Binance is the largest crypto exchange globally in terms of daily trading volumes. Hence, this article discusses how to hedge, trade, and do a deep dive in Binance futures trading and various terms related to them.

Table of contents

- Summary (TL;DR)

- What is Binance Futures?

- Binance Crypto Futures Market

- COIN-Margined Vs USDⓈ-Margined

- Leverage and Margin of contracts

- How to open a Futures account on Binance?

- Difference between Isolated Margin and Cross Margin

- What happens in case of Liquidation?

- Perpetual Contract Vs Traditional Futures Contract

- Binance Futures Trading: Funding Rate

- What is Auto-Deleveraging (ADL)?

- Binance Futures Trading: Fees Schedule

- How to Borrow funds using Cross Collateral?

- What is Hedge Mode?

- What is Binance BTCDOM Index?

- Binance Futures Trading: Conclusion

- Frequently Asked Questions

Summary (TL;DR)

- Future trading in USDⓈ-Margined contract means settlement happens in USD-pegged assets like USDT or BUSD.

- Future trading in Coin-Margined contract means denominated and settled in the underlying cryptocurrency.

- The maintenance margin model is a sophisticated risk control system and a liquidation model to support high leverage trading.

- The trader can use isolated Margin or Crossed Margin mode as per their trade requirement.

- Funding rates are payments made to long or short traders, calculated on the difference between the perpetual contract price and spot price.

What is Binance Futures?

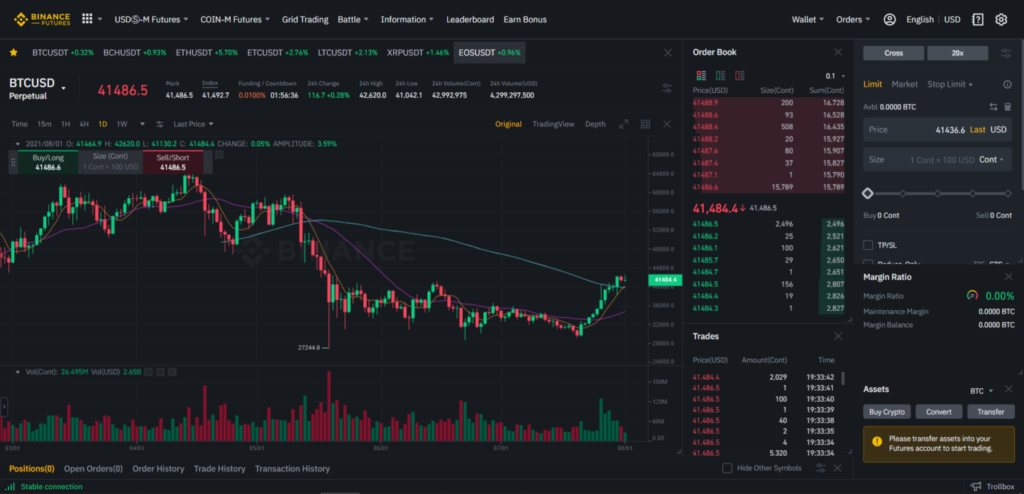

Binance is the largest crypto exchange platform and allows you to trade in a variety of cryptocurrencies. Furthermore, they have a broad number of crypto derivative instruments. Along with that, Binance Futures lets the traders and investors trade in many different ways. For example, the platform offers Coin Margined and USDT Margined futures trading.

Also, read our guide to futures trading to understand the futures market better.

Binance Crypto Futures Market

USDⓈ-Margined futures contracts

The Binance USDT-Margined contract has the following characteristics:

- Settlement happens in USD-pegged assets, i.e., and they are denominated and settled in USDT or BUSD.

- The contract follows a Clear Pricing Rule where each future contract specifies the base asset’s quantity delivered for a single contract known as ‘’Contract Unit’’. For example – BTC/ USDT, ETH/ USDT, and BCH/ USDT.

- Expiration – Perpetual and Quarterly

- The minimum notional value of each order must be not less than the threshold of 5 USDT. The order will be rejected if the threshold is less.

- In this case, “Reduce only” orders are not affected.

