Yo, what’s up! Altie here, ready to break down the ultimate showdown between Binance, Hyperliquid, dYdX, and GMX! These platforms are all fighting for the top spot in the world of perpetual contracts, liquidity, and low fees.

Whether you’re into the fast-paced action of centralized exchanges or the decentralized freedom of platforms like GMX and Hyperliquid, we’ve got you covered. In this article, we’ll compare their key metrics, execution speeds, and fees, so you can make the right call based on your trading needs. Let’s dive in!

In the world of crypto trading, liquidity, fees, execution speed, and market coverage are paramount to making the right choice when selecting a platform. The competition in decentralized and centralized exchanges is fierce, and traders often find themselves weighing different metrics to identify the best platform for their needs.

The following charts and data sets offer a glimpse into the performance of Binance, Hyperliquid, dYdX, and GMX in 2025.

These metrics include not just total trading volumes, but also detailed breakdowns of stablecoin balances, inflows and outflows, and total market share. Here’s a look at how Binance stacks up with decentralized platforms such as Hyperliquid, dYdX, and GMX

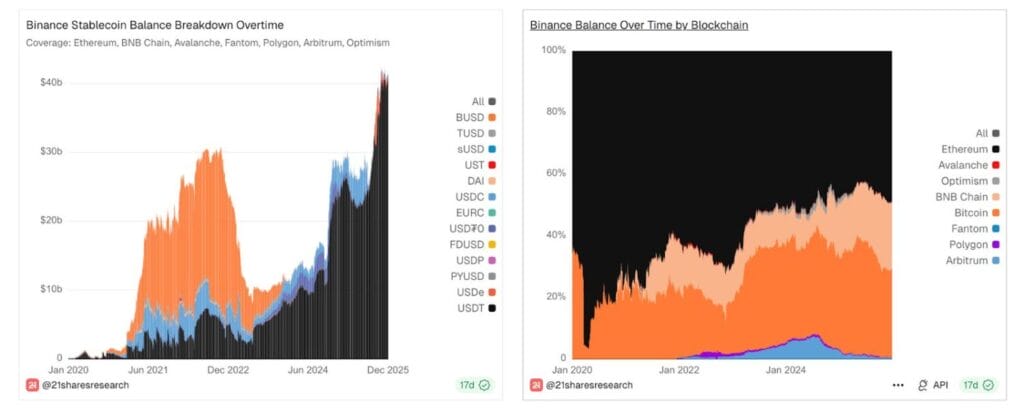

The Binance Stablecoin Breakdown Over Time and Binance Asset Flow Summary charts provide critical insights into Binance’s performance:

Stablecoin Balances: The stablecoin balance for Binance has seen massive growth, especially from 2021 to 2025. The stablecoin assets in USD peaked at over $40 billion, with BUSD leading the charge. This indicates Binance’s ability to maintain vast liquidity, particularly in USDT, DAI, and USDC, which dominate the market.

The breakdown over time reveals significant fluctuations, especially as new blockchain platforms (like BNB Chain, Ethereum, and others) take increasing shares of Binance’s total stablecoin balances.

The dominance of BUSD and USDT underlines Binance’s strategic focus on stablecoins, which offer liquidity depth in both spot and perpetual markets.

Binance 24-Hour Asset Flow:

The 24-hour net inflow is a staggering $304.11 million, which showcases Binance’s liquidity and trading activity, solidifying its position as the largest exchange by volume.

The inflow of $1.65 billion and outflow of $1.35 billion further demonstrate Binance’s dominance and liquidity. This strong flow of assets highlights its role as a market leader in both centralized and decentralized trading, offering tight spreads and deep liquidity for traders.

Hyperliquid’s performance, shown in the screenshot, emphasizes key metrics relevant for perpetual contract traders:

Total Value Locked (TVL): Hyperliquid has a TVL of $4.255 billion, a significant number for a decentralized platform. This indicates that the platform is gaining traction, with substantial funds locked into perpetual contracts.

Fees & Revenue:

- The annual fees for Hyperliquid are recorded at $707.67 million, showing that despite being a relatively new platform, it is able to generate considerable revenue, signaling active trading and growing adoption.

- The $629.45 million in holders’ revenue is another indicator that Hyperliquid’s liquidity pools are profitable for stakers, which contributes to the platform’s growing ecosystem.

Perpetual Volume: Hyperliquid’s perpetual contract volume shows consistent growth, with $144.809 billion in 30-day perpetual volume. This showcases its competitive edge in low slippage and efficient liquidity routing, key selling points for traders who prioritize minimal price impact in fast-paced markets.

