Hylo is a permissionless DeFi protocol built entirely on Solana, designed for those waiting on TradFi hand-holding or centralized stablecoins that glitch when things get spicy. It introduces a dual-token setup that actually makes sense:

- hyUSD, a decentralized stablecoin backed by liquid staking tokens (LSTs).

- xSOL, a synthetic token offering long-term, passive 2X leveraged exposure to SOL.

No custodians. No fiat. No real-world assets hiding under the hood. Just pure, on-chain mechanics engineered for Solana’s speed and scalability.

This isn’t just another stablecoin protocol. Hylo is building an independent, self-contained monetary system that stays native to Solana—complete with built-in risk management, slippage-free liquidity, and a focus on yield efficiency from day one.

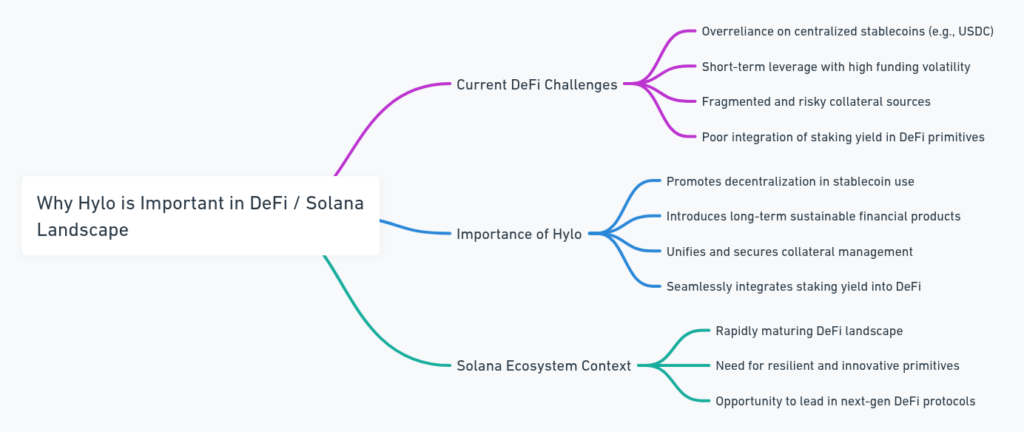

Why Hylo Even Matters Right Now

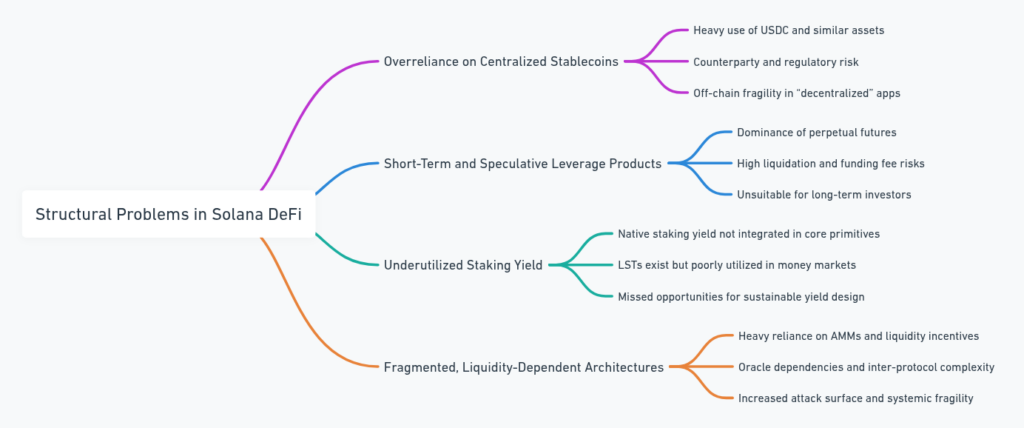

Solana DeFi is evolving fast, but still wrestling with the same old problems:

- Overdependence on centralized stablecoins like USDC.

- Short-term, speculative leverage tools that melt your portfolio overnight.

- Risky and scattered collateral across protocols.

- A DeFi ecosystem that still doesn’t know what to do with staking yield.

Hylo addresses all of it in one integrated protocol that’s both autonomous and composable.

hyUSD skips the fiat dependency entirely. It doesn’t touch off-chain assets, making it one of the few stablecoins that won’t crack if a centralized custodian locks the door.

xSOL isn’t here for degen trades. It’s built for conviction—offering long-term, yield-bearing exposure to SOL without liquidation risk or perpetual funding fees.

Collateral? Hylo doesn’t rely on arbitrary tokens. It’s built on LSTs like mSOL and jitoSOL—meaning you’re locking up staked SOL and turning that yield into a native, DeFi-ready asset. Think of them like on-chain bonds that pay you while securing the network.

And liquidity? No slippage. No AMM games. Minting and redemption happen directly through the protocol with deep, built-in liquidity that doesn’t depend on external markets.

Plus, there are no oracles or off-chain feeds dictating price flows. No fund managers behind the curtain. Hylo is fully autonomous by design and stays that way.

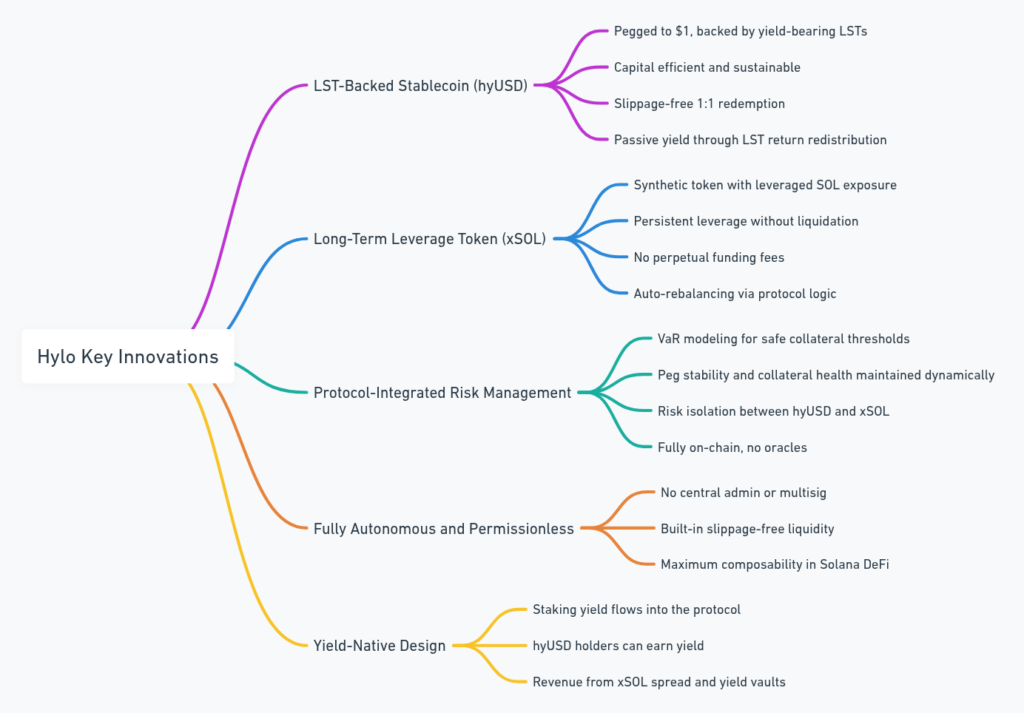

Hylo’s Core Innovations

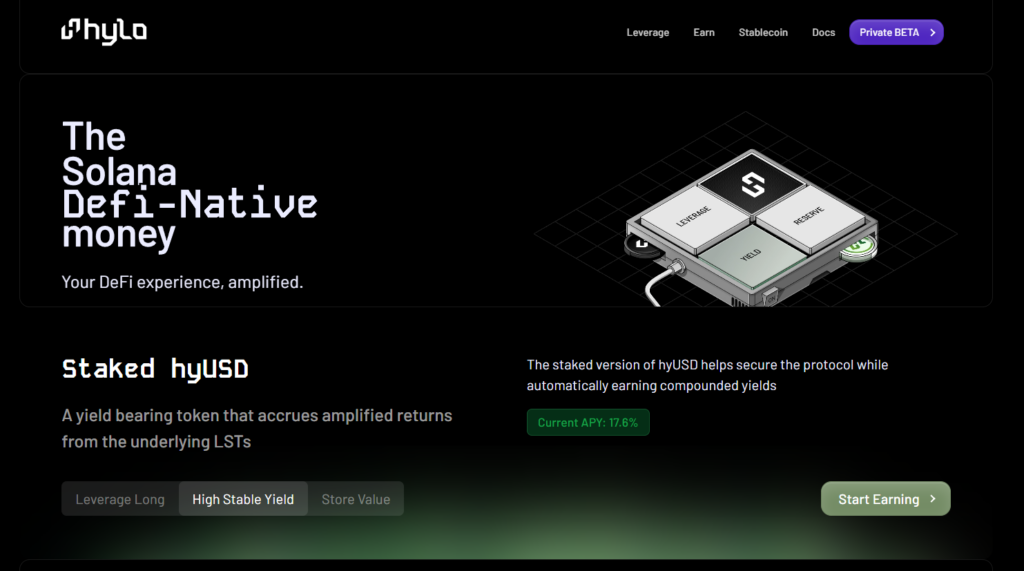

- hyUSD: A Stablecoin That Earns While It Sits

- Pegged to $1, backed entirely by LSTs.

- Zero-slippage redemptions straight from the protocol.

- Doesn’t just sit still—holders can opt-in to earn passive yield redistributed from collateral.

- Efficient, sustainable, and totally off-chain free.

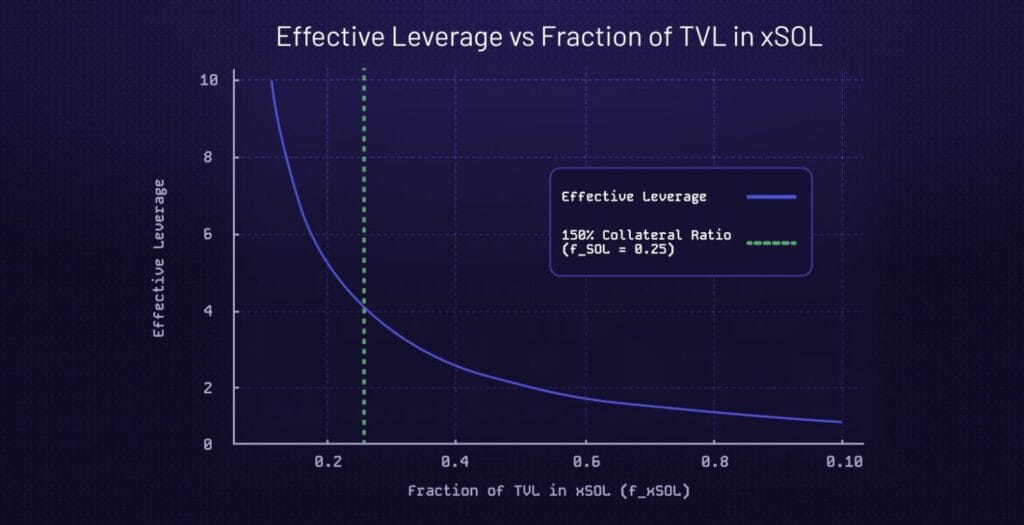

- xSOL: Passive Leverage That Doesn’t Nuke You

- Long exposure to SOL, with embedded leverage that adjusts automatically.

- No liquidations. No funding rate roulette.

- Ideal for long-term holders who want to boost exposure without playing margin games.

