In the fast-paced world of Decentralised Finance (DeFi), lending and borrowing have long been dominated by pooled liquidity models like those on Aave or Compound, where variable interest rates and limited asset support often expose users to volatility and inefficiency. On Solana, a high-throughput blockchain known for its speed and low fees, these challenges are amplified by the ecosystem’s focus on memecoins and yield farming, leaving room for innovation in capital markets. Enter Loopscale, a modular lending platform that introduces an order book-based system for fixed-rate borrowing and lending, tailored for the next generation of on-chain assets.

This article delves into Loopscale’s innovative mechanics, flagship products, user applications, and challenges, including a notable security incident earlier in the year. By blending modularity with Solana’s ecosystem—integrations with protocols like Hylo, OnRe Finance, and Adrena—Loopscale is positioning itself as a foundational layer for on-chain credit markets. For crypto investors, yield farmers, and developers, it promises better rates, asset flexibility, and reduced risk, potentially redefining DeFi and crypto lending in a post-hype Solana landscape.

Table of Contents

Evolution of Loopscale

Loopscale’s roots trace back to 2021, when it operated under the name Bridgesplit, focusing on on-chain liquidity infrastructure for Solana. Founded by a team with expertise in DeFi apps and their primitives—led by figures like Luke Truitt, who has spoken on building on-chain credit markets—the project initially raised $4.25 million in seed funding from prominent backers including Solana Labs, Coinbase Ventures, CoinFund, Jump Capital, and Solana Ventures. Subsequent rounds pushed total funding to around $8.25 million by mid-2025, fueling development amid Solana’s DeFi boom.

The platform’s full evolution came with its new launch as Loopscale, introducing a modular order book model that shifted from algorithmic rate pools to direct lender-borrower matching. This pivot addressed Solana-specific needs, such as integrating with Jupiter for swaps and Kamino for yield optimisation, while supporting diverse collaterals like staked SOL (LSTs) and LP tokens. Early traction was swift: Within days of launch, deposits exceeded $40 million, driven by fixed-rate appeals in a volatile market.

By Q2 2025, Loopscale hit $62 million in deposits, marking substantial progress with releases like P&L tracking cards and integrations for leveraged yields. The team’s background in protocols like Centrifuge informed its focus on real-world asset (RWA) compatibility, though public details remain sparse—emphasising pseudonymous development common in Solana DeFi. Partnerships flourished, including with Adrena for ADX rewards (boosting USDC yields to 10%+), OnRe Finance for points farming, and Hylo for restaked SOL loops. Recent X activity highlights community-driven growth, with users farming dual airdrops via Loopscale’s loops, such as 3x OnRe points alongside 10% APY.

This evolution positions Loopscale as a response to Solana’s maturation, where memecoin frenzy gives way to structured finance. From seed funding to post-launch TVL surges, it exemplifies how targeted innovation can capture market share in a competitive ecosystem.

How Loopscale Works

Loopscale’s engine is its on-chain order book, a departure from pooled models that use automated market makers (AMMs) for rates. Instead, it facilitates direct matching of lenders and borrowers, enabling fixed rates, custom terms, and isolated markets to prevent contagion. Built on Solana’s Rust-based smart contracts, this system leverages the chain’s 65,000 TPS capacity for near-instant executions at sub-cent fees, ideal for high-frequency lending.

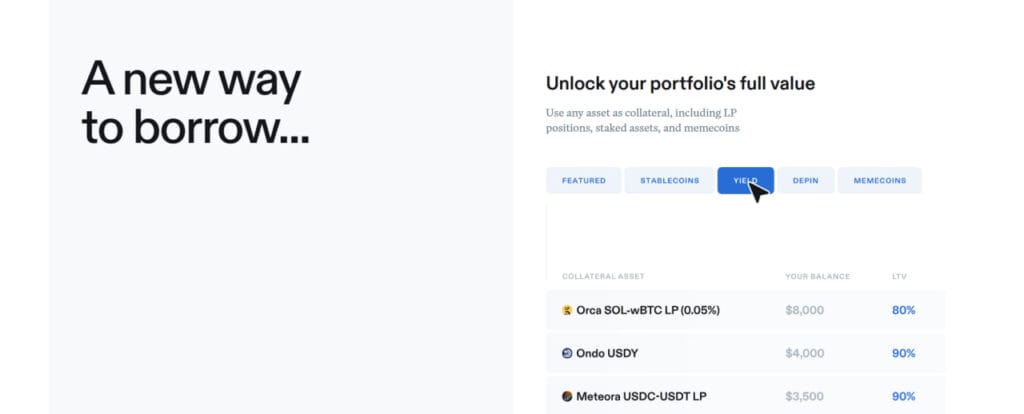

At the heart is the borrowing process: Users collateralise assets—ranging from stablecoins like USDC to exotic ones like memecoins or JLP (Jupiter LP tokens)—for overcollateralized loans. Borrowers set fixed durations (e.g., 3 months) to lock rates, avoiding spikes from market volatility. The order book matches orders based on parameters like LTV (up to 80% for stables) and exposure limits, with atomic settlements ensuring no partial fills. For example, borrowing USDC against hyloSOL allows users to retain staking rewards while accessing liquidity at ~5% fixed APY.