Looking at dYdX, the platform that uses Layer 2 (StarkEx) for faster and cheaper trading, we see:

Total Value Locked (TVL): dYdX’s TVL is around $198.07 million. While this is smaller compared to Binance and Hyperliquid, it shows that dYdX is still a strong player in the derivatives market, particularly for professional traders seeking high-frequency and leveraged trading options.

Perpetual Volume: dYdX has experienced significant fluctuations in perpetual volume, especially in 2022-2023, with spikes driven by volatile markets. The $9.357 billion in 30-day perpetual volume indicates dYdX’s focus on derivatives and high-leverage trading.

Revenue: dYdX’s annual fees of $4.11 million highlight the platform’s smaller but dedicated user base, focusing more on advanced trading tools than on offering a broad range of assets.

Lastly, GMX, a decentralized platform focused on perpetual contracts and low fees, shows impressive data:

Total Value Locked (TVL): GMX’s TVL stands at $408.37 million, which indicates strong adoption in the decentralized space for its perpetual contract offerings. This TVL is impressive, especially considering GMX’s focus on lower fees and decentralized liquidity pools.

Perpetual Volume: GMX has experienced major spikes in perpetual contract volume, particularly during periods of high volatility. The $3.836 billion in 30-day perpetual volume signifies growing trader confidence in GMX’s liquidity model.

Fees & Revenue: GMX’s annual fees stand at $32.88 million, highlighting its success in generating revenue from its decentralized liquidity model. While lower than Binance, GMX’s low fees for perpetual trading make it an attractive choice for retail traders seeking cost-effective options.

Table of Contents

Introduction

The world of crypto trading can be overwhelming, with so many options for where and how to trade. In this article, we’ll break down four major platforms: Hyperliquid, Binance, dYdX, and GMX.

- Hyperliquid focuses on decentralized perpetual contracts with low slippage, providing an efficient liquidity routing system to ensure smooth execution for traders.

- Binance is a centralized exchange (CEX) that’s been a major player in the crypto space, offering everything from spot trading to futures and perpetual contracts, boasting huge liquidity across a variety of assets.

- dYdX is a decentralized exchange (DEX) known for high-frequency trading and advanced risk management, catering to both professional traders and retail investors with sophisticated tools.

- GMX stands out with its decentralized liquidity model and user-friendly perpetual contracts, offering low fees and strong market coverage.

Choosing between centralized and decentralized platforms is a common dilemma for traders.

While centralized platforms like Binance offer liquidity and speed, decentralized platforms like Hyperliquid, dYdX, and GMX provide transparency and control over assets. This article will help traders weigh these factors by comparing key performance metrics for 2025.

Key Metrics Comparison

| Platform | Execution Speed | Fees | Liquidity | Market Coverage | Security |

| Binance | Fast | Low (with BNB discount) | Excellent | Extensive | Custodial Risk |

| dYdX | Good (Layer 2) | Low | Strong | Niche (Derivatives) | Smart Contract Risk |

| GMX | Moderate | Very Low | Strong (Decentralized) | Moderate | Smart Contract Risk |

| Hyperliquid | Fast | Competitive | Efficient (Decentralized) | Moderate | Smart Contract Risk |

Platform Deep Dives

Hyperliquid

Hyperliquid is a decentralized trading platform focusing primarily on perpetual contracts. Its key selling point is its low slippage and efficient liquidity routing, which ensures that users experience minimal price impact when trading.

Hyperliquid’s unique approach leverages decentralized liquidity pools to maintain high liquidity for its perpetual contracts, making it a strong contender in the decentralized finance (DeFi) space.

Trading Volume: Hyperliquid’s trading volume has been consistently rising, particularly in the perpetual contracts market. This is a testament to the growing demand for decentralized trading with low slippage.

Assets Supported: The platform primarily supports perpetual contracts for major cryptocurrencies like BTC, ETH, and a few other high-volatility tokens.

User Base: As a decentralized platform, it has a growing community of traders, particularly those who prefer DeFi solutions over centralized exchanges. However, its user base is not as large as Binance’s, which limits its market penetration.

- Execution Speed: Hyperliquid excels in execution speed due to its efficient liquidity routing system. It provides fast order matching, particularly for perpetual contracts, which makes it ideal for active traders seeking low slippage.

- Fees: The platform offers competitive fees for perpetual contract trading. It doesn’t have the extensive fee structure of centralized exchanges but keeps costs low compared to other decentralized platforms. Traders can expect minimal fees per trade, making it cost-effective for high-frequency traders.

