The cryptocurrency market in 2025 thrives with platforms catering to diverse needs, from retail beginners to institutional investors. Robinhood, Figure Markets, and OKX stand out with distinct approaches. Robinhood offers commission-free simplicity, Figure Markets pioneers tokenised real-world assets (RWAs), and OKX provides a global, feature-rich exchange. This article compares their features, fees, security, and target audiences to help you choose the right platform for your crypto trading goals.

Table of Contents

Exchange Overviews

Robinhood

Since 2013, Robinhood has disrupted retail investing with commission-free stock trading, later expanding into crypto. Supporting ~18 cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), and Cardano (ADA), it integrates crypto into its mobile-first app alongside stocks and ETFs. Features like IRA accounts with a 1% contribution match (3% for Gold members) appeal to U.S.-based beginners and long-term investors.

Also Read: Kraken Review – Best Crypto Exchange in the USA?

Figure Markets

Figure Markets, backed by Figure Technologies, specialises in tokenised RWAs, such as U.S. Treasuries and private credit. As a FINRA-regulated broker-dealer, it bridges traditional finance and DeFi, targeting accredited investors and institutions. With tokenised assets reaching $12 billion in on-chain value in 2024 (excluding stablecoins), it taps into a high-growth sector.

Also Read: 7 Best Crypto Trading Platforms to Buy Bitcoin in India

OKX

Founded in 2017 and rebranded from OKEx in 2022, OKX is a Seychelles-based global exchange serving 100+ countries (excluding U.S. exchange services). It supports 350+ cryptocurrencies and 500+ trading pairs, offering spot trading, derivatives, staking, DeFi, and an NFT marketplace, catering to both retail and advanced traders.

Also Read: Coinbase vs Binance vs BYDFI

Feature Comparison

Trading Options

- Robinhood: Limited to spot trading with basic orders (market, limit, stop). No derivatives or staking.

- Figure Markets: Focuses on tokenized RWAs and DeFi integration, not retail spot trading.

- OKX: Offers spot, margin (up to 10x leverage), futures, perpetual swaps (up to 125x leverage), options, DeFi, and NFTs.

Also Read: Cryptohopper vs 3Commas – Ultimate Comparison

User Interface and Experience

- Robinhood: Streamlined, mobile-first, ideal for beginners.

- Figure Markets: Institutional-grade, less intuitive for retail users.

- OKX: Customizable, with advanced charting for all levels.

Also Read: Top 6 Live Online Bitcoin Casino Gaming Platforms

Supported Assets

- Robinhood: ~18 cryptocurrencies.

- Figure Markets: Tokenised RWAs (e.g., Treasuries, private credit) and select crypto.

- OKX: 350+ cryptocurrencies, 500+ trading pairs.

Also Read: Best AI Tools for Students

Accessibility

- Robinhood: U.S.-only.

- Figure Markets: Restricted to accredited investors in supported regions.

- OKX: Global (100+ countries), excluding U.S. exchange services.

Also Read: KuCoin vs Binance: Read this before choosing? [Important]

Fee Structures

- Robinhood: Commission-free but includes spread-based costs, which can raise expenses for active traders.

- Figure Markets: Fees are less transparent, likely higher due to institutional focus.

- OKX: Tiered maker/taker fees (0.02%-0.10%), with discounts for high-volume traders and OKB token holders.

Also Read: 8 Best AI Recruiting Tools

Security and Regulation

- Robinhood: SEC-regulated, with cold storage and two-factor authentication (2FA).

- Figure Markets: FINRA-regulated, emphasising compliance and security for tokenised assets.

- OKX: Licensed in the UAE and Singapore, with proof-of-reserves, 2FA, and withdrawal whitelists.

Also Read: 20 Best Crypto Exchange Reddit Communities

Target Audience

- Robinhood: Beginners and casual investors.

- Figure Markets: Accredited investors and institutions.

- OKX: Beginners to professional traders.

Also Read: A Candid Explanation of Bitcoin

Pros and Cons

Robinhood

- Pros:

- User-Friendly Interface: Its sleek, mobile-first design simplifies trading for novices, with intuitive navigation and clear visuals.

- Commission-Free Trading: No direct trading fees make it cost-effective for small trades or beginners.

- No Account Minimums: Start trading with any amount, lowering barriers for new investors.

- IRA Incentives: 1% match (3% for Gold members) on IRA contributions encourages long-term investing.

- Integrated Investing: Trade crypto, stocks, and ETFs in one app, streamlining portfolio management.

- Cons:

- Limited Crypto Selection: Only ~18 coins restrict diversification compared to competitors.

- U.S.-Only Access: Excludes global users, limiting its reach.

- No Advanced Features: Lacks derivatives, staking, or advanced order types, disappointing experienced traders.

- Spread-Based Costs: Hidden spreads can inflate costs for frequent trading, less transparent than fee schedules.

- Basic Analytics: Minimal charting tools hinder technical analysis.