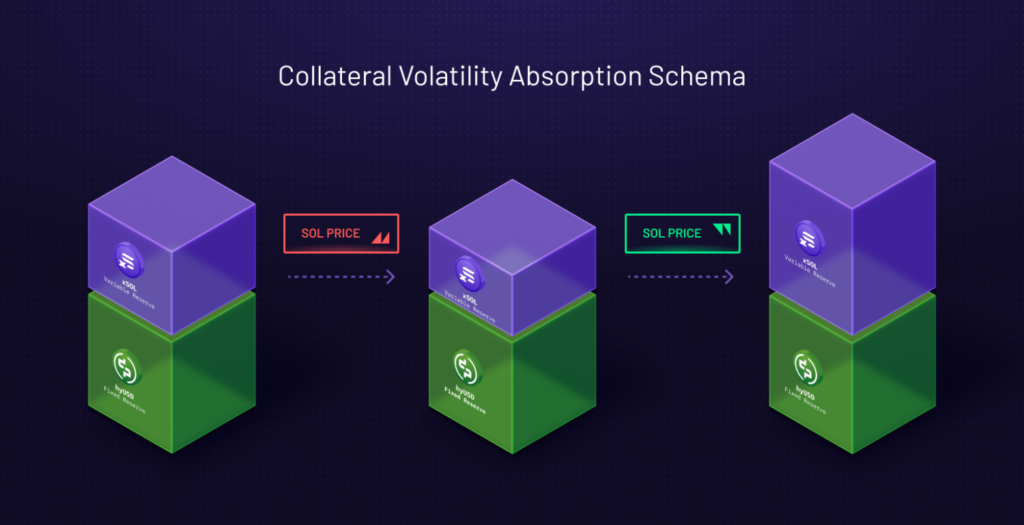

- On-Chain Risk Management That Actually Works

- Uses Value-at-Risk (VaR) modeling to set safe collateral thresholds.

- Peg stability and collateral health are managed automatically.

- Isolates risk between hyUSD and xSOL through separate accounting systems.

- Operates entirely on-chain with zero oracle reliance.

- Autonomous and Composable by Default

- No admin keys, multisigs, or human intervention.

- Instant, slippage-free minting and redemption.

- Fully designed to plug into other Solana DeFi protocols.

- Built Around Yield, Not Just Buzzwords

- All protocol collateral earns staking rewards.

- hyUSD holders can opt-in to share in that yield.

- Protocol revenue comes from xSOL spread and yield vault participation—designed to be sustainable, not extractive.

Hylo Isn’t Copy-Pasting DeFi

This isn’t a fork with lipstick. Hylo redefines what stable value and leverage can look like on Solana. No TradFi dependencies. No centralized pegs. No leveraged gambling wrapped in a new UI.

It’s yield-aware, composable, and autonomous—exactly what Solana DeFi should be building toward. Whether you’re holding stable value or leaning into SOL with conviction, Hylo gives you a system that works with the market instead of fighting against it.

Hylo: Redefining Stable Value and Leverage in Solana DeFi

Solana’s DeFi Landscape: Built Fast, but Still Flawed

Solana has quickly risen as a top-tier smart contract platform. Its high throughput, low fees, and parallel processing make it a natural home for DeFi innovation. Over time, it’s developed a strong ecosystem of decentralized exchanges like Orca and Jupiter, lending protocols like MarginFi and Solend, and liquid staking solutions like Marinade, Jito, and Blaze.

But despite that growth, many of the same structural weaknesses found across broader DeFi have followed Solana:

- Centralized stablecoin dependency: USDC still dominates DeFi value on Solana. It brings counterparty risk, regulatory vulnerability, and a centralization problem hiding under the surface.

- Speculative, short-term leverage: Most leveraged exposure comes from perpetual futures—products built for day-traders, not long-term holders. Liquidation risks, funding fees, and volatility make them unreliable for conviction-based positions.

- Staking yield is underused: Solana has native yield via staking, and LSTs exist. But most protocols ignore this potential, leaving valuable yield on the table.

- Reliance on external infrastructure: Many protocols are tightly coupled to AMMs and oracles for pricing and liquidity, leading to fragility, complexity, and exploitable interdependencies.

Solana has the infrastructure to support a new generation of DeFi, but it still lacks the foundational systems that prioritize decentralization, yield efficiency, and native protocol composability. That’s where Hylo comes in.

Table of Contents

Hylo’s Purpose: A First-Principles Redesign of DeFi’s Core Layers

Hylo is built from the ground up to fix the structural problems holding Solana DeFi back. It introduces two native assets:

- hyUSD: A decentralized stablecoin backed entirely by a basket of yield-bearing LSTs. It avoids fiat, off-chain assets, and oracles altogether.

- xSOL: A synthetic asset offering long-term, passive leveraged exposure to SOL without liquidation or funding volatility.

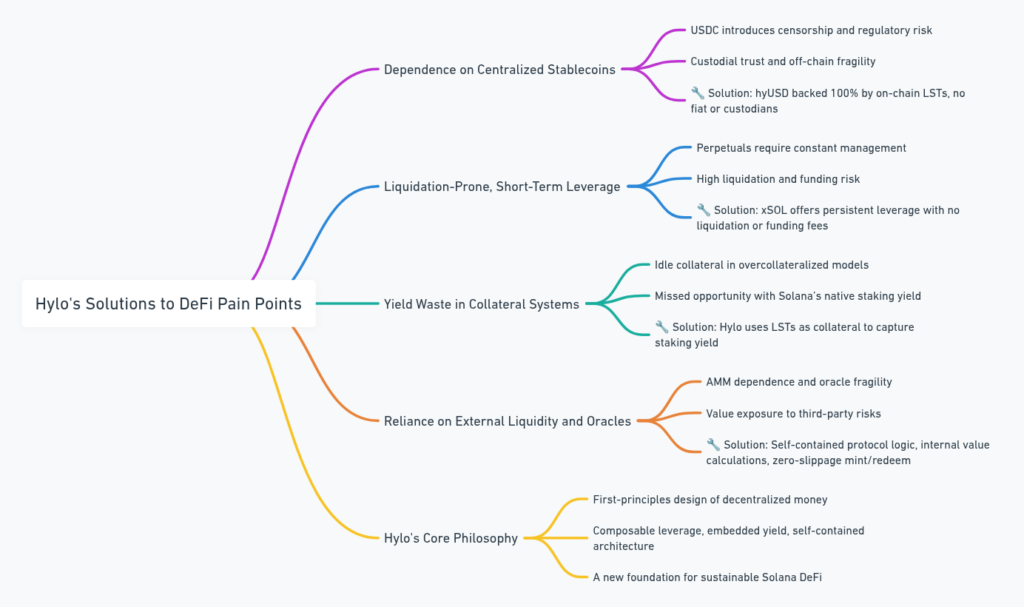

Here’s how Hylo directly tackles the core pain points:

1. Centralized Stablecoins Are a Liability

USDC and similar fiat-backed stablecoins introduce censorship risk, regulatory exposure, and a level of custodial trust that undermines DeFi’s ethos.

Hylo’s Answer: hyUSD is backed 100% by on-chain LSTs like mSOL and jitoSOL. No fiat. No real-world collateral. No centralized gatekeepers.

2. Liquidation-Prone, Short-Term Leverage Doesn’t Cut It

Most DeFi leverage products are structured for short-term speculation. They require constant micromanagement and come with liquidation risk, making them impractical for long-term SOL holders.

Hylo’s Answer: xSOL delivers synthetic leverage that’s persistent and passive. It doesn’t rely on margin calls or funding rate arbitrage. Instead, it’s designed for users with long-term SOL conviction.

3. Wasted Collateral and Idle Capital

Collateral in most DeFi systems sits idle. Even protocols like MakerDAO leave value on the table by not utilizing staking yield.

Hylo’s Answer: Collateral in Hylo is made up entirely of yield-bearing LSTs. The protocol captures staking yield and routes it toward peg stability, protocol revenue, and optional user yield through hyUSD+ vaults.

4. Third-Party Reliance Increases Fragility

Protocols that rely on AMMs for liquidity and oracles for valuation are exposed to manipulation, outages, and cascading failure risks.

Hylo’s Answer: The entire minting and redemption process in Hylo is internal. There’s no reliance on external oracles or AMMs, no slippage, and no exposure to third-party market mechanics. Valuation is determined solely through the protocol’s on-chain logic.

Hylo’s Architecture: A Self-Contained Financial Layer for Solana

Hylo isn’t just a rework of existing models. It’s a full departure from the status quo. By removing fiat from the equation, capturing staking yield directly at the protocol level, and embedding composable leverage within its own system, Hylo positions itself as a foundational layer of decentralized money for Solana.

The protocol’s architecture is autonomous, yield-aware, and designed to outlast the volatility and limitations of traditional DeFi systems.

With zero-slippage minting, long-duration asset strategies, and total on-chain independence, Hylo offers an alternative to the unstable mix of stablecoins, perpetuals, and third-party dependencies that currently define the DeFi landscape.

This is not another DeFi derivative. It’s a rebuild—starting from first principles and tailored specifically for Solana.

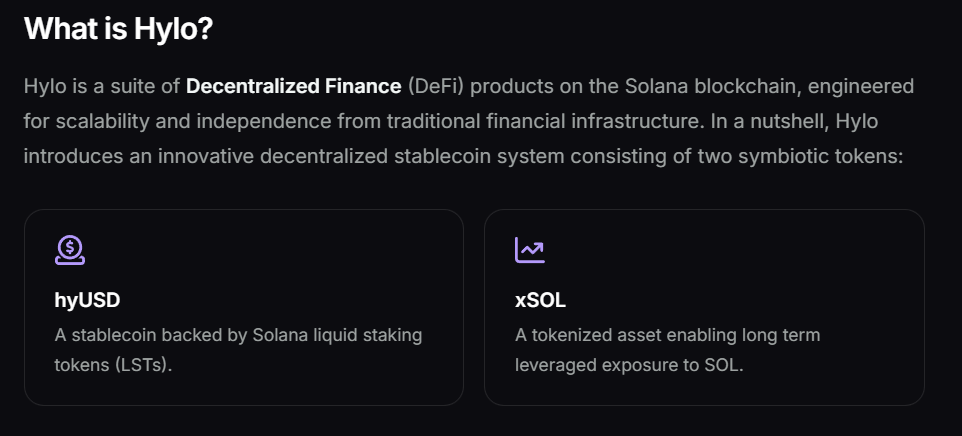

What Is Hylo

Hylo is a decentralized finance protocol built natively for the Solana blockchain. It introduces two foundational financial primitives designed to anchor a stable, autonomous on-chain economy:

- hyUSD: A decentralized stablecoin backed by a basket of yield-bearing liquid staking tokens (LSTs)

- xSOL: A synthetic asset that provides long-term, automated leveraged exposure to SOL

Hylo isn’t just another DeFi toolkit or protocol plugin. It operates as a self-contained, permissionless system—similar to an on-chain central bank—managing mint and redeem functions, risk mechanics, and staking yield capture without any reliance on fiat, oracles, or centralized custodians.

It’s designed from the ground up to maximize capital efficiency and composability while remaining fully decentralized and yield-native.

Mission and Core Principles

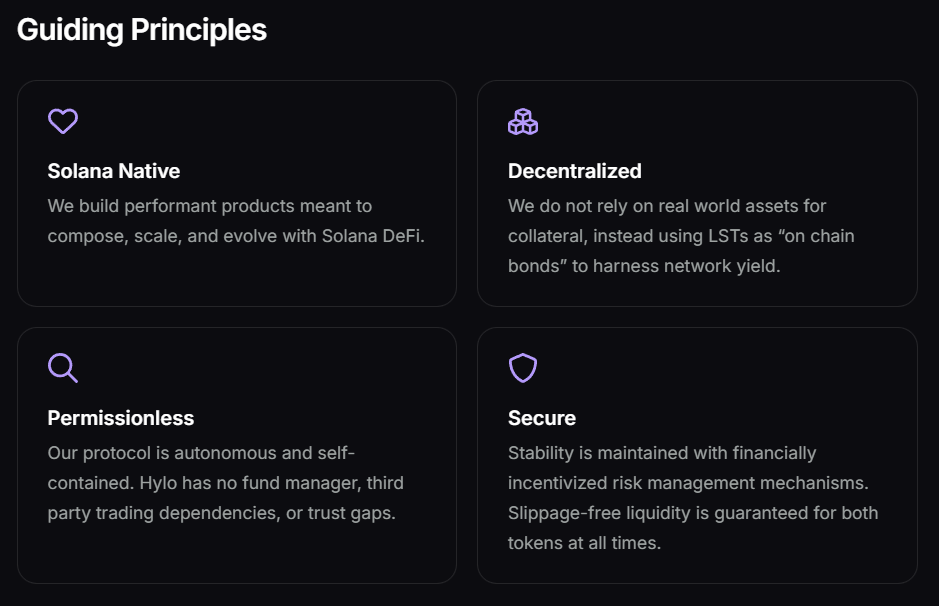

Hylo exists to create a self-sustaining, protocol-native financial layer for Solana—built for longevity, autonomy, and scale. Its vision is defined by four guiding principles:

1. Solana-Native

Hylo is purpose-built to run on Solana. Its performance, structure, and integration align with Solana’s high-throughput, low-cost design and parallel execution capabilities. The protocol is made to compose with core Solana primitives, including staking platforms like Marinade and Jito, and DeFi protocols like Jupiter, Kamino, and Meteora.