- Liquidity: Liquidity on Hyperliquid is powered by decentralized pools, and the platform’s efficient liquidity routing ensures low slippage even during high volatility periods. However, compared to Binance, the liquidity may not be as deep, but it’s more than adequate for most traders focused on decentralized trading.

- Security: Hyperliquid operates on smart contracts, so it is non-custodial. This means users retain control over their funds at all times. The platform conducts regular audits to ensure that its smart contracts are secure. However, as with any decentralized platform, the risk of smart contract vulnerabilities remains.

Hyperliquid stands out due to its low slippage and efficient liquidity routing in the decentralized space.

While it doesn’t have the liquidity depth of centralized exchanges like Binance, its decentralized approach allows users to maintain full control over their funds while experiencing minimal price impact on trades.

Hyperliquid performs particularly well in the low slippage category, which is important for traders who are highly sensitive to price movements.

While Binance excels in liquidity and volume, Hyperliquid offers a more decentralized alternative with an efficient liquidity model that minimizes slippage. It’s an ideal choice for traders who prefer decentralized finance solutions but still want fast, reliable execution for their perpetual contracts.

Binance

Binance is a centralized exchange (CEX) and one of the largest crypto trading platforms globally. It offers a wide range of services, including spot trading, futures, perpetual contracts, and more.

Binance is well-known for its liquidity, making it a go-to platform for both retail and professional traders looking for execution speed and reliability.

Trading Volume: Binance consistently leads the market with some of the highest trading volumes across various assets, particularly for Bitcoin, Ethereum, and stablecoins.

Assets Supported: Binance supports thousands of trading pairs across multiple assets, including a vast array of cryptocurrencies and derivatives.

User Base: With over 300 million users, Binance dominates the global exchange space, providing a vast and active user base.

- Execution Speed: Binance’s centralized infrastructure allows for incredibly fast order matching and low latency. This makes it an ideal platform for high-frequency traders and those who value speed in execution.

- Fees: Binance’s fees are competitive, starting at 0.1% for both maker and taker. However, users can reduce fees further by using Binance Coin (BNB) for payments or by staking a certain amount of BNB.

- Liquidity: Binance leads in liquidity, consistently offering tight spreads and minimal slippage, especially in high-volume markets like BTC/USDT and ETH/USDT.

- Security: Binance invests heavily in security with features like 2FA, asset insurance, and regular audits. However, as a custodial exchange, users must trust Binance to safeguard their funds, introducing a level of custodial risk.

Binance’s main strength lies in its liquidity and execution speed. With its industry-leading infrastructure,

Binance offers unparalleled trading volume and tight spreads across thousands of pairs. This makes it the go-to platform for users looking for reliability, speed, and extensive market coverage.

When compared to decentralized platforms like Hyperliquid or GMX, Binance stands out due to its liquidity and volume.

While decentralized platforms offer greater control over funds, they often lack the liquidity and speed offered by Binance. This makes Binance a better choice for retail traders or professionals looking for tight spreads and fast execution, especially during times of high volatility.

dYdX

dYdX is a decentralized exchange (DEX) that specializes in derivatives trading, particularly perpetual contracts.

It is built on Layer 2 solutions (StarkEx) to enhance speed and scalability, offering a platform suitable for high-frequency traders and institutional investors.

dYdX’s focus is on providing an advanced trading experience with features like margin trading, high leverage, and advanced risk management tools.

Trading Volume: dYdX has grown substantially, with significant trading volume in perpetual contracts, especially for major assets like BTC and ETH.

Assets Supported: dYdX supports a solid range of perpetual contracts, primarily focused on crypto assets such as BTC, ETH, and a few altcoins.

User Base: As a decentralized platform, dYdX has a dedicated user base, particularly among advanced traders and institutions. Its user base is growing, but it’s still smaller than that of Binance.

- Execution Speed: By utilizing Layer 2 solutions (StarkEx), dYdX offers fast execution for its users. This improves latency and trade matching times, ensuring that users experience high-frequency trading speeds without compromising security.

- Fees: dYdX operates with relatively low fees for decentralized trading, but it has a slightly more complex fee structure compared to centralized exchanges. Traders must consider opening and closing fees for perpetual contracts. Nonetheless, its fees remain competitive in the decentralized space.

- Liquidity: While dYdX leverages Layer 2 to enhance speed and scalability, its liquidity pool depth is not as vast as Binance’s. However, it provides sufficient liquidity for most major assets and pairs, with low slippage.

