Leverage is a trading strategy that allows traders to use borrowed funds to increase their exposure and potential profits in the crypto market. However, leverage also comes with higher risks and requires more skill and experience to trade successfully. Therefore, choosing a reliable and secure crypto exchange that offers high leverage options is crucial for traders who want to take advantage of the market movements.

In this article, we will review the top high leverage crypto exchanges based on their features, products, fees, security, and reputation. We will also provide some tips and best practices for using leverage in the crypto market.

Table of Contents

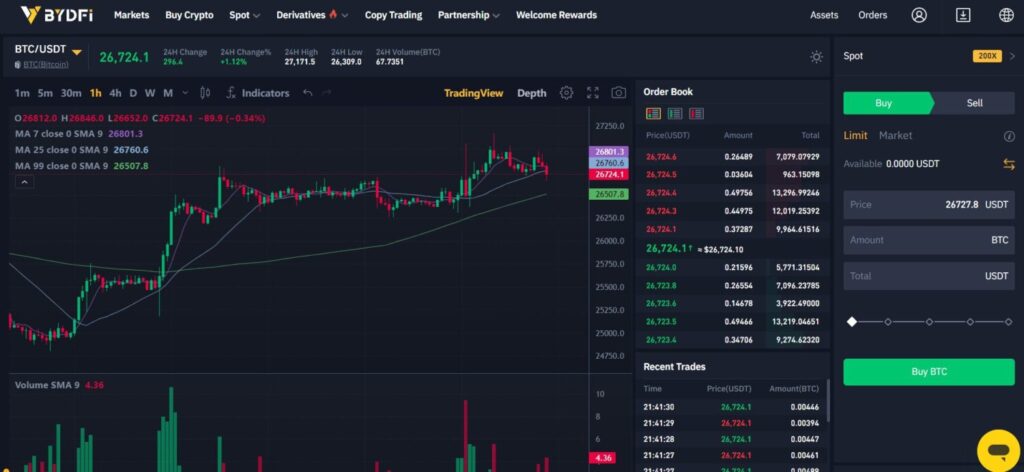

BYDFi

Welcome to the crypto sphere! Let’s kick off our journey with BYDFi, previously known as BitYard. Based in Seychelles, BYDFi Fintech LTD, standing for “BUILD Your Dream Finance,” is our guide through this global exchange adventure.

BYDFi offers up to 200x leverage on its perpetual contracts, which are contracts that track the price of an underlying asset without expiration date. Perpetual contracts are ideal for traders who want to speculate on the long-term trends of cryptocurrencies without worrying about time decay or settlement issues.

What BYDFi Offers:

- Leverage Magic: BYDFi lets you play with up to 200x leverage on perpetual contracts.

- Product Wonderland: Dive into spot trading, margin trading, copy trading, and coin management.

- User-Friendly Ride: Smooth sailing with a user-friendly interface and a handy mobile app.

Pros:

- Low fees compared to other exchanges

- Fast execution speed and low latency

- It has a variety of products and tools for different trading styles

- It has a strong community and customer support

Cons:

- It requires KYC verification for some features

- It does not support fiat deposits or withdrawals

- It does not have a native token or governance system

Read full review of Bydfi here.

PrimeXBT

Welcome to the cutting edge of crypto derivatives. PrimeXBT has carved a niche in the digital asset space as a powerful platform tailored for leverage-focused and derivatives-driven traders. Founded in 2018 and headquartered in Seychelles, PrimeXBT delivers institutional-grade trading infrastructure to retail and professional users across the globe.

PrimeXBT offers up to 200x leverage on crypto derivatives, making it one of the highest-leverage exchanges available today. This enables traders to amplify their market exposure and potentially magnify profits — but with high leverage comes increased risk, so strict risk management and sound strategy are essential.

What PrimeXBT Offers

Leverage Powerhouse: Trade with up to 200x leverage on crypto derivatives, and up to 1000x leverage on traditional assets like forex and commodities.

All-in-One Trading Hub: Access not just crypto, but also forex, commodities, stock indices, and more — all from one platform.

Copy Trading Made Easy: Use the Covesting module to follow