Coin-Margined Future Contracts

- The Binance Coin margined contract has the following characteristics

- They are settled in cryptocurrency, i.e., they are denominated and settled in the underlying crypto. The trader doesn’t need to hold stablecoins as collateral.

- A contact multiplier represents the value of a contract. For example, each BTC futures contract represents 100 USD, while each ETH futures contract represents 10 USD.

- Expiration – Perpetual, Quarterly, and Bi-quarterly

- It is important to note that Binance futures will regularly adjust the minimum order threshold without prior intimation. Therefore, traders must check via API for details regularly.

| Features | COIN-Margined | USDⓈ-Margined |

|---|---|---|

| Collateral | Cryptocurrency (i.e. BTC, ETH) | USDT, BUSD |

| Margin Type | Isolate/ Cross | Isolate/ Cross |

| Cross collateral | No | Yes |

COIN-Margined Vs USDⓈ-Margined

| COIN-Margined | USDⓈ-Margined |

|---|---|

| Denominated and settled in cryptocurrency. | Linear crypto futures are quoted in USDT or BUSD. |

| Ideal for HODler or miner, any profits made can contribute to the long-term stack. | Easy to calculate returns in Fiat currency. This makes them more intuitive. |

| The contract can be used as a direct hedge for the trader’s spot investment. | They are more flexible as there is no need to buy the underlying crypto asset. |

| ‘The need to convert your holding into USDT is not required. | It can help to reduce risk in high volatility markets or during a giant price swing. Then, the need for a hedge is less. |

Leverage and Margin of contracts

Binance uses a Maintenance Margin model, a sophisticated risk control system, and a liquidation model to support high leverage trading. The maximum amount of leverage available depends on the notional value of the trader’s position, i.e., the more considerable the position, the lower the leverage.

Furthermore, the leverage can be adjusted according to the traders’ needs and will calculate position size based on the contract’s notional value (USDT or BUSD denominated). The Initial Margin is calculated as per the leverage selected by the trader.

Rules to use Leverage on Binance

From July 19th, 2021, Binance has introduced leverage limits for the trader with registered futures account of fewer than 30 days. The leverage limits are as follows.

- Newly registered accounts less than 30 days old will not be allowed to open positions with leverage exceeding 20x.

- The new leverage limit will apply to the existing users with registered future accounts of less than 30 days –

- Users with open positions of less than 20x leverage will not be allowed to adjust their open positions beyond 20x leverage.

Users with open positions of more than 20x leverage may choose to maintain their position leverage but will not increase their position leverage further. Instead, they will be allowed only to deleverages their open position to 20x below.

- For new users with no open position, all new positions must not exceed 20x leverage.

- Leverage limits for new users will increase gradually only after one month from registration.

Also, read Binance Leveraged Token Limitations: What’s the alternative now?

How to open a Futures account on Binance?

- Open the ‘’Binance Futures’’ page once you log into your Binance account.

- Now, Click “Open Account”, that will redirect you to the Futures trading interface.

- After you successfully enable your futures account, you can start with Binance futures trading after funding your account.

- To transfer funds into your futures accounts, you can head over to the wallet section.

- Thereafter, transfer funds from fiat and spot account to your Futures account.

- In case you don’t have any funds in your Fiat account, you can refer to our Binance review for detailed steps.

Furthermore, you’ll need to enable 2FA to fund your account before start trading on Binance Futures.

Difference between Isolated Margin and Cross Margin

Each trading pair has a separate Isolated Margin Mode. Only specific cryptocurrencies can be transferred in, held, and borrowed in one particular Isolated Margin Mode. For instance, in the BTCUSDT Isolated Margin Mode, only BTC and USDT are accessible. You may choose the isolated mode for several trades.

Margin in cross margin mode is shared among the user’s Margin trade. All positions share assets in cross-margin reports. The margin level is calculated according to the total asset value and debt in the account. To learn more, read what is margin trading?

Furthermore, if the trader has an open position in Isolated Margin Mode, they cannot lower the leverage. Moreover, Cross Margin Mode can only be shared with the same type of asset. So, for example, in Cross Margin Mode, all BUSD in USDⓈ-M Futures Wallet can be used for all BUSD -margined contracts.

