Stock screeners help investors filter thousands of stocks using technical, fundamental, and market criteria. The screener improves decision quality, saves research time, and aligns opportunities with strategy, experience level, risk tolerance, investment horizon, and goals across short and long term. In this article we will explore the 10 Best Stock Screeners (Free & Paid).

Table of Contents

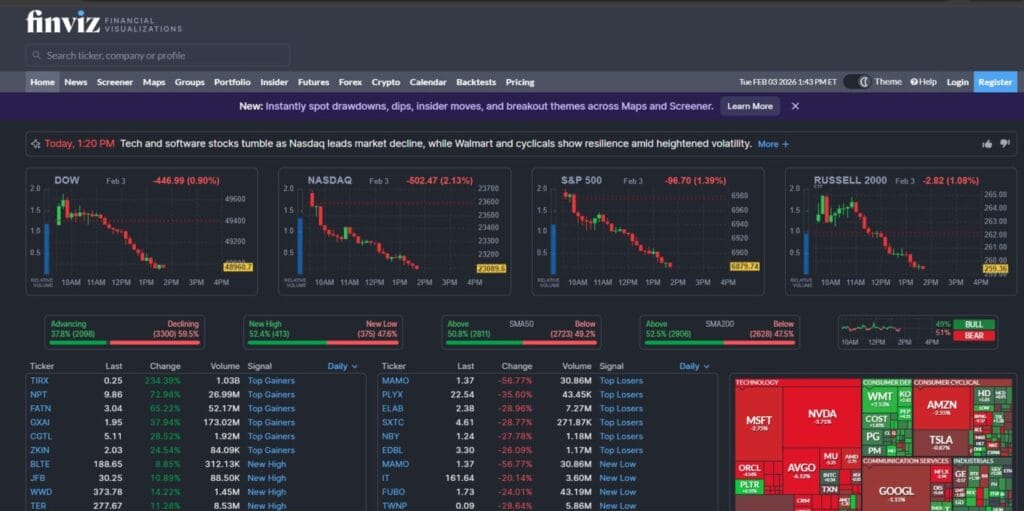

1) Finviz

- Finviz is a popular web based stock screener offering fast visual filters, heatmaps, and snapshots for traders seeking quick market level insights.

- Exclusive features include market heatmaps, insider trading data, sector performance visuals, and simple technical pattern recognition for rapid idea generation.

- Finviz offers a free version, while the Elite plan with real time data and alerts costs approximately forty dollars per month.

- Finviz does not offer a dedicated mobile app, but the website is usable through mobile browsers with limited interactive functionality.

- Data refresh speed matters for active traders, especially when screening intraday momentum or unusual volume opportunities.

- The breadth of available filters across fundamentals, technicals, and descriptive metrics determines flexibility for different trading styles.

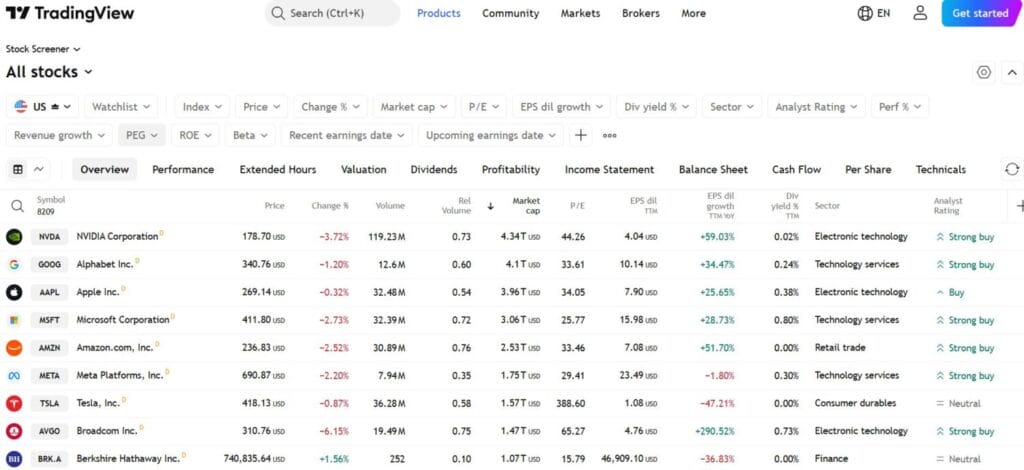

2) TradingView

- TradingView is a widely used charting and screening platform combining technical analysis, social trading ideas, and multi market stock screening tools.

