Proprietary trading firms, commonly known as prop firms, allow traders to trade financial markets using the firm’s capital rather than their own personal funds. In exchange, traders share a portion of the profits they generate while operating under predefined risk and performance rules. This model has gained significant popularity in the futures trading space, as it provides skilled traders with access to larger capital, professional trading environments, and structured risk frameworks without requiring substantial upfront investment. In this article, we compare four well-known futures prop trading firms:Blueberry Futures vs Take Profit Trader vs Apex Trader Funding each offering a different approach to trader evaluation, funding, and profit distribution.

Table of Contents

Blueberry Futures vs Take Profit Trader vs Apex Trader Funding : Program Structure Comparison

| Aspect | Blueberry Futures | Take Profit Trader | Apex Trader Funding |

|---|---|---|---|

| Evaluation Model | Streamlined evaluation challenges leading to funded accounts | One-step evaluation with PRO / PRO+ funded progression | One-step futures evaluation converting to a funded Performance account |

| Market Focus | Futures trading on exchange-listed products | Futures trading via supported platforms | Futures trading with flexible contract access |

| Account Sizes | Multiple sizes (e.g., $25K, $50K, $100K, $150K) | Multiple sizes (e.g., $25K, $50K, $75K, $100K, $150K) | Multiple plans based on capital tier |

| Time Limits | No strict time limit to pass challenges | Designed for quick qualification and funded status | No maximum time limit to complete evaluation |

| Minimum Days | Minimum trading day requirements per challenge | Standard rule-based evaluation (no explicit global minimum) | Must complete at least 7 trading days |

| Drawdown Rules | Defined per plan (profit & risk limits) | Risk rules include drawdown and position limits | No daily drawdown limits; trailing drawdown applies |

1. Blueberry Futures – Broker-Backed Futures Funding Program

Blueberry Futures emphasizes a broker‑backed infrastructure and transparent evaluation process that mirrors real market conditions. With advanced technology, notably the Blackarrow trading platform, and a suite of analytics tools intended to support trader decision making. This infrastructure is presented as a competitive advantage aimed at enhancing execution quality and risk analysis during the evaluation phase.

Blueberry Futures Key Details

- Evaluation Program: Traders can showcase their skills through a streamlined evaluation process that leads to access to funding

- Futures-Focused: Allows trading of exchange-listed futures products across major markets like CME, CBOT, NYMEX, and COMEX

- Plan Sizes: Multiple account sizes available, such as $25K, $50K, $100K, and $150K

- Profit Split: Qualified traders keep up to 90% of the profits they generate

- Trading Technology: Uses advanced data and tools backed by robust trading infrastructure

- 24/7 Support: Round-the-clock assistance for account and trading-related queries

Also, you may read 10 Best Forex Prop Trading Firms

Blueberry Futures – Challenge Overview

| Feature | Details |

|---|---|

| Evaluation Structure | Traders engage in a streamlined evaluation process to showcase their skills and qualify for funding. |

| Account Sizes | Multiple account sizes are offered (e.g., $25,000, $50,000, $100,000, $150,000), allowing traders to choose according to their capital goals. |

| Profit Targets | Each challenge has defined profit target requirements that traders must meet to pass evaluation and unlock funding. |

| Drawdown & Risk Rules | Challenges include drawdown limits and daily profit caps as part of the risk rules to demonstrate disciplined trading. |

| Minimum Days to Pass | Each challenge has a specified minimum number of trading days required to qualify and transition to a funded account. |

| Profit Split Upon Funding | Traders can keep up to 90% of profits once they become funded. |

| Funding Access | After passing the evaluation, traders receive access to funded trading with Blueberry Futures capital. |

| Platform & Tools | Evaluation and funded trading leverage advanced trading platforms with robust market data and analytic tools. |

It is best suited for futures traders who seek a clear progression from simulated assessment to funded capital, value broker‑backed infrastructure, and are focused on regulated listed futures markets rather than other asset classes.

