Forex trading has become one of the most popular forms of trading today. Everybody focuses on trading their way out with the best profits in hand. Forex trading is the buying and selling of foreign exchange currencies, also known as forex. The rate of the forex depends on the market and fluctuates on a frequent basis. This trading involves focus and determination. In this article, we are going to guide people on how to do day trading for beginners, and we are going to share the best strategies for the same.

Table of Contents

What is forex day trading?

Forex day trading is a way to trade that involves the opening and closing of the trade within a single day. It is a good way to enter the forex trading market. It is a short-term strategy. The day traders use technical tools to identify the entry and exit points. Day trading needs knowledge and the trader’s patience; if not done properly, then it may be risky.

Day trading features in a market:

Liquidity: It refers to how easy it is for a trader to enter and exit a market, that is, the liquidity of a market. Liquidity is important for day traders as they execute multiple trades in a day.

Volatility: How rapidly the price moves of an asset is an important aspect of day trading. If it is high then it could create more and more opportunities for day trading.

Trading Volume: An asset’s trading volume is how many times it has been bought or sold in a period of time. The high volume shows that there is a high level of interest.

Here are the top 10 strategies if you want to get into day trading:

Trend Trading

The trend in trend trading means the direction in which the trade is moving in. Trend trading is a strategy used by traders to make money by studying the directions of an asset. It is a strategy in which one should buy the asset when its price goes upwards and sell an asset when the price goes down. Traders make sure to enter a trade in the direction of that trend, and the main goal is to stay in the trend for as long as possible.

Swing Trading

Swing Trading is a speculative trading strategy that involves making profits from short-term price fluctuations in the market. Swing traders enter a position where they hold for days to weeks and then exit their position, having hopefully taken profits. The key to successful swing trading is picking the right stocks, which are volatile and liquid. Profits in swing trading can be made by either buying an asset or short-selling. For example, while other traders may wait five months to earn a 20% profit, swing traders may earn 5% gains weekly and exceed the other trader’s gains in the long run.

Scalping

Scalping is a trading strategy that involves making profits from small price changes in a stock’s price over a short period of time. Traders indulged in scalping, buying, and selling a stock multiple times in a single day, entering and exiting orders within seconds to minutes. It is a very short-term strategy in which the traders take small but frequent profits. Scalpers must be careful as small profit margin from each trade can be ruined by overnight funding.

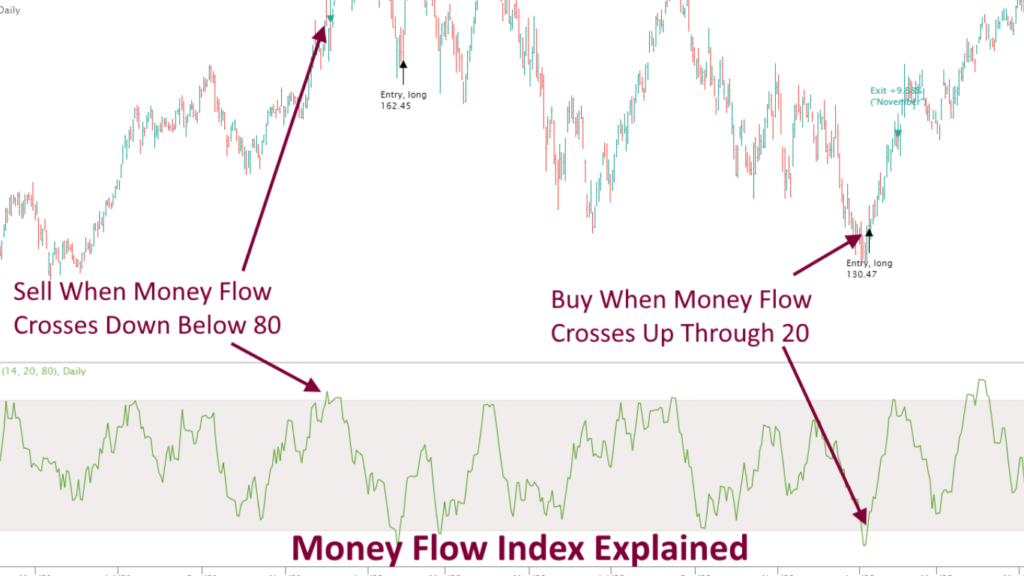

Money flow

Money flow is a strategy used by traders to indicate whether an asset might be overbought or oversold based on the asset’s trading demand and supply. It compares the results from the previous day with those from the current day, which helps the traders determine whether the results are negative or positive. Positive results indicate that the price will go higher and negative results indicate that they will fall.