2. Decentralized

Hylo avoids any dependence on fiat, real-world assets, or off-chain collateral. It uses only Solana-based LSTs, transforming staking yield into a decentralized bond layer that underpins both its stablecoin and leverage systems. There are no custodians, no regulatory middlemen, and no off-chain assets.

3. Permissionless

Hylo requires no intermediaries or administrative access. Anyone with a Solana wallet can mint hyUSD, leverage into xSOL, or deposit into a yield vault. There is no KYC, no gatekeeping—only immutable smart contracts enforcing the rules.

4. Secure

Hylo applies conservative risk parameters and autonomous modeling to maintain protocol stability. Value-at-risk (VaR) calculations set dynamic collateral thresholds. Liquidity is protocol-native and slippage-free. There are no AMM dependencies or external oracle feeds, which reduces attack surface and systemic fragility.

Design Philosophy

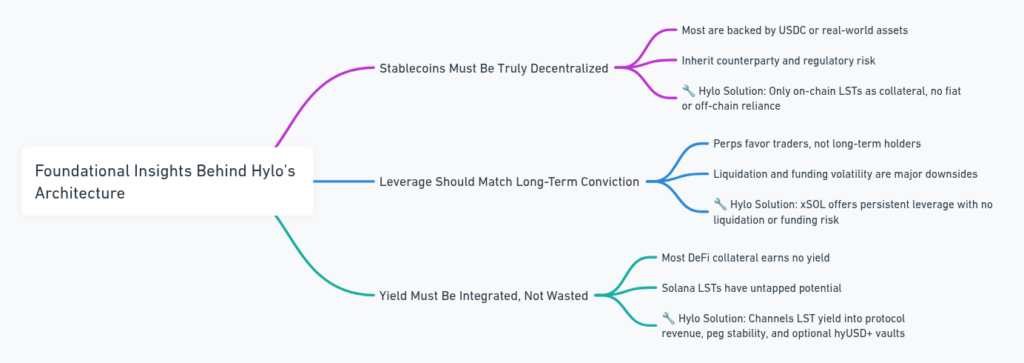

Hylo’s architecture responds to three persistent DeFi challenges with targeted design choices:

1. Stablecoins Must Be Fully On-Chain

Most Solana DeFi stablecoins, including USDC-backed systems, rely on centralized custodians. Even “decentralized” options like DAI increasingly turn to real-world assets for collateral.

Hylo rejects this. hyUSD is collateralized solely by LSTs—staking-backed, on-chain tokens that keep value and trust fully inside the protocol.

2. Leverage Should Align With Long-Term Conviction

Leverage in DeFi is mostly built for traders using perps and margin platforms. These tools require active management, expose users to funding volatility, and liquidate positions at market swings.

Hylo introduces xSOL, a passive leverage token that gives long exposure to SOL without liquidations, without funding fees, and without needing to babysit the position. It’s designed for long-term holders—not speculative churn.

3. Yield Must Be Put to Work

In most protocols, collateral is idle. Solana’s LSTs already generate yield, but it often goes unused or wasted in current DeFi models.

Hylo routes LST staking rewards directly into protocol mechanics. That yield supports peg stability, protocol revenue, and optional yield for hyUSD holders via vaults like hyUSD+.

Collateral Pool: The LST Basket

Hylo’s engine runs on a diversified Collateral Pool composed of multiple Solana-based LSTs:

- mSOL (Marinade)

- JitoSOL (Jito Labs)

- bSOL (BlazeStake)

- Future additions can be proposed via governance or protocol updates

This LST basket backs both hyUSD and xSOL, creating a unified, yield-bearing foundation for the entire protocol. Rewards from each LST are used to:

- Offset systemic protocol risk

- Provide optional yield to hyUSD holders

- Support sustainable protocol-level revenue

Hylo applies internal weighting and risk limits to prevent any single LST from dominating the basket. This enhances stability and decentralization while avoiding validator or protocol-specific concentration risks.

Protocol Architecture: A Self-Contained Model

Hylo’s smart contracts control all aspects of the protocol, with no reliance on:

- AMMs for liquidity

- Oracles for pricing

- Multisigs or fund managers for upgrades or collateral control

All value flows are internal, slippage-free, and calculated through pre-defined protocol logic. The system operates autonomously, removing third-party failure points and enabling seamless integration into Solana’s DeFi stack.

Research-Driven Foundation

Hylo’s model is shaped by extensive analysis across three DeFi categories:

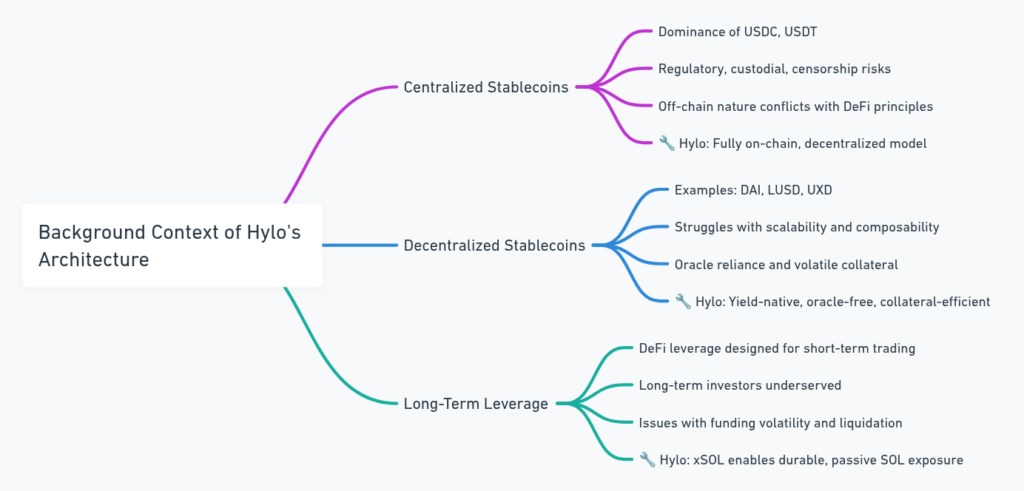

1. Centralized Stablecoins

Assets like USDC and USDT dominate DeFi volume but introduce regulatory risk, censorship potential, and custodial dependence. Hylo eliminates these vectors by avoiding fiat entirely.

2. Decentralized Stablecoins

Efforts like DAI, LUSD, and UXD have pushed decentralization forward but suffer from scalability bottlenecks, over-reliance on volatile collateral, or oracle-based pricing. Hylo addresses these constraints with a yield-native, oracle-free, collateral-efficient approach.

3. Long-Term Leverage

Current DeFi leverage is designed for traders. It excludes long-term investors who want structured exposure without liquidation risk. Hylo’s xSOL bridges that gap—offering passive, rebalanced leverage embedded into the protocol layer.

Hylo is not a fork, a wrapper, or a temporary workaround. It’s a full-stack financial system built for Solana, from first principles. By using staking-backed collateral, integrating native yield, and removing reliance on third-party infrastructure, Hylo creates a self-sustaining, composable base layer for decentralized money on Solana.

Hylo Core Products

Hylo introduces two flagship assets—hyUSD and xSOL—designed to anchor a decentralized, yield-native monetary layer on Solana. These assets are backed by a purpose-built protocol architecture that integrates staking yield, ensures risk-aware design, and includes a points-based incentive system called the XP System.

hyUSD — A Decentralized, Yield-Backed Stablecoin

How It Works

hyUSD is a stablecoin pegged to the US dollar and minted against a basket of liquid staking tokens (LSTs) on Solana, including:

- mSOL (Marinade)

- jitoSOL (Jito Labs)

- bSOL (BlazeStake)

To mint hyUSD, users deposit LSTs into Hylo’s Collateral Pool. Each LST is valued based on internal, protocol-defined logic—there are no external oracles involved. This keeps the process fully on-chain and independent of centralized price feeds.

Collateral System: Yield-Backed and Diversified

The LST basket functions as both collateral and yield source. Staking rewards generated from these tokens are directed into:

- Supporting peg stability

- Funding opt-in yield via the hyUSD+ vault

- Generating protocol revenue

Hylo actively balances exposure across LSTs to reduce the risk of any single validator or staking provider dominating the pool.

Stability Mechanism

Hylo maintains hyUSD’s peg using several mechanisms:

- Mint and redeem logic: Users can always mint hyUSD with LSTs or redeem hyUSD back into LSTs at a fair, slippage-free rate determined by the protocol.

- Value-at-Risk (VaR) modeling: The protocol dynamically enforces collateral limits to prevent over-minting and protect solvency.

- Incentives: Yield distribution, redemption flows, and protocol fees are aligned to promote behaviors that support the peg.

The system avoids reliance on AMMs, price oracles, or real-world collateral, which sharply reduces systemic risk.

Use Cases

- Stable Payments: On-chain payments with no exposure to custodial stablecoins.

- Yield Farming: Users can deposit hyUSD into hyUSD+ vaults to earn a share of the staking rewards.

- Composability: As a fully decentralized Solana-native stablecoin, hyUSD can be integrated across DeFi, including lending platforms like MarginFi or Solend, yield protocols like Kamino, and routing engines like Jupiter.

xSOL — Long-Term, Passive Leverage on SOL

Design and Mechanics

xSOL is a synthetic token that gives users leveraged exposure to SOL without relying on perps, margin accounts, or centralized price feeds. Instead, it uses internal protocol logic to simulate leverage.

xSOL is minted when users deposit hyUSD into the protocol. That capital is used to increase exposure to SOL by acquiring additional LST collateral, amplifying the user’s position.

Leverage Model

- hyUSD deposits are converted into more LSTs

- These LSTs serve as overcollateralized backing for the leverage

- Staking rewards from the underlying LSTs continue to accrue to the protocol

There are no liquidations, no margin requirements, and no funding rates to manage. The leverage is embedded and rebalanced automatically.

Target Users

- Long-term SOL holders seeking enhanced exposure

- Users looking for passive leverage without day-to-day management

- DeFi-native investors who want staking yield integrated into leveraged positions

Risk Profile and Use Cases

xSOL avoids liquidation, but it still amplifies the price movements of SOL. This means users take on higher volatility and must be aware of directional risk.

Key use cases:

- Long-term portfolio exposure to SOL

- Pairing with hyUSD in leveraged DeFi strategies

- Non-custodial, staking-powered high-beta positions

xSOL can be redeemed back into hyUSD at any time based on the protocol’s current valuation model.

Hylo XP System — Participation-Based Incentives

Hylo includes a non-transferable, wallet-bound incentive system called XP (Experience Points). This system is designed to reward early adopters and committed users across the protocol.

What is Hylo XP

- Tracks engagement with Hylo’s core products

- Tied directly to wallet activity

- Non-transferable and currently non-monetized

- Expected to carry future utility (e.g., governance power, token distribution, feature access)

How XP is Earned

Users earn XP by holding:

- hyUSD

- hyUSD+ (vault-optimized, yield-bearing version)

- xSOL

XP earnings are calculated based on:

- Dollar value held

- Duration of holding

For example, a user holding $1,000 in hyUSD for 30 days will earn more XP than a user holding $100 over the same period. Products with higher protocol utility or risk exposure (like xSOL or hyUSD+ vaults) may receive boosted XP multipliers.