Also, you may read Blueberry Futures Review: A Deep Dive

Blueberry Futures – Strengths & Considerations

| Strengths | Considerations |

|---|---|

| Multiple Account Sizes: Offers a range of evaluation sizes to match trader goals. | Detailed Risk Rules: Traders must understand drawdown and profit target requirements to succeed. |

| High Profit Split: Up to 90% profit share on funded accounts. | Structured Evaluation: Meeting both profit and risk rules is required to unlock funding. |

| Advanced Trading Technology: Backed by sophisticated data tools and platforms for futures markets. | Minimum Trading Days: Some evaluation categories have minimum trading day requirements. |

| Broker-Backed Infrastructure: Strong support from Blueberry’s regulated broker ecosystem. | Challenge Costs: Evaluation plans may include subscription or fee components depending on the challenge selected. |

| 24/7 Support: Around-the-clock support for traders during evaluation and funded stages. | Trading Discipline Required: Passing the challenge requires disciplined execution under formal risk parameters. |

2. Take Profit Trader – Fast-Track Futures Funding Model

Take Profit Trader positions itself as a proprietary futures trading funding firm designed to empower disciplined traders by providing access to funded accounts following a structured evaluation process. Traders select a futures account size and pursue a profit target under a defined set of risk rules; successful completion of this evaluation grants access to a PRO account where profits can be withdrawn from day one and shared under an 80/20 profit-split arrangement.

The platform emphasizes a straightforward, no-nonsense model with immediate profit access, a simplified progression to enhanced PRO+ status, and a suite of services including risk management, customer support, and scalable account options.

Take Profit Trader Key Details

- One-step evaluation: Traders reach a profit target while following defined risk rules to qualify for a PRO account.

- Immediate withdrawal: Once funded, traders can withdraw profits from the very first day of trading.

- Profit splits: Standard PRO accounts offer an 80/20 split, with upgraded PRO+ accounts offering 90/10 and end-of-day drawdown features.

- Multiple platforms supported: Traders can connect via platforms such as NinjaTrader, Tradovate, and TradingView.

- Account progression: Traders may upgrade to live market PRO+ accounts where orders are sent to regulated brokers.

- Five PRO accounts: Traders can manage up to five PRO accounts concurrently.

Also, you may read 10 Prop Trading Firms Australia

Take Profit Trader – Challenge Overview

| Feature | Details |

|---|---|

| Evaluation Structure | A one-step evaluation where traders prove skill by reaching a profit target while following risk rules. |

| Account Sizes | Multiple futures account sizes available (e.g., $25K, $50K, $75K, $100K, $150K). |

| Profit Target | Traders must hit defined profit objectives relative to account size during the test. |

| Risk Rules | Traders must follow core rules including profit targets, maximum positions, drawdown rules, and consistency requirements. |

| Time to Funding | Once the test is passed, traders receive a PRO account. |

| Profit Sharing | PRO accounts typically start with 80% trader profit share, and upgrading to PRO+ offers 90/10 splits and enhanced rules. |

| Payout Timing | Day-one profit withdrawals are allowed once PRO account requirements (e.g., buffer) are met. |

| PRO Account Resets | Traders are allowed up to three PRO account resets if needed. |

| Supported Platforms | Traders can connect to over 15 supported platforms including NinjaTrader, Tradovate, and TradingView via regulated broker feeds. |

| Execution Environment | Trades in PRO accounts are simulated via regulated broker data feeds (e.g., Rithmic, Tradovate) before live exchange execution in PRO+. |

Take Profit Trader positions itself as a trader-first proprietary funding firm focused on providing a streamlined path from evaluation to funded futures trading with a strong emphasis on day-one profit access, platform flexibility, and straightforward risk rules. Take Profit Trader is best suited for experienced futures traders who seek capital access through a structured funding model rather than trading their own funds, and who value a simplified, transparent evaluation and payout process.

Also, you may read Take Profit Trader Review: Is it Reliable?

