The cryptocurrency market has a lot of potentials, and many investors are keen on earning interest in their crypto assets. If you are new to the crypto space or even a seasoned investor, you might have already heard about the price volatility in the crypto market.

With so many exchanges and crypto lending platforms in Australia, hodlers are always looking for ways to earn a greater yield on their cryptocurrencies. Despite the market conditions, hodlers always want to grow their cryptocurrency portfolio.

A crypto savings account is an excellent option in this regard as it helps you to earn interest on your cryptocurrencies without actively trading. If you live in Australia and are considering crypto interest-earning platforms, then here is a list of the best crypto wallets to consider.

Table of Contents

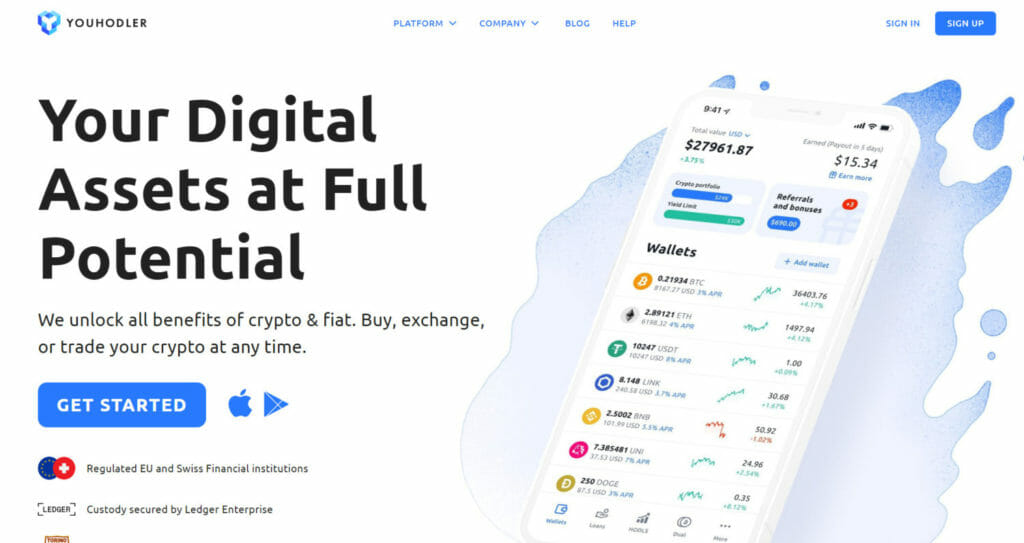

Youhodler: 1st Best Crypto Lending Platforms in Australia

YouHodler should not be overlooked while discussing the crypto loan exchanges that stand out the most for Australian investors. It is on par with Crypto.com in terms of variety, as the facility offers lending across 50 different cryptocurrencies.

There are a variety of interest rates available, however Tether has the highest rate at 12.3% APY, followed by USD Coin at 12.0% APY and Bitcoin at 4.8% APY.

YouHodler‘s distinct characteristics set it apart from other lending platforms. You can, for example, use the crypto in your savings account as collateral for crypto loans by taking out crypto loans.

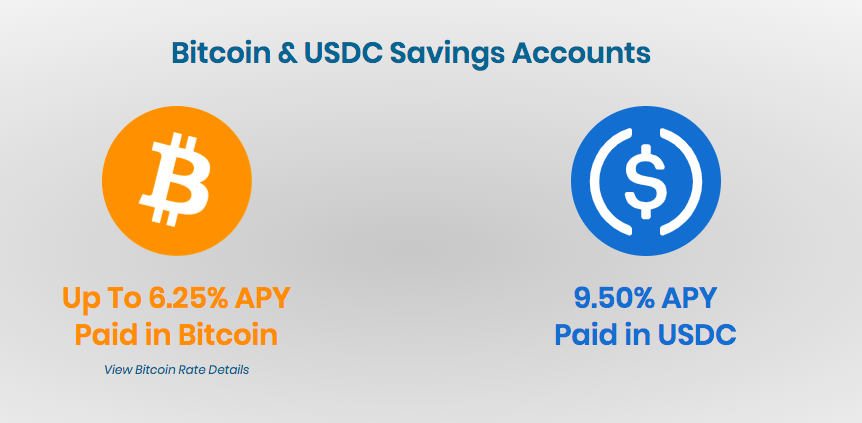

Ledn: 2nd Best Crypto Lending Platforms in Australia

Ledn is a robust and secure platform that allows users to maximize their Bitcoin holdings to secure a loan against BTC. If you are keen on taking a Bitcoin-specific loan or savings account, Ledn is a great option. The platform essentially offers three products. Firstly, they have Bitcoin-backed loans for people who wish to take a loan while leveraging their BTC holdings. Moreover, there is also a bitcoin, and USDC savings account with which users can earn up to 6.10% APY on Bitcoin and 9.5% APY in USDC.

