The world of proprietary (prop) trading continues to evolve as traders seek flexible ways to access capital without risking their personal funds. Among the many firms in the space, Fundedfast stands out with straightforward rules, multiple challenge options tailored to different skill levels, high profit splits, and a unique scaling plan. Read on this Fundedfast Review to learn more about the firm as a proprietary trading firm.

Table of Contents

What is Fundedfast?

FundedFast is a proprietary trading firm that offers traders the opportunity to access capital quickly through affordable evaluation challenges.

The company offers challenge account sizes ranging from $3,000 to $400,000, with profit targets and risk parameters such as maximum daily loss and overall drawdown clearly defined for each plan.

Traders who successfully meet the challenge requirements can progress to a funded account, where they are eligible to receive up to 90% of the profits they generate. FundedFast emphasises fast funding, transparent rules, and a straightforward path for traders to demonstrate their skill and trade with the firm’s capital.

Fundedfast: Key Features

1. Challenge-Based Funding Model

FundedFast provides traders with access to funded accounts by completing a trading challenge. Traders must meet specific profit targets while adhering to predefined risk rules to qualify for funding.

2. Three Challenge Types

The platform offers three challenge options tailored to different skill levels: a 10% profit target challenge, a 5% profit target challenge, and an Unlimited profit target challenge.

3. Defined Risk Parameters

All challenges enforce consistent risk controls: a maximum daily loss limit of 5%, a maximum total drawdown of 10%, and leverage of 1:100. These parameters are clearly displayed on the official challenge specifications.

4. Profit Target Requirements

To pass a challenge, traders must achieve the specified profit target (10%, 5%, or Unlimited) while staying within the daily loss and drawdown limits. The profit target is calculated as a percentage of the starting account balance.

5. High Profit Split for Funded Traders

Once funded through the Unlimited Challenge, traders can retain up to 90% of the profits they generate.

6. Scaling Plan for Consistent Performers

Traders who pass 2-Phase challenges (10% or 5% profit targets) gain access to a 5-level scaling plan. This plan allows traders to grow their capital by 25% at each level upon hitting performance milestones, potentially scaling up to 2.5 times their starting balance.

7. Unlimited Challenge Duration

There is no time limit to complete the challenge. The maximum duration is unlimited, giving traders flexibility to trade at their own pace.

8. Minimum Trading Days Requirement

Traders must actively trade for a minimum of 3 days before completing the 10% and 5% challenges. The Unlimited Challenge has no specified minimum trading day requirement.

9. Community and Support

FundedFast provides an official Discord community where traders can network, share strategies, and receive real-time support from the Trader Success team.

10. Refundable Challenge Fees

Challenge fees are dynamic in price and fully refundable if a trader successfully passes the evaluation and becomes funded.

Also, you may read 10 Best Prop Trading Firms

How FundedFast works: A step-by-step guide

Step 1: Challenge Selection

Traders begin by selecting a challenge type matching their current skill level and risk appetite. FundedFast offers three distinct options:

- 10% Profit Target Challenge: Requires 10% profit generation on starting balance

- 5% Profit Target Challenge: Requires 5% profit generation on starting balance

- Unlimited Challenge: No specific profit target requirement

This tiered structure allows beginners to start with lower thresholds (5%) while experienced traders can opt for unlimited flexibility.

Step 2: Challenge Entry and Fee Payment

Traders pay a dynamic challenge fee to initiate their evaluation. Critically, this fee is 100% refundable upon successfully passing the challenge, reducing financial risk for traders.

Step 3: Trading Within Risk Parameters

Once enrolled, traders must generate their target profit while adhering to three inviolable risk constraints:

- Keep daily losses below 5% of current equity

- Maintain total drawdown within 10% of starting balance

- Operate within 1:100 leverage limits

These constraints remain consistent across all challenge types, ensuring traders develop disciplined risk management regardless of which challenge they pursue.

Step 4: Meeting Evaluation Criteria

To pass the challenge, traders must achieve their profit target while satisfying all risk requirements. There is no time pressure—traders have unlimited duration to complete their evaluation. For 10% and 5% challenges, active trading for a minimum of 3 days is required; the Unlimited challenge has no minimum trading day requirement.

Profit Target Calculation: The profit target is calculated as a percentage of the starting account balance. For example, with a $10,000 starting balance and a 10% target, the trader needs to generate exactly $1,000 in profit to pass.

Step 5: Transition to Funded Trading

Upon successfully passing the challenge, traders transition from evaluation mode to funded trading status. The challenge fee is refunded, and traders gain access to the firm’s capital for live trading.

Step 6: Profit Sharing and Continued Trading

Funded traders retain up to 90% of profits generated (for Unlimited Challenge). This profit-sharing structure incentivizes consistent, profitable trading while allowing the firm to sustain operations.

