Key Takeaways

- According to a recent survey, 73% of merchants intend to integrate crypto payments internally within the next three years.

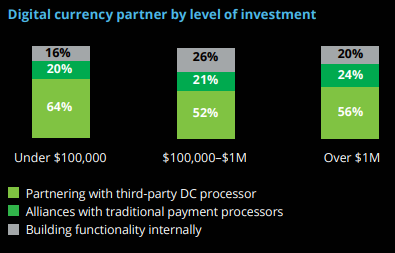

- Furthermore, more than half of large retailers (those with a revenue of $500 million or more) are now investing at least $1 million in crypto payment infrastructure.

- The eagerness of their customers for the asset class drives merchants’ adoption of crypto payments.

- Customers have demanded such integration, according to 64% of them, and 83 percent expect this interest to grow by 2022.

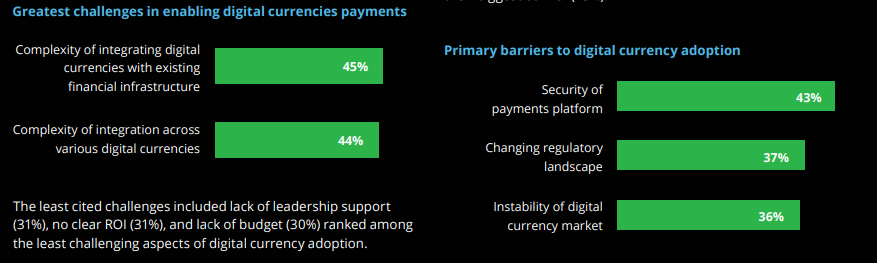

- The complexity of merging crypto payments into existing systems was the biggest barrier to merchant crypto adoption (45 percent).

The study, titled “Merchants Getting Ready for Crypto,” was developed in cooperation with PayPal by auditing and consulting firm Deloitte.

According to a recent survey, 73% of merchants intend to incorporate crypto payments domestically within the next three years. Furthermore, more than half of large retailers (with $500 million or more in revenue) are now spending nearly $1 million to build a crypto payment infrastructure. As consumers increasingly use digital currencies to buy a broader range of goods and services, U.S. merchants are showing greater positivity, prioritisation, and implementation of alternative payments to fulfil this requirement.

This survey was supposedly performed between December 3 and 16, 2021, as per information obtained. The survey included 2,000 senior executives from retail companies with annual revenues ranging from less than $10 million to more than $500 million. Fashion, cosmetics, electronics, hospitality and leisure, home and garden, and digital goods were among them. Others worked in the private and residence goods, mass transit, and food service industries, among others.

All in all, merchants comprehend that acknowledging digital currency payments gives them a market edge and comparative benefit, with 87 percent of those surveyed widely consenting with the declaration that organisations that accept digital currencies have a competitive advantage over its competitors.

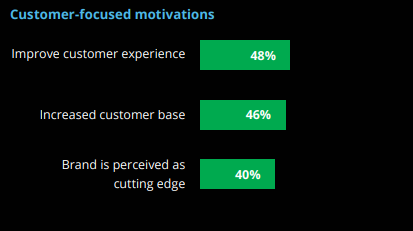

Merchants recognise that the market is changing rapidly and want to accommodate consumer trends. They hope to obtain value from digital currency adoption in three ways: They hope to obtain value from digital currency adoption in three ways:

- improved customer experience (48 percent)

- increased customer base (46 percent)

- and brand perception as cutting edge (40 percent ).

According to the Big Four accounting firm, nearly three-quarters of those polled plan to accept cryptocurrency or stablecoin payments within the next 24 months.

According to the survey results, the vast majority (93 percent) of those who normally accept cryptocurrency as a payment tool have already seen a positive effect on their company’s customer metrics. This includes things like customer base expansion and brand perception. Furthermore, they anticipate that this impact will continue next year.

A Preferred Approach:

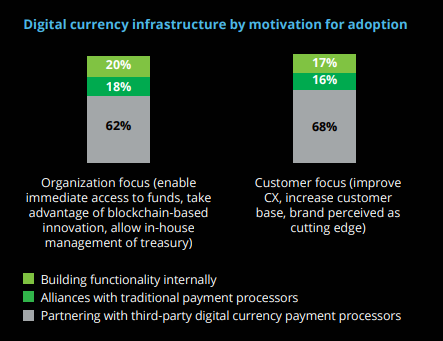

Organizations are mostly collaborating with third-party payment processors to enable digital currency payments, and there would seem to be no link among their encouragement for adoption, their level of investment, and how they are developing their digital currency functionality.

May Zabaneh, vice president of product for PayPal’s Blockchain, Crypto, and Digital Currencies business unit, said, “Merchants know how important it is to accept payment types their customers want to use, and digital currencies are now an important consideration as merchants think about their payment capabilities.”

“What this survey reveals is how many merchants are now aware of the importance of digital currencies and are making plans to accommodate them.”

There are a variety of believable reasons for holding fiat, such as price fluctuations, third-party product design (e.g., invoicing in digital currency, forced liquidation), seller acceptance of digital currency, and relationship between tax.

The most significant barrier to merchant crypto adoption (45 percent) was the complexity of integrating crypto payments into legacy systems, particularly when multiple digital assets were involved.

Other roadblocks included security concerns (43%), changing regulations (37%), crypto volatility (36%), and budget constraints (36%). (30 percent ).

Deloitte believes that “ongoing education” will provide much-needed regulatory clarity, easing the fear and uncertainty surrounding cryptocurrency.

According to Zachary Aron, principal, Deloitte Consulting LLP, and Global and U.S. Banking and Capital Markets Payments Leader, merchants see digital currency acquiescence as critical to driving business, influenced by customer acceptance and demand, and those who are slow to adopt can suffer potential losses of falling behind significantly.