficient and transparent trading options without intermediaries.

GMX is gaining popularity for its robust security and transparency, with over $1 billion in total value locked (TVL) on the platform.

GMX Pros

- Low trading fees and reduced slippage.

- Fee-sharing rewards for token holders.

- User-friendly interface.

GMX Cons

- Limited to crypto trading.

- High leverage risk for inexperienced traders.

5th Best DeFi Apps: Aave

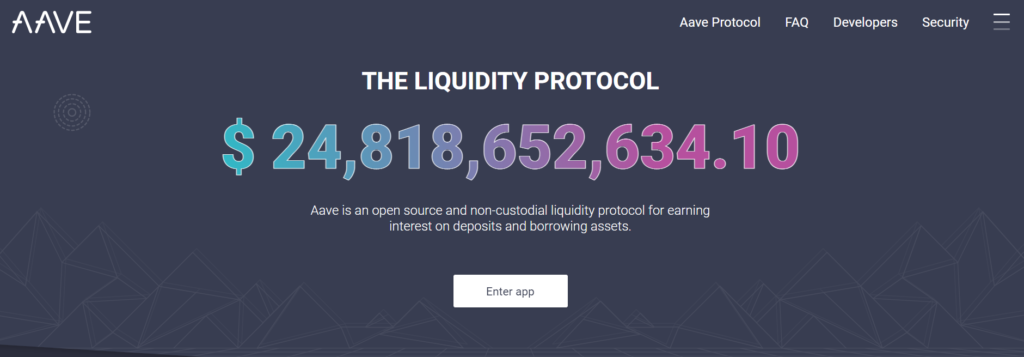

Aave is a decentralized, non-custodial liquidity market protocol where participants can either be lenders or borrowers.

Aave presently has over $5 billion locked up in contracts.

Lenders earn passive income by providing liquidity to the market, while borrowers can obtain undercollateralized and overcollateralized loans.

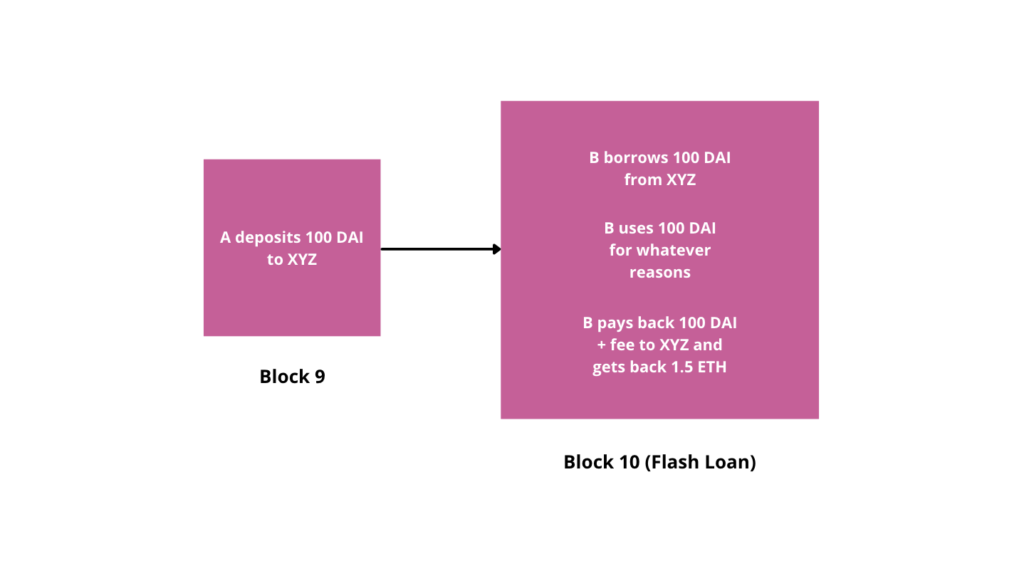

Aave provides trustless, uncollateralized loans that work because loans borrowed must be paid back In the same transaction. The transaction reverts if the loan can’t be paid back, as if nothing ever happened.

Thanks to its high market capitalization and lending pools, Aave has become a household brand among blockchain and cryptocurrency professionals.

Aave is an excellent choice for experienced users, with unique attributes and functionality for both high and low users. Individuals who understand crypto-based lending and borrowing are best suited to Aave due to its rapid and simple lending processes.

| Pros | Cons |

|---|---|

| Resistance against price patterns of Bitcoin. | Over-collateralization of digital assets. |

| Huge returns. | Low-interest rates. |

| Expanding TVL. | Strong rivalry. |

| Increasing partnerships. | |

| Support from legitimate stakeholders. | |

| Infinite supply. |

6th Best DeFi Apps: Uniswap

Uniswap is a fully decentralized protocol that allows users to swap between ETH and ERC20 tokens or earn fees by providing liquidity of any amount.