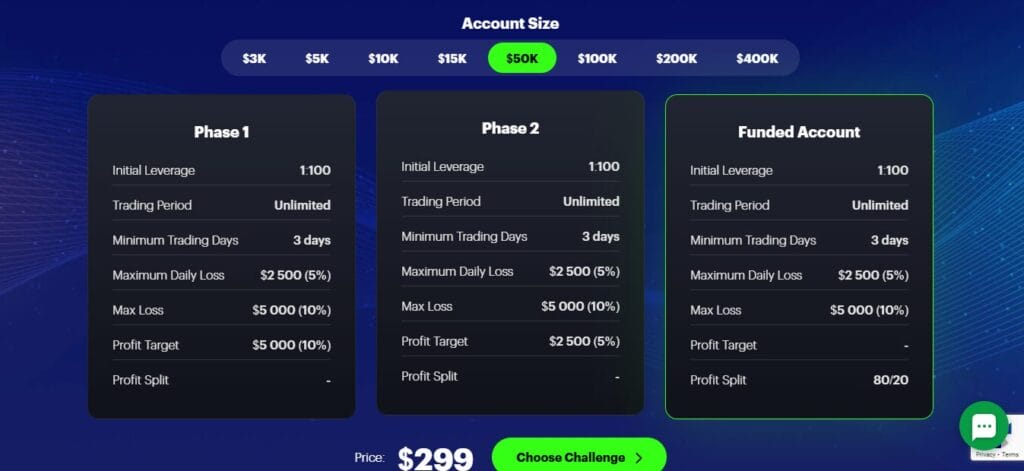

FundedFast Challenge Structure Overview

| Feature | Phase 1 | Phase 2 | Funded Account |

|---|---|---|---|

| Profit Target | 10% | 5% | Not specified |

| Maximum Daily Loss | 5% | 5% | 5% |

| Maximum Drawdown | 10% | 10% | 10% |

| Minimum Trading Days | 3 days | 3 days | Unlimited |

| Challenge Duration | Unlimited | Unlimited | Unlimited |

| Leverage | 1:100 | 1:100 | 1:100 |

| Profit Split (Funded) | — | — | Up to 90% |

| Scaling | Available (per site; up to $400K) | Available | Available |

Key Advantage: No Time Pressure

The unlimited challenge duration is a significant differentiation point. Traders are not forced to compress their trading into tight timeframes, which might otherwise encourage reckless decision-making. This flexibility allows traders to maintain their natural trading rhythm while meeting evaluation requirements.

Also, you may read RebelsFunding Review: A Comprehensive Analysis of a No-Time-Limit Prop Trading Firm

Fundedfast: Security & Safety

FundedFast offers a baseline level of transparency and regulatory awareness: they define themselves clearly as a prop-firm (not a broker), operate challenge-based simulated trading until funding, enforce AML / CFT compliance and KYC, and maintain a privacy/data-protection policy. These are positive signals for data protection and compliance discipline.

However — in absence of any public licensing disclosures, audited financials, or documented fund-custody protections — the “safety” of real capital (once funded) ultimately depends heavily on the firm’s internal integrity. Therefore, while FundedFast can be considered reasonably transparent on paper, users should approach funded accounts with caution and treat the arrangement as based on trust rather than strong external guarantees.

Alpha Capital Group vs Fundedfast: Which Prop Firm Fits You Best?

| Feature | Alpha Capital | Fundedfast |

|---|---|---|

| Company / Structure | UK-based proprietary trading firm operating under Alpha Capital Group Limited. | Proprietary trading firm offering challenge-based funding; not a broker and does not take client deposits. |

| Evaluation / Challenge Models | Offers 1-step, 2-step, and 3-step evaluations depending on program. | Offers One-Phase and Two-Phase trading challenges with published rules and parameters. |

| Profit Targets (Evaluation) | Typically around 10% for main programs; varies by plan. | Phase 1 profit target of 10%; Phase 2 profit target of 5%. |

| Drawdown / Risk Limits | Varies by plan; includes daily loss limits, max drawdown, and in some cases trailing drawdown. | Daily loss limit of 5%; maximum drawdown of 10% across challenges and funded accounts. |

| Leverage | Leverage varies by plan and asset class; some plans offer lower leverage (e.g., 1:30). | Fixed leverage of 1:100 as shown in challenge parameters. |

| Lot / Position Size Limits | Lot-size and exposure limits defined per account size; larger accounts allow higher lot caps. | No publicly detailed lot-size table; rules focus more on percentage-based risk limits. |

| Profit Split (Funded Accounts) | Up to approximately 80% depending on program. | Up to 90% profit split for funded traders. |

| Account / Funding Size Range | Multiple account sizes, with higher tiers depending on evaluation type. | Account sizes from $3,000 up to $400,000 with scaling options. |

| Payout / Withdrawal Structure | Offers regular payouts; specific conditions vary by plan and may include profit caps or timing rules. | Profit-split available after funding; detailed payout timing not heavily specified publicly. |

| Flexibility / Trading Conditions | Asset diversity, varying leverage, and customizable evaluation structures. | Simple, uniform risk rules and straightforward evaluation paths. |

| Transparency of Public Info | Provides detailed help-center articles but information varies by plan. | Publishes a clear challenge-parameters chart with risk rules and funding structure. |

Also, you may read Alpha Capital: Is it the Most Transparent Prop Firm?