- Exclusive features include Pine Script customization, community published strategies, advanced indicators, and real time interactive charts across global exchanges.

- TradingView offers a free tier, with paid plans starting around fifteen dollars per month for additional indicators and alerts.

- TradingView provides full featured mobile apps on Android and iOS with synchronized charts, alerts, and watchlists.

- Charting depth and indicator customization are critical parameters for technically focused traders using complex strategies.

- Global exchange coverage matters if investors screen stocks beyond domestic markets or trade multiple asset classes.

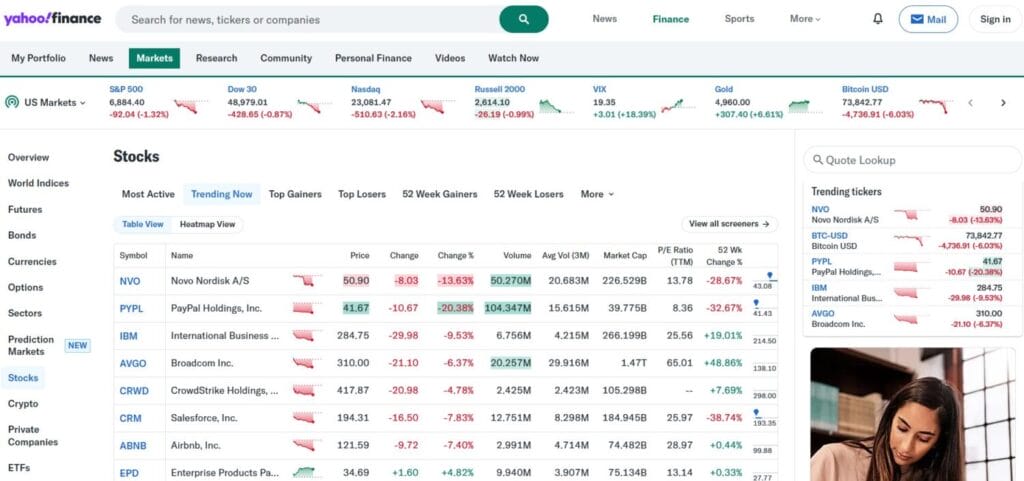

3) Yahoo Finance

- Yahoo Finance offers a beginner friendly stock screener integrated with news, earnings data, analyst ratings, and basic portfolio tracking features.

- Exclusive strengths include broad market coverage, integrated financial news, earnings calendars, and simple fundamental and valuation filters.

- The stock screener is free to use, with optional Yahoo Finance Plus subscriptions offering enhanced research and deeper analytics.

- Yahoo Finance provides a robust mobile app supporting screening, alerts, watchlists, and real time market news access.

- Ease of use is important for beginners who prioritize clarity over advanced customization or scripting capabilities.

- Availability of reliable fundamental data supports long term investors focused on valuation and financial health screening.

