For novice investors, individual stock picking requires extensive analysis. It is advisable to start with passive investments and low-cost index funds rather than purchasing stocks independently. We have compiled a list of the best stock research sites to provide news and data on companies, the economy, and the market.

Table of Contents

Summary:

- Seeking Alpha is an investor-centric platform offering extensive financial data, analysis articles, and a premium subscription for personalized support and insights from accomplished traders and fund managers.

- Morningstar is a thorough, high-quality stock research service with original content and a focus on fundamental analysis, empowering investors with reliable information to understand a company’s worth.

- Stock Rover is a user-friendly and efficient platform and customized equations for personalized investment approaches, catering mainly to US stocks and ETFs.

- TradeStation Analytics is an advanced platform offering real-time technical and fundamental analysis for stocks, options, ETFs, stock futures, and cryptocurrency markets, with personalized support for active traders.

- Ycharts is a data-rich platform with various offerings, serving over 4,000 clients and managing over $750 billion in assets.

- WallStreetZen is a user-friendly stock research site prioritizing context and interpretation, presenting key financial results and valuable insights.

- A valuable tool for novice investors is Google Finance providing financial data, real-time updates, and user-friendly navigation, making it an ideal starting point for investment journeys.

- The Slope of Hope is a popular charting site offering free competitive features for traders and investors.

- Motley Fool Rule Breakers targets high-growth stocks using six essential rules for emerging opportunities.

- Active trader pro can customize charts, trading tools, and notifications for technical indications in preferred stocks.

Seeking Alpha

- Seeking Alpha is designed for investors who study extensive financial data, reports, transcripts, and analysis articles to find the best-performing stocks available in the market.

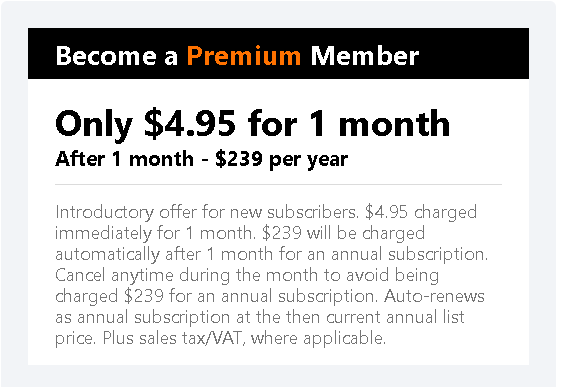

- While the platform offers a free version with valuable resources, the Seeking Alpha Premium subscription combines a research platform, an investing community, and a centralized repository of diverse analysis.

- Intermediate investors use Seeking Alpha Premium due to its valuable content, actionable investment ideas, ratings, and insights from most accomplished traders and fund managers on the internet.

- Seeking Alpha Premium goes beyond teaching the basics and provides real-life examples of successful investors in action, allowing subscribers to learn from the best in the industry.

- Moreover, the platform offers advanced stock screeners, quant ratings, portfolio analysis, and other features.

- You can download its application from your mobile device’s Google play store or Apple App Store.

OpenBB Terminal

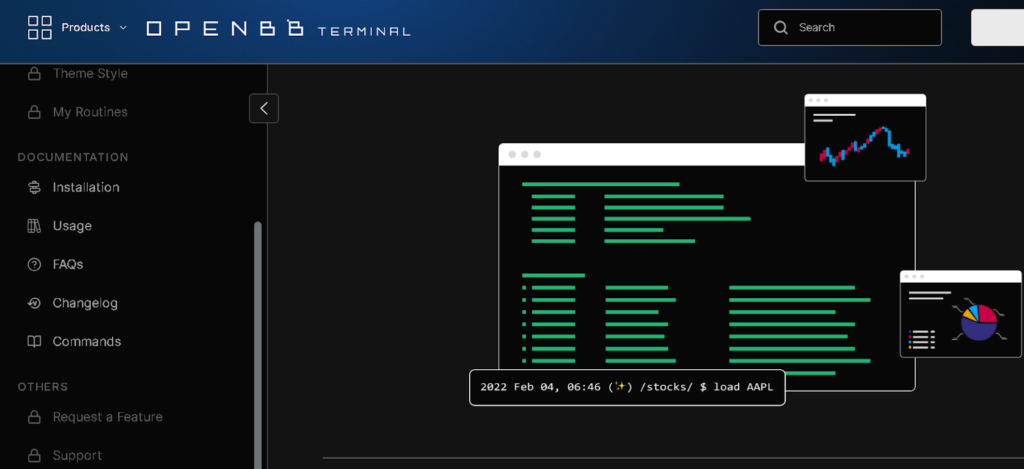

- OpenBB Terminal is the sole open-source investment research platform, connecting diverse data providers for unified access.