What happens in case of Liquidation?

Binance will use the Mark Price to avoid unnecessary liquidation and to combat market manipulations. Liquidation occurs when the Mark Price hits the Liquidation price of the position. A liquidation is triggered when,

Collateral = Initial Collateral + Realized PnL + Unrealized PnL < Maintenance Margin

Perpetual Contract Vs Traditional Futures Contract

The difference between a perpetual contract and a traditional one is that the perpetual contract doesn’t have an expiry date or settlement date, which is a defining feature of conventional contracts. Instead, funding is used to keep a long-term convergence between a perpetual contract and the Mark Price.

A perpetual contract will mimic the movement of the Spot Price of underlying crypto without the need to having the delivery of the said asset. To learn more, read our guide to Futures trading.

Binance Futures Trading: Funding Rate

Funding rates are payments made to long or short traders, calculated on the difference between the perpetual contract price and spot price. Thus, the funding rate forces convergence of price between perpetual contract and spot price. The two components that determine the funding rate are the Interest Rate and the Premium.

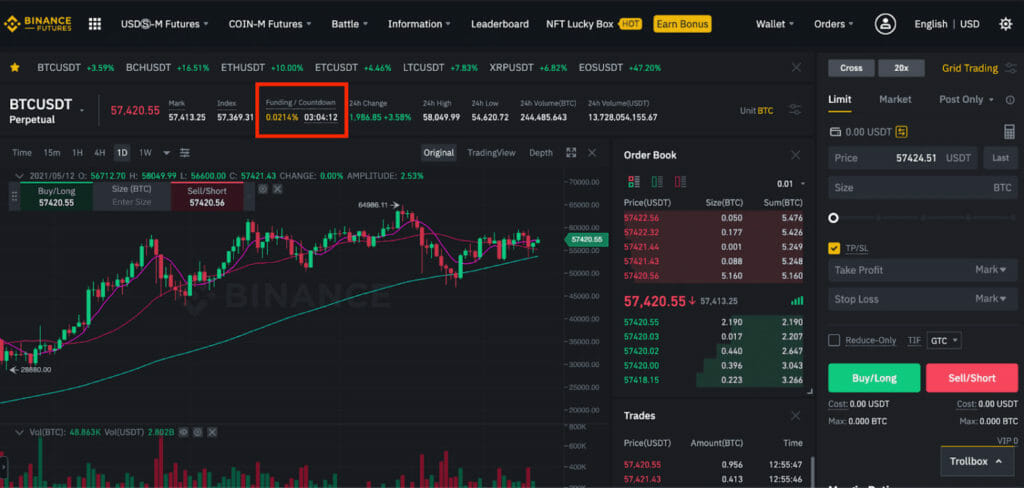

You can view the Funding Rates and a countdown timer to the subsequent funding on the Binance Futures interface above the candlestick chart:

What is Auto-Deleveraging (ADL)?

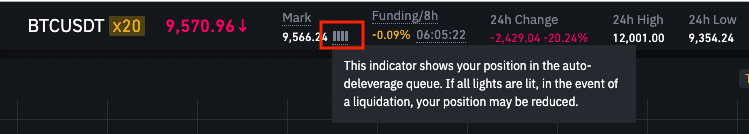

ADL is the final step when the Insurance Fund cannot accept the bankrupt client’s positions. Binance has several features like Immediate Cancel Limit Order and others before ADL needs to be implemented and reduce the impact created by ADL. However, it is difficult to avoid any auto-deleverage liquidation due to the high volatility of the cryptocurrency markets.

Binance Futures Trading: Fees Schedule

Binance provides its users with a 10% discount on the standard trading fees using BNB to pay the fees. However, users will have to transfer BNB from their Spot Wallet to their Future Wallet to receive the 10% discount.

