Decentralized Finance (DeFi) has provided investors with new sources of revenue. Minimax.finance is an aggregator of staking, lending and yield farming opportunities with stop loss and take profit. The platform lets you enjoy the great benefits of DeFi (high APYs and ease of asset manipulation) and not be worried about its risks (impermanent loss or sharp token depreciation). Is it, however, a fair trade for investors? Let’s find out in this Minimax Finance review.

Table of Contents

Summary

| Features | Minimax Finance |

|---|---|

| Founded in | 2021 |

| Deposit option and withdrawal | BUSD |

| Staking option available | CAKE tokens in the PancakeSwap pools |

| Transaction/Deposit fee | 0.1% |

| Chain | Binance Smart Chain |

| Token | MMX |

| Mobile App | Not Available |

Key features

- Minimax Finance introduced stop-loss and take profit features for staking, lending and farming deposits (something not available before).

- When the value of a stake falls below the stop loss level or goes above the take profit level, it is converted into stable coins (currently BUSD, more options will be added later).

- The BUSD is sent to the user’s wallet automatically.

- The current version allows staking to pools from PancakeSwap, Beefy and Venus platforms, while setting stop loss and take profit levels.

- Isolated CEX-like positions for staking and farming with independent user-defined parameters

- As of now, Minimax Finance is launched on Binance Smart Chain (BSC) with other blockchains coming soon.

Minimax Finance Review: Overview

Minimax Finance is a decentralized application that allows you to get the benefits of DeFi while avoiding or at least minimizing the risks. With Minimax Finance the user will be able to set stop loss and take profit parameters for their staking and farmed deposits, causing them to be immediately removed from staking/farming pools and converted into stable coins if the deposit value falls dramatically or skyrockets. In addition, Minimax will expand to other blockchains in the near future, starting with the integration of Aave platform on Polygon.

Also read, Top 5 DeFi Tokens to Look Out for

Minimax Finance Review: Interface

Minimax Finance has just launched the second version of its platform. The user interface is basic and easy to understand.

How to Get started with Minimax Finance?

Follow the steps to get started:

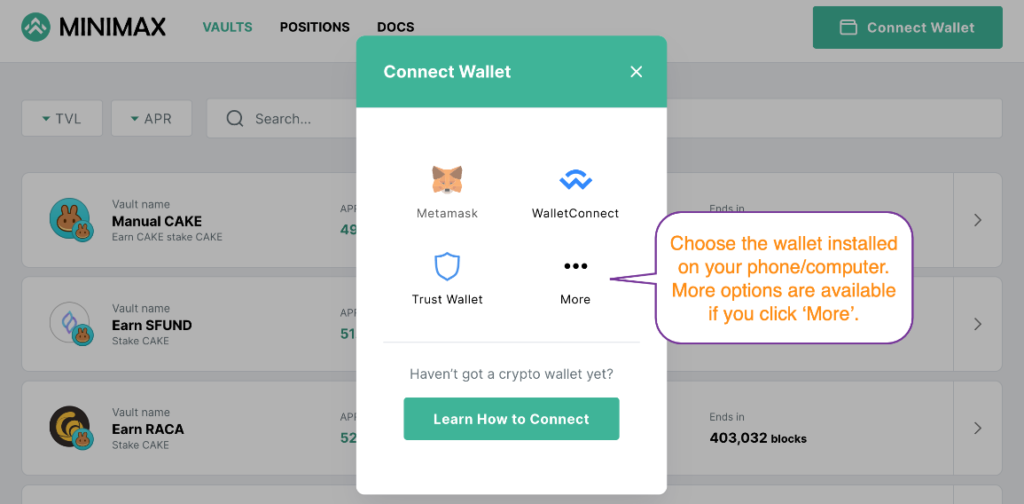

How to connect to Minimax?