- Users can benefit from customization. Moreover, Users can add personal data sources and develop their analysis on the open-source platform.

- Open source fosters transparency, innovation, quality, and community.

- This platform’s affordability aims to make investment research accessible to all, leveraging free datasets and economic indicators.

- It is accessible globally post-COVID-19, providing free remote access to OpenBB Terminal and tools.

- This platform uses Python Integration which utilizes Python for its simplified syntax, extensive use in finance, and user-friendly customization options.

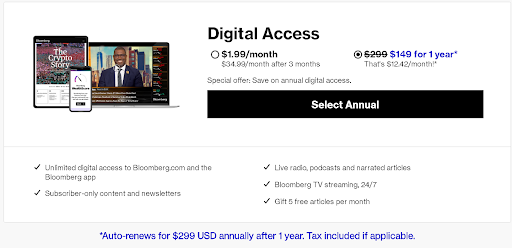

Bloomberg

- Bloomberg offers a vast financial data repository, including real-time stock prices, historical data, and company financials.

- The platform provides up-to-the-minute news coverage, expert analysis, and insights on companies, industries, and markets.

- Bloomberg offers access to earnings reports, conference call transcripts, and analyst estimates, aiding in understanding company performance.

- Traders can track stock movements and trends using interactive charts, technical indicators, and market comparison tools.

- Users can set customized alerts for price movements, news releases, and other events, ensuring timely information delivery.

- Moreover, Detailed profiles provide information on company fundamentals, key executives, major shareholders, and corporate events.

MorningStar

- With almost four decades of experience, Morningstar offers one of the most thorough and high-quality stock research services available.

- Unlike its competitors, Morningstar has a free version, producing original content rather than merely aggregating news from external sources.

- Its main strength lies in its network of over 150 highly skilled analysts who produce excellent research and in-depth analysis of stocks worldwide.

- Morningstar stands out from other financial media by focusing on fundamental analysis. It provides reliable information for investors to understand a company’s true worth.

- Morningstar offers meticulous ratings, including performance and ESG statistics, alongside impressive portfolio analysis tools for fundamental-focused investors.

- Though lacking advanced indicators and charting, it compensates with thoroughness, catering to various aspects for insightful investment decisions.

- Its mobile app is also on the Apple Appstore and Google play store.

Stock Rover

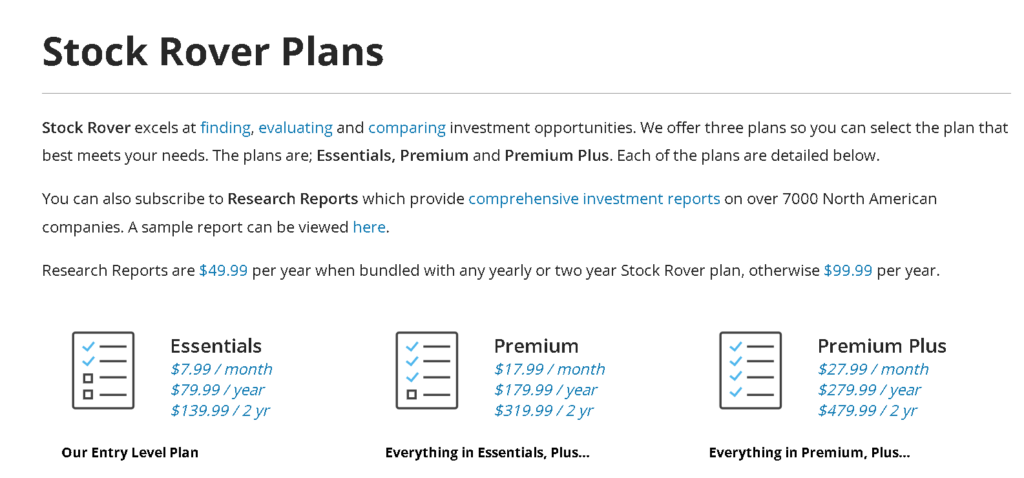

- Stock Rover is a robust collection of interconnected tools, highly regarded for its efficiency and user-friendliness, catering mainly to US stocks and ETFs.

- The platform’s appeal lies in its design, an interactive and color-coded dashboard, and its ability to empower users to create customized equations.

