The growth of on-chain trading, particularly in meme coins and early-stage tokens, has driven the rise of specialized tools focused on speed, automation, and analytics. Platforms such as Sigma, BonkBot, BullX, and Bloom serve different trader segments, from Telegram-based bots to advanced web dashboards. While they share similar goals, each differs in design, features, and target audience, making them suited to different trading styles.

Table of Contents

Sigma vs BonkBot vs BullX vs Bloom: Overview

| Platform | Main Type | Main Interface | Main Focus | Primary Chain Focus |

|---|---|---|---|---|

| Sigma | Analytics & strategy platform | Web-based dashboard | On-chain analytics, wallet tracking, trading insights | Multi-chain (commonly Solana-focused in practice) |

| BonkBot | Trading execution bot | Telegram bot | Fast manual trading, meme coin sniping | Solana |

| BullX | Advanced trading terminal | Web interface (with rapid execution tools) | Token discovery, charting, wallet tracking, fast trading | Solana (with limited multi-chain support depending on version) |

| Bloom | Automated trading platform | Web dashboard & automation engine | Strategy automation, rule-based trading, portfolio efficiency | Multi-chain (often Solana and EVM chains) |

Sigma

Sigma is a multi-chain trading and sniping bot that operates primarily through Telegram, supported by a web dashboard for setup and monitoring. It emphasizes rapid execution, sniping capabilities, and wide blockchain support, along with core features like scam protection, trade controls, and copy trading. Relative to purely Telegram-based tools, Sigma is well-suited for traders who want the speed and convenience of chat-based execution combined with a web interface for easier wallet management, configuration, and overall supervision.

Key Points

- Sigma is a meme-focused token project built on the Solana blockchain.

- It is led by its community and launched without a presale.

- The project centers on decentralized values and culture.

- Sigma debuted in July 2024.

- Its token is primarily traded on Solana-based decentralized exchanges and related markets.

- Sigma is not designed to function as a comprehensive trading platform.

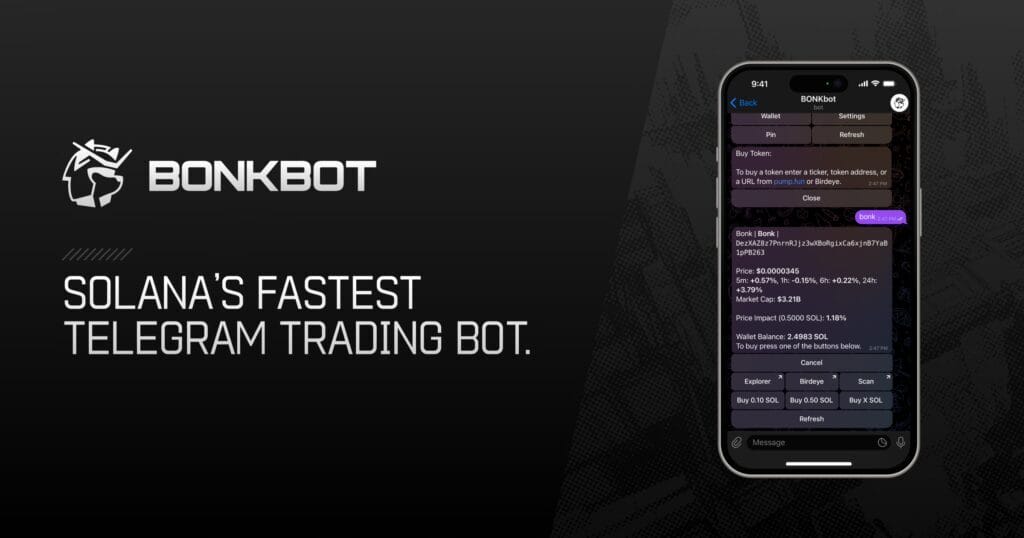

BonkBot

BonkBot is a well-known Telegram trading bot in the Solana ecosystem, valued for its speed and ease of use. It allows users to trade tokens directly from Telegram with minimal setup, making it popular among meme coin traders and early launch participants. While it offers convenient features like preset buys and instant sells, it provides limited advanced analytics and customization compared to more robust platforms.