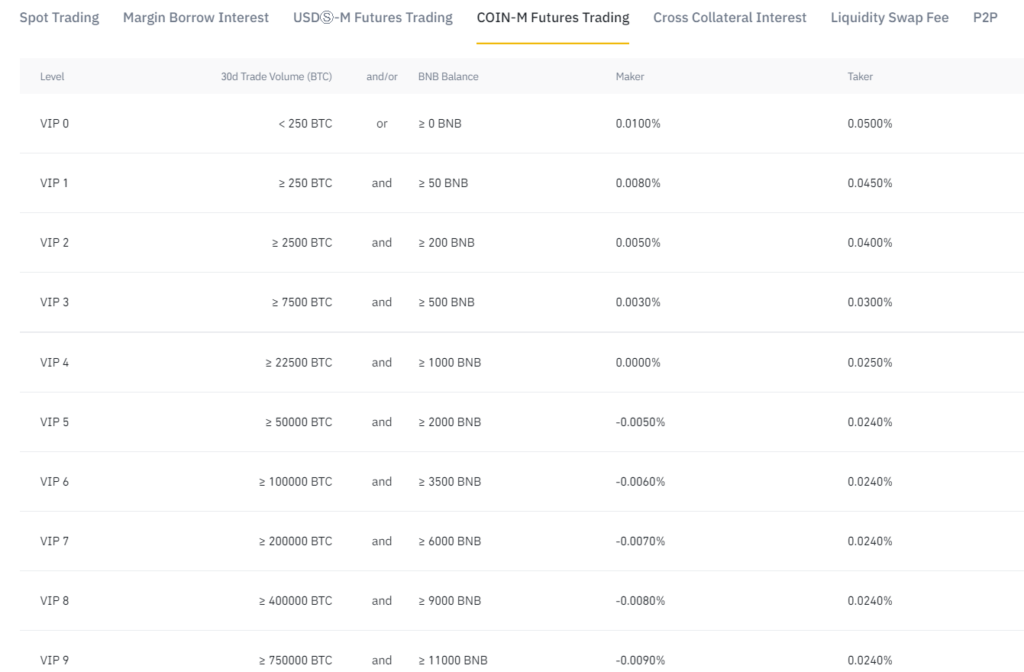

Calculating the commission of COIN-Margined Futures

Commission fee = notional value x fee rate

Notional value = (number of contracts x contract size) / trade price

For example,

VIP 0 marker commission: 0.015%; taker commission: 0.040%

Buy 10 BTCUSD 0925 quarterly contract using Market order: Notional value = (number of contracts x contract size) / opening price = (10 Cont x 100 USD) / 10,104 USD = 0.09897 BTC Taker commission fee is paid: 0.09897 x 0.040% = 0.00003959 BTC After the price rises, Sell 10 BTCUSD 0925 quarterly contract using Limit order: Notional value = (number of contracts x contract size) / closing price = (10 Cont x 100 USD) / 11,104 USD = 0.09 BTC Maker commission fee is paid: 0.09 x 0.015% = 0.00001351 BTC

Please note that a flat 0.015% settlement fee for quarterly delivery contracts is charged for all positions settled on the delivery date. Below is the tier-based trading fee:

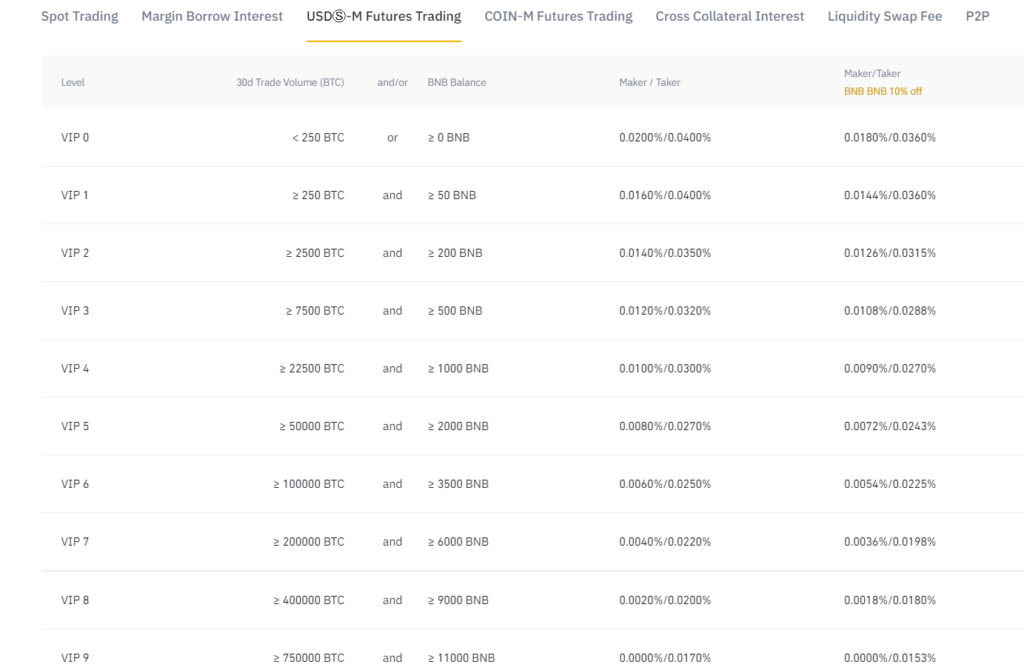

Calculating the commission of USDⓈ-Margined Futures

Commission fee = notional value x fee rate

Notional value = number of contracts x trade price

For example,

VIP 0 marker commission: 0.02%; taker commission: 0.040% Buy 1BTC BTCUSDT contract using Market order: Notional value = number of contracts x opening price = 1BTC x 10,104 = 10,104 Taker commission fee is paid: 10,104 x 0.040% = 4.0416 USDT After the price rises, Sell 1BTC BTCUSDT contract using Limit order: Notional value = number of contracts x closing price = 1BTC x 11,104 = 11,104 Maker commission fee is paid: 11,104 x 0.02% = 2.2208 USDT

Below is the tier-based trading fee:

How to Borrow funds using Cross Collateral?

- The trader can click on “Futures” from the drop-down under the heading “Wallet” once they log into the account.

- From here, choose the “Cross Collateral” function in your futures wallet interface. For example, Binance provides collateral for BUSD, BTC, ETH, and EUR for this function.

- Enter the amount of USDT you would like to borrow. Then, click on “Start Borrowing” once you have confirmed. The amount of USDT burrowed will be transferred to the future wallet, while the collateral amount of BUSD, BTC, ETH, or EUR will be deducted from the spot wallet.

It is advisable that a trader reads and agrees to the "Cross Collateral Service Agreement" and must be aware of these risks and confirm to use this services.

What is Hedge Mode?

With Hedge Mode, the trader can hold positions in both long and short directions at the same time under the same contract. Whereas in a One-Way Mode, the traders can hold a position in one direction only under one contract. This can help you in preventing liquidations while using cross margin mode.

What is Binance BTCDOM Index?

Binance BTCDOM Index is a cryptocurrency price index reflecting the market dominance performance of Bitcoin. The BTCDOM Index is a metric that traders can use to quickly get a sense of Bitcoin’s value relative to the broader cryptocurrency market. Unlike the real Bitcoin market dominance indicator, which is capped within 0~100%, the BTCDOM index is uncapped and more suitable for derivatives trading. It is calculated with Bitcoin price denominated in the constituent cryptocurrency, e.g., BTC/ ETH, BTC/ BNB, BTC/ ADA, etc.

Binance Futures Trading: Conclusion

With this, we can conclude that Binance is one of the most advanced futures trading platforms for cryptocurrencies in the world. The facilities they provide andThis is because theseFor example, strict compliance rules, and regular checks and balances also make it a safe platform. It is an excellent place for new beginners to learn and experience crypto futures trading here.

Frequently Asked Questions

Can I trade in multiple contracts at the same time in the Binance Future Platform?

Yes, you can trade in multiple contracts. For example, you can have a long and a short open position in the contract with their hedge mode.

Can I borrow funds to trade with Binance?

Yes, you can borrow funds. However, it is advisable that a trader reads and agrees to the ‘’Cross Collateral Service Agreement’’ and must be aware of these risks and confirm to use this services. In addition, traders can enjoy different borrowing limits and daily interest rates at different VIP levels; and Please refer to ‘’Cross Collateral Interest Rate’’ for more details.

Where to trade bitcoin futures?

Binance is the most significant example, with exchange turnover wise and one of the best exchanges to trade bitcoin future.