- There are specific factors for stock screening, allowing for a tailored and personalized investment approach.

- It has many features for managing portfolios and analyzing stocks, perfect for even the most selective investors.

- It excels in charting and technical analysis with hundreds of options to customize stock charts.

- If you like combining technical and fundamental analysis, Stock Rover is a great choice, as it offers both in a user-friendly way.

- Stock Rover does not have a mobile app, but you can access the smartphone experience by logging into the website on your mobile.

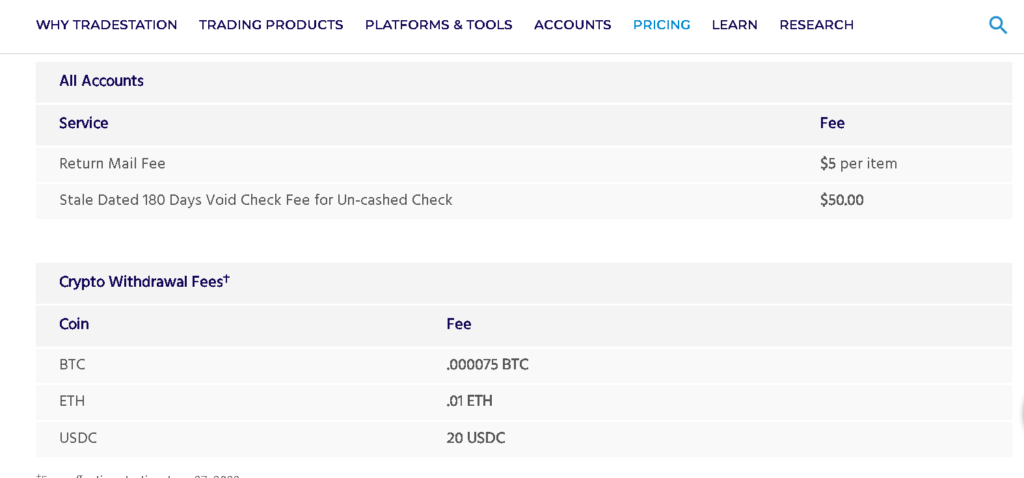

TradeStation Analytics

- TradeStation Analytics offers comprehensive analysis for stocks, options, ETFs, stock futures, and cryptocurrency markets with backtesting, historical intraday data, and advanced charting capabilities.

- Users receive personalized support from brokerage professionals catering to active individual and institutional traders.

- Through technical and fundamental analysis, the platform enables real-time identification of trading opportunities, entry and exit points, and hidden prospects.

- Up to 1,000 ticker symbols can be monitored and ranked in real-time, with access to over 180 technical and fundamental indicators for stock valuation and price action assessment.

- TradeStation is recognized as one of the best trading software platforms available.

- The TradeStation mobile app has everything you need to put your strategies into action, all on your phone from the google play store and apple app store.

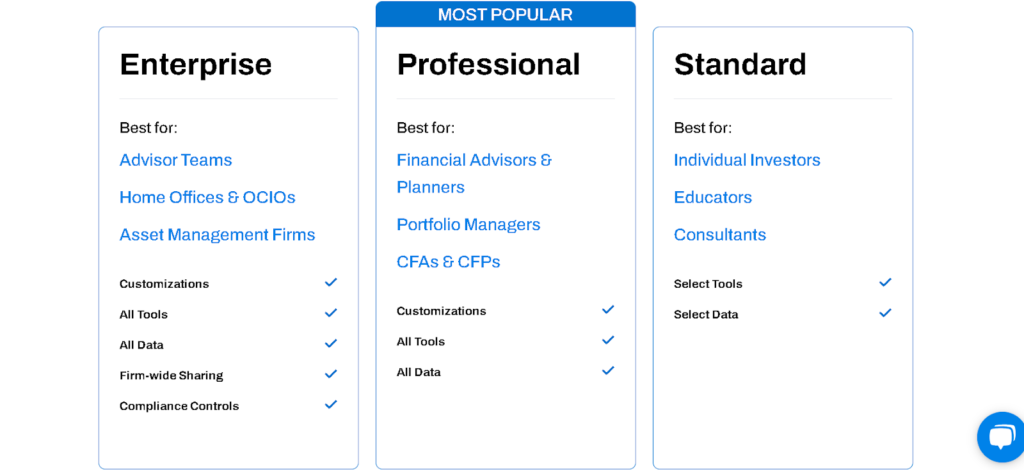

Ychart

- Ycharts, established in 2009, is widely recognized for offering an extensive range of data points, catering to over 4,000 clients with a combined management of over $750 billion in assets.