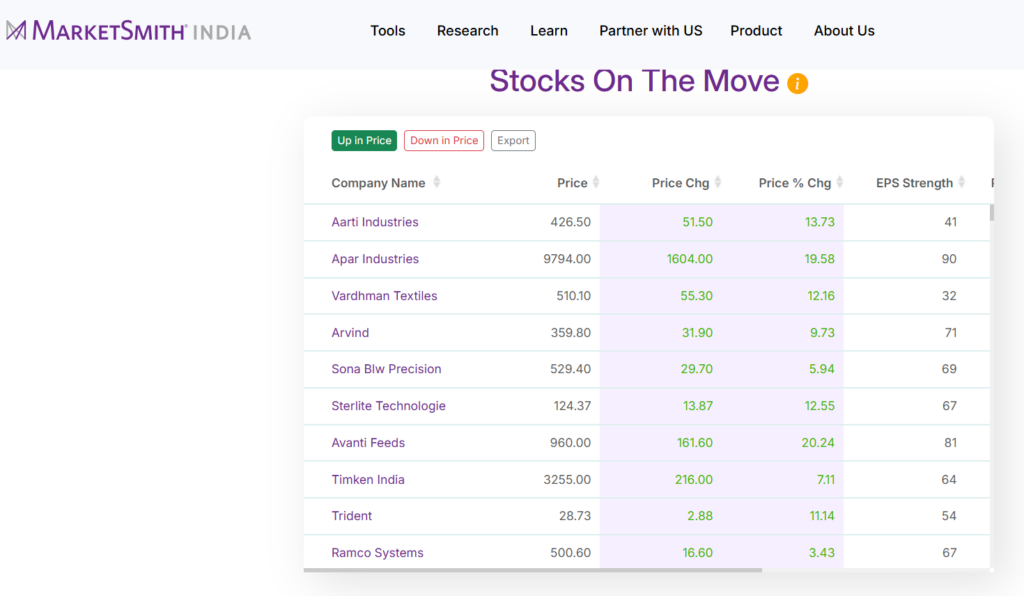

4) MarketSmith

- MarketSmith is a premium stock screening and research platform designed primarily for growth investors following CAN SLIM methodologies.

- Exclusive features include proprietary EPS ratings, relative strength scores, industry rankings, and curated growth stock lists.

- MarketSmith is a paid only platform, typically priced higher than basic screeners, reflecting its specialized research focus.

- MarketSmith does not offer a standalone mobile app, but the platform is accessible through optimized mobile web interfaces.

- Proprietary scoring models are important when screening for consistent earnings growth and institutional accumulation patterns.

- Educational resources and guided insights add value for investors following structured growth investing frameworks.

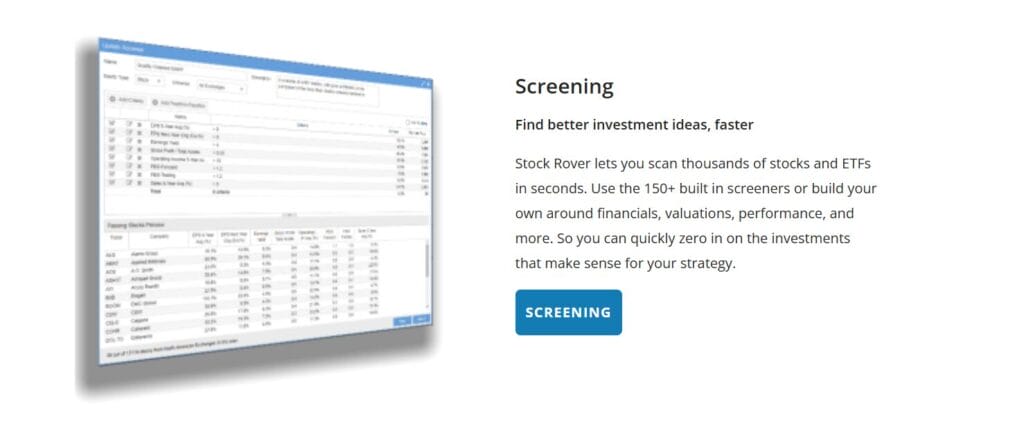

5) Stock Rover

- Stock Rover is a powerful stock screener focused on deep fundamental analysis, portfolio analytics, and long term investment research.

- Exclusive features include custom financial metrics, historical ratio analysis, comparison tools, and prebuilt value and quality screens.

- Stock Rover offers a free plan, while premium subscriptions start around eight dollars per month when billed annually.

- Stock Rover does not provide a native mobile app, but mobile browser access supports most research functionality.

- Depth of financial statement data is crucial for value investors analyzing long term business performance.

- Portfolio integration capabilities help investors connect screening insights directly with allocation and performance tracking.