Key Points

- BonkBot is a Telegram-based trading bot for the Solana ecosystem that enables fast trades via contract addresses pasted in chat.

- It prioritizes speed and security, offering features like MEV protection, auto-buy, real-time alerts, and PnL tracking.

- The bot has seen widespread adoption and high trading volumes among meme coin and SPL token traders on Solana.

- BonkBot emerged in late 2023 and expanded rapidly through 2024 and 2025 as a leading Solana Telegram trading tool.

Also, you may read Top 7 Bonk Bot Alternatives for Crypto Trading

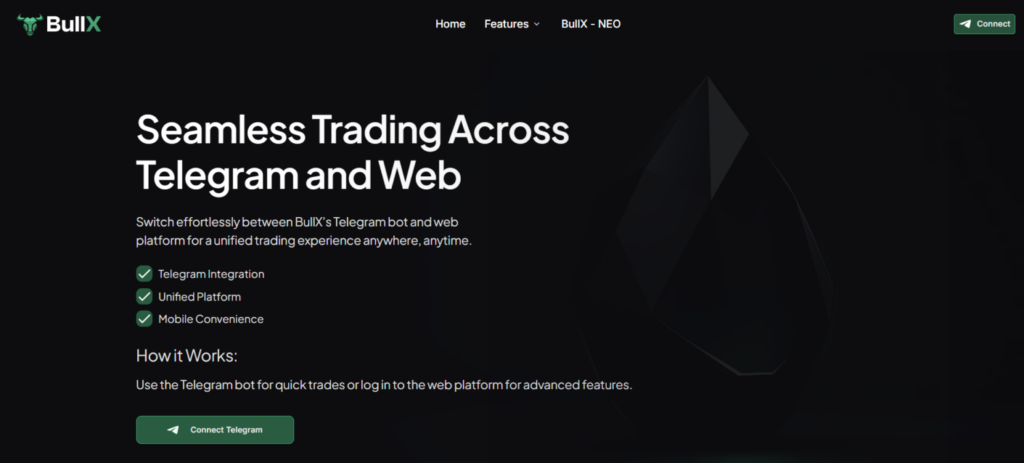

BullX

BullX is a combined analytics and trading platform built to surface early-stage, high-risk crypto opportunities. It pairs a research-driven web dashboard with integrated automated trading tools, offering features such as token discovery, smart wallet tracking, on-chain analytics, and sentiment-style indicators. Aimed at meme coin and narrative-driven traders, BullX sets itself apart from execution-only bots by focusing on generating actionable insights alongside trade execution.

Key Points

- BullX is a multi-chain DeFi trading bot and web platform with Telegram integration, launched in June 2024 and later upgraded to BullX NEO.

- It supports token discovery, live charts, limit orders, multi-wallet management, and Pump Vision tracking across multiple blockchains.

- The platform stands out for its advanced web dashboard, real-time analytics, and seamless Telegram login.

- BullX is built for traders who want research, analytics, and execution combined in a single interface.

Also, you may read BullX vs GMGN vs DBot

Bloom

Bloom Bot is a crypto trading automation service built on Telegram, with an optional browser extension, that allows users to trade tokens on Solana and EVM-compatible blockchains without relying on a standalone, complicated application. It streamlines token buying and selling for both novice and advanced traders by automating trades, supporting rapid sniping of new launches, and providing tools like limit orders, automated sell strategies, copy trading, and portfolio monitoring.

Key Points

- Telegram-based, non-custodial trading bot that operates without the need for additional applications.

- Introduced in 2024 and experiencing rapid user growth with notable cumulative trading volume.