The full breakdown of emission rates and mechanics is available in Hylo’s “Season 0” documentation. Check here!

Strategic Advantages of Hylo

Hylo’s protocol design isn’t just different—it’s built to eliminate systemic weaknesses across both traditional and decentralized finance. Its core strengths are rooted in a self-contained architecture, internalized liquidity, and incentive-driven risk management—all implemented without relying on oracles, AMMs, or third-party infrastructure.

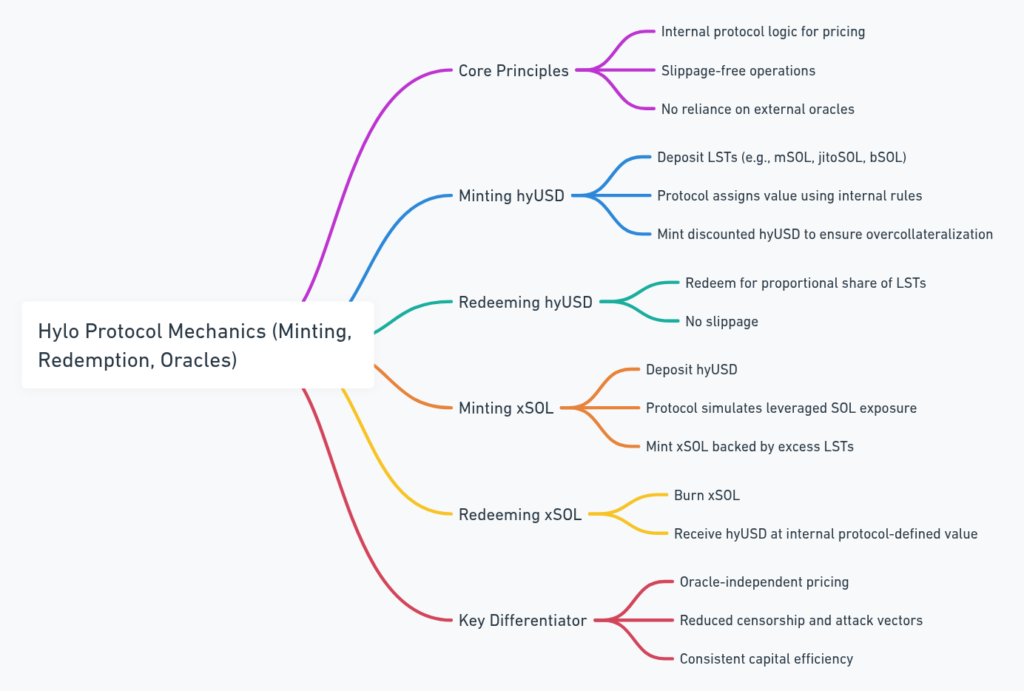

Protocol Mechanics

Minting and Redemption

Hylo determines all pricing and operations internally, using protocol logic that remains consistent even during volatility. There are no external oracles, and every transaction—whether minting or redeeming—is slippage-free.

- Minting hyUSD: Users deposit a basket of LSTs (e.g., mSOL, jitoSOL, bSOL). The protocol applies its own internal valuation framework and mints hyUSD at a slightly discounted value to ensure overcollateralization.

- Redeeming hyUSD: Users can redeem hyUSD at any time for a proportional amount of LSTs, using internal fair value logic. There is no slippage or market dependence.

- Minting xSOL: Users deposit hyUSD, which the protocol converts into a leveraged long exposure to SOL by increasing its backing with additional LSTs.

- Redeeming xSOL: Burning xSOL returns the corresponding hyUSD value as defined by the protocol’s internal accounting.

Key Differentiator: All value calculations are handled within the protocol itself. Hylo does not rely on external oracles like Pyth or Switchboard, minimizing attack vectors, price manipulation, and censorship risk.

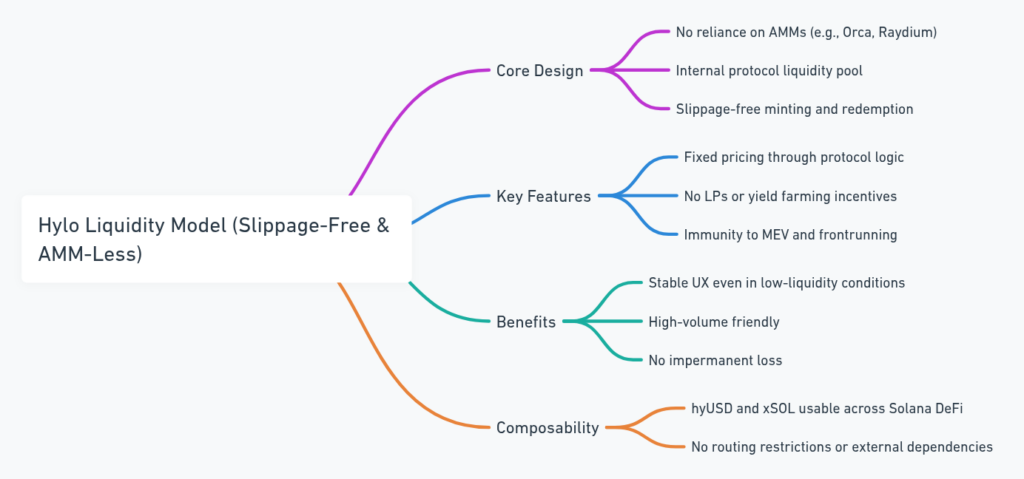

Liquidity Model

Hylo operates with a native liquidity design that removes the need for AMMs, LPs, or market-based routing altogether. Minting and redemption happen directly against the protocol, under fixed-value conditions.

Key Features:

- Zero Slippage: All operations follow pre-defined price logic. Users don’t pay slippage, regardless of volume.

- Protocol Liquidity: The protocol holds and manages its own asset pools. Users interact with Hylo directly—no intermediaries.

- No LPs Required: There are no liquidity mining programs, yield farming incentives, or impermanent loss mechanics. The system is capital-efficient without requiring external contributions.

- Composability: hyUSD and xSOL are freely composable across the Solana DeFi ecosystem, and fully compatible with lending markets, vaults, and DEX routing.

Strategic Benefit: This architecture is immune to frontrunning, MEV extraction, and market depth issues. It offers a frictionless experience, especially for high-volume users and protocols that integrate with Hylo’s stablecoin or leverage products.

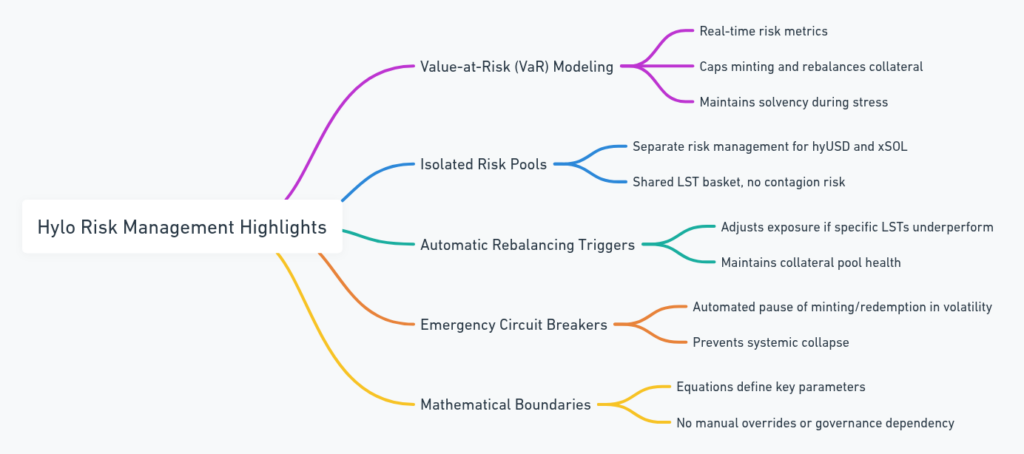

Risk Management

Hylo replaces forced liquidations and reactive protection measures with proactive modeling and built-in economic incentives. Its risk framework ensures peg stability, system solvency, and long-term collateral health.

1. Overcollateralization With Yield

Every unit of hyUSD and xSOL is backed by yield-bearing LSTs. That yield acts as a buffer, reducing the need for emergency interventions or backstops. It also funds vault incentives and peg mechanisms.

2. Value-at-Risk (VaR) Modeling

The protocol continuously evaluates risk through Value-at-Risk analysis. It dynamically adjusts mint and redemption conditions in response to market shifts. If volatility increases or LSTs deviate from expected value, the protocol can slow or pause issuance to protect itself.

3. Risk Isolation Between Products

While hyUSD and xSOL share the same collateral infrastructure, they are risk-isolated by design. Losses or volatility in one product cannot cascade into the other. hyUSD maintains its peg independently, and xSOL’s performance doesn’t affect stablecoin users.

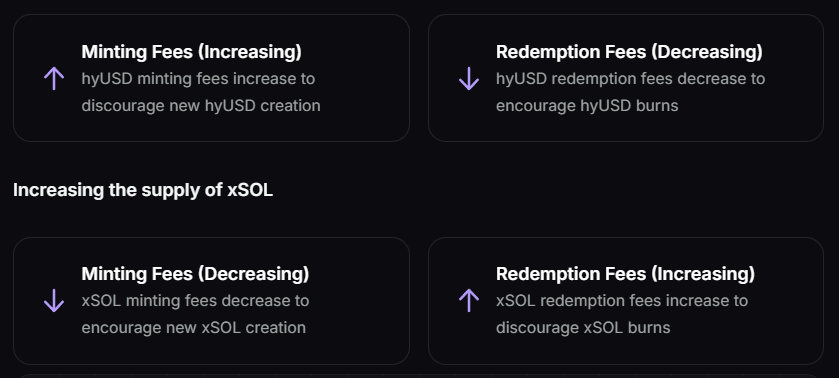

4. Incentivized Redemption Mechanics

When hyUSD or xSOL drift from internal fair value, users are economically incentivized to redeem. Arbitrage restores pricing, but without requiring coordination across third-party platforms. All redemptions settle at protocol-defined values, enabling self-correction.

5. No Liquidations for Users

Hylo does not enforce liquidations on users. There are no margin calls, debt auctions, or vault liquidations. System safety is enforced through overcollateralization, real-time modeling, and protocol-level controls—not user penalties.

Hylo is designed to outperform legacy DeFi by doing what most protocols won’t: cutting external dependencies, embedding yield at the base layer, and separating risk cleanly between products. With no AMMs, no oracles, and no centralized price feeds, Hylo builds a fully self-contained financial system for Solana.

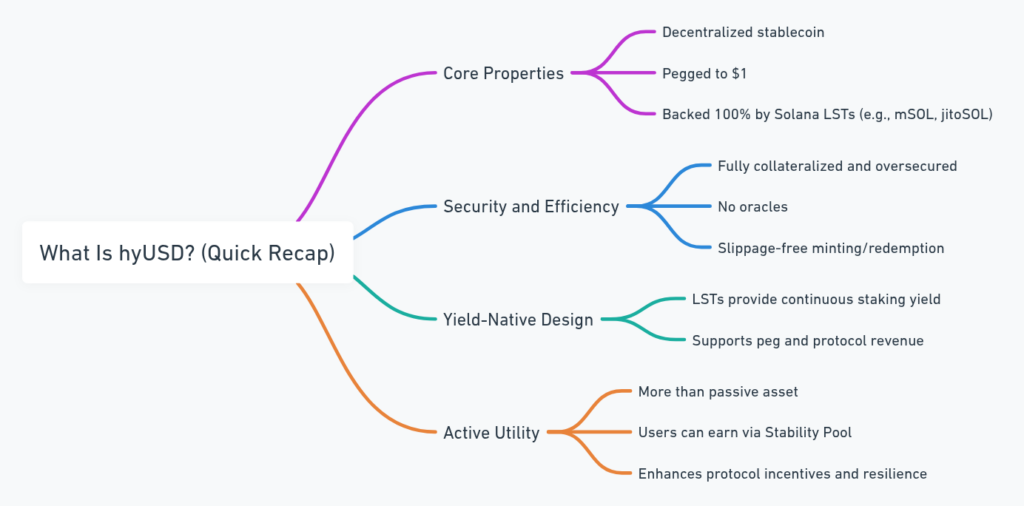

Earn Real Yield with hyUSD — The Altie Way

What’s hyUSD Again? Quick Reset

hyUSD is Hylo’s decentralized stablecoin, built straight on Solana and backed 1:1 by a diversified basket of liquid staking tokens (LSTs) like mSOL, JitoSOL, and bSOL.