- Users can use a 7-day free trial to experience the platform’s services.

- The platform offers two main packages: Standard and Professional, each designed to suit different user needs.

- The Standard package includes access to features like Fundamental & Technical Charting, Stock & Fund Screeners, Live News, Customizable Alerts, and Analyst Estimates & Recommendations.

- The Professional and Enterprise packages unlock additional advanced features, including Charts, Excel Add-In, Model Portfolios, Tailored Onboarding & Training Programs, and more, tailored to specific subscription levels.

- However, there is no mobile app for this platform, but you can access the website through your phone browser.

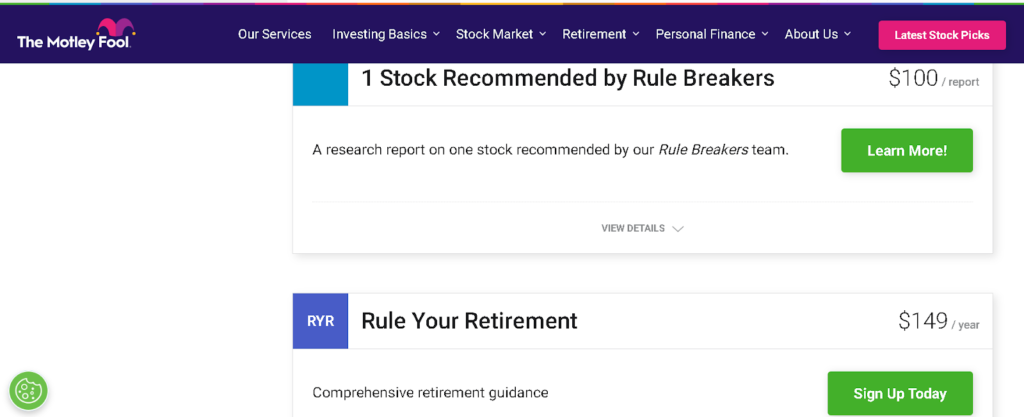

Motley Fool Rule breakers

- Motley Fool Rule Breakers targets stocks with massive growth potential in emerging industries, focusing on the next big stock.

- Their recommendations are guided by six rules: sustainable advantage, strong past price appreciation, competent management, strong consumer appeal, and financial media undervaluation.

- The service seeks well-run companies in emerging industries with a competitive advantage.

- The subscription costs $99 for the first year, justified by their successful results.

- Subscribers receive Starter Stocks, 5 “Best Buys Now” opportunities monthly, and two new stock picks each month.

- Regular communications provide analysis and rationales for recommended stocks, and a refund is available within the first 30 days if unsatisfied.

- Keep up with the most recent stock ratings, advice, updates, and insights from The Motley Fool using their mobile app on the Google play store and Apple Play Store.

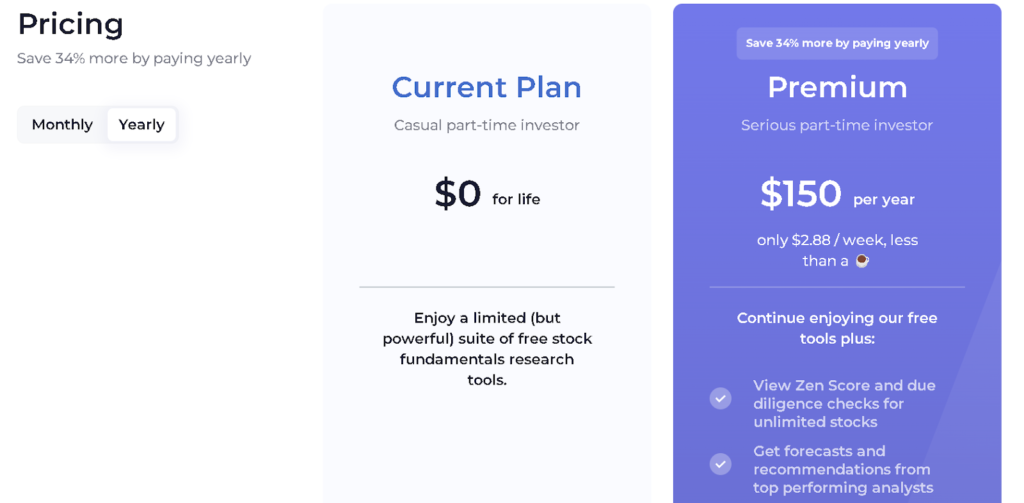

WallStreetZen

- WallStreetZen was founded to provide a better stock analysis experience for serious investors who are not financial professionals.