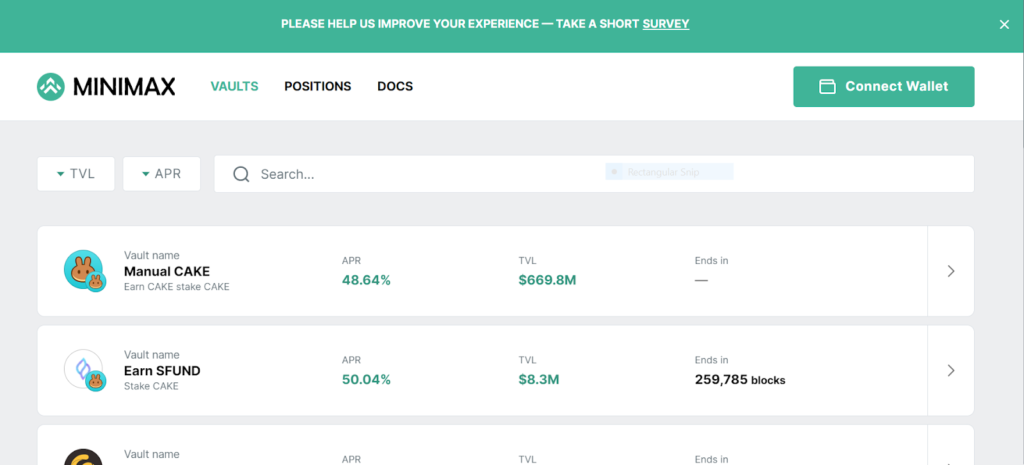

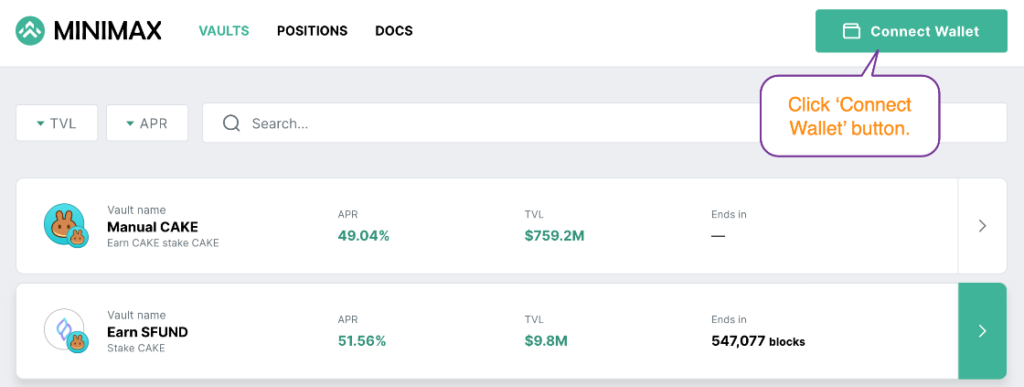

- To begin using Minimax, users must first link their wallets to the platform.

- Once the user clicks the ‘Connect Wallet’ button, a popup with wallet options appears.

- After selecting a wallet, users need to verify the link in their wallet, and Minimax is ready to use.

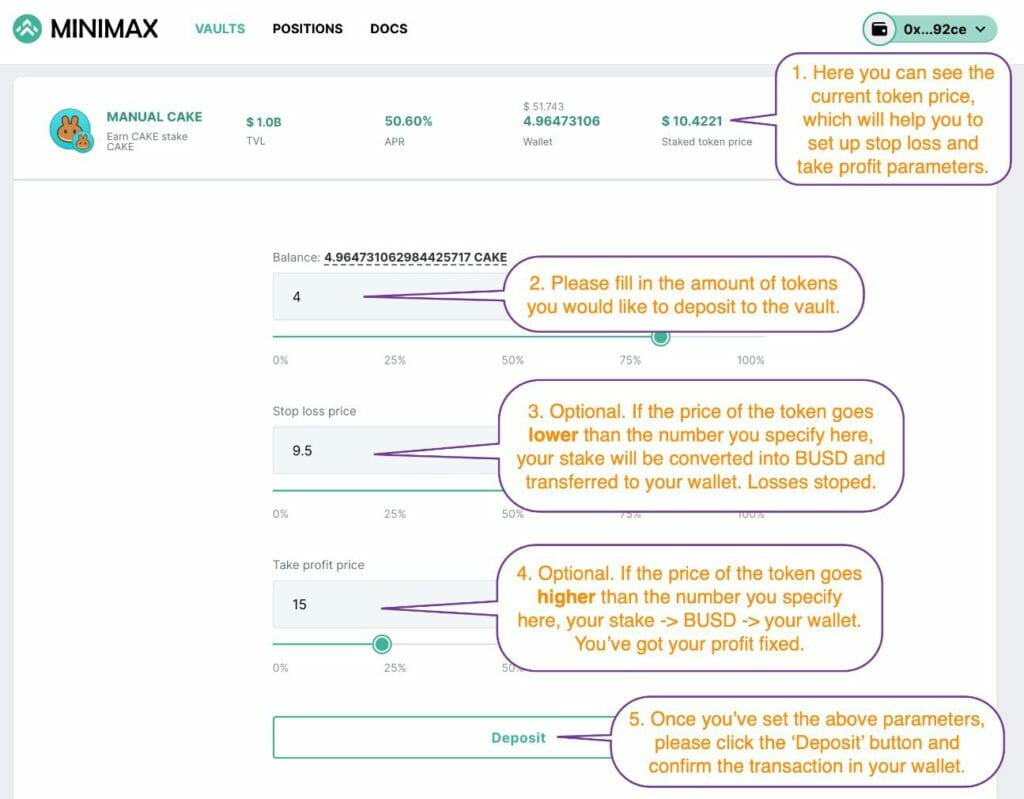

How to open a Position in Minimax?