Let’s break down what that actually means:

- Pegged to $1? ✅

- Backed by yield-generating assets? ✅

- No reliance on oracles or AMMs? ✅

- Fully on-chain, overcollateralized, and slippage-free? ✅

But here’s the kicker: hyUSD isn’t just “stable.” It’s productive. You don’t just hold it — you deploy it, and it starts working.

Enter the Stability Pool: Where the Real Yield Lives

The Stability Pool is the core of Hylo’s system. It’s where hyUSD holders become more than passive savers — they become co-insurers of the protocol, and they get paid for it.

What’s the Point?

By depositing your hyUSD into the Stability Pool, you’re:

- Helping absorb system risk if an xSOL position gets undercollateralized

- Earning protocol revenue and staking yield in return

- Accumulating XP — Hylo’s native points system that may unlock future governance or rewards

Altie’s view? This is not a “farm”. This is DeFi infrastructure doing what TradFi can’t: letting you get paid for keeping a system stable.

How It Works (Without the Buzzwords)

- You mint hyUSD (collateralized by LSTs like mSOL and JitoSOL)

- You deposit that hyUSD into the Stability Pool

- You earn yield in three ways:

- LST staking yield, routed through the protocol

- Protocol fees from every hyUSD and xSOL mint/redeem

- XP points — not tokens (yet), but early signals of governance power

And no — you’re not exposed to impermanent loss or AMM volatility. All of this is handled internally by deterministic math.

🔊 Altie says: “No Degen games here. Just real rewards from real activity. You’re getting paid to keep Hylo stable.”

Why Yields Hit Double Digits

Let’s be clear — this isn’t magic. It’s a combo of three very intentional designs:

- Calculated Risk, High Reward

You’re absorbing smart contract/systemic risk by stepping in when needed — and Hylo rewards that. - Continuous LST Yield

The LSTs backing hyUSD (mSOL, JitoSOL, bSOL) are always earning. A portion of that gets distributed back to you. - No External Friction

No oracles. No AMMs. No inefficiency. All revenue stays inside the protocol and gets recycled.

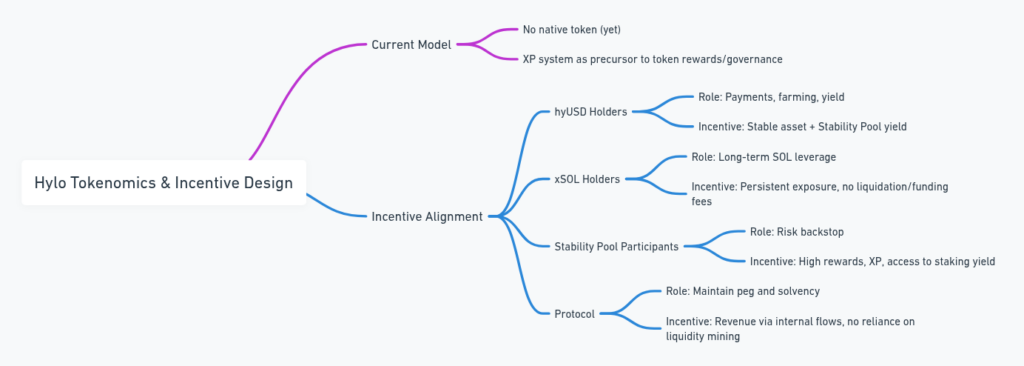

No Token Yet, But XP Isn’t Nothing

Hylo doesn’t have a native token (for now). But the XP system is designed as a precursor to future governance or incentive mechanisms. The earlier and deeper you participate, the more XP you earn — and the more weight you’ll likely carry when token governance goes live.

Aligned Incentives, Top to Bottom

| Player | Role | Why They Win |

| hyUSD holders | Save, pay, farm, or deposit | Get native yield + system rewards |

| xSOL holders | Leverage SOL long-term | No liquidations, no funding fees |

| Stability Pool depositors | Protocol backstops | Earn top-tier rewards + XP |

| Hylo protocol | Stay solvent, generate revenue | Operates sustainably, no dilution |

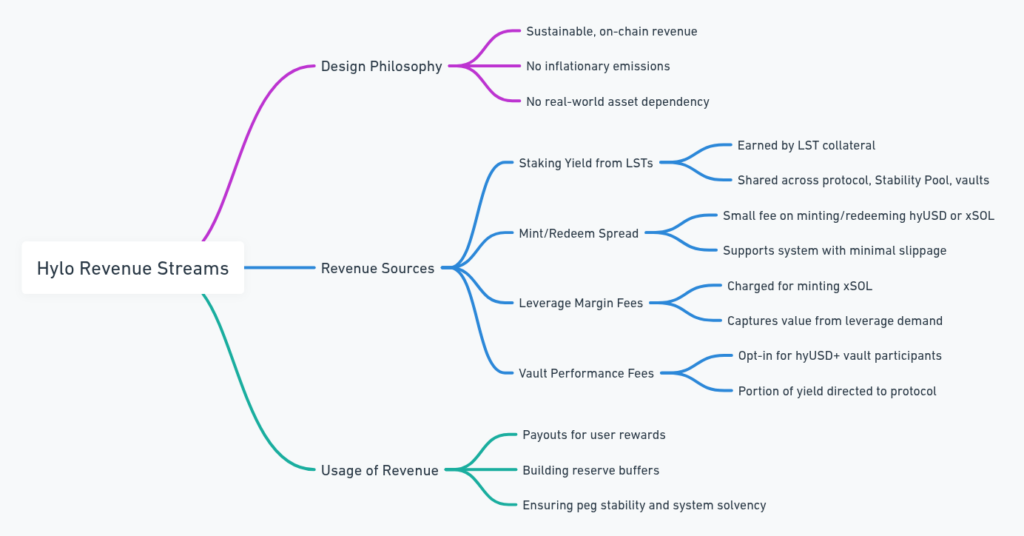

Revenue Streams (Yeah, They’re Real)

Hylo doesn’t rely on printing tokens or liquidity mining games. Its cash flow is on-chain, organic, and sustainable.

- LST Staking Yield

Yield from mSOL, bSOL, JitoSOL — shared with the protocol, Stability Pool, and vaults. - Mint/Redeem Spread

Every time someone mints or redeems hyUSD or xSOL, a small fee supports the system. - xSOL Leverage Fees

Demand for synthetic leverage = revenue for the protocol. - Vault Performance Fees (opt-in)

hyUSD+ vaults may include performance-based fees. Totally optional.

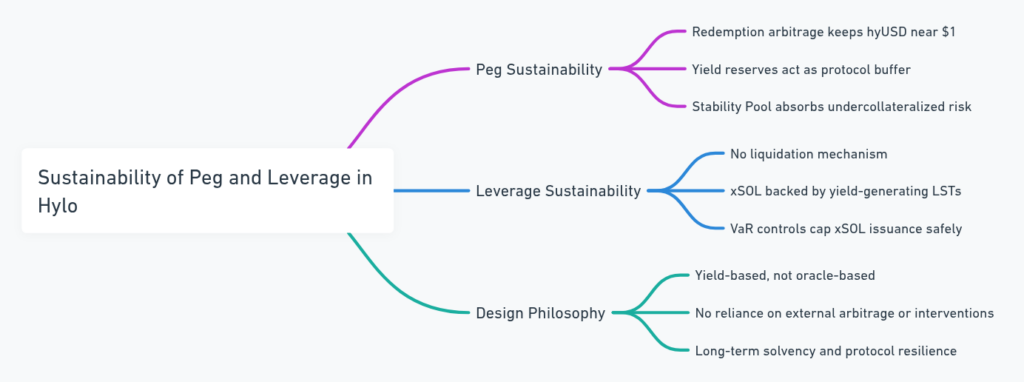

Peg & Leverage: Designed for Long-Term Sustainability

Hylo doesn’t play pegging games or rely on fragile arbitrage. The design is built to hold — even when markets don’t.

How the hyUSD Peg Holds:

- Redemption arbitrage: If hyUSD drops below $1, users can redeem it for LSTs, pulling it back up.

- Staking reserves: Yield builds up as a protocol buffer.

- Stability Pool defense: Absorbs shocks from undercollateralized positions.

Why xSOL Doesn’t Break:

- No liquidations: No cascading margin calls.

- Staking yield offsets cost: LST collateral helps make leverage “cheaper.”

- VaR caps risk: Hylo’s internal models limit leverage to safe levels.

🧠 Altie’s Final Take

Hylo’s Stability Pool turns stablecoin users into protocol guardians — and pays them accordingly. With no AMMs, no emissions, and no fiat-backed nonsense, it’s pure DeFi value extraction.

This is what sustainable stablecoin yield should look like.

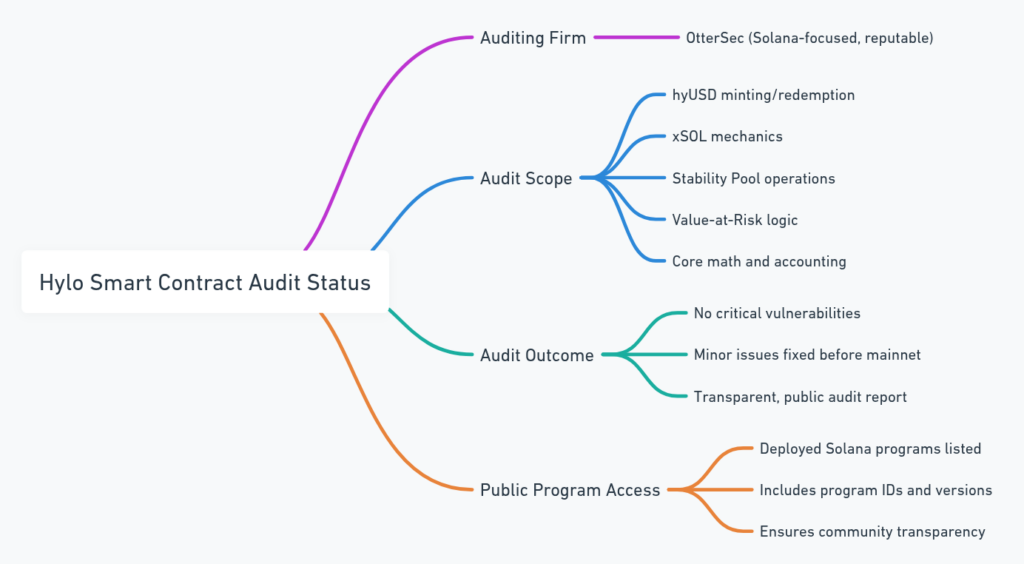

Security and Audits

Hylo is built to be autonomous, stable, and composable—but none of that matters without rigorous security. From its architecture to its deployment, Hylo prioritizes protocol safety through smart contract audits, oracle-free pricing, and clear risk containment strategies. Everything is designed to hold up under stress—without relying on luck, custodians, or patchwork fixes.

