Table of Contents

Key Takeaways:

- Proof-of-Work Algorithm is energy intensive. Proof of stake is a lot cleaner in terms of energy.

- Bitcoin’s energy utilization is higher than entire Argentina. Kazakhstan plans to increase energy rates for crypto mining.

- Bitcoin consumes more than 15 times energy for one transaction as compared to Visa.

- Distributed ledgers effect on environment.

- Funding provided by Bitcoin offsets its costs.

The original consensus algorithm in a blockchain network is Proof of Work (PoW). The algorithm confirms the transaction and adds another block to the chain. Minors compete against each other to accomplish the network transaction in this method. The miner is credited as soon as they successfully construct a valid block.

Obtaining proof of work can be of low-probability, unpredictable procedure. Many trials and errors are required before a valid proof of work can be generated. A mathematical challenge that can easily prove the solution is the primary working premise of proof of work. The Hashcash proof of work mechanism can implement proof of work on a blockchain.

Proof of Work illustration:

Proof of work requires a computer to perform hashing functions randomly until it generates an output with the correct number of leading zeroes. The hash for block #660000, mined on December 4, 2020, is 00000000000000000008eddcaf078f12c69a439dde30dbb5aac3d9d94e9c18f6.

6.25 BTC was the block reward for that successful hash.

Why is Proof of Work Required for Bitcoin?

Blockchains, like the Bitcoin network, are structured to be decentralised and peer-to-peer. Thus, they need a mechanism to achieve both consensus and security. Proof of work is one mechanism that makes attempting to overrun the network excessively resource-intensive.

From a security standpoint, proof of work is more reliable. However, one drawback with proof of stake is that parties with massive crypto holdings may have too much power, whereas proof of work does not have this concern.

Because getting the target hash is difficult, but verifying it isn’t, proof of work in bitcoin works well. Furthermore, the method is complicated enough to prevent transaction records from being tampered with.

Proof of work vs. Proof of stake:

Proof of work vs. proof of stake: Peercoin, a proof-of-stake cryptocurrency, was launched in 2012 as an alternative. PoS is a consensus mechanism in which the node that will mine or validate block transactions is allocated randomly based on the number of coins held by that node. The greater the number of tokens in a wallet, the more mining power it receives.

Proof of stake is more scalable than proof of work since it does not require nearly as much computational power. As a result, it can execute transactions more quickly for cheaper fees and less energy usage, making proof-of-stake cryptocurrencies more environmentally friendly. Staking crypto is also easier to get started with than mining because it doesn’t require any expensive hardware.

Is Bitcoin Really Harmful to the Globe?

One of the most prominent complaints levelled at Bitcoin, the first cryptocurrency, was that it had a significant environmental impact that was unsustainable in the long run. These arguments implied that Bitcoin supporters supported a large carbon footprint by employing an environmentally harmful technology.

According to the Cambridge Centre for Alternative Finance, Bitcoin’s annualised consumption is estimated to be 135 TWh. This amounts to around 0.7% of world consumption, which is higher than most small Nations. However, compared to other businesses, the crackdown and emphasis on Bitcoin being unsustainable are utterly incorrect.

In comparison to other businesses, the energy usage of Bitcoin was determined to be relatively low, according to the Galaxy Digital Report. When you consider all the servers in banks and ATMs, card networks, payment providers, as well as the many audits and public records required, not to mention the decades-long storage of customer and client information. The banking sector’s energy use, according to Bitcoin.com, is double that of Bitcoin, at 263 TWh.

What is the primary objective of energy usage?

The energy in Bitcoin is used according to three tight rules:

- Keep bitcoin’s maximum supply at 21 million coins.

- Every 10 minutes, create a 1MB block to hold transactions on the blockchain.

- The first two rules should not be changed.

Bitcoin, in the end, expends a large amount of energy to safeguard and protect its network from attack. An attack might potentially come from a party wishing to change the protocol’s essential parameters. This entity may attempt to change one of three things: supply, block size, or block schedule.

Bitcoin does not directly use the energy it consumes to complete transactions.

