Currency.com is the first platform, as they say, to bridge the gap between the old-school investment system and the new investment industry, i.e., stocks and crypto industry. Further, it has connected these two investment industries, which sounds interesting right? So in this Currency.com review, we’d talk about all its features and talk about why this platform can turn out to be one of your options.

Table of Contents

Summary

- Currency.com is the first platform to connect two worlds of investment.

- Low fees and no hidden charges.

- Standard security is practised by adhering to industry security norms. In addition, features like 2FA and audits are regulated.

- Different markets are available for stocks, crypto, indices, shares, and commodities.

- Mobile applications are available.

- Deposit and withdrawal are made easy with various payment options available.

What is Currency.com?

Currency.com is the first platform regulating tokenized securities and is a crypto exchange based in Belarus. You must be wondering what tokenized securities are? We will be covering that later in the article. However, other than the regulation of tokenized securities, the platform lets you trade the traditional assets and commodities, while at the same time, you can also trade your crypto. This can be done with crypto and fiat currencies, with no deposit fees. Finally, you can again make the withdrawal in crypto or fiat.

What is Tokenized Securities?

For a fundamental understanding, tokenized securities are nothing but your asset, be it a digital currency, stocks, shares, indices, or commodity that is now a token. Now the platform Currency.com releases these tokens, a cryptocurrency representing the underlying asset. You can buy the tokenized assets with fiat or crypto. The liquidity for these tokenized securities is provided by the partner company Capital.com.

These tokenized securities let the user benefit by providing diversified financial instruments and, at the same time, increasing crypto holdings.

Also Read: A simple explanation of Security Token

How does Tokenised Securities Trading Work?

Trading with tokenized securities works the same way as any other investment instrument works. The potential for profit and losses are the same. You can buy or sell these tokenized securities and either make a profit or a loss. That’s how trading works, and the situation is the same for these tokens. You can purchase these securities with fiat and crypto. At present, the platform provides the top two thousand plus tokenized assets and crypto. However, the platform aims to take these assets up to 10,000.

Currency.com Review: Products

Knowing that the platform bridges the gap between traditional financial investment and the new crypto way, it is also a crypto exchange platform. And thus has various products to offer to its users.

Also Read: CEX.IO Staking – The Best Way to Earn Passive Income?

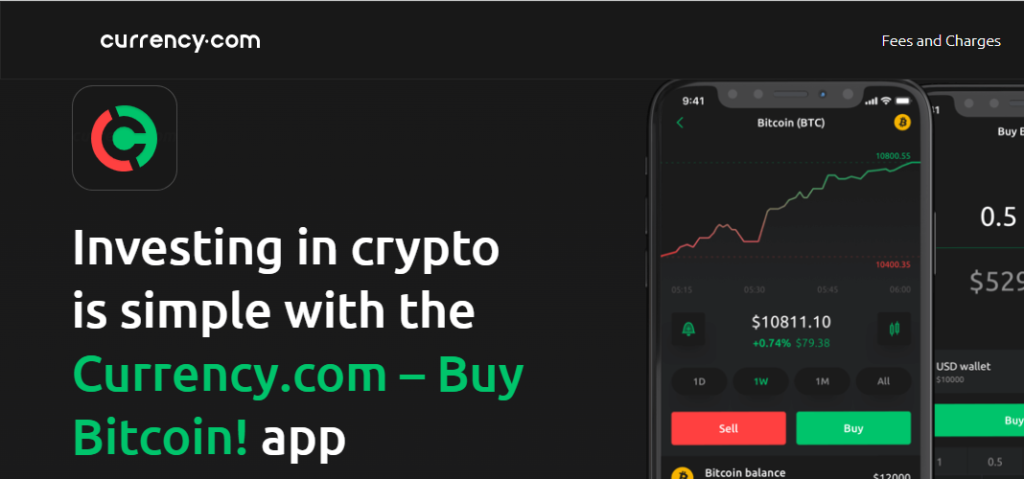

Currency.com Review: BUY BITCOIN

As the platform calls it, “easy, simple, and functional.”,” All you have to do is simply download the application of currency.com on your mobile phone using fiat money at the best competitive prices. The platform provides the application on both Android and iOS. Once the application is on your phone, you must verify yourself. The platform asks for a two-factor KYC(know-your-customer). Once the verification is completed, you can safely start your purchase of cryptocurrencies.