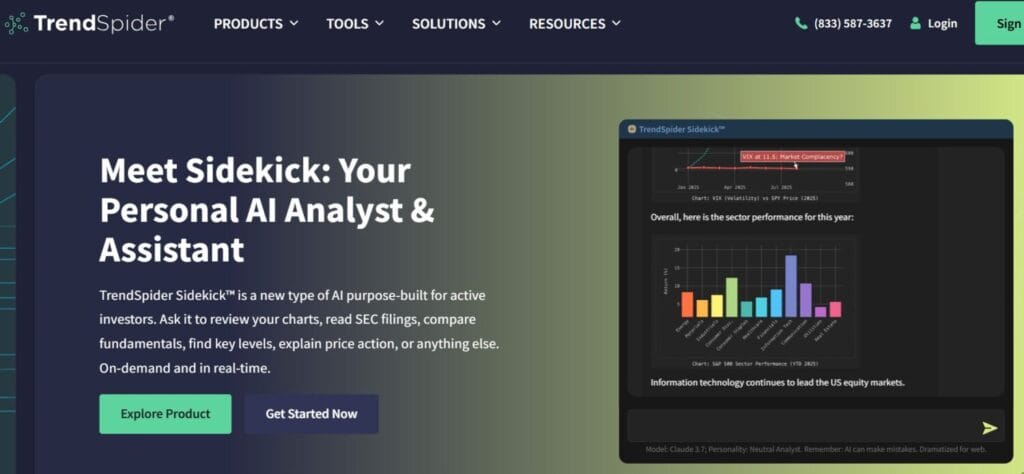

6) TrendSpider

- TrendSpider is a technical analysis focused stock screener designed for traders who rely on automation and systematic strategies.

- Exclusive features include automated trendlines, multi timeframe analysis, strategy backtesting, and advanced alert automation tools.

- TrendSpider is subscription based, with pricing tiers generally starting above thirty dollars per month.

- TrendSpider offers mobile friendly access, enabling chart reviews and alerts through responsive browser based interfaces.

- Automation level is a key consideration for traders aiming to reduce manual chart analysis workload.

- Backtesting reliability matters when validating strategies before committing real capital to live trading.

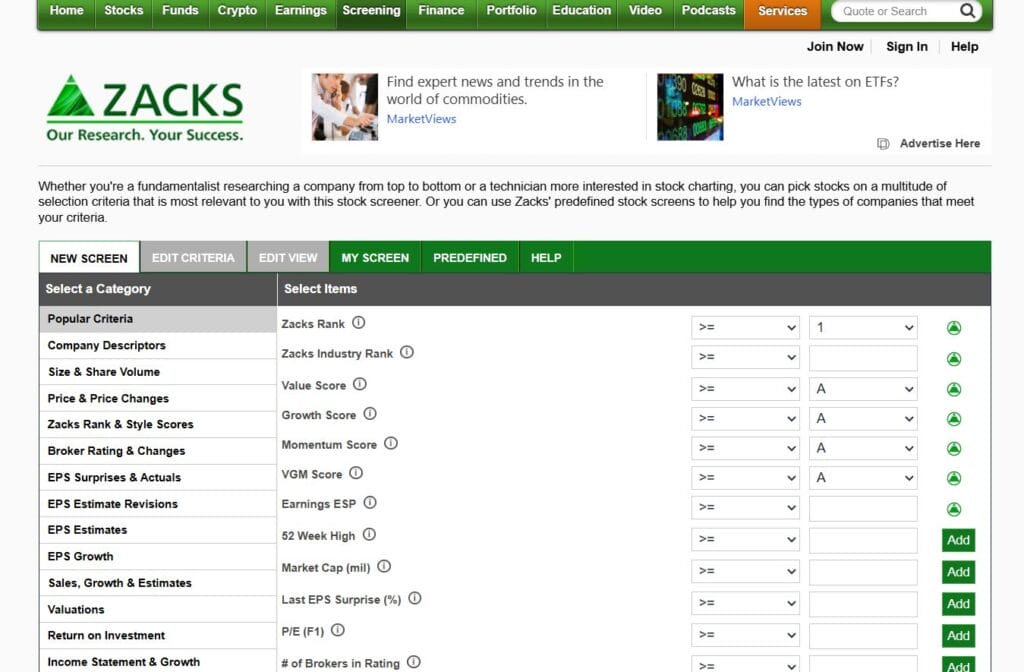

7) Zacks

- Zacks Stock Screener focuses on earnings based analysis, combining fundamental filters with proprietary ranking systems.

- Exclusive features include Zacks Rank, earnings estimate revisions, and research driven stock recommendations.

- Zacks offers a free basic screener, while advanced research tools require paid premium subscriptions.

- Zacks does not have a standalone mobile app, but its website is accessible on mobile devices.

- Earnings momentum is a critical parameter for investors screening stocks around quarterly performance trends.

- Access to analyst research strengthens decision making beyond raw screening outputs.