Smart Contract Audit Status

Hylo’s core contracts have been independently audited by a top-tier Solana-native firm:

- Auditor: OtterSec

Recognized for deep expertise in Solana smart contract auditing. - Audit Scope:

- hyUSD minting and redemption logic

- xSOL creation and leverage mechanics

- Stability Pool infrastructure

- VaR-based risk modeling

- Core accounting and protocol math

- Outcome:

- No critical vulnerabilities found

- Minor findings were addressed and resolved before mainnet deployment

- The full audit report is public for transparency and community review

Deployed Programs

All deployed Solana program IDs and version hashes are available for public verification. This gives users the ability to validate exactly what’s running on-chain—no hidden logic, no opaque upgrades.

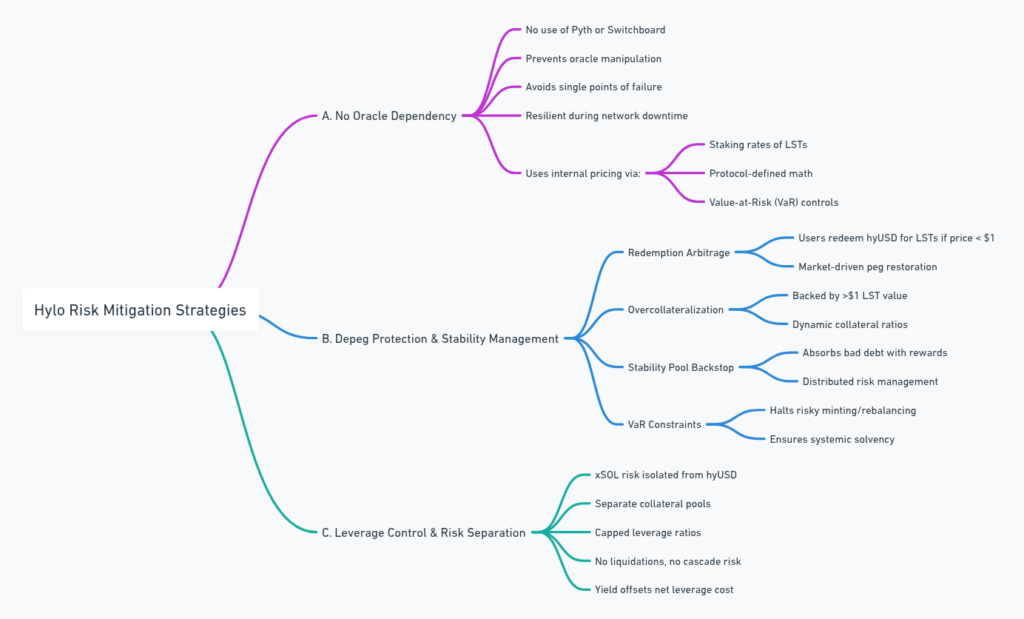

Risk Mitigation Strategies

Hylo isn’t just audited—it’s architected from first principles to reduce attack surfaces and maintain solvency under pressure. Its risk design focuses on removing single points of failure, isolating volatility, and preserving stability without relying on reactive mechanics like liquidations.

A. No Oracle Dependency

Hylo does not use external price oracles for minting, redemption, or asset valuation.

Why it matters:

- Eliminates one of the most common DeFi attack vectors: oracle manipulation

- Ensures uptime even during price feed outages or network congestion

- Removes reliance on off-chain infrastructure (e.g., Pyth, Switchboard)

Instead, Hylo computes asset values internally using:

- Protocol-defined logic based on known staking yields

- Fixed exchange rates tied to collateral types

- Real-time Value-at-Risk (VaR) controls to adjust collateral ratios

B. Depeg Protection and Stability Management

Hylo employs multiple overlapping mechanisms to keep hyUSD stable and solvency intact:

- Redemption Arbitrage: If hyUSD trades below $1, users are incentivized to redeem it directly for LSTs at full value. This pulls price back toward peg via market action.

- Overcollateralization: hyUSD is always backed by more than $1 worth of LSTs. Collateral ratios adjust dynamically to match market volatility.

- Stability Pool: A dedicated buffer where users absorb protocol risk in exchange for yield. It acts as a systemic backstop, distributing risk across incentivized participants.

- VaR Constraints: If real-time risk modeling exceeds safe thresholds, minting or rebalancing operations are automatically paused to protect solvency.

C. Leverage Control and xSOL Risk Separation

Leverage introduces inherent volatility. Hylo isolates that risk so it doesn’t bleed into the stablecoin layer.

- Isolated Collateral Pools: hyUSD and xSOL share infrastructure but are separated at the accounting level. Risk isn’t pooled.

- Capped Leverage: xSOL has protocol-defined exposure limits. The system cannot spiral into overextension.

- No Liquidations: Hylo doesn’t use margin calls or forced selloffs. Instead, it manages risk proactively through collateral ratios and internal logic.

- Staking Yield Offset: Since xSOL is backed by LSTs, its embedded yield reduces the net cost of leverage.

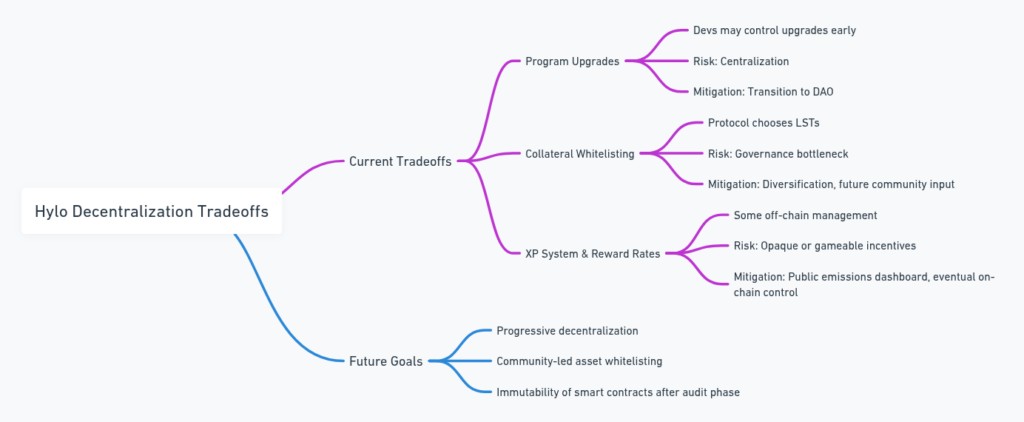

Decentralization Tradeoffs

Hylo’s long-term vision is full autonomy. But in early stages, some system parameters are still controlled off-chain. These are transitional and transparently acknowledged.

Current Tradeoffs and Mitigations

| Area | Description | Risk | Mitigation |

| Program Upgrades | Some upgrade permissions held by core team | Centralization risk | Planned migration to DAO governance |

| Collateral Whitelisting | LSTs are manually added by protocol team | Governance bottleneck | Diversification now; DAO governance later |

| XP & Reward Parameters | Off-chain control of XP emissions and incentives | Incentive manipulation | Public emissions dashboard; future on-chain |

Future Governance Goals

- Transition all control to on-chain governance

- Community-driven whitelisting for new collateral assets

- Lock smart contracts into immutability once matured

Hylo doesn’t just rely on audits—it bakes resilience into the core. No external price feeds. No forced liquidations. No centralized value control. The protocol is designed to stand on its own, with slippage-free internal mechanics, publicly verifiable code, and clear separation of risk between stable and leveraged products.

Comparison with Alternatives

Hylo’s architecture separates it from other stablecoin and leverage protocols by eliminating reliance on external infrastructure, reducing complexity, and prioritizing sustainable, yield-native design. Compared to existing models across both Solana and Ethereum ecosystems, Hylo offers a more autonomous, capital-efficient, and modular approach.

vs. MakerDAO (DAI)

MakerDAO’s DAI is a crypto-collateralized stablecoin that increasingly relies on real-world assets (RWAs) and external oracles for price feeds and collateral valuation. This introduces both regulatory and custodial risk, and makes DAI’s decentralization increasingly partial.

Hylo, in contrast:

- Is fully backed by Solana liquid staking tokens (LSTs)

- Does not use any fiat or off-chain collateral

- Avoids oracles entirely by using protocol-defined math

- Supports slippage-free minting and redemption

- Maintains peg stability without liquidations

The result is a stablecoin—hyUSD—that delivers higher capital efficiency, better decentralization, and frictionless usability, without introducing real-world counterparty risk.

vs. UXD Protocol

UXD is a Solana-native stablecoin that maintains its peg using delta-neutral strategies involving perpetual futures. While innovative, this design introduces significant complexity and exposure to perpetual market volatility and oracle pricing.

Hylo offers a simpler, more robust architecture:

- No dependence on perpetuals or complex hedging strategies

- No external price feeds or market exposure

- Peg stability maintained through overcollateralized LSTs, a Stability Pool, and internally managed buffers

- Slippage-free minting and redemption with no reliance on market depth

Hylo delivers similar Solana-native advantages while minimizing systemic risk and reducing protocol complexity.

vs. Lybra and Ethena (Ethereum-based LST-backed models)

Lybra and Ethena are Ethereum-based protocols that use LSTs to back stablecoins and deliver staking yield to users. These models introduce useful mechanics but often involve tradeoffs around control, dilution, and complexity.

Hylo offers key improvements:

- hyUSD yield is opt-in via hyUSD+, allowing users to retain control over their exposure and avoid forced dilution from rebasing

- Redemption is transparent and slippage-free, not dependent on secondary markets

- Built specifically for Solana, Hylo integrates natively with its ecosystem and avoids Ethereum’s gas costs and L1 dependencies

While economic outputs are comparable—stable value and integrated yield—Hylo’s model delivers a cleaner, more modular experience with fewer built-in assumptions and constraints.

vs. Drift, MarginFi, Kamino (Leverage Platforms)

Solana platforms like Drift, MarginFi, and Kamino offer leveraged trading through perps or margin accounts. These tools are trading-focused and suited for short-term positions, but introduce key limitations:

- Liquidation risk

- Funding fees

- Constant active management

- Oracle reliance

Hylo’s xSOL provides a fundamentally different leverage experience:

- Passive, long-term exposure to SOL with no liquidation mechanics

- No funding rates or ongoing position maintenance

- Staking yield from LST collateral helps offset risk and boost returns

- Fully on-chain, autonomous logic with no external price dependencies

This makes Hylo the first Solana-native protocol to unify decentralized stable value and non-liquidating leverage in a single system—tailored for long-term DeFi users seeking sustainable exposure and simplified user experience.

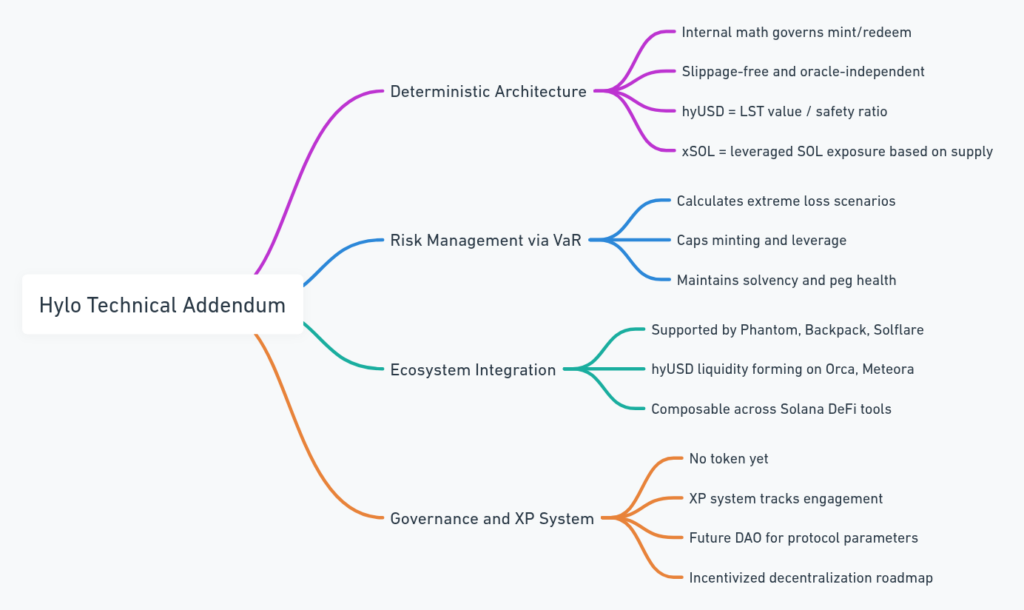

Hylo Review – Technical Addendum

Hylo is built on deterministic, math-driven architecture that governs how users interact with its two core assets—hyUSD and xSOL. The protocol is designed to ensure transparency, consistency, and safety without reliance on external oracles or liquidity providers.