- Security: As a decentralized platform, dYdX offers non-custodial trading, meaning users retain control over their funds. The platform also conducts regular smart contract audits to maintain a high-security standard. However, decentralized platforms face inherent risks like smart contract vulnerabilities.

dYdX is unique for its advanced trading tools, including high leverage, margin trading, and risk management features.

The platform is well-suited for professional traders who need more than just spot trading, offering institutional-grade tools for sophisticated strategies.

dYdX shines in terms of advanced features for professional traders, especially those looking for leverage and high-frequency trading.

It offers a strong alternative to centralized platforms like Binance for those who want decentralized solutions but need advanced risk management tools and high leverage options. However, it may not have the same liquidity as Binance, and its interface and tools may be more complex for new traders.

GMX

GMX is a decentralized exchange (DEX) that focuses on perpetual contracts with low fees and decentralized liquidity.

It operates on Layer 2 solutions like Arbitrum and Avalanche, providing decentralized perpetual contract trading with competitive fees and excellent user experience.

GMX offers highly liquid perpetual contracts without relying on centralized order books, using decentralized liquidity pools instead.

Trading Volume: GMX has gained significant attention in the DeFi space, with rising trading volume, especially in perpetual contracts.

Assets Supported: GMX supports major assets like BTC, ETH, and other high-velocity tokens in the perpetual contracts market.

User Base: GMX is growing rapidly, thanks to its low fees, decentralized model, and user-friendly interface. Its user base is mostly retail traders looking for decentralized perpetual contracts with low costs.

- Execution Speed: GMX’s use of Layer 2 solutions like Arbitrum ensures fast execution speeds with minimal latency, providing an optimal experience for traders who prioritize speed.

- Fees: GMX is known for its low fees, with a flat 0.1% fee for both makers and takers on perpetual contracts. This is particularly attractive for high-frequency traders who wish to minimize their trading costs.

- Liquidity: Liquidity on GMX is provided through decentralized liquidity pools, primarily on Arbitrum and Avalanche. While it doesn’t have the liquidity depth of Binance, GMX performs well in maintaining tight spreads and low slippage in the decentralized space.

- Security: Like other decentralized platforms, GMX is non-custodial, meaning users control their funds at all times. GMX is also audited regularly to ensure its smart contracts are secure, but it still faces the risks associated with decentralized finance.

GMX excels due to its low fees, decentralized liquidity model, and user-friendly interface for perpetual contracts. It offers traders a decentralized alternative to centralized exchanges with a focus on low-cost trading and a seamless user experience.

GMX is a strong alternative for those looking for a decentralized solution with low fees and easy-to-use perpetual contracts.

It excels in areas where centralized platforms like Binance have higher fees. However, it may lack the same liquidity depth, making it less ideal for traders needing extremely deep liquidity or access to a wide range of assets.

Comparison Table

Here’s a quick comparison of the key metrics across Hyperliquid, Binance, dYdX, and GMX:

| Metric | Hyperliquid | Binance | dYdX | GMX |

| Execution Speed | Fast (Low slippage, decentralized liquidity) | Ultra-fast (Centralized infrastructure) | Fast (Layer 2 solutions) | Fast (Layer 2 solutions) |

| Trading Volume | Growing (Focused on perpetual contracts) | High (Industry leader) | High (In derivatives market) | Moderate (Strong decentralized volume) |

| Fees | Competitive (Low fees for perpetual contracts) | Low (Fee discounts with BNB) | Low (Fees for opening/closing positions) | Very Low (0.1% maker/taker) |

| Assets Supported | Limited (Mainly perpetual contracts) | Extensive (Thousands of pairs) | Moderate (Focus on derivatives) | Moderate (Major cryptos, Perpetual contracts) |

| Liquidity Depth | Strong (Efficient liquidity routing) | Excellent (High liquidity across pairs) | Strong (Layer 2 liquidity) | Strong (Decentralized liquidity pools) |

| User Base | Growing (Decentralized community) | Largest in crypto (300M+ users) | Growing (Traders looking for advanced tools) | Growing (DeFi-focused retail traders) |

| Security | Smart contract security (Decentralized) | Custodial risk (Security audits) | Smart contract security (Decentralized) | Smart contract security (Decentralized) |

Security & Risk Management

When it comes to security, each platform has its own strengths and weaknesses, especially when comparing centralized and decentralized models.

Smart Contract Risk

- Hyperliquid: As a decentralized platform, Hyperliquid relies on smart contracts to facilitate trading. While this allows for greater transparency and control, it also exposes users to risks associated with smart contract vulnerabilities.

