WOOFi continues to strengthen its position in DeFi with more than 27 million dollars in daily swap volume, consistently rising multi-chain activity, and growing market visibility across EVM and non-EVM ecosystems. In this article, we will explore WOOFi Review.

Table of Contents

What is WOOFi?

WOOFi is an all-in-one decentralized finance application within the broader WOO ecosystem, designed to make on-chain trading as intuitive and efficient as centralized exchanges. It supports swaps, cross-chain trading, yield vaults, staking, and perpetual futures across more than 10 blockchains.

At its core, WOOFi uses a Synthetic Proactive Market Making (sPMM) model that simulates centralized exchange liquidity on-chain, delivering tight spreads, low slippage, and high capital efficiency without relying on massive TVL. The platform has processed over $70B in cumulative trading volume and serves more than 250,000 monthly active users. WOOFi is tightly integrated with AI-native tooling across the WOO ecosystem, allowing traders to focus on outcomes rather than managing fragmented DeFi workflows.

WOOFi Review: Features and Products

- All-in-One DeFi Trading Suite

WOOFi combines spot swaps, cross-chain swaps, single-sided yield vaults, staking, and perpetual futures in one interface. Instead of juggling multiple protocols, bridges, and dashboards, users can manage their entire on-chain trading and yield strategy from a single platform. - Synthetic Proactive Market Making (sPMM)

Unlike traditional AMMs that depend on pool balances, WOOFi’s sPMM uses high-frequency on-chain price oracles and algorithmic pricing to simulate order-book depth. This results in 200%–1000% capital efficiency, meaning WOOFi can deliver CEX-like execution quality with significantly less locked liquidity. - Cross-Chain Swaps in One Transaction

WOOFi pioneered one-click cross-chain swaps by integrating LayerZero messaging and Stargate liquidity. Users initiate a single transaction on the source chain, pay gas once, and receive assets on the destination chain without manual bridging, intermediate approvals, or fragmented UX. - Earn Vaults with No Impermanent Loss Exposure

WOOFi Earn allows users to deposit assets into single-sided vaults while delegating liquidity management to the sPMM pool manager. Users retain exposure only to the deposited asset and earn yield from borrowing interest, without managing impermanent loss directly. - WOOFi Pro Perpetual Futures

WOOFi Pro is a decentralized perpetual futures exchange built on an order-book model. It delivers a CeFi-grade trading experience—limit orders, deep liquidity, advanced charts—while preserving on-chain settlement and self-custody, with leverage up to 50x on supported pairs.

WOOFi Review: Fees

- Low and Competitive Swap Fees

WOOFi’s high capital efficiency allows it to charge lower swap fees compared to many AMMs. Reduced borrowing costs at the liquidity layer translate directly into better execution prices and lower trading friction for end users across supported chains. - Fee Rebates for Order Flow Providers

WOOFi is the only swap DEX that rebates 20% of its swap fees (paid in USDC) to wallets, apps, and aggregators that route trades to it. This incentive structure aligns liquidity sources, integrators, and traders while reinforcing sustainable volume growth. - Perpetual Futures Fee Structure

On WOOFi Pro, trading fees follow a maker-taker model and are charged in USDC. Traders can reduce fees by staking WOO or meeting rolling 30-day volume thresholds, making the platform attractive to both active and professional traders.

WOOFi Review: Mobile App

- Cross-Platform Accessibility

While WOOFi itself is a web-based DeFi application, users can interact with the ecosystem through mobile wallets and WOO X’s centralized mobile app for staking. This hybrid access model caters to both DeFi-native users and those who prefer app-based experiences. - Seamless Wallet Integration

WOOFi supports popular wallets such as MetaMask, Rabby, Trust Wallet, Coinbase Wallet, and Ledger. Mobile users can easily connect, approve tokens, and execute swaps or stake assets without leaving their wallet environment. - Consistent Experience Across Devices

The interface adapts cleanly across desktop and mobile browsers, ensuring that trading, staking, and vault management remain intuitive even on smaller screens, without stripping away advanced functionality.

Security

- MEV and Sandwich Attack Protection

WOOFi mitigates common DeFi attack vectors by determining prices via oracles and the sPMM algorithm rather than pool balances. Prices update proactively around small deviations, preventing attackers from manipulating pool state to frontrun user trades. - Audited Smart Contracts and Risk Controls

WOOFi smart contracts undergo security audits, and external protocols integrated into Earn vaults are carefully evaluated. Emergency withdrawal mechanisms are in place to reduce exposure in the event of third-party exploits. - Market-Neutral Liquidity Management

The sPMM pool manager actively hedges positions using a combination of on-chain and centralized exchange execution. This approach helps ensure that vault users can withdraw their original assets even during volatile market conditions.