- Unlike typical stock research sites cluttered with dense financial data, WallStreetZen offers context and interpretation to help users understand the information.

- Their Zen Score and automated due diligence checks present key financial results in easy-to-understand explanations.

- The website focuses on important metrics and visualizes historical and industry contexts to aid investors.

- WallStreetZen prioritizes creating a minimalist, clean, and user-friendly interface for a superior user experience.

- Currently in beta mode, WallStreetZen is an indispensable stock research site, offering valuable insights with less overwhelming data.

- Unfortunately, there is currently no mobile app offered by this platform yet.

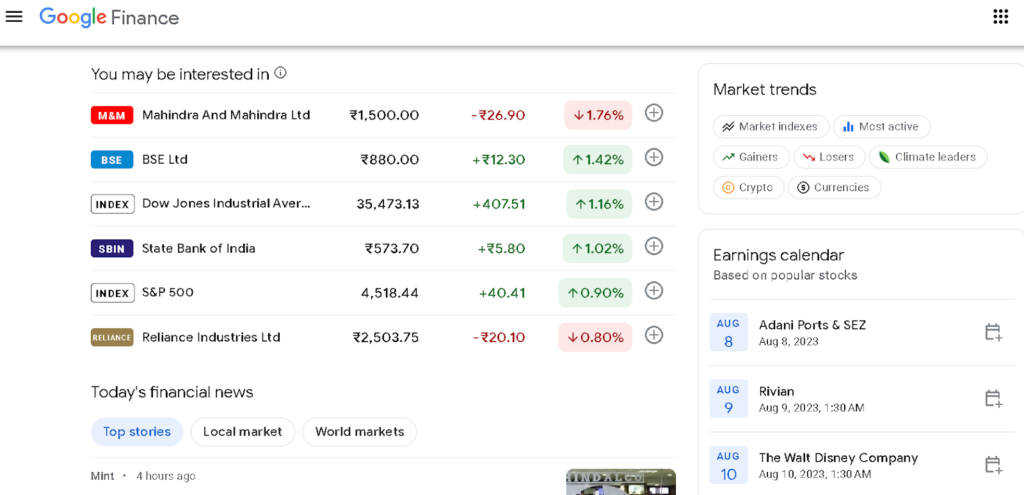

Google Finance

- Google Finance is a valuable tool for novice investors entering the financial markets.

- The site provides comprehensive financial data, including stock quotes and news, aiding investment decisions.

- It resembles Yahoo! Finance, offering real-time data and similar services.

- Users can track global stock indices, currency performance, and bond yields in the world markets section.

- Although the stock portfolio tool and stock screener were discontinued, a Watchlist section allows users to monitor selected securities effectively.

- With its user-friendly interface and familiarity with Google products, Google Finance is a straightforward starting point for investors before exploring more advanced platforms.

- Presently, there is no official app for google finance.

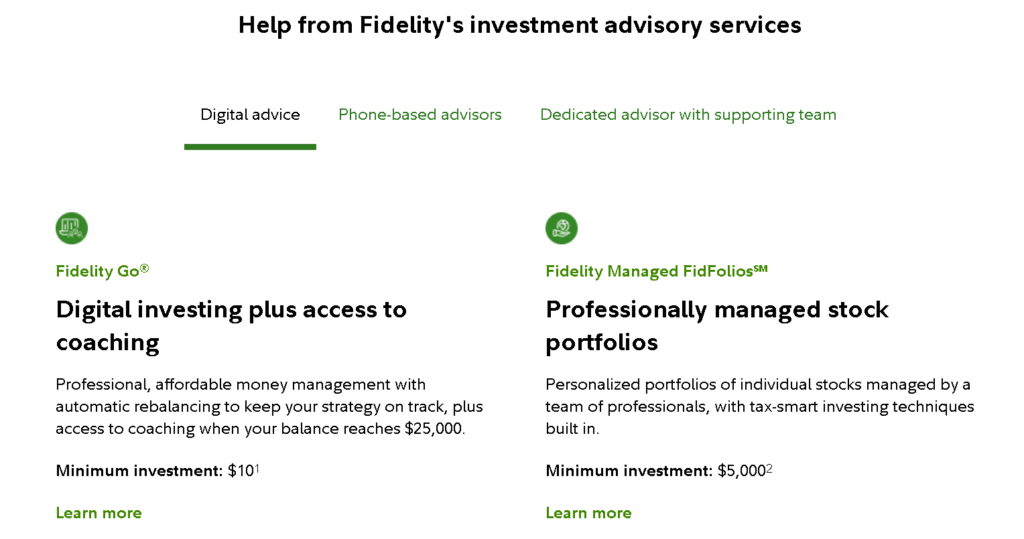

Active trader pro

- Fidelity offers a digital transaction platform called Active Trader Pro with advanced features surpassing the original website.