Users can create markets (i.e., liquidity pools) on Uniswap that helps to improve the protocols exchange liquidity. Each liquidity pair stands for a unique freely-transferable ERC20 token.

ERC20 tokens are converted through a simple UI in a private, non-custodial and secure manner

Uniswap is a decentralized exchange that enables its users to maintain complete control over their funds, unlike a Centralized exchange that makes users give up their private keys.

Also read, ERC-721 Definition | NFT Explained

| Pros | Cons |

|---|---|

| Large market capitalization. | Disbursement leads to decentralization. |

| Availability. | Faces competition. |

| No verification is needed. | Slow network speed. |

| Upgraded versions. | |

| Secure |

7th Best DeFi Apps: MakerDAO

Maker is a collateralized lending protocol based on the Ethereum blockchain that supports Dai(DAI), a stablecoin pegged to the USD.

Maker is a decentralized autonomous organization designed to lessen volatility for DAI, its USD- fixed token.

Users of Maker CA generate Dai by leveraging collateral assets authorized by “Maker Governance.”

Maker offers efficient stablecoin trading without limitations. The DAI stablecoin does not hold USD in the bank, unlike other dollar-backed stablecoins.

Investors are interested in Makers MKR because of its competitive environment generated by receiving interest on CDPs who lend DAI.

DAI and MKR, MakerDAO’s tokens, offer investors significant revenue and rewards by functioning together using smart contracts.

| Pros | Cons |

|---|---|

| Stablecoins are decentralized. | Black swan events may happen. |

| Enforces transparency. | Malicious hacks may occur. |

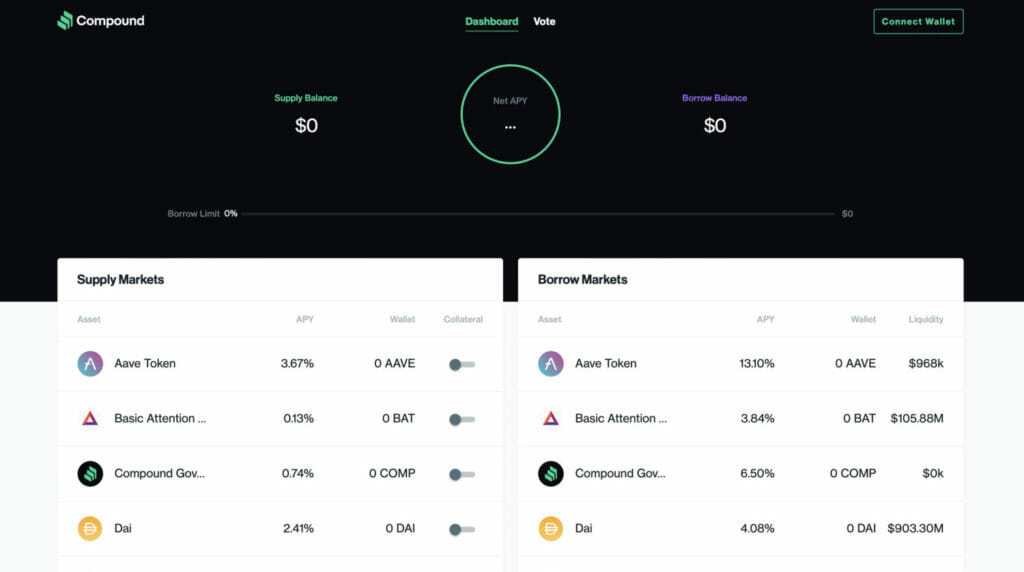

8rth Best DeFi Apps: Compound

Compound is an Ethereum based market protocol that allows holders of digital assets to lend and borrow funds in exchange for collateral.

Anyone can contribute to Compound’s liquidity pool and start earning compounding Interest immediately. Interest rates are adjusted with demand and supply and market dynamics. Tokens retained by liquidity pools are supplied to the compound protocol and yield income for liquidity providers.

Compound is one of the most secure, open, and user-friendly apps available, with over $6 billion locked up in its liquidity pools.

| Pros | Cons |

|---|---|

| The distribution of COMP tokens will create scarcity. | Questions around its decentralized status. |

| Improvement in TVL. | Market share competition with other Ethereum DApps. |

| Rise in popularity. | Risk of more regulations. |

| Access to DeFi Bitcoin. | |

| Trading volume improvements. | |

| Secure protocol. | |

| Highly interoperable. |

9th Best DeFi Apps: SushiSwap

SushiSwap is an Ethereum based DeFi platform that aims to encourage users by providing a platform where users can sell and purchase digital assets.

Essentially, SushiSwap is a copy and paste of Uniswap with a few changes to Uniswaps open-source code.

SushiSwap allows users to create a liquidity pool for their tokens by providing ETH and any ERC20 tokens of their choice and swapping one token for another.

SushiSwap is emerging as a leading DeFi platform, with over $4 billion locked in its trading pools.