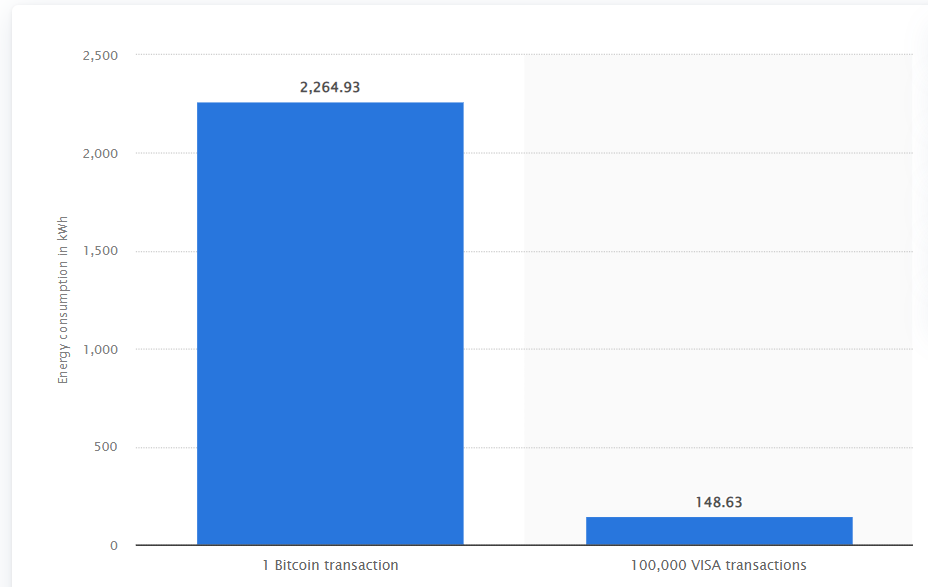

As of January 2022, Bitcoin’s average energy consumption per transaction compared to VISA’s was:

In 2021, one Bitcoin transaction could consume the same amount of energy as hundreds of thousands of VISA card transactions. According to a source that attempts to estimate Bitcoin (BTC) and Bitcoin Cash (BTH) energy consumption over time. It estimates how much money miners may spend on electricity because no one keeps track of how much energy the cryptocurrency consumes. This also holds which nations mine the most Bitcoin, as determined by comparing IP addresses.

The processing power – and thus energy – required to mine Bitcoin increases as it approaches its supply constraints. The difficulty of BTC mining or the amount of processing power used to mine Bitcoin, reflects the following: Bitcoin mining was more accessible and less energy-intensive in 2014, for example, when there was fewer Bitcoin in circulation than it was now in 2021.

Statista – Bitcoin average energy consumption per transaction compared to that of VISA as of January 10, 2022 (in kilowatt-hours)

Mining new Bitcoin (BTC) on the blockchain is as challenging as it has ever been as of May 2021, with mining difficulty reaching a record high of approximately 22 trillion. This figure represents how much processing power is used to mine this particular cryptocurrency. It is calculated every 14 days based on the hashing power fighting for rewards on the network during that time. As a result, more miners attempt to obtain this cryptocurrency as the mining difficulty rises. BTC’s maximum supply was initially expected to be reached by 2024, but approximately 90% of that quantity has already been reached by March 2021.

Statista – Average mining difficulty of Bitcoin from January 2014 to May 13, 2021 (in terahash)

Since all that is required to mine Bitcoin is computers that operate on power, Bitcoin incentivizes miners to pursue cheaper types of energy production. As a result, the miner spends less time mining blocks when the energy is cheaper. In addition, a miner is compensated with BTC when they mine a block, which they can then sell to repay their energy costs. As a result, miners frequently locate their operations near renewable energy sources like hydroelectric, wind, and solar.

Bitcoin’s high energy consumption can create room for a greater demand for renewable energy sources. When retail and industrial purchasers are unavailable, asleep, or when the energy would otherwise be dumped, Bitcoin can operate as a 24/7 buyer-of-last-resort for these energy farms.

This enables bitcoin to operate as a grid buffer, smoothing out energy production and earnings. Both bitcoin mining farms and renewable energy suppliers benefit more due to this. Profits can then be re-invested in new green energy projects, hastening the world’s transition to a more sustainable energy grid.

‘Imagine the climate,’ say Democrats, who are Targeting Bitcoin Mining as Part of their Green Energy Drive

As Democrats questioned how Bitcoin’s energy-intensive mining-impacted President Joe Biden’s green energy plan, cryptocurrency leaders were brought before Congress to defend Bitcoin.

A congressional hearing has been scheduled following the rejection of two requests to use coal-fired power plants to fuel bitcoin mining operations by the Environmental Protection Agency.

The session, titled “Cleaning Up Cryptocurrency: The Energy Impacts of Blockchains,” was started by Democrat Diana DeGette. She stated that there must be an overarching focus on lowering carbon emissions and developing green energy.

According to Brian Brooks, the current CEO of BirFury and former chief legal officer of Coinbase, cryptocurrency mining consumed 58% of sustainably derived power, compared to 31% for the US economy as a whole.