The platform’s interface is beginner-friendly, which means the navigation or application becomes a cakewalk. Not only is the interface friendly, but the financial diversification is a plus over there. Currency.com accepts card payment for ease and convenience.

You can find most of the popular cryptocurrencies, like Bitcoin, Ethereum, Dogecoin, and many more.

Finally, the platform supports Visa cards and Mastercards payment systems.

Currency.com Review: Crypto Platform

As the platform Currency.com is an exchange, it speaks for its trading platform. The platform’s most significant exclusive trading feature has been discussed above, which is trading Tokenised securities. The trading platform of Currency.com connects both the financial system of investing and allows trading.

The trading platform supports both types of currencies, fiat, and crypto. However, note that if you have tokenized tokens in your profit, you can reinvest those tokens as well. Thus, you have a diversified financial system that significantly enhances your portfolio if you have been a traditional stock investor.

The platform ensures liquidity and security as it practices AML rules. In addition, the platform provides a risk management tool, real-time price alerts, and negative balance protection. Furthermore, the platform provides leverage up to 100x and guaranteed stop losses.

Also Read: BitForex Review 2021 – Is it Really Safe?

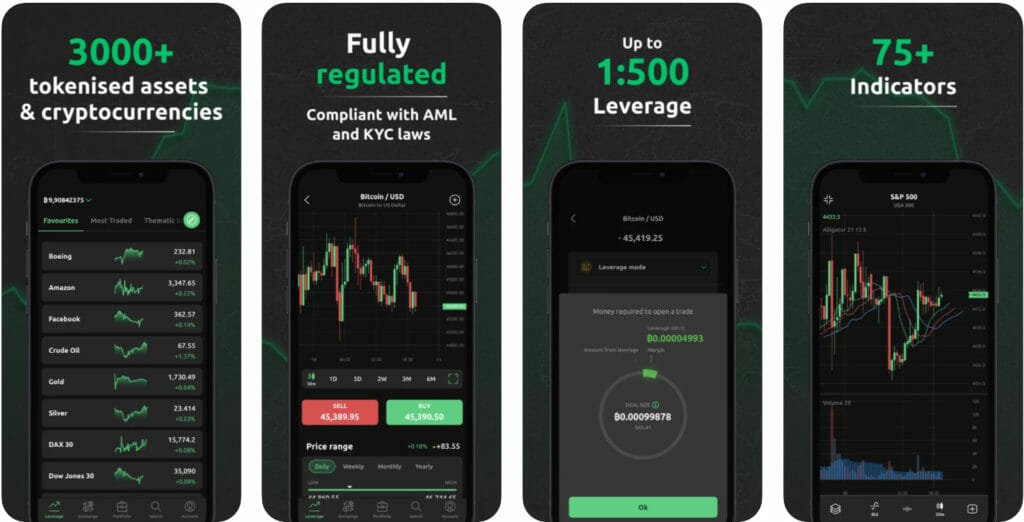

Currency.com Review: Exchange App

The platform has its easy-to-use mobile interface, which they call an exchange app. The mobile application is available on both Android and iOS. So users can easily download it and make use of it. Investing on your phone is one of the most straightforward interfaces every user looks for, as this can take place anywhere and whenever you wish.

The mobile versions also offer two thousand plus tokens, which will keep growing shortly.

Just like the trading platform, the application provides the best analysis through technical indicators and advanced charts. Overall, the application ensures the best trading experience for you.

Currency.com Review: Corporate Account

The platform offers a “corporate account product,” which is highly dedicated to businesses that accept crypto as payment, small or big crypto mining companies. Advantages of the corporate accounts are as follows:

- Innovative investments of extra cash in tokenized assets, bonds, and ETFs.