Lending mirrors this modularity: Suppliers define assets, minimum rates, and risk tolerances, creating personalised order books. Idle capital is optimised by routing to variable-rate protocols, boosting yields—recently up to 12.56% on USDC via OnRe integrations. The matching engine uses Solana’s program-derived addresses (PDAs) for secure, isolated positions, reducing systemic risks compared to monolithic pools.

Technically, Loopscale employs oracles for pricing (post-hack upgrades enhanced this), supporting isolated collateral to mitigate oracle failures. Onboarding is straightforward: Connect a wallet like Phantom to the app interface, view markets, and submit orders. P&L cards, launched in September 2025, provide real-time tracking of returns, customizable for lending or looping.

This mechanics set enables “powerful markets made simple,” with higher efficiency than competitors like Marginfi (variable rates only). By democratising fixed-rate access, Loopscale unlocks strategies like hedging memecoin exposure or amplifying LST yields, all while maintaining Solana’s composability.

Flagship Features: Vaults and Loops

Loopscale’s products shine through Vaults and Loops, extending its core mechanics into user-friendly, high-yield tools. Vaults are managed lending pools curated by experts, offering passive strategies with defined risk profiles. The flagship Loopscale USDC Vault, self-managed by the team, deposits into fixed-rate borrow markets while deploying idle funds to variable protocols like those from Adrena, yielding 10%+ base APY plus ADX rewards. Other vaults, like the JLP example, support deposits of 6 JLP with leverage sliders (1x unleveraged, up to 4x), locking rates for 3 months to predict costs.

Curators—third-party managers—earn fees by designing vaults, fostering a marketplace of strategies (e.g., RWA-focused via OnRe’s PT-ONyc, yielding 37.43% when looped). Benefits include diversified exposure and expert oversight; for instance, the OnRe USDC Vault hit $3.5M deposits, offering 12.56% APY and 3x points for airdrop farming. Compared to Kamino’s automations, Vaults provide fixed-rate stability, ideal for conservative lenders.

Loops build on this for aggressive yield: One-click leveraged positions multiply returns from yield-bearing assets like staked SOL or LPs. Users deposit (e.g., hyloSOL), select leverage (3x-4x), and borrow at fixed rates, compounding APY—recently up to 206.9% on ALP (Adrena LP) loops or 92.4% on Fragmetric’s wfragSOL. Integrations amplify this: Looping Hylo PTs from Exponent or RateX earns XP points while borrowing USDC/SOL, with net APYs around 34% after borrow costs.

For builders, API access (though sparse in docs) allows custom integrations; curators monetise via fees. Early withdrawals and default customisations add flexibility. Versus Tulip’s yield vaults, Loopscale’s fixed costs and broad collateral (e.g., fragBTC LPs) offer superior leverage without slippage, though APYs fluctuate (0.00% placeholders mask real 10-200% peaks). These features make Loopscale a yield powerhouse, blending simplicity with sophistication.

User Experience

- Loopscale’s interface prioritises accessibility: The minimalist homepage funnels users to the app, where a dashboard displays markets, positions, and P&L cards for intuitive monitoring. Wallet connection is seamless via Solana standards, with leverage sliders and one-click deposits streamlining flows—no gas wars here.

- A typical borrow: Select hyloSOL as collateral, borrow USDC at 5% fixed, deploy elsewhere for 19% yield—net 14% minus fees, plus Hylo XP. Lending USDC into the OnRe Vault yields 12.56% + points, trackable via dashboard. Loops simplify amplification: Deposit JitoSOL, 3x leverage via Fragmetric for 92.4% APY, earning F points.

- Applications span retail to advanced: Yield farmers loop LSTs for compounded staking (e.g., 34% net on hyloSOL-USDC). Traders hedge memecoins by borrowing stables against them, avoiding sales. Airdrop hunters farm dual rewards—OnRe points via loops, Hylo XP on collaterals—often at 10%+ base yields. Community on X buzzes with strategies, like RateX-Exponent loops for controlled leverage.

- Ecosystem ties enhance UX: Partnerships with Orca, Raydium, and Exponent enable seamless composability. Low barriers suit Solana natives, but education on leverage is key—tutorials in-app guide novices. Overall, Loopscale delivers frictionless DeFi, turning complex tactics into clicks.

Risks and Security

- Despite innovations, Loopscale carries DeFi risks: Leverage of up to 4x amplifies liquidations if collateral drops (e.g., due to memecoin volatility). Smart contract bugs and oracle dependencies persist, alongside Solana congestion. Overcollateralization (150%+ typical) mitigates but doesn’t eliminate these.