Also read, How to Swap on SushiSwap?

| Pros | Cons |

|---|---|

| More than 100 ERC20 trading pairs. | High gas fees. |

| SUSHI-based initiatives. | It might be difficult for beginners to navigate. |

| Easy to navigate and use. | Several security concerns. |

10th Best DeFi Apps: Synthetix

Synthetic is an Ethereum based platform that allows users to create and trade artificial assets called “Synths,” which offer on-chain exposure to tokenized, synthetic versions of real-world assets.

Originally known as Havven, Synthetix enables users to invest ETH in synthetic assets representing Bitcoin, gold, dollars, and more. Trade happens on a peer-to-peer basis.

SNX is Synthetix’s native token. Users can lock collateral like SNX and ETH to mint Synths. The Synths are freely tradeable ERC20 tokens.

Synthetix’s primary focus is to diversify the crypto market by introducing assets that are non-blockchain. Synthetix has around $2 billion in its liquidity pool.

| Pros | Cons |

|---|---|

| Uses oracle technology does not track price movements. | Faces centralisation issues. |

| Provides users with exposure to different assets. | Competition with many new projects. |

| The forefront of the DeFi movement. | More synths are needed to unlock stacked SNX. |

| Physical assets are not needed to trade. | No guarantee to its future success. |

| Heavily dependent on Ethereum. |

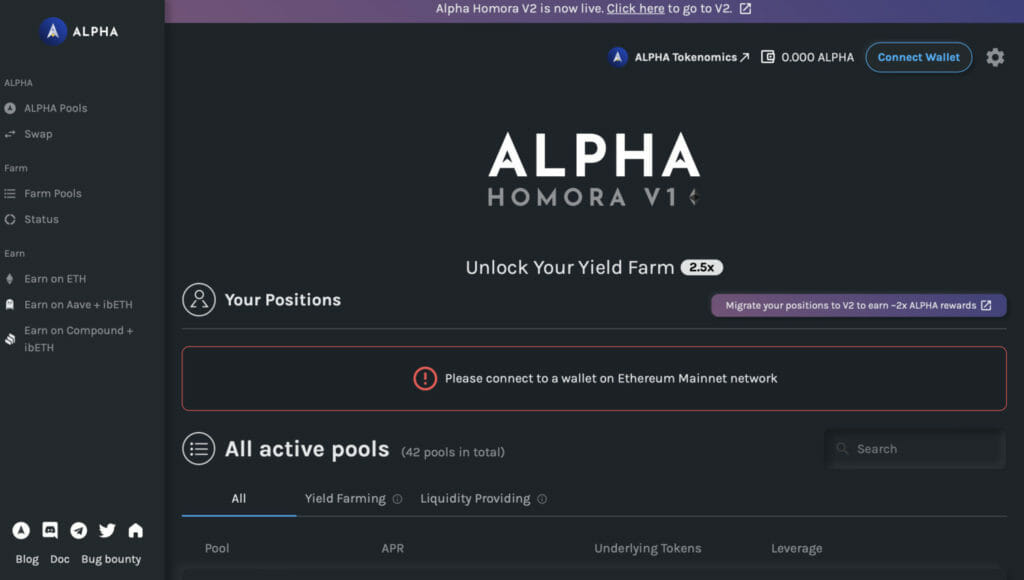

11th Best DeFi Apps: Alpha Homora

Alpha Homora is an Ethereum based yield farming protocol that allows lenders to generate yield farming revenue and earn Interest on ETH.

Alpha Homora’s native token is called ALPHA. Users are attracted to Alpha Homora through its magical graphical user interface, based on the Harry Potter theme.

Alpha Homora is a decentralized oracle launched on the Ethereum Mainnet. Also, it is a protocol that leverages liquidity provision and offers yield farming.

A significant breakthrough has been carved for the Alpha Finance ecosystem by Alpha Homora.

Alpha Homora has assets locked on-chain worth over $900 million.

| Pros | Cons |

|---|---|

| Unlocks innovative ways to engage in yield farming. | Exposure to impermanent loss of risk. |

| Offers smart contracts audited by Peckshield. | Exposure to the risk of debts accrued by underwater position. |

| Earn higher APYs without intermediaries. | Audited codes do not guarantee risk-free contracts. |

| Yield farmers risk liquidation. |

Conclusion

Decentralized financial applications allow you to own and completely control your crypto assets. These DeFi apps also grant the freedom to interact on a peer-to-peer level with financial systems.

The DeFi market is a testament to the innovations emerging from the blockchain industry. Many users make a lot of money when the value locked up in Ethereum DeFi projects is skyrocketing.

We could see borderless, decentralized, open finance solutions replacing many functions today’s traditional financial institutions offer, should the current DeFi growth rate continue.

Making your own research and seeking financial and investment advice is strongly advisable before trading, as the crypto market is highly volatile.

Also read,