“What is clear is that the 188 terawatt-hours used by Bitcoin last year out of about 155,000 terawatt-hours consumed globally for all uses were sourced more sustainably than other uses on average,” he explained.

Bitcoin miners, he continued, benefit the renewable energy industry by creating demand for otherwise underutilized energy, such as the 1.5 million megawatt-hours that would be squandered in California in 2020.

Former Chelan County general manager Steve Wright advised that mining companies employ mechanisms to ensure bitcoin production is encouraged toward efficient ends.

In the power market, clean energy is acquiring value while carbon-emitting generation is steadily declining, he added, stressing that this is likely to push crypto production toward fossil-fired resources for at least the near term.

Gregory Zerzan, a former acting assistant secretary of the US Treasury under President George W Bush, believes that excessive regulation could suffocate blockchain innovation.

“Bitcoin is one cryptocurrency, but not all cryptocurrencies are meant to be a cash substitute,” he explained. Instead, according to him, cryptocurrency is the oil that keeps the blockchain running; it’s an internal economic incentive for the computational power that blockchain represents.”

The European Union should Prohibit Energy-Intensive Crypto Mining, According to a Regulator:

A top EU financial regulator has revived calls for a bloc-wide “ban” on the most common kind of bitcoin mining and raised concerns about the growing use of renewable energy for crypto mining.

Erik Thedéen, vice-chair of the European Securities and Markets Authority, bitcoin mining has become a “national issue” in his homeland Sweden, and cryptocurrencies represent a risk to fulfilling the Paris sustainability goals.

To reduce the sector’s massive power consumption, European regulators should consider prohibiting the “proof of work” mining approach and drive the business toward the less energy-intensive “proof of stake” model, according to Thedéen.

“We need to have a conversation about moving the sector to a more efficient system,” Thedéen said, emphasizing that he is not advocating a blanket ban on cryptocurrency.

He explained that the financial industry and many influential organizations are now participating in cryptocurrency markets, and they have [environmental, social, and governance] duties.

His remarks came after Swedish officials proposed a ban on the practice in November of last year, citing the growing quantity of renewable energy devoted to cryptocurrencies while claiming that the societal benefit of crypto assets is dubious.

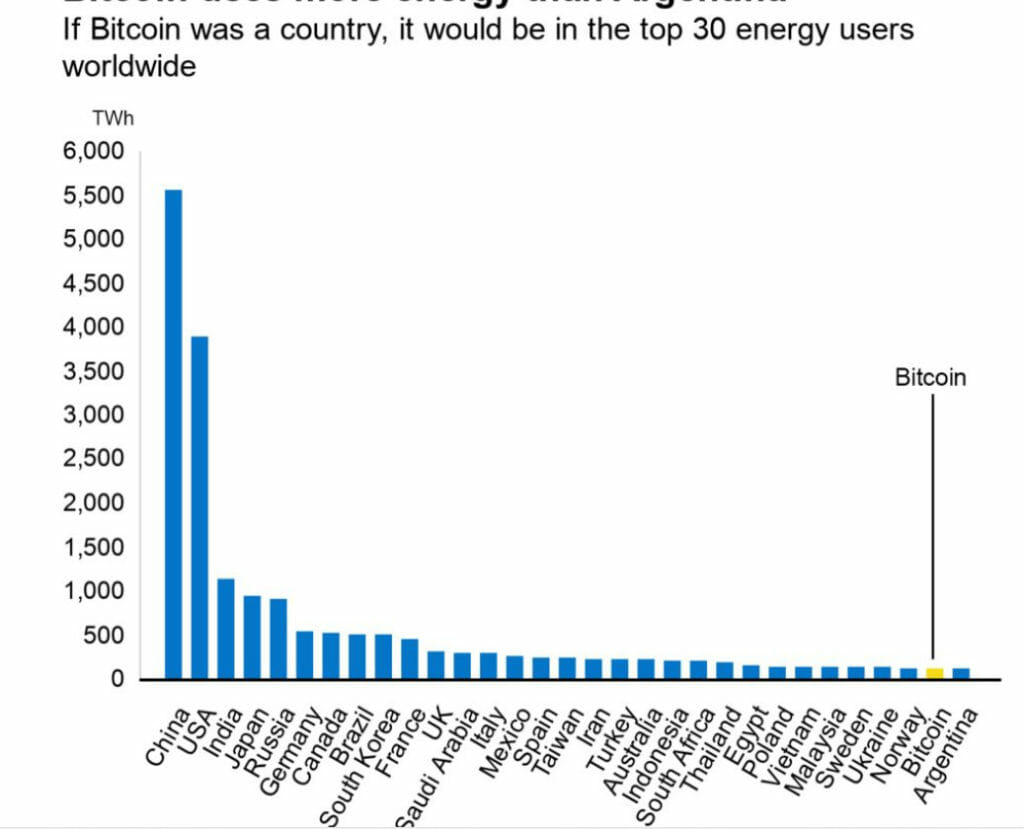

Bitcoin Uses More Electricity than Argentina:

According to a Cambridge University study, Bitcoin consumes more electricity annually than Argentina and the United Arab Emirates combined.

Since its inception in 2008, Bitcoin has grown immensely in popularity, becoming a popular investment among prominent billionaires, institutions, and ordinary investors alike.

According to the Cambridge Center for Alternative Finance, Bitcoin’s annual electricity consumption of 121.05 terawatt-hours (TWh) is more than Argentina’s (121 TWh) and the United Arab Emirates (113.20 TWh), and it’s near to Norway’s (122.20 TWh).

Bitcoin’s power consumption is now higher than Argentina’s (121 TWh), the Netherlands’ (108.8 TWh), and the United Arab Emirates (113.20 TWh) – and it’s catching up to Norway (122.20 TWh).

It claims that the energy it requires could power all kettles in the UK for 27 years.

However, the amount of electricity wasted annually by always-on but inactive home devices in the United States alone could run the Bitcoin network for a year.

Kazakhstan Considers a Fivefold Increase in Electricity Tax on Crypto Mining:

Kazakhstani lawmakers are considering new regulations for the cryptocurrency business. According to local media, the creators of a proposed law titled “On Digital Assets in the Republic of Kazakhstan” have addressed many burgeoning crypto mining industry issues.

Since last year, when Kazakhstan welcomed mining businesses fleeing China when Beijing initiated a crackdown on bitcoin mining activities in May, the country has attempted to address a rising power shortfall. Miners were blamed for the shortages, and crypto farms were recently shut down across Central Asia.

All unlicensed mining will be banned under the proposed revisions. In addition, the tax burden on registered entities will be increased. Kazakhstan also intends to charge a levy on all mining equipment, whether in operation or not. Furthermore, mining companies will be required to record the quantity and type of coin minting devices they use quarterly and pay the additional costs. Due to power outages, some mining corporations have already been forced to leave Kazakhstan.

Can Distributed Ledgers Genuinely Help the Environment?

Aside from choosing chains with low energy consumption and transferring industry data onto them, distributed ledgers can help the environment in several ways.

WildEarth, one of the most popular wildlife show broadcasters, has lately used NFTs to aid specific animals. In addition, over 5 million people use Roku, DStv Africa, Amazon, iOS, Android, Plex, Bolt, Huawei, Xumo, Samsung+, Sling, LG+, and Zeasn to watch the various distribution channels.

WildEarth chose the Polygon blockchain because of its speed and efficiency, which are seen as critical environmental concerns. This option isn’t limited to tasks involving nature.

Then some efforts aim to disrupt the energy sector directly. Power Ledger (POWR) is a startup located in Australia to build blockchain-based renewable energy infrastructure for homes. It will simplify participants to buy and sell energy using a cryptocurrency. It employs two blockchains, each with its own set of tokens. It not only promotes green energy but also eliminates the middleman. If your household produces extra energy, you are free to sell it for a price that others will pay.

Animal Concerts is attempting to offer live metaverse VR broadcasting of the concert industry while having nothing to do with the environment. Integrating virtual reality, distributed ledgers, and cryptocurrencies into the live music arena creates a new online entertainment paradigm.

There is no way to imply that Bitcoin is flawless. It is controlled by computers, which produce their carbon footprint. Solar, hydro, and electric energy all have an environmental cost associated with their production. Finally, non-renewable energy sources like coal and fossil fuels account for roughly 41.5% of Bitcoin’s energy use. However, every valuable industry generates trash of some kind. No one is immune. Transitioning to a more sustainable and trustworthy financial system is the goal of Bitcoin. Bitcoin employs energy to safeguard the network’s integrity, protecting about $1 trillion in bitcoin. However, specific positive externalities are associated with bitcoin’s high energy consumption. It buys energy from suppliers who might not have a buyer otherwise.

Bitcoin’s ecosystem consumes a lot of energy to keep running. However, it contributes a large amount of societal suitable inadequate financing that offsets its use.