- Active Trader Pro includes customized charting, trading tools, and notifications for technical indications in preferred stocks.

- Recognia’s technical patterns and functions are integrated into Fidelity’s website-based charting, allowing access to extensive stock data and over 60 configurable technical indicators.

- The Fidelity study center emphasizes technical analysis, providing resources like videos, articles, infographics, webinars, and recorded webinars.

- Weekly online coaching sessions and in-depth talks on options and technical analysis are also available for clients.

- There is presently no mobile application for Active Trader Pro.

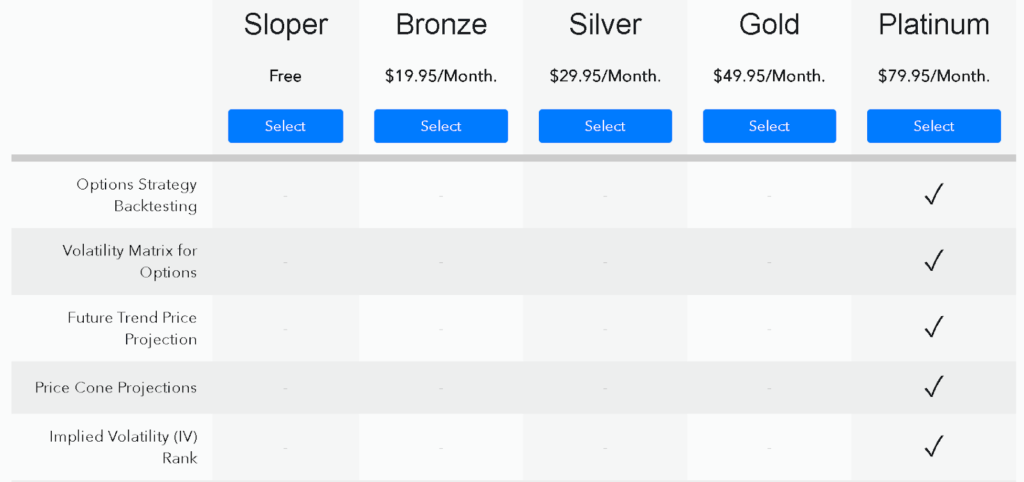

Slope of Hope

- Slope of Hope, founded by Tim Knight, is a popular charting site for trading ideas, technical analysis, charts, and trader conversations.

- The site offers numerous free features that rival the functionality of more expensive platforms.

- SlopeRules, a crucial part of SlopeCharts, allows users to make and test trading systems based on technical principles by dragging and dropping rules into a chart and setting alerts when conditions are met.

- A virtual trading system with a $100,000 account is available to help users practice and improve their trading skills.

- Slope offers a phone app for Android and iOS devices, granting access to all website content.

- A range of tools at different price points, ranging from $14.95 to $79.95 per month, with advanced features available in the higher-priced option.

- You can download the mobile application from Apple App Store and the Google play store

Conclusion:

As many individuals look forward to investing in the stock market, monitoring it can be daunting, especially for those with limited expertise. The listed technical analysis tools offer accessible options for achieving financial goals. Share analysis tools can help them understand the stock market’s intricacies, aiding in informed investment decisions.

Frequently Asked Questions

Q. How to do stock market research?

The steps required to do stock market research are as follows-

- Collect the necessary materials for conducting stock research.

- Refine and concentrate on specific areas of interest.

- Engage in qualitative analysis to complement your stock research.

- Consider the broader context to contextualize your findings in stock research.

Q. What is the best stock research website?

The best stock research websites include seeking alpha, morningstar, stock rover, and more.

Q. What to research about a stock?

The crux of the analysis includes the following steps-

- Initiating the process by examining the company’s financial statements is essential.

- Comparing the company’s performance with its competitors or industry peers is a valuable analysis step.

- Utilizing ratios and metrics aids in assessing the stock’s potential for investment.

- The primary goal of research and analysis is to establish a price target, guiding decisions for entry or exit in the investment.