WOOFi Review: Affiliate & Referrals

- Revenue Sharing via WOO Staking

WOOFi distributes 80% of its net protocol revenue to WOO stakers, paid in USDC or auto-compounded into WOO. - Gamified Staking with XP and Boosters

Staking WOO generates XP at a base APR of 30%, which increases staking weight and unlocks perks such as higher yields, airdrops, and fee discounts. Boosters and quests add a gamified layer that rewards active ecosystem participation. - WOOFi Pro Affiliate Program

The WOOFi Pro affiliate program offers up to 40% commission sharing, direct support, campaign collaboration, and access to exclusive events and merchandise.

Data Analytics and Performance

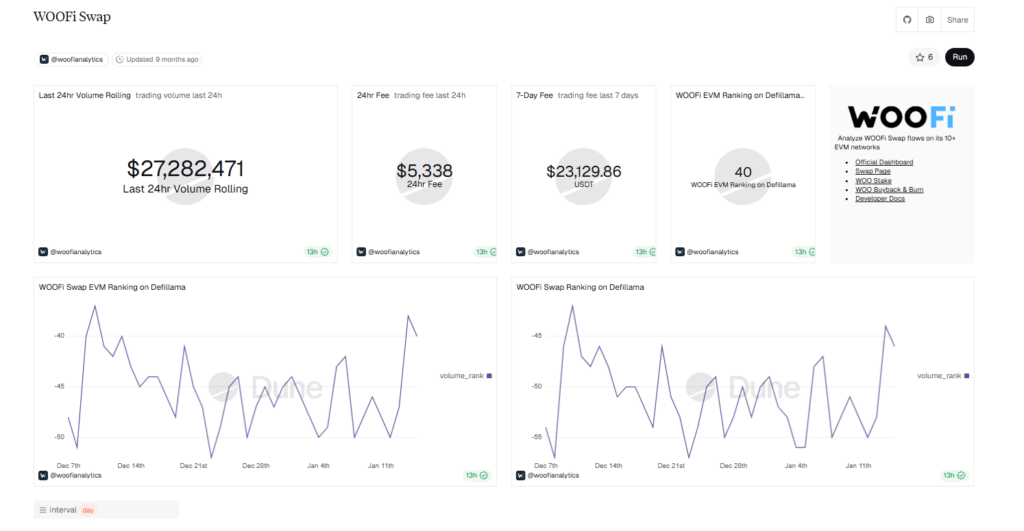

Strong 24-hour activity

WOOFi recorded 27.28 million dollars in rolling 24-hour swap volume, indicating healthy user participation and stable liquidity flows across chains.

Solid fee generation

Daily trading fees reached 5,338 dollars, while the 7-day cumulative fee pool exceeded 23,129 dollars, showing steady protocol-level revenue and consistent usage throughout the week.

Competitive EVM ranking

WOOFi held an approximate rank of 40 on DeFiLlama among EVM swap platforms, demonstrating solid execution volumes relative to its category peers.

Multi-chain volume strength

The EVM volume breakdown shows sustained activity across multiple networks, with noticeable spikes between January 6 and January 14, reflecting increased cross-chain swaps and market volatility.

Healthy pair and source diversity

Top trading pairs and source breakdown charts reveal broad participation rather than concentration in one or two assets, supporting a resilient liquidity and fee-generation structure.

WOOFi Review: Conclusion

WOOFi’s recent performance highlights its rise as a key player in multi-chain decentralized trading, consistently generating over $27 million in daily volume and maintaining stable fee flows. Its strong EVM ranking indicates effective competition in a crowded AMM market, while diverse chain, pair, and source activity shows liquidity isn’t reliant on one ecosystem. These trends point to growing user confidence, better routing efficiency, and increasing adoption across networks. For traders seeking reliable execution, predictable fees, and multi-chain depth without centralized venues, WOOFi is evolving into one of the most complete and performance-driven platforms available today.

Is WOOFi suitable for beginners in DeFi?

Yes. WOOFi abstracts complex DeFi actions like bridging, routing, and liquidity management into simple, guided flows, making it far more approachable for users transitioning from centralized exchanges.

Does WOOFi require KYC to use its DeFi products?

No. All core WOOFi products—including swaps, earn vaults, staking, and WOOFi Pro—are non-custodial and do not require KYC when accessed on-chain.

Can I use WOOFi without holding the WOO token?

Yes. Users can swap, trade perps, and use earn vaults without holding WOO, though staking WOO unlocks revenue sharing, fee reductions, and additional ecosystem benefits.