Breakout Strategy

Breakout strategy is a strategy in which the trader enters the trade as soon as the prices are about to break out of their range. This strategy involves opening your FX position early with a new trend and placing your stop-loss at the point of market breakout. In this strategy, traders will have to closely monitor their moves or by placing their buy-stop and sell-stop orders. Ichimoku Cloud is a great example of a breakout strategy.

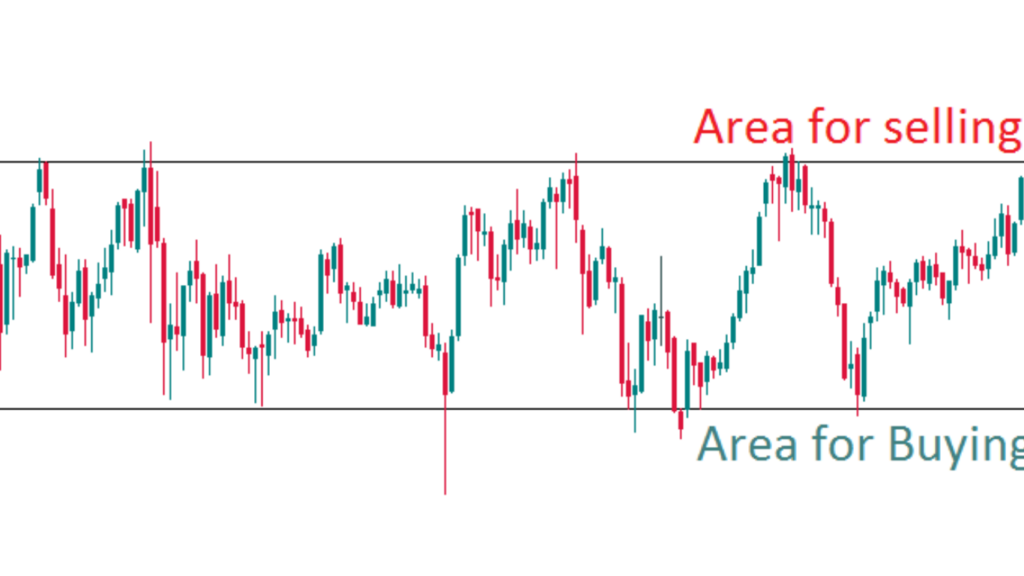

Range Trading

Range trading strategy is a strategy in which the traders have to identify a range of prices and then buy and sell within that range over a short period of time. When the market consistently moves between two price levels, then it is said to be in a range. Range trading can be both long-term and short-term. For example, if a stock is trading at $30 and you think it is going to rise to $40, then you will trade in the range of $30-$40.

Momentum Trading

Momentum trading strategy involves buying an asset that has shown a significant movement in price or volume. To use this strategy, you will open your position when the trend goes up or gains momentum and close it when the trend goes down. Momentum trading strategies mainly focus on price action and price movements rather than company growth or economics.

These were some of the top strategies for forex day trading. These are best for beginners. They require determination, attention, and close monitoring for the best results. Get going into your forex day trading voyage with these strategies!

Also read: Top 10 Forex Trading Signal Channels on Telegram

Top 10 Books every forex trader should read

Is forex day trading a good idea for beginners?

Forex day trading is a good idea for traders who want to enter and exit positions in the same day, while avoiding overnight market movements. Day trading requires a lot of time, focus, and dedication.

Can anyone do day trading in forex?

Yes, anyone can trade forex if they have a live, funded trading account.