- To open a position, go to the ‘VAULTS’ tab and select one of the vaults.

- When you click a vault, the form below will appear.

- Allow a few seconds after clicking the ‘Deposit’ button for the position to be established. It takes time to complete the necessary transactions and record position data on the Binance Smart Chain.

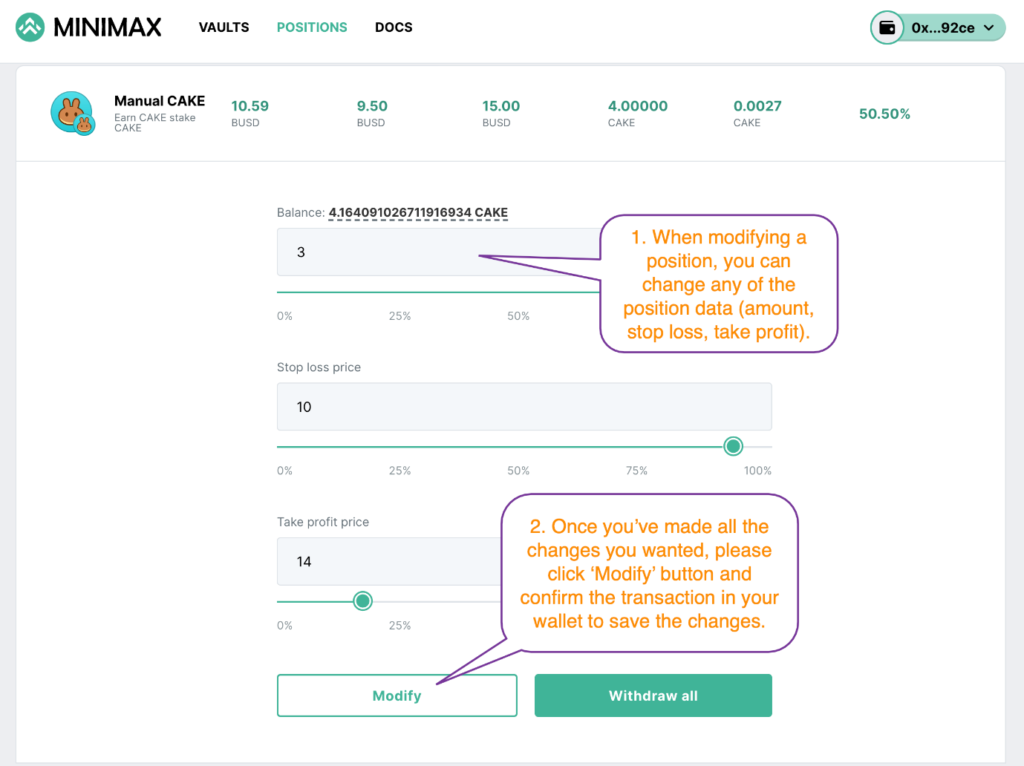

How to manage a Position in Minimax?

- You can view your open positions at the ‘POSITIONS’ page.

- Any position can be changed or withdrawn. Click on the position you want to alter, and the following form will appear.

- The most recent position data can be viewed on the ‘POSITIONS’ page.

How does Minimax Finance work?

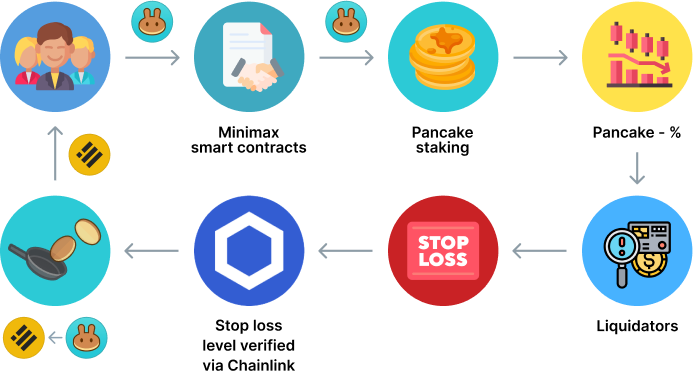

- First, clients create positions by depositing their crypto into vaults. When creating the positions, the clients can specify stop loss and take profit levels (optional).

- The positions are constantly monitored. When a position reaches its stop loss or take profit level, the liquidation is initiated. Our platform uses Chainlink price feeds to verify that stop loss and take profit are initiated correctly.

- Once verified, stop loss or take profit events are processed with the help of Gelato Network – the tokens get converted into stable coins (currently BUSD, more options will be available later).