- Primarily focused on spot trading, with strong emphasis on Solana tokens and memecoins.

- Provides features such as sniping, instant buy/sell, limit orders, and a high-speed “degen mode.”

- Enables precise trade entry and exit through limit orders in addition to market execution.

- Applies transaction fees to trades, with possible fee reductions through referral programs.

Sigma vs BonkBot vs BullX vs Bloom: Fees Structure

Sigma

- The standard bot fee is 1% per transaction, covering both sniping and regular trades on most supported networks, including Ethereum, Avalanche, BSC, and Base.

- On Solana, the bot may charge a 0% trading fee, with users only paying the applicable network fees.

- Fees are applied per transaction and remain uniform across all supported EVM-compatible chains.

BonkBot

- BonkBot does not charge a subscription fee to set up or to use the bot.

- A 1% fee is applied to each successful swap (trade) transaction executed through BonkBot.

- Users may receive a portion of fees back as rewards via the Telemetry rewards program, depending on trading volume.

- Network gas fees (e.g., Solana fees) are separate and paid to the blockchain by the user.

BullX

- The platform generally applies a trading fee of about 1% per transaction, which aligns with fees charged by other Solana-based trading platforms.

- Users who register through referral or affiliate links may qualify for discounted fees, often receiving roughly a 10% reduction on standard platform charges.

- Beyond the platform’s trading fees, users are also responsible for Solana network transaction costs, as well as any relevant priority fees or validator tips.

Bloom

- Bloom charges a 1% fee on every buy and sell transaction executed through the platform.

- Users who sign up using a referral link receive a 10% discount, reducing the transaction fee to 0.9% per trade.

- There are no additional hidden fees, and network gas fees are paid separately to the blockchain by the user.

- The fee supports platform operations, development, infrastructure, and community growth.

Sigma vs BonkBot vs BullX vs Bloom: Security Information

| Platform | Custody Model | User Key Control | Security Transparency | Overall Security Summary |

|---|---|---|---|---|

| Sigma | Bot-managed hot wallet | Partial user control; keys created/imported in bot | Low; limited public details on key storage or audits | Standard Telegram-bot security; relies heavily on user precautions and separate low-fund wallets |

| BonkBot | Fully non-custodial (remote signing) | Full user control; private keys never held by platform | High; well-documented signing model, encryption, and optional 2FA | Strongest security model among Telegram bots due to non-custodial design |

| BullX | Hybrid / unclear custody model | User funds wallets, but key handling details not explicit | Medium; general security features mentioned, limited custody disclosure | Moderate security with limited transparency; best used with restricted-fund wallets |

| Bloom | Non-custodial (wallet connection / extension) | Full user control; private keys not requested or stored | Medium-High; clear statements about non-storage of keys | Strong non-custodial approach; security depends on correct wallet and extension usage |

Conclusion

Sigma, BonkBot, BullX, and Bloom each address different trading needs within the on-chain crypto ecosystem. Sigma is best suited for analytics-driven and research-oriented traders. BonkBot prioritizes simplicity and speed for Solana meme coin execution, BullX offers a comprehensive and professional trading environment with advanced tools, and Bloom focuses on automation and systematic trading. The most effective choice depends on a trader’s experience level, risk appetite, and preferred balance between speed, insight, and automation.

Frequently asked questions (FAQs)

Which platform is best for beginners?

BonkBot is generally the most beginner-friendly due to its simple Telegram-based interface and fast trade execution.

Which tool is best for advanced or professional traders?

BullX is best suited for advanced traders because of its detailed charts, token discovery filters, wallet tracking, and multi-chain support.

Do these tools support multiple blockchains?

Sigma and BullX support multiple EVM chains, BonkBot is primarily Solana-focused, and Bloom is mainly Solana-based with limited multi-chain expansion.

Is it common to use more than one of these tools?

Yes, many traders combine tools—for example, using Sigma for research, BullX for execution, and BonkBot for rapid trades.