If you already have crypto assets and wish to make the most of them, you can consider lending your crypto. It allows you to earn passive income with crypto assets without trading them. This article brings to you the top 4 crypto.com alternatives.

What is Crypto.com?

Crypto.com is one such platform that allows customers to spend, trade, store, and save cryptocurrencies. It offers an array of services and is one of the most popular platforms for HODL-ing your cryptocurrency.

It is easy to convert money on Crypto.com with low fees and robust security. Customers can also earn interest on their crypto assets by lending them out on the platform. The platform supports over 100 coins and 20 fiat currencies. However, almost 40 of those coins are not present in the U.S, and not all coins are present in every state.

The downside of Crypto.com is that the website can be overwhelming for those who are new to crypto lending. The company has revamped its website recently, but the interface is still a bit difficult to navigate.

Top 5 Crypto.com Alternatives for HODL-ers

First Crypto.com alternatives: BitBuy

Bitbuy allows users to transfer their cryptos between the Bitbuy wallet and their external wallet. The users can do two things:

- First, they can hold their digital assets in their wallets outside the exchange platform.

- Second, they can deposit Bitbuy supported cryptocurrencies for investing and trading purposes.

Bitbuy aims at providing maximum security to its users. Therefore, they offer a built-in crypto wallet that keeps all the assets secured. In addition, it is partnered with Knox that allows the users to store their Bitcoin holdings safely.

BitBuy Pros

- The verification process is fast for Canadian users.

- There is a high limit on wire transfers.

- There is a high limit on wire transfers.

BitBuy Cons

- Only limited cryptocurrencies are available.

To learn more read our Bitbuy Review

Second Crypto.com alternatives: Coinbase

Coinbase is the world’s second-largest cryptocurrency exchange and one of the finest cryptocurrency exchanges in Canada, allowing customers to trade 150+ cryptocurrencies.

Aside from the custodial wallet, Coinbase provides a self-hosted crypto wallet that is widely regarded as the most secure mobile wallet in the crypto world, allowing you to keep your private keys on your mobile device while maintaining full control over your crypto assets.

The Coinbase Wallet is separate from the Coinbase exchange, and you do not need to sign up for an account to utilize it.

Coinbase Pros

- You can earn free crypto assets on Coinbase to check their functionality in the real market.

- The exchange offers high liquidity.

- The exchange offers high liquidity.

To learn more about the platform, read our Coinbase Review.

Coinbase Cons

- The fees charged by the exchange are among the highest charges.

- Coinbase does not have desired customer support.

Third Crypto.com alternatives: YouHodler

YouHodler is a versatile financial service company based out of Switzerland that helps crypto users earn interest in cryptocurrencies. You can trade crypto or fiat currency, take a loan with keeping crypto as collateral and invest in a high-interest savings account.

The platform is suitable for all types of investors and allows users to grow their crypto seamlessly. Users can earn up to 12.7% APY on 22 assets, including BTC, ETH, and the like. YouHodler also has an integrated wallet for cryptocurrencies and fiat.

Products such as TurboCharge and Multi-HODL can be interesting for those who are experienced in crypto.

YouHodler Pros

- A wide array of crypto assets

- Interesting trading products

- High interest rates

YouHodler Cons

- Not available in countries like the USA or China

- Mobile application needs to be improved

- It comes at a higher price compared to other platforms

To learn more read our YouHodler review.

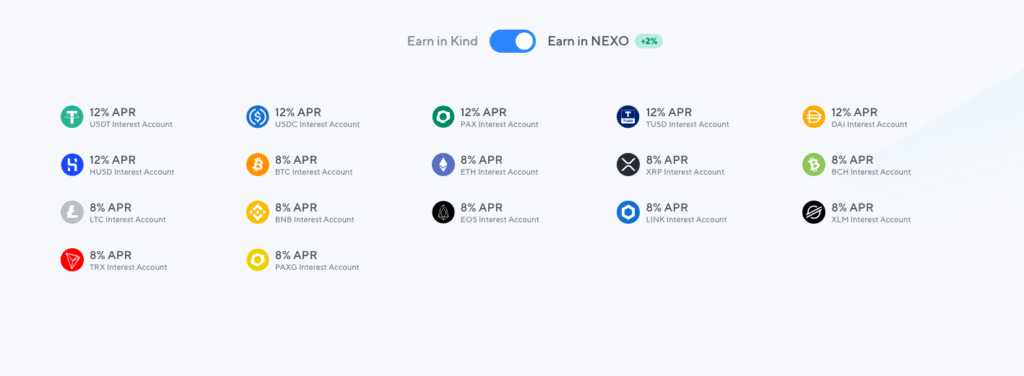

Fourth Crypto.com alternatives: Nexo

Nexo is a renowned platform in the crypto space with a mission to replace traditional banking with cryptocurrencies. It has a good mix of interest accounts, crypto debit cards, crypto loans, and exchanges.

It is an excellent alternative to Crypto.com as its platform is easy to navigate, and there are enough resources to help customers understand the products. Nexo supports 17 crypto assets and some fiat currencies like Euro, British Pound sterling, and US Dollar.

Nexo offers 12% APY for those who choose to earn in NEXO tokens.

Nexo Pros

- Earn higher yield with Nexo tokens

- Well established platform with over 1 million clients

- No fees for withdrawal or transactions

Nexo Cons

- Best interest rates are available only for those who hold Nexo tokens

- Borrowing rates are higher than other platforms

- Insurance is only applicable to assets stored in cold storage.

Crypto.com Alternatives: Conclusion

Bitcoin started the cryptocurrency revolution, and other cryptocurrencies are gaining momentum too. Needless to say, cryptocurrencies are emerging to be the future of finance.

However, holding crypto is not the only way one can invest in them. A good alternative is lending the crypto assets to earn interest on cryptocurrencies, thus making the most out of your cryptocurrencies.

Although Crypto.com is a great platform, other platforms in the market are worth exploring too. BitBuy, Coinbase, YouHodler, and Nexo are the top four alternatives to Crypto.com. With the right strategy, users can earn passive income through these crypto lending platforms.

Frequently Asked Questions

Is BlockFi legit?

Yes, BlockFi is legit as it operates within the federal and state guidelines of the United States and is regulated by the New York Department of Financial Services (NYDFS).

Who owns blockfi?

BlockFi is a privately owned company founded by Flori Marquez and Zac Prince, it has raised funding from various investors.

Is Nexo safe to use?

Yes, Nexo is safe to use. Nexo is driven by trust and designed for security. Further, It follows global AML and KYC standards and complies with strict regulations to avoid risk. Nexo has security measures in place and has become one of the most secured crypto lending companies.

Which Coins Are Supported by Nexo?

Crypto assets can be deposited on the Nexo platform and also used as collateral for obtaining a cash loan instantly with ETH, BTC, LTC, XRP, BCH, XLM, PAXG, EOS, BNB, and NEXO.

Is Hodlnaut safe ?

Yes, Hodlnaut is safe to use as the platform runs on secure AWS (Amazon Web Services) cloud infrastructure with all traffic SSL encrypted. Furthermore, Hodlnaut uses industry-standard algorithms for password hashing and procedures while encouraging users to enable two-factor authentication (2FA) for account transactions.