Ledn also has a B2X product that enables hodlers to quickly double their Bitcoin balance with a BTC purchase and a Bitcoin-backed loan. With B2X, users can increase their bitcoin holdings. As long as the savings accounts are concerned, you can withdraw the funds at any time. However, hodlers will need to bear a $10 fee for every USDC withdrawal.

Also read, Top 5 Crypto Lending Platforms in Hong Kong

Nexo: 3rd Best Crypto Lending Platforms in Australia

Nexo is a London-based platform that offers a multitude of products. It comes with a crypto interest account that allows users to earn significant interest rates on their crypto or even fiat assets. Nexo also has a Nexo card and crypto loan product. It also has a debit card that grants access to the crypto credit line, which users can spend without selling their crypto.

Nexo aims to replace the traditional banking system and provide tax-efficient and high-yield products for maximizing the value of digital assets. Nexo supports a variety of crypto assets, including Bitcoin and Ethereum, and fiat currencies like the Pound Sterling. The platform offers up to 12% APY for users that choose to earn Nexo tokens.

Also read, Nexo Card Review : Is It the Best Crypto Card?

Also read, BlockFi vs CoinLoan vs Nexo | Best Lending Platform?

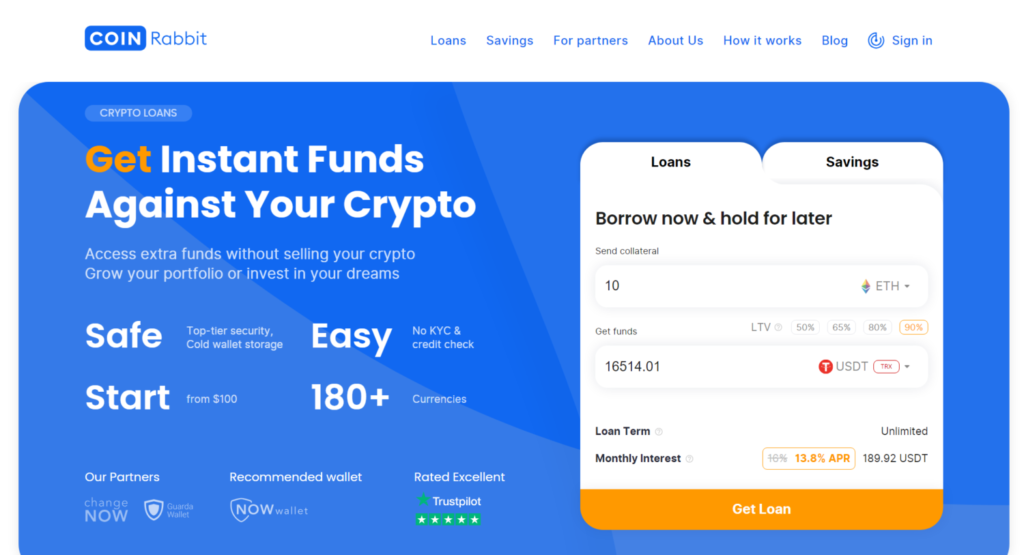

CoinRabbit: 4th Best Crypto Lending Platforms in Australia

CoinRabbit provides a number of borrowing solutions to meet the needs of various consumers. Users can select either a collateralized or uncollateralized loan. Users can borrow up to 80% of the value of their bitcoin assets with a collateralized loan, while users can borrow up to $5,000 without the requirement for collateral with an uncollateralized loan.

The site accepts a variety of cryptocurrencies such as Bitcoin, Ethereum, Litecoin, and others. CoinRabbit also provides fixed-term loans, in which consumers may select the loan term and interest rate that best meets their needs.

Also, CoinRabbit’s interest rates are competitive. Interest rates are set by market demand and supply and are modified on a regular basis.

Crypto.com: 5th Best Crypto Lending Platforms in Australia

Crypto.com is regarded as one of the leading organizations in the crypto lending industry for earning interest on cryptocurrencies. Furthermore, because this loan platform accepts over 50 different coins, it is willing to provide USD Coin with an annual percentage income of up to 14.0%.

Among the various exchanges we studied, Crypto.com stood out because it offers appealing crypto lending options, such as the option of selecting a flexible loan length that you may lock in for 1 or 3 months. Naturally, locking in your cryptocurrency will earn you better rates (you will be penalized if you withdraw it sooner), but you can also earn higher rates if you unlock it before that time.

Also read,