- dYdX: dYdX operates on Layer 2 solutions and smart contracts, which provides users with a decentralized trading experience but introduces the risks tied to smart contract failures or bugs. The platform does regularly undergo audits to mitigate these risks.

- GMX: GMX also operates through decentralized smart contracts. While it offers users non-custodial control of funds, it still faces the same risks associated with vulnerabilities in the underlying smart contract code.

- Binance: As a centralized platform, Binance takes on custodial risk. However, it heavily invests in security protocols, including asset insurance, multi-signature wallets, and security audits to safeguard users’ funds.

Custodial Risk

- Hyperliquid and dYdX are non-custodial, meaning users retain full control of their funds. This reduces custodial risks but introduces the need for users to manage their private keys securely.

- GMX is similarly non-custodial, leveraging decentralized liquidity pools and user control over funds.

- Binance operates with a custodial model, meaning that users’ funds are held in Binance’s wallets. While Binance employs advanced security protocols, it also makes users reliant on Binance’s security measures, which introduces custodial risk.

Audit and Transparency

- Hyperliquid and dYdX both undergo regular smart contract audits to ensure their systems are secure and free from vulnerabilities. However, users need to be aware that no system is entirely risk-free.

- GMX is similarly transparent, conducting smart contract audits and ensuring its decentralized system is secure.

- Binance also undergoes regular audits, and its centralized model allows for more direct oversight of user funds, although it may not be as transparent as decentralized platforms.

Liquidity & Market Impact

Security issues can sometimes affect liquidity. For example, if a vulnerability is discovered in a decentralized protocol, liquidity pools might be temporarily impacted, affecting trades and causing higher slippage. Binance, with its centralized liquidity model, can quickly resolve such issues and maintain uninterrupted trading. On the other hand, decentralized exchanges like GMX, dYdX, and Hyperliquid may experience delays in addressing liquidity disruptions caused by smart contract vulnerabilities or system updates.

How to Choose the Right Platform Based on Metrics

Now that we’ve compared key metrics, let’s break down how to choose the best platform based on what matters most to you as a trader:

For Speed & Liquidity:

- If execution speed and liquidity are your top priorities, Binance is the clear winner. With its centralized infrastructure, Binance leads in liquidity, tight spreads, and fast order execution, making it ideal for traders who need speed and reliability, especially in volatile markets.

For Low Fees:

- If minimizing fees is your key factor, GMX and Hyperliquid stand out. GMX offers extremely low fees (0.1% maker/taker), making it an excellent choice for traders focused on cost savings. Hyperliquid also provides competitive fees, especially in the decentralized space.

For Advanced Features & Risk Management:

- dYdX is the platform to choose if you’re a professional trader looking for advanced features like leverage, margin trading, and sophisticated risk management tools. The platform excels in high-frequency trading and complex strategies, particularly for institutional-grade traders.

For Decentralized Options:

- If you prioritize decentralization, Hyperliquid and GMX offer robust decentralized options. GMX is especially appealing due to its low fees and decentralized liquidity, while Hyperliquid shines in low slippage for perpetual contracts.

Conclusion

- Binance: Industry-leading liquidity, fast execution, and a comprehensive range of assets make it ideal for retail traders and those looking for high-volume, fast execution with minimal slippage.

- dYdX: Known for its advanced trading tools and high-frequency trading capabilities, dYdX excels with professional traders who need advanced risk management and leverage options.

- GMX: Low fees, decentralized liquidity, and a user-friendly interface make GMX the go-to platform for retail traders who want a decentralized alternative with a simple and efficient perpetual contracts experience.

- Hyperliquid: With low slippage and a decentralized liquidity model, Hyperliquid is a great choice for traders who prioritize low-cost, decentralized perpetual contract trading.

When choosing between these platforms, consider your trading goals:

- Binance is great for traders focused on speed and liquidity.

- dYdX excels for advanced traders seeking high leverage and complex strategies.

- GMX and Hyperliquid offer decentralized solutions with low fees, making them ideal for those who value decentralization and minimal slippage.

Ultimately, the choice depends on your trading style, risk tolerance, and whether you prioritize centralized or decentralized platforms.

And that’s a wrap! From Binance’s massive liquidity to GMX’s low fees and Hyperliquid’s decentralized edge, each platform brings something unique to the table.

Whether you’re a retail trader looking for fast execution or a pro trader seeking advanced tools, this comparison has you covered. Just remember, your platform choice depends on what matters most, liquidity, fees, or decentralization. Keep your eyes on the charts, and always trade smart! Until next time, stay bullish, fam!