Take Profit Trader – Strengths & Considerations

| Strengths | Considerations |

|---|---|

| One-step evaluation model that is easy to follow | Evaluation must be passed before profit withdrawal eligibility |

| Profit withdrawal from day one of funded PRO accounts | Standard profit split is lower than some competitors (80%) |

| PRO+ accounts can offer 90% profit splits | Higher profit split tied to upgraded account tiers |

| Supports many trading platforms (e.g., NinjaTrader, Tradovate, TradingView) | Focus is mainly on futures markets |

| Up to five PRO accounts concurrently | Intensive futures trading focus may not suit all traders |

| Offers account resets and progression opportunities | Evaluation risk rules must be followed strictly |

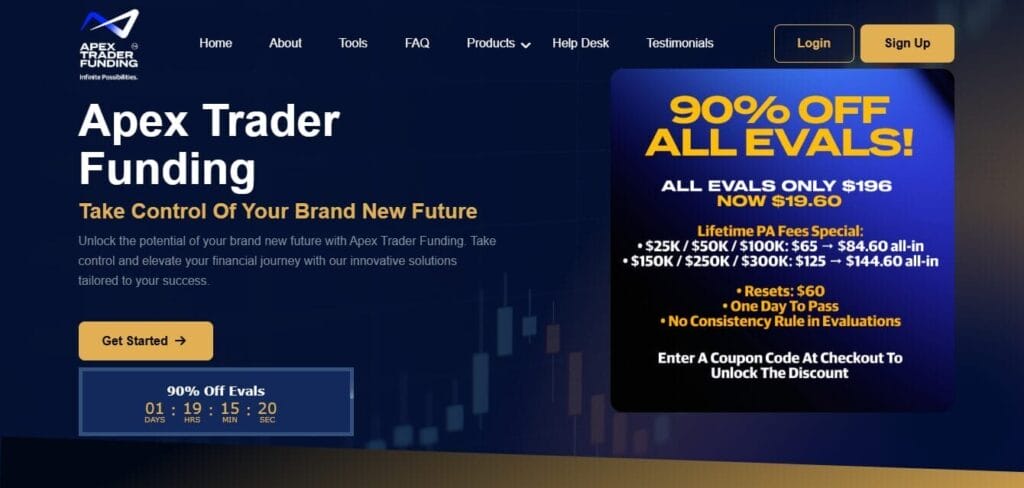

3. Apex Trader Funding – Simple one-step funding for futures traders.

Apex Trader Funding operates within the growing proprietary trading ecosystem, positioning itself as a performance-based capital access platform for futures traders seeking scale without deploying substantial personal capital. Its core proposition centers on a single-step evaluation model, emphasizing risk discipline and consistency over multi-phase challenges, reflecting an industry shift toward simplified qualification frameworks designed to attract high-volume and retail-professional traders.

Apex Trader Funding Key Details

- One-step evaluation process: Traders aim to reach profit targets without complex multi-stage hurdles.

- Profit splits: Traders receive 100% of the first $25,000 in profits and 90% beyond that.

- Regular payouts: Profit withdrawals occur every 8 days.

- No daily drawdown limit: Apex does not impose daily drawdown rules.

- Trading flexibility: Traders can trade full-sized futures contracts in both evaluation and funded accounts and are allowed to trade across holidays and news hours.

- Multiple accounts: Traders can hold up to 20 funded accounts simultaneously.

- Instruments: Futures contracts including equities, currencies, energies, metals, and more are supported.

Also, you may read 10 Best Forex Prop Trading Firms

Apex Trader Funding: Challenge Overview

| Feature | Details |

|---|---|

| Evaluation Type | One-step evaluation process with defined profit targets and risk rules. |

| Profit Targets | Profit goals are set based on account size (e.g., $1,500 for 25K, $3,000 for 50K, etc.). |

| Minimum Trading Days | Traders must complete at least 7 trading days in the evaluation. |

| Drawdown Rules | No daily drawdown limits; trailing drawdown applies and must not be breached. |

| Trailing Drawdown | The drawdown threshold trails with account profits until the safety net is reached. |

| Contract Limits | Contract size limits apply until the drawdown threshold is surpassed. |

| Time Limit | No maximum time limit — traders may take as long as needed to qualify. |

| Transition to Funded Account | After meeting profit and day requirements without rule breaches, the evaluation converts into a Performance (funded) account. |

Apex Trader Funding positions itself as a futures-focused prop firm offering a simple one-step evaluation, high profit splits, and flexible risk management through a trailing threshold. With features such as no daily drawdowns, frequent payouts, and the ability to trade full-sized contracts, news events, and holidays, the platform is designed for traders seeking funded capital with fewer restrictions. Overall, Apex presents a structured yet flexible funding framework for disciplined futures traders looking to scale their trading without using personal capital.