Also Read: Top 5 Open-Source Trading Bots on GitHub

Figure Markets

- Pros:

- RWA Innovation: Leads in tokenised assets like Treasuries ($2 billion, up 1627% YTD in 2024), offering high-yield opportunities.

- Institutional Compliance: FINRA regulation ensures trust for high-net-worth clients.

- DeFi Integration: Connects traditional finance with DeFi, enabling yield farming and liquidity pools.

- High-Value Assets: Access to private credit and real estate tokens appeals to wealth-focused investors.

- Secure Infrastructure: Robust security tailored for institutional-grade transactions.

- Cons:

- High Entry Barriers: Restricted to accredited investors, excluding most retail users.

- Limited Retail Appeal: Focus on RWAs over mainstream crypto limits accessibility.

- Opaque Fees: Lack of clear fee disclosure complicates cost planning.

- Complex Interface: Less intuitive for non-institutional users, requiring financial expertise.

- Narrow Asset Focus: Limited crypto trading options compared to general exchanges.

Also Read: Best MLOps Platforms: Streamlining AI and ML Operations

OKX

- Pros:

- Diverse Asset Range: 350+ cryptocurrencies and 500+ pairs support broad trading strategies.

- Advanced Trading Tools: Margin, futures, and options with up to 125x leverage cater to pros.

- Global Accessibility: Serves 100+ countries, ideal for non-U.S. users.

- Competitive Fees: Low maker/taker fees (0.02%-0.10%) benefit high-volume traders.

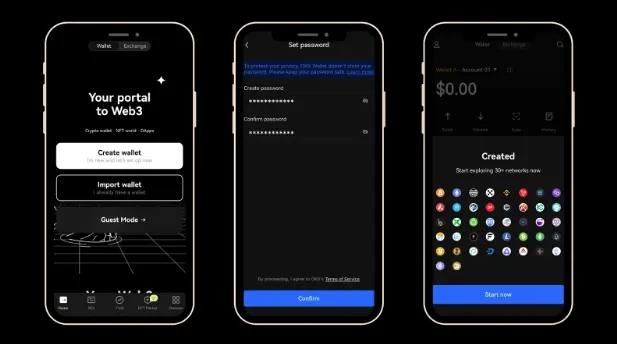

- Web3 Ecosystem: Includes DeFi, NFTs, and a Web3 wallet for comprehensive crypto engagement.

- Cons:

- Complex for Beginners: Feature-heavy platform can overwhelm new users.

- No U.S. Exchange Access: U.S. users are limited to wallet services, not full trading.

- Regulatory Restrictions: Some features are unavailable in certain regions due to compliance.

- Learning Curve: Advanced tools require time to master.

- Customer Support Variability: Response times can lag during peak demand.

Also Read: Top 7 Best Open Source LLMs to try

Conclusion

Choosing between Robinhood, Figure Markets, and OKX hinges on your trading goals and experience. Robinhood excels for beginners with its commission-free, user-friendly platform, but lacks depth for advanced traders. Figure Markets leads in tokenised RWAs, ideal for accredited investors seeking high-yield assets, yet its exclusivity limits broader appeal. OKX offers unmatched versatility with diverse assets and tools, but its complexity and U.S. restrictions may deter some. Align your choice with your needs—simplicity, institutional-grade investments, or global trading power—to navigate the crypto landscape effectively. Always research thoroughly before investing.

Frequently Asked Questions (FAQs)

What types of users are best suited for Robinhood’s crypto trading platform?

Robinhood is ideal for beginners and casual investors in the U.S. who want a simple, commission-free way to buy and sell a limited selection of ~18 cryptocurrencies. Its mobile-first interface and integration with stocks and ETFs make it perfect for those new to crypto or seeking a streamlined experience.

What makes Figure Markets different from other crypto exchanges?

Figure Markets specialises in tokenised real-world assets (RWAs), such as U.S. Treasuries, private credit, and real estate tokens. Unlike traditional crypto exchanges, it targets accredited investors and institutions, offering DeFi integration and high-yield opportunities backed by blockchain technology.

Can I use OKX if I’m based in the United States?

OKX’s full exchange services are not available in the U.S. due to regulatory restrictions. However, U.S. users can access OKX’s Web3 wallet for DeFi and NFT activities. For trading, U.S. residents should consider Robinhood or Figure Markets.

How do the fees compare across Robinhood, Figure Markets, and OKX?

Robinhood offers commission-free crypto trading but incorporates a spread (typically 1-2%) in its pricing. Figure Markets’ fee structure is less transparent but likely higher due to its institutional focus. OKX uses a tiered maker/taker fee model (0.02%-0.10%), which is competitive for high-volume traders.

Which exchange offers the widest range of cryptocurrencies?

OKX supports over 350 cryptocurrencies and 500+ trading pairs, far surpassing Robinhood’s ~18 coins and Figure Markets’ focus on tokenised RWAs and select crypto assets. OKX is the go-to for traders seeking diverse altcoin exposure.