- After the conversion, the stable coins are transferred to the client’s wallet.

- Minimax’s smart contracts may be upgraded to provide new features and address minor bugs.

- DAO will be deployed once the platform matures. MMX is a governance token; it will be compatible with standard DAO features such as proposals and so on. Each client’s voting rights will be determined by the quantity of MMX staked.

Also read, 3 Best Futures Trading Bots | Future Bot

Minimax Finance Review: Fees

Currently there are no costs associated with the platform, users pay only for the transactions. A 0.1 percent charge for depositing funds will be introduced at a later date. The fee will not be applied to staking of MMX or MMX-BNB LP tokens.

Minimax Finance Review: Fees

Currently the only fee only fee charged by Minimax is 0.005 BNB, which is paid to Gelato Network for reliable processing of stop loss and take profit events.

A 0.1 percent charge for depositing funds will be introduced at a later date. The fee will not be applied to staking of MMX or MMX-BNB LP tokens.

Minimax Finance Review: Other Bonuses

- For early adopters.

The deployment of a smart proxy contract incurs certain gas expenditures. Therefore, before the platform goes live, Minimax Finance will pre-deploy a hundred proxy smart contracts. As a result, the lucky clients who generate the first hundred positions will pay the transaction charge and receive free proxy contracts for their holdings. The system will repurpose proxy smart contracts that become available when positions are concluded to reduce client fees.

- Airdrops

In addition to the rewards listed above, platform clients will get regular airdrops based on the number of funds deposited at Minimax.

Is it safe to invest with Minimax Finance?

Minimax is an early-stage start-up; hence investing with Minimax might be risky, but it can also be incredibly profitable. The website trust score is low, but it has a valid SSL certificate. Because it is a new platform, it is difficult to predict its trustworthiness. If you want to invest with Minimax, keep yourself updated with their announcements and know more about the project from its creators.

Minimax Finance Review: Alternatives

- KillSwitch.Finance: KillSwitch is a smart yield aggregator that aims to give yield farmers ease and security. It also provides the stop loss/take profit feature, an automated system to facilitate orders based on user presets.

- YieldShiled.com: uses a smart contract and Artificial intelligence functionality that finds new max gain farms, auto-sells users’ yield to compound earnings, and quickly enters the next best opportunity while remaining within the specified risk parameters.

Also read, Top 5 Crypto.com Alternatives To Earn Interest

Minimax Finance Review: Pros and Cons

Pros

- It’s possible to stake all popular tokens, including BTC, ETH, BNB, DOGE, etc, with stop loss and take profit

- Users can open multiple staking positions within one staking pool.

- There is no Service fee to pay on the platform.

- A leading cybersecurity consulting company called Hacken have carefully audited Minimax’s smart contract and granted a ‘well-secured’ grade which makes it free from security issues.

Cons

- In some cases, positions may not be liquidated immediately once the token price hits the stop loss or take profit level. It happens when the slippage is higher than allowed by the user.

- Because Minimax is a decentralized application, all position data is stored on the blockchain and is therefore publicly available.

It doesn’t have a mobile application (but can be accessed through dApp browsers, such as Trust Wallet).

Conclusion

The main worry for yield framers is a significant drop in the value of their staking positions. Minimax Finance, a decentralized application has come up with a solution that provides users with an easy interface to establish staking positions with stop loss/take profit features to safeguard their assets, allowing them to enjoy high APYs without worrying about risks. It is developing solutions to make it easier for investors to generate risk-free earnings. Because it is a new platform, predicting its dependability, legality, and trustworthiness is challenging.

Frequently Asked Questions

Does Minimax have a mobile app?

No, It only has a web application.

Does the Minimax platform have its token?

Yes, it has its token with ticker MMX and a total supply of 100 million tokens.

Is there any reward for staking MMX tokens?

Platform users who stake MMX for 30 or 90 days will be eligible for platform fee discounts based on the tokens staked.

1. Basic level 0-1,000 MMX staked – 0.1% fee (no discount)

2. Bronze level 1,000-5,000 MMX staked – 0.09% fee (10% discount)

3. Silver level 5,000-10,000 MMX staked – 0.08% fee (20% discount)

4. Gold level 10,000-50,000 MMX staked – 0.07% fee (30% discount)

5. Prime level 50,000+ MMX staked – 0.05% fee (50% discount)

Why don’t I stake my CAKEs directly at Pancakeswap?

There are two main reasons why you should use Minimax Finance

First – you may establish stop loss and take profit levels on the platform. It will immediately withdraw your staking deposit and convert it to BUSD if the CAKE price falls below the stop loss level or rises over the take profit level you choose. The other reason is that you will be eligible for MMX token airdrops.

Also read,