Math-Based Architecture

At the core of Hylo is a set of internally defined equations that dictate minting, redemption, and pricing:

- Minting hyUSD: Users deposit a basket of LSTs. The protocol calculates the USD value of this collateral and applies a fixed safety ratio to determine how much hyUSD can be minted. This guarantees overcollateralization and system solvency.

- Minting xSOL: Users deposit hyUSD, which is converted into additional LST exposure. The resulting xSOL supply reflects the protocol-defined leverage factor, ensuring consistent, long-term exposure to SOL without margin calls or rebalancing.

- Redemptions: Both hyUSD and xSOL can be redeemed at any time using internal pricing logic. There is no slippage and no dependency on AMMs or external price feeds.

This deterministic framework makes user outcomes predictable and protocol behavior verifiable, enabling safer, oracle-free participation.

Value-at-Risk (VaR) Risk Management

Hylo incorporates a real-time Value-at-Risk (VaR) model to monitor and manage systemic exposure. This model:

- Calculates potential losses under extreme stress scenarios, such as LST depegs or validator failure

- Dynamically adjusts minting thresholds and leverage caps based on current risk levels

- Acts as a forward-looking mechanism to preserve solvency and peg integrity

By embedding risk constraints into protocol logic, Hylo eliminates the need for forced liquidations or external backstops. This preemptive approach allows it to remain operational even during volatile market conditions.

Ecosystem Integration

Hylo is already integrated across the Solana ecosystem:

- Accessible via major wallets, including Phantom, Backpack, and Solflare

- Composable with Solana-native lending markets, DEXs, and yield protocols

- hyUSD liquidity is emerging on Orca and Meteora, with growing opportunities for LP strategies and stablecoin utility

While minting and redemption occur entirely within Hylo’s smart contracts—independent of any AMM—secondary market liquidity is forming organically, enabling broader use in DeFi applications.

XP System and Progressive Decentralization

Although Hylo currently operates without a native governance token, it features the XP system—a non-transferable, wallet-bound points model that rewards protocol usage across hyUSD, hyUSD+, and xSOL. XP is expected to play a future role in:

- Token distributions

- Governance participation

- Priority access to features or vaults

Hylo’s team has outlined a progressive decentralization roadmap, with plans to:

- Transition protocol governance to a DAO

- Enable community-based LST whitelisting

- Lock key protocol parameters into on-chain control post-audit maturity

Until full governance migration is complete, the team provides regular public updates via X (Twitter) and maintains active community channels on Telegram.

Hylo’s technical design goes beyond reactive safety—it’s proactive, deterministic, and fully transparent. With no oracles, no slippage, and embedded yield mechanics, the protocol delivers a stablecoin and leverage system engineered for long-term DeFi use.

Its commitment to risk isolation, ecosystem composability, and future community governance positions it as a foundational layer for Solana-native decentralized finance.

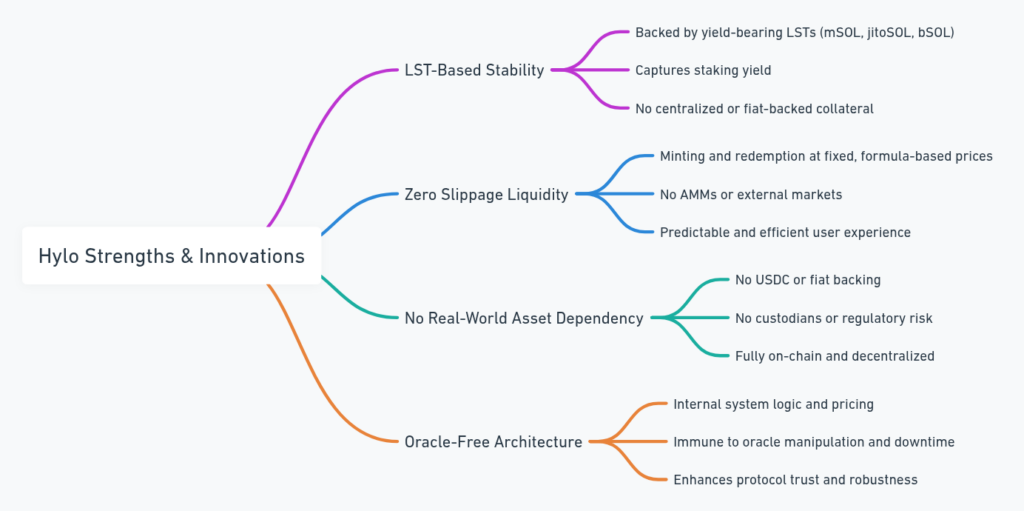

Strengths and Innovations

Hylo introduces a set of structural advantages that make it distinct from legacy DeFi systems and centralized stablecoin platforms. Its design is rooted in autonomy, precision, and risk minimization—achieved through tightly integrated architecture and a clear focus on decentralization.

LST-Based Stability

hyUSD is fully collateralized by a diversified basket of yield-bearing liquid staking tokens (LSTs), including mSOL, jitoSOL, and bSOL. This setup delivers two critical advantages:

- Captures on-chain staking yield as a native financial primitive

- Completely avoids centralized, fiat-backed collateral like USDC

By using only Solana-native staking assets, Hylo anchors its stablecoin to real, productive value on-chain while preserving decentralization and avoiding exposure to off-chain risks.

Zero Slippage Liquidity

All minting and redemption of hyUSD and xSOL is performed directly through Hylo’s smart contracts. Pricing is deterministic and governed by protocol logic—no AMMs, liquidity providers, or market depth constraints are involved.

As a result:

- Users mint and redeem at precise, formula-based rates

- There is zero slippage, regardless of transaction size

- The user experience is consistent and fully predictable

This model is particularly beneficial during high volatility, where reliance on external markets can introduce instability or execution risk.

No Real-World Assets or Custodial Dependencies

Hylo does not rely on fiat collateral (such as USDC) or tokenized real-world assets (RWAs). It also avoids centralized custodians, regulatory exposure, and off-chain dependencies entirely.

Key benefits:

- Removes single points of failure

- Enhances protocol trustlessness

- Ensures the system remains decentralized at its foundation

This positions Hylo as a truly autonomous alternative to collateral systems dependent on TradFi infrastructure or regulatory permissions.

Oracle-Free Architecture

All asset valuations and protocol operations are handled internally using pre-defined logic and staking-derived metrics. Hylo does not integrate with external price oracles (e.g., Pyth, Switchboard).

Advantages of this approach:

- Eliminates the risk of oracle manipulation

- Avoids latency and price feed disruption during network stress

- Enhances system stability and uptime, even in volatile conditions

By removing oracle reliance entirely, Hylo ensures that core operations—like minting, redemption, and risk modeling—remain transparent, consistent, and fully within protocol control.

Risk Management Highlights

Hylo’s protocol is built to preempt systemic threats through automated safeguards, mathematical controls, and product isolation. Its risk framework minimizes the chance of cascading failures, even under severe market conditions.

Value-at-Risk (VaR) Modeling

Hylo continuously monitors real-time protocol health using Value-at-Risk (VaR) calculations. This model is used to:

- Cap new hyUSD and xSOL minting

- Dynamically adjust collateral thresholds

- Maintain system solvency during volatility

VaR ensures Hylo operates with conservative parameters under stress, without relying on forced liquidations or reactive governance decisions.

Isolated Risk Pools

Although both hyUSD and xSOL are backed by the same LST collateral basket, they are managed through separate accounting systems. This isolation:

- Prevents contagion between stablecoin and leverage layers

- Ensures that risk in one product does not affect the solvency or behavior of the other

Each asset’s risk profile is contained within its own logic and rules.

Automatic Rebalancing Triggers

If any LST within the collateral basket underperforms or introduces new risk, Hylo can automatically rebalance exposure. This is governed by internal logic and helps:

- Mitigate validator or protocol-specific risk

- Preserve basket diversity and collateral integrity

- Maintain stable peg and leverage conditions without manual overrides

Emergency Circuit Breakers

The protocol includes built-in circuit breakers that trigger under extreme conditions. These safeguards can pause critical functions such as:

- Minting

- Redemption

- Leverage creation

This mechanism helps prevent protocol-wide failures during black swan events or network-wide instability.

Mathematical Boundaries for Exposure

Hylo defines all core protocol limits—such as maximum leverage, mint caps, and asset weighting—through deterministic formulas. These boundaries are enforced by smart contracts and are not subject to real-time governance votes or manual overrides.

This approach ensures consistency, predictability, and protection from human error or governance delays during fast-moving markets.

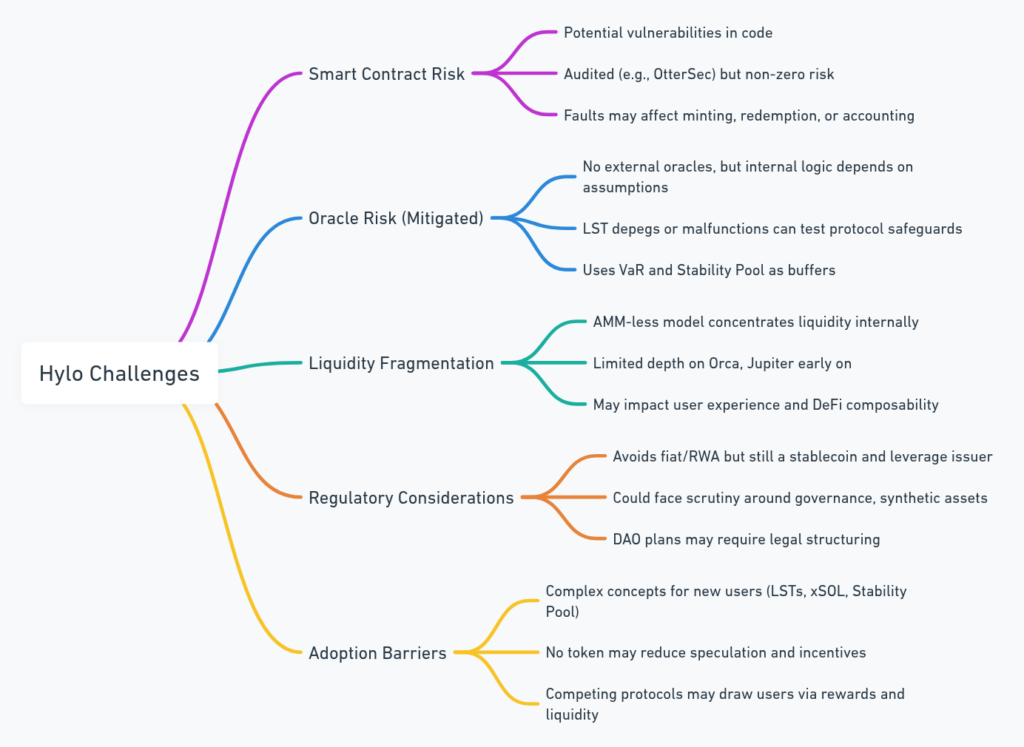

Challenges

While Hylo introduces a novel architecture and strong risk controls, several structural and ecosystem-wide challenges remain. These reflect both the protocol’s current limitations and the broader realities of building sustainable, decentralized financial systems on Solana.

1. Smart Contract Risk

As with all DeFi protocols, Hylo is exposed to potential vulnerabilities at the smart contract level. Despite undergoing third-party audits (e.g., by OtterSec), there remains non-zero risk of:

- Logic bugs in minting or redemption functions

- Accounting errors in collateral valuation

- Exploits targeting protocol design or edge cases

Any significant failure could affect user funds or compromise protocol solvency.