Also, you may read Apex Trader Funding: A Detailed Review

Apex Trader Funding – Strengths & Considerations

| Strengths | Considerations |

|---|---|

| Clear and simple one-step evaluation process | Focused primarily on futures markets only |

| 100% profit on first $25,000, then 90% profit split | Payouts are not instantaneous — they occur on a fixed schedule (every 8 days) |

| No daily drawdown limits and flexible risk rules | Primarily for traders comfortable with futures trading |

| Ability to trade full-size contracts during evaluation and funded stages | Limited to futures — no forex or other asset classes |

| Supports up to 20 funded accounts simultaneously | Not focused on extensive educational programs |

| Regular payout cadence enhances cash flow predictability | Profit split tiers focus on futures instruments |

Blueberry Futures vs Take Profit Trader vs Apex Trader Funding: Profit, Payouts & Trading Infrastructure

| Aspect | Blueberry Futures | Take Profit Trader | Apex Trader Funding |

|---|---|---|---|

| Profit Split | Up to 90% for funded traders | 80/20 standard, upgraded to 90/10 (PRO+) | 100% of first $25K, then 90% thereafter |

| Payout Access | Available after meeting funded account requirements | Day-one withdrawals once PRO account conditions are met | Withdrawals based on scheduled payout cycles |

| Payout Frequency | Based on funded account rules | On demand after conditions met | Typically every 8 days |

| Withdrawal Conditions | Must maintain funded status and rule compliance | Requires meeting buffer and PRO account rules | Must follow payout windows and risk rules |

| Platform Support | Advanced trading platforms backed by broker infrastructure | 15+ platforms including NinjaTrader, TradingView, Tradovate, Rithmic, Quantower | Rithmic, Tradovate, WealthCharts |

| Broker / Data Access | Broker-backed execution and market data | Uses regulated brokers and official market data feeds | Execution via supported clearing and data platforms |

| Trading Tools & Analytics | Advanced analytics and market data tools | Platform-dependent charts, indicators, and feeds | Platform-provided analytics and execution tools |

| Platform Flexibility | Moderate – structured toolset | Very high – wide platform choice | Moderate – select major platforms |

Blueberry Futures vs Take Profit Trader vs Apex Trader Funding: Final Verdict

Blueberry Futures is best suited for traders who want a broker-backed futures prop firm with multiple challenge options and professional trading infrastructure. It appeals to traders who value strong technological support, scalable account sizes, and a high profit share, while operating within clearly structured evaluation and risk parameters.

Take Profit Trader is ideal for traders who prioritize fast access to profits and simplicity. With its one-step evaluation, day-one profit withdrawals on PRO accounts, and broad platform support, it suits traders who are confident in their strategies and want minimal friction between qualification and payouts.

Apex Trader Funding fits traders who seek high profit retention and flexible trading conditions. With its 100% profit on the first $25,000, regular payout cadence, and absence of daily drawdown limits, it is particularly attractive to futures traders who prefer fewer intraday restrictions and predictable payout cycles.

Also, you may read My Funded Futures vs Elite Trader Funding vs Alpha Futures vs BluSky Trading: Comparasion

Conclusion

Blueberry Futures, Take Profit Trader, and Apex Trader Funding demonstrate how diverse the futures prop trading space has become. Blueberry Futures highlights a broker-backed, institutionally aligned model, Take Profit Trader reflects the shift toward fast qualification and immediate profit access, while Apex Trader Funding emphasizes high profit retention and flexible trading conditions. Together, they show that modern prop trading is no longer built around a single structure, but around varied approaches to evaluation, payouts, and trading freedom.

Frequently Asked Questions

Are there time limits to pass the evaluation?

Blueberry Futures and Apex Trader Funding do not impose strict time limits, while Take Profit Trader is designed for fast qualification.

How often can profits be withdrawn?

Take Profit Trader allows day-one withdrawals once funded, Apex Trader Funding follows scheduled payout cycles, and Blueberry Futures allows withdrawals based on funded account conditions.

Are daily loss limits applied?

Apex Trader Funding does not apply daily drawdown limits, while Blueberry Futures and Take Profit Trader enforce plan-specific risk rules.