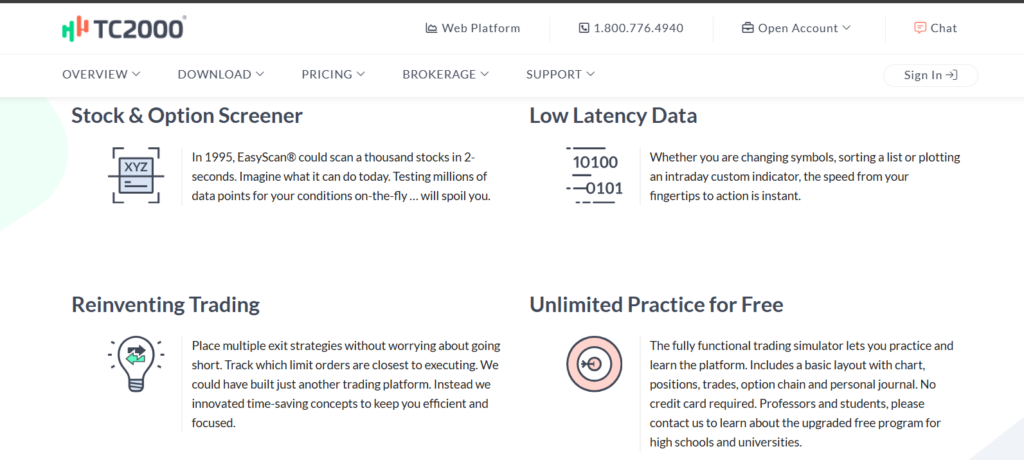

8) TC2000

- TC2000 is an established stock screener and charting platform favored by active traders for speed and reliability.

- Exclusive features include powerful custom scans, real time alerts, and integrated technical charting tools.

- TC2000 is a paid platform, with multiple plans offering increasing levels of data and functionality.

- TC2000 provides fully functional mobile apps for Android and iOS supporting screening and alert management.

- Scan execution speed matters for traders reacting to intraday price movements.

- Simplicity in building custom scans reduces errors and accelerates strategy deployment.

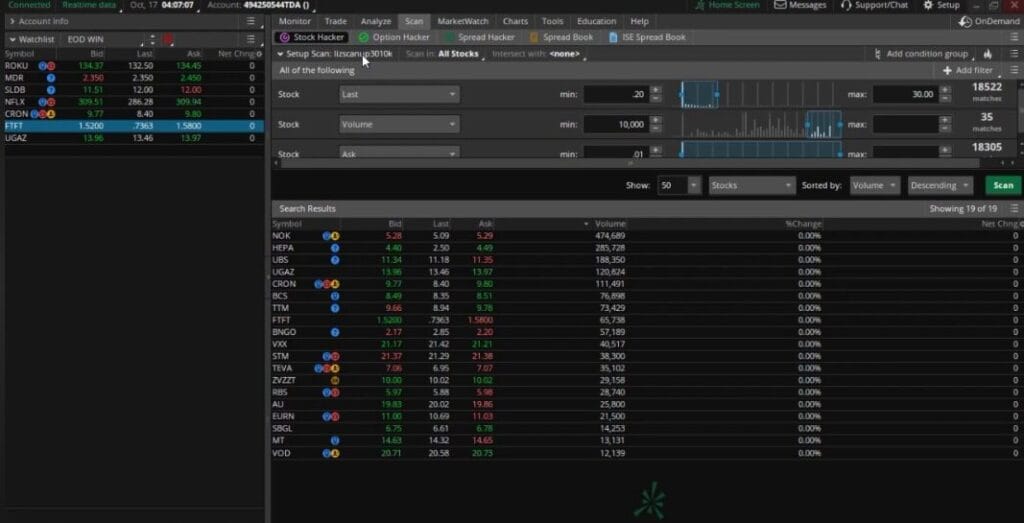

9) Thinkorswim

- Thinkorswim is a professional grade trading and screening platform offered through TD Ameritrade brokerage accounts.

- Exclusive features include advanced scanners, options analytics, real time data, and integrated trade execution.

- Thinkorswim is free for brokerage account holders, with no separate subscription fees for screening tools.

- Thinkorswim offers comprehensive mobile apps with scanners, charts, and full trading functionality.

- Platform integration is important for traders who want screening and execution within one ecosystem.

- Learning curve should be considered, as advanced tools may overwhelm beginner investors.