- Security emphasises isolation: Modular markets limit breaches, with PDAs securing funds. Audits (implied post-launch) and upgrades focus on pricing oracles.

The April 26, 2025, hack underscored vulnerabilities: Two weeks post-launch, an attacker exploited oracle manipulation in pricing, draining $5.8 million (5.7M USDC, 1,200 SOL) via undercollateralized loans—12% of TVL. Unlike off-chain attacks, this was a smart contract flaw, per Halborn’s post-mortem. The team paused functions, negotiated a 10% bounty ($580K), and recovered funds swiftly. A detailed report followed, outlining oracle fixes and the recovery roadmap. Mitigations include enhanced oracles and bug bounties; no incidents since. Users should monitor health factors and diversify, as regulatory scrutiny on Solana DeFi grows.

Conclusion

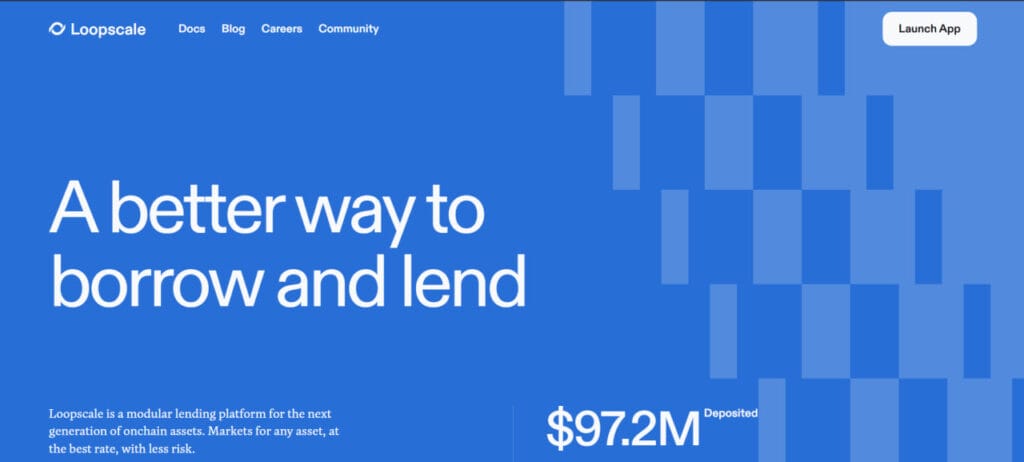

Loopscale reimagines DeFi lending on Solana through modular order books, fixed rates, and versatile products like Vaults and Loops, delivering superior yields and risk control. From $40M launch TVL to $97M today, its growth amid challenges like the April hack affirms resilience. Explore the app for hands-on strategies, but always DYOR—leverage risks remain. As Solana evolves, Loopscale stands ready to power the next era of on-chain capital.

Frequently Asked Questions (FAQs)

What is Loopscale, and how does it differ from other DeFi lending platforms?

Loopscale is a modular lending platform on Solana that uses an on-chain order book to match lenders and borrowers, offering fixed-rate loans and lending for a wide range of assets, including LP positions, staked tokens, and memecoins. Unlike traditional DeFi platforms like Aave or Compound, which rely on pooled liquidity with variable rates, Loopscale provides customizable terms, isolated markets, and predictable costs, reducing risks like impermanent loss and volatility exposure.

What are the main products offered by Loopscale?

Loopscale features three core products: Lend, Borrow, and Loop. Lend allows users to supply assets with personalized parameters for higher yields, often through expert-curated Vaults like the Loopscale USDC Vault. Borrow enables overcollateralized loans using diverse assets at fixed rates. Loop offers one-click leveraged strategies to amplify returns on staked assets or LPs, with options like 1x to 4x leverage and locked rates for 3 months.

How safe is Loopscale, especially after the 2025 hack?

While Loopscale has implemented security measures like isolated markets and enhanced oracles post-hack, DeFi inherently carries risks such as smart contract vulnerabilities and leverage-related liquidations. The April 2025 hack, which saw $5.8 million drained due to an oracle exploit, led to swift recovery and upgrades, including bug bounties and improved pricing mechanisms. Users should monitor collateral health and diversify to mitigate risks.

How can I start using Loopscale, and what do I need?

To begin, connect a Solana-compatible wallet (e.g., Phantom) to the Loopscale app. You’ll need some SOL for transaction fees and assets to lend, borrow, or leverage (e.g., USDC, JLP, or staked SOL). The app provides a dashboard to view markets, set orders, and track P&L, with tutorials for beginners. Ensure you understand leverage risks before proceeding.

What future developments can we expect from Loopscale?

Loopscale plans to expand with more Vaults (e.g., RWA-focused), enhance builder APIs, and potentially launch a token amid airdrop campaigns. Recent integrations like Hylo loops and partnerships with protocols like OnRe and Adrena suggest deeper ecosystem growth. These updates aim to boost liquidity and attract TradFi interest, solidifying its role in Solana’s DeFi landscape.