2. Oracle Risk (Minimized but Not Eliminated)

Hylo avoids external oracles, reducing direct exposure to manipulation or downtime. However, it still relies on internal logic that makes assumptions about:

- Exchange rates between hyUSD and underlying LSTs

- The consistent performance and integrity of LSTs like mSOL, jitoSOL, and bSOL

If one or more LSTs depeg or malfunction, Hylo’s internal controls—such as Value-at-Risk limits and the Stability Pool—must respond quickly to preserve solvency.

3. Liquidity Fragmentation

Hylo’s AMM-less model keeps most liquidity within the protocol, enabling deterministic, slippage-free operations. But this also means:

- External trading venues (e.g., Orca, Jupiter) may initially have thin liquidity

- Fragmentation between on-protocol and secondary market pricing can occur

- Early composability with other DeFi tools may be constrained by integration depth or liquidity bridges

These conditions may affect UX until broader adoption and deeper integrations mature.

4. Regulatory Considerations

While Hylo avoids fiat and real-world assets—reducing custodial and regulatory exposure—it still operates in a gray area across several jurisdictions:

- hyUSD functions as a decentralized stablecoin

- xSOL represents synthetic leveraged exposure

- Decentralized governance could raise compliance questions as the protocol matures

Hylo’s current lack of a governance token limits exposure, but future DAO transitions will likely require intentional legal structuring and jurisdictional strategy.

5. Adoption Barriers

Hylo’s architecture introduces new financial concepts that may limit accessibility to general users:

- LST-based collateralization

- Non-liquidating synthetic leverage (xSOL)

- Internal peg stability mechanics and risk modeling (e.g., VaR)

Additionally, without a native token or short-term incentive layer, the protocol may face slower early traction compared to competitors that offer immediate rewards or centralized liquidity. Continued growth will depend on:

- Educating new users

- Building ecosystem integrations

- Demonstrating performance through volatile market cycles

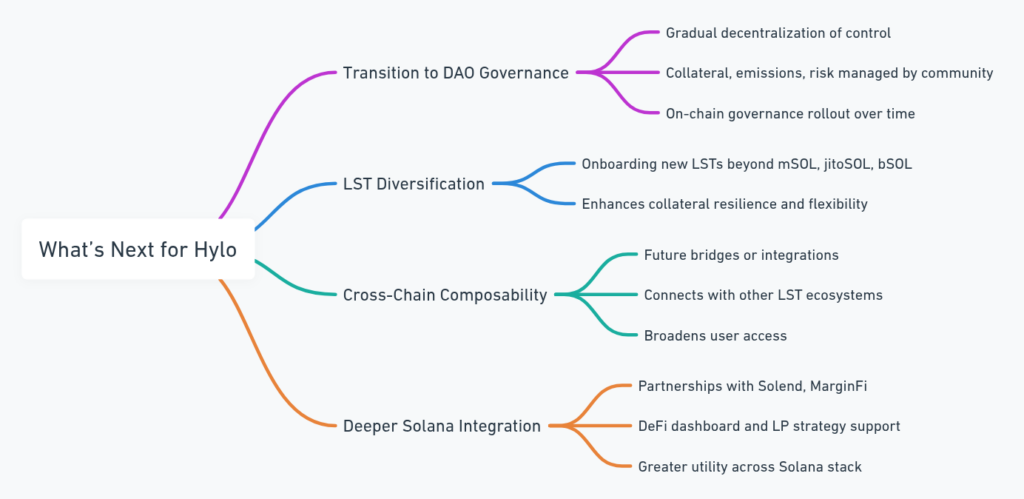

Roadmap and Future Outlook

Hylo is built to evolve progressively. While the core protocol is live and operational, several forward-looking initiatives are planned to expand its decentralization, asset support, and ecosystem reach.

What’s Next for Hylo

1. Transition to DAO Governance

Hylo plans to shift key control mechanisms—including collateral parameters, reward emissions, and risk modeling—to community governance. Initially managed by the core team, these functions will move toward on-chain DAO structures in future upgrades.

2. LST Collateral Expansion

The protocol aims to expand its LST basket beyond mSOL, jitoSOL, and bSOL. Controlled onboarding of additional LSTs will increase collateral diversity and reduce concentration risk.

3. Cross-Chain Composability

Future roadmap phases may include cross-chain integrations or bridging to support LSTs and user access across additional ecosystems, further expanding hyUSD and xSOL adoption.

4. Solana Ecosystem Integration

Expect deeper connectivity with Solana-native protocols such as Solend, MarginFi, Kamino, and Meteora. Hylo will integrate into lending platforms, LP strategies, DeFi dashboards, and yield aggregators to boost accessibility and protocol utility.

While no public timeline is provided, community updates suggest these developments are planned for the medium term and will roll out incrementally.

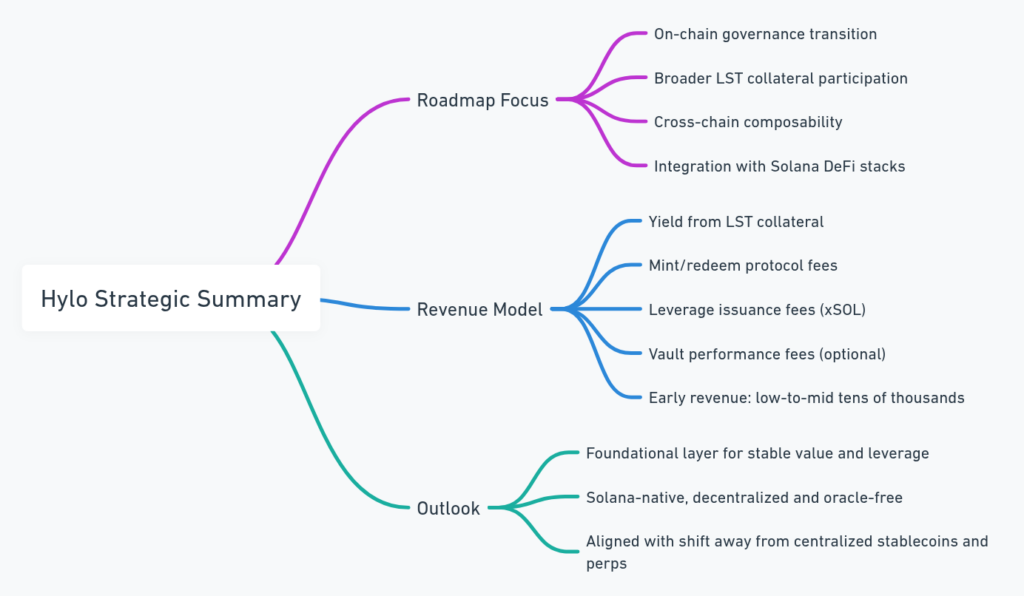

Protocol Revenue

Hylo’s revenue model is yield-based and driven by usage of its core products. Key revenue streams include:

1. Staking Yield from LSTs

The LST collateral basket generates native staking rewards, which are distributed between:

- Protocol revenue

- Stability Pool incentives

- hyUSD+ yield vault participants

This forms the foundation of Hylo’s recurring income.

2. Mint and Redeem Spreads

Every mint or redemption of hyUSD and xSOL includes a small fee, structured to:

- Minimize friction for users

- Support peg stability

- Contribute directly to protocol reserves

3. Leverage Issuance Fees

Users minting xSOL incur fees through built-in leverage spread mechanics. These support both protocol revenue and long-term system sustainability.

4. Vault Performance Fees (Optional)

hyUSD+ vaults may include performance-based fees tied to yield generation, designed to maintain economic efficiency over time.

According to recent metrics from Hylo’s analytics dashboards, the protocol has already generated tens of thousands of dollars in revenue—demonstrating early traction and economic viability.

DeFi Landscape Outlook

Hylo is positioned as one of the only Solana-native platforms combining decentralized stable value and non-liquidating synthetic leverage. Its architecture and incentives align well with emerging DeFi trends:

- Shift toward oracle-free, decentralized stablecoins: hyUSD provides a fiat-independent solution to Solana’s stablecoin infrastructure.

- Tailored for SOL-native users: xSOL offers a long-term leverage product without funding rate exposure or liquidation risk—ideal for conviction-based SOL holders.

- Built for composability: hyUSD and xSOL are designed to plug into lending markets, LP strategies, and yield protocols across the Solana DeFi stack.

- XP System and Governance Potential: The XP points mechanism sets the stage for future governance and token-based incentives, further increasing user engagement and retention.

Strategic Summary

- Roadmap Focus: Progressive transition to on-chain governance, expanding LST collateral types, exploring cross-chain functionality, and strengthening Solana DeFi integration.

- Revenue Model: Anchored in staking yield, mint/redeem fees, leverage issuance, and optional vault fees. Current revenue sits in the low-to-mid tens of thousands USD.

- Outlook: Positioned as a foundational protocol for decentralized money on Solana. As market preferences move away from centralized stablecoins and speculative leverage products, Hylo is well-placed to gain long-term adoption.

Hylo Review – Conclusion

Hylo introduces a fundamentally new model for decentralized finance on Solana—combining a protocol-native stablecoin (hyUSD) and a long-term leverage asset (xSOL), both backed entirely by yield-generating liquid staking tokens (LSTs).

By removing reliance on fiat, custodians, and external oracles, Hylo builds a self-contained, capital-efficient system. Its operations are deterministic and slippage-free. Risk is modeled internally using Value-at-Risk (VaR) frameworks, and staking yield is directly integrated into its economic engine.

Hylo is built for users who want more than short-term trading tools:

- Long-term SOL holders gain access to non-liquidating, yield-offset leveraged exposure through xSOL

- Stablecoin users can mint hyUSD, opt into yield via the Stability Pool, and transact without off-chain dependencies

- DeFi builders and integrators benefit from hyUSD’s oracle-free, composable design—suitable for lending markets, swaps, and vault strategies

The XP rewards system offers early participants a role in the protocol’s long-term trajectory, paving the way for future governance and token-based participation. Its roadmap centers on progressive decentralization, ecosystem-level integrations, and eventual cross-chain expansion—laying the foundation for a resilient, high-utility protocol infrastructure.

Hylo is not just a stablecoin issuer or leverage platform—it’s a foundational layer for decentralized value creation on Solana. With its LST-backed collateral model, real yield mechanics, and autonomous risk design, Hylo sets a high bar for what DeFi can look like when built for scalability, composability, and self-sovereignty.

Hylo Review – FAQs

What is Hylo and how is it different from USDC or DAI?

Hylo is a Solana-native decentralized finance protocol offering two core products:

- hyUSD: a stablecoin backed by liquid staking tokens (LSTs) like mSOL, jitoSOL, and bSOL

- xSOL: a synthetic asset offering long-term leveraged exposure to SOL

Unlike centralized stablecoins such as USDC, hyUSD is fully on-chain, with no fiat backing or custodial risk.

Compared to DAI, Hylo removes oracle reliance, eliminates idle overcollateralization, and directly integrates staking yield—making it more decentralized, efficient, and yield-aware by default.

How can I earn yield with Hylo?

There are two primary ways to earn yield:

- Stability Pool: Deposit hyUSD to support the protocol during volatility. In return, you receive rewards funded by staking yield, protocol fees, and xSOL leverage spreads.

- hyUSD+ Vault: Opt into a passive yield vault that redistributes staking rewards from the protocol’s LST collateral. No farming, no AMMs—just direct protocol-native yield.

Both options let you earn without depending on external liquidity pools or incentives.

Is Hylo safe to use?

Hylo has undergone a full audit by OtterSec, one of the leading smart contract security firms on Solana. In addition to audit validation, the protocol uses:

- Value-at-Risk (VaR) modeling for real-time risk control

- Slippage-free, oracle-free minting and redemption logic

- Isolated accounting between hyUSD and xSOL to prevent systemic risk crossover

While all DeFi protocols carry some risk, Hylo is designed to minimize key failure points by avoiding price oracles, AMMs, centralized collateral, or liquidation mechanics—making it one of the most secure and autonomous systems in Solana DeFi.