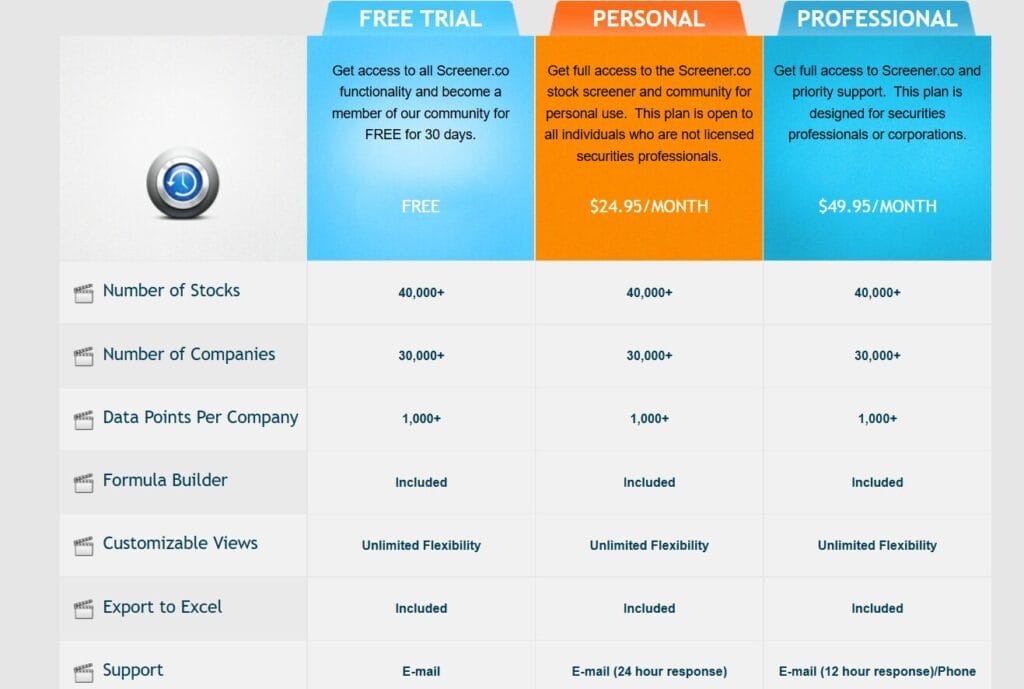

10) Screener.co

- Screener.co is a customizable stock screening platform offering deep control over fundamental and technical screening logic.

- Exclusive features include custom formulas, reusable templates, unlimited filters, and detailed export options.

- Screener.co is a paid service with tiered pricing based on feature access and data limits.

- Screener.co does not offer a mobile app, but the web interface works on mobile browsers.

- Customization flexibility is essential for advanced users building unique investment screening rules.

- Data transparency and formula clarity help investors trust and refine their screening outputs.

| Platform | Type | Best For | Pricing | Mobile App | Key Strength |

| Finviz | Web-based | Quick market scans | Free / Paid | No | Fast visual heatmaps and simple filters |

| TradingView | Web + App | Technical traders | Free / Paid | Yes | Advanced charting and custom indicators |

| Yahoo Finance | Web + App | Beginners | Free | Yes | Integrated news and fundamental data |

| MarketSmith | Web-based | Growth investors | Paid | No | Proprietary growth and EPS ratings |

| Stock Rover | Web-based | Value investors | Free / Paid | No | Deep fundamental and portfolio analytics |

| TrendSpider | Web-based | Systematic traders | Paid | Limited | Automated trendlines and backtesting |

| Zacks | Web-based | Earnings-focused investors | Free / Paid | No | Earnings revision driven rankings |

| TC2000 | Desktop + App | Active traders | Paid | Yes | High-speed custom technical scans |

| Thinkorswim | Brokerage platform | Advanced traders | Free with account | Yes | Integrated screening and execution |

| Screener.co | Web-based | Advanced investors | Paid | No | Highly customizable screening formulas |

Conclusion

Stock screeners play a critical role in transforming raw market data into actionable investment opportunities. Free tools like Yahoo Finance and Finviz are ideal for beginners exploring markets, while advanced platforms such as TradingView, TrendSpider, and MarketSmith serve experienced traders and growth investors. The best stock screener depends on data accuracy, customization depth, mobile access, and investment style. Investors should evaluate screening speed, filter breadth, and research integration before committing to paid plans. Testing multiple platforms helps identify the most efficient fit for long term success.

Can stock screeners replace fundamental or technical analysis entirely?

No. Stock screeners only filter opportunities. Investors must still perform deeper fundamental, technical, or qualitative analysis before making investment decisions.

Are stock screeners suitable for long-term investors or only traders?

How often should I run a stock screener?

Active traders may screen daily or intraday, while long-term investors typically run screens weekly or monthly to reassess opportunities.