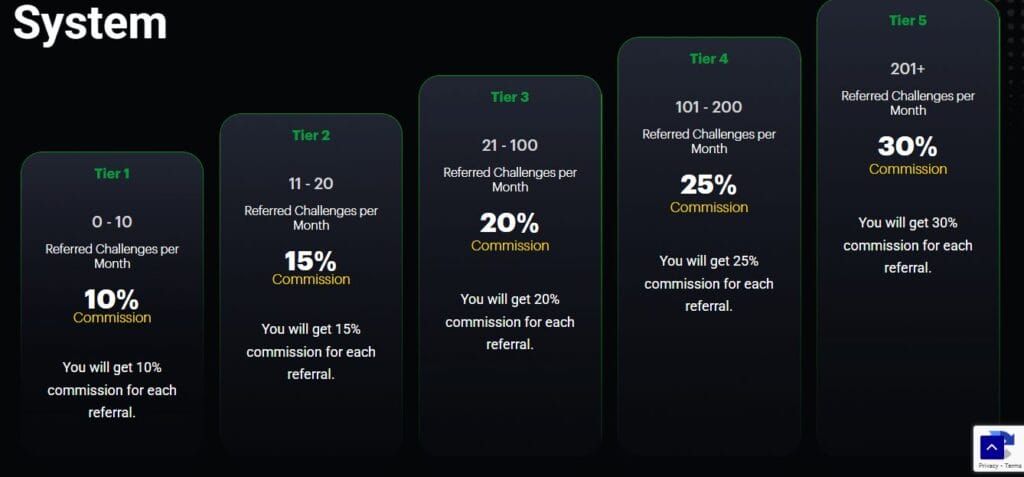

Partnership and Affiliate Programs

- Join as an Affiliate: Sign up on FundedFast’s “Team Up” page to receive your own referral link or coupon code.

- Earn Commission on Every Challenge Sold: When someone uses your link/code to buy a FundedFast challenge, you earn a percentage of the sale.

- Tier-Based Commission System: Your commission rate increases as you refer more people in a single month:

- Tier 1: 10% commission (0–10 referrals)

- Tier 2: 15% commission (11–20 referrals)

- Tier 3: 20% commission (21–100 referrals)

- Tier 4: 25% commission (101–200 referrals)

- Tier 5: 30% commission (201+ referrals)

- Monthly Reset: Your tier level resets at the start of each new month based on your referral count.

- Marketing Support: FundedFast provides banners, graphics, and promotional materials to help you advertise.

- Real-Time Tracking: You can monitor clicks, referrals, and commissions using the affiliate dashboard.

- Withdraw Earnings: Once you reach the minimum payout amount, you can request a withdrawal through the platform.

- Rules & Compliance: Affiliates must follow FundedFast’s marketing guidelines and avoid misleading promotions.

Support and Community Ecosystem

FundedFast supports traders with several community and learning resources.

The platform hosts an active Discord community, where traders share strategies, market insights, and support each other throughout the evaluation and funded stages. A dedicated Trader Success Team provides real-time human assistance for challenge rules, trading questions, and platform navigation—offering more personalized support than automated-only services.

FundedFast also provides practical educational resources, including risk-management tips, challenge-passing strategies, explanations of profit targets and loss limits, and clear definitions of key terms in the FAQ. The site features learning testimonials from traders who credit these resources with helping them progress faster—such as one funded trader who completed the challenge in just two weeks.

Who is Fundedfast best suited for?

FundedFast is best suited for disciplined traders who want affordable access to funded capital and prefer simple, transparent rules. Its unlimited challenge duration, fixed risk parameters, and straightforward profit targets make it ideal for traders who value flexibility and want to trade at their own pace.

It’s also a good fit for traders with smaller personal capital who want the chance to scale up to larger funded accounts. Manual and strategy-driven traders who can consistently manage risk are likely to benefit most from FundedFast’s structure.

Also, you may read 10 Best Forex Prop Trading Firms

Conclusion

FundedFast offers a user-friendly, challenge-based prop-trading model that aims to give skilled retail traders fast access to firm capital under transparent, straightforward rules. With low-cost entry, clear profit targets and risk limits, no time pressure to complete the evaluation, and a generous profit-split for funded accounts, it presents a viable option for traders looking to scale with limited personal capital.

Who is behind FundedFast?

FundedFast is operated by Memento Enterprises Limited, a company registered in Malta.

How do I start my first Challenge?

To begin, you pick a trading challenge from the options listed on the FundedFast website (account-size, challenge type), complete the registration, pay the challenge fee, and begin trading under the challenge rules.

Can I trade more than one challenge at the same time?

Yes, FundedFast allows you to have multiple active challenges simultaneously.