- Foreign exchange hedging, this reduces the risk of handling international fiats, that is, saving yourself from currency rate fluctuations.

- More than 1700 digital assets are offered.

- All the major cryptocurrencies are supported, like Bitcoin, Ethereum, Litecoin, Bitcoin Cash, and more.

Also Read: Unbound Finance: The Cross-Chain Aggregator Layer For AMMs

Currency.com Review: Company Tokens

The platform offers its users to invest in tokens of their company which are the new financial instrument of this century. By investing in tokens, you can increase your capital. Moreover, tokens give you several perks like a high-interest rate, exemption from taxes, and zero commission.

The best part is that you can start investing in a single token, which costs as little as 100 USD. In addition, the platform provides tokens that are secured by collateral. This is a good deal, and safety precautions encourage to rethink. Other advantages include:

- Easy payment methods accepted.

- Quick and easy

- Early resale

- No intermediaries are involved

- Regular interest is given. However, this varies from company to company.

Currency.com Review: Prime

This product is for traders with high investment values that require special attention, privacy, expertise, and trust. The user is given a dedicated account manager who is highly trained and is professional. And they will be available for you anytime and anywhere. There are various vital takeaways of this product, that is:

- 200 plus OTC markets: More than 200 assets are provided 24/7

- Multi-language support

- Fast order execution 24/7

- Multi-currency supported: G10, regional currencies, and most of the major currencies are supported.

- Dedicated account manager

- Deep liquidity

- No hidden fees

Also Read: YouHodler review | 4 Easy Ways to Make Money

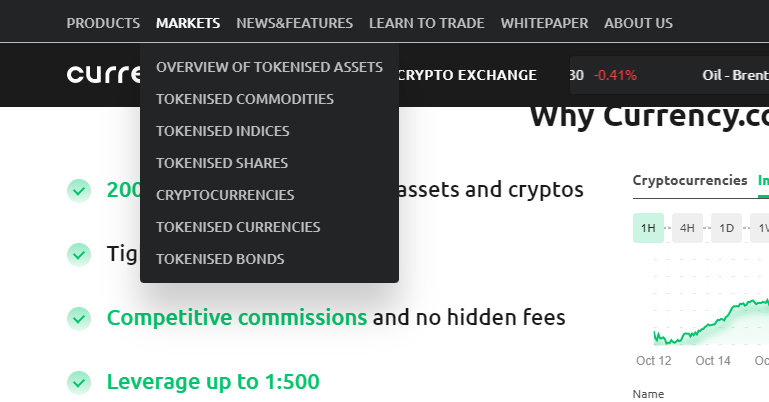

Currency.com Review: Market

The platform has six different kinds of market, known as:

- Tokenised commodities: You can easily trade commodities like gold, crude oil, natural gas, and silver on the platform.

- Tokenised Indices: You can easily trade indices such as Dow Jones 30, the S&P 500, and the Nasdaq 100 in the form of tokenized securities.

- Tokenised shares: The shares of companies such as Amazon, Apple, Tesla, and Alibaba group are provided to trade in the form of tokenized securities. You can then earn a profit either in crypto or fiat.

- Cryptocurrencies: As the platform is a cryptocurrency exchange, it clearly supports crypto trading alone. Cryptocurrencies like Dogecoin, Bitcoin, Ethereum are all available.

- Tokenised Currencies: Not only assets you can also tokenize your currencies, more than one hundred and thirty currencies are tokenized. For example, Euro/ US dollar, British Pound/ US dollar, Australian dollar/ US dollar, and many more. To know more, click here.

- Tokenised Bonds: Finally, the most interesting market is tokenized bonds. Though at present, the platform provides only bond Belarusian Government bonds, it does have plans to add more government bonds in the future. The advantage of these government bonds is that they give fixed returns, and the security is pretty high in these types of bonds. Therefore, the risk involved is potentially low, with predictable results.

The Belarusian government bond offers a 4.2% yield two times a year.

Also Read: Best Paid And FREE Crypto Trading Bots

Currency.com Review: Fees

Currency.com Deposit Fees: No deposit fees.

Currency.com Trading Fees: When you trade without leverage, the trading fee then is 0.2% of the exchange value. When trading with leverage, the fees then depends on the tokenized securities. The charges are as follows:

- Bond – 0.05%

- Crypto taker fees: 0.075%

- Crypto maker fees: -0.025%

- Tokenised assets: 0.0125%

- Tokenised currencies: 0.002%

Currency.com Withdrawal Fees: In addition to these, the platform charges transaction fees or gas fees. Now, this charge depends on the blockchain being used, which is known as withdrawal fees. The platform has a 1.5% withdrawal fee on tokenized assets.

Currency.com Other charges: The platform has a commission charge for guaranteed stop loss. This charge is shown during the execution of the order. If the stop loss did not work for some reason, the commission amount is returned to the trader.

Currency.com Review: Security

The platform has very standard security guidelines. The data on currency.com is stored on centers certified for PCI-DSS level 1, ISO 27001, ISO 27017, ISO 27018, and ISO 9001. Furthermore, it is protected following the highest security requirements like:

- AES-GCM with 256-bit secret keys

- Data encryption via PGP (pretty good service) and GPG (GNU privacy guard). Note that the platform ensures that all the data stored is encrypted.

- The platform has a robotic infrastructure to protect it from fraudulent activities.

- The platform has 14 years of experienced compliance team in trading, banking, and crypto to monitor client data, identifying the origin of funds and tokens.

- The platform has built a coin tracking platform with third-party services like Elliptic, confirm, to verify that all transactions take place on the blockchain.

Is Currency.com safe?

The platform currency.com is safe to use because of the following reasons:

- The platform has a secure login system, and whitelisting of devices is provided

- Highly effective verification

- Compliance with AML/CTF and KYC

- Two-factor authentication

- Compliance with strict industry standards

- Payment protection

Currency.com Review: Pros and Cons

| Pros | Cons |

|---|---|

| Bridges the gap between the traditional investment industry and the crypto industry. | Not a decentralized exchange platform. |

| Low fees, with no hidden charges. | Knowledge of both the investment industry is needed. |

| Consumer data is protected with standard security guidelines. | The platform’s two significant products involve high-value investors. |

| Introduction of tokenized securities. | |

| A different set of investing markets, including the cryptocurrency market. | |

| Profits can be withdrawn in crypto, including other fiat currencies. | |

| Beginner-friendly interface. |

Conclusion

Currency.com is a worth trying platform for traders who have an interest in trading stocks, crypto, and commodities. Take your profit in any currency you like, be it digital or fiat. In addition, the platform is beginner-friendly as the interface is designed in a way that makes navigation easy. The best part is the low fees, with no hidden fees charged. The commission charges are there but only when stop loss is guaranteed. And that too will be returned if the execution fails.

The platform has its own wallet and mobile applications. Finally, depositing fiat is convenient as it accepts Visas and MasterCard.

Frequently Asked Questions

Yes, Currency.com is legit. The platform is fully regulated in Berlus and adheres to legalities transparently. In addition, the platform complies with KYC practices. Note that there are no taxes for crypto operations in Berlus.

Yes, the platform currency.com is a good broker for both the industries, stock market, and crypto market. In addition, Currency.com creates liquidity through capital.com.

Yes, Currency.com has a mobile application. The platform’s mobile application is a multi winning product, with more than one million downloads across fifty-three countries.

The withdrawal fees on Currency.com depend on the tokenized security being withdrawn. Charges vary from bond, commodity, stocks, shares, indices to crypto. Different charges are charged for different investment instruments being used. For example, the charges for bonds are 0.05%, for tokenized assets, the charges are 0.0125%, for tokenized currencies, the charges are 0.002%, while for cryptocurrency, there are taker and maker charges.

Yes, currency.com does provide a demo account facility. You can practice and see for yourself in the demo account if you like the platform or not. Features like demo account are great for beginners or experts alike, which builds trust in the consumer. Beginners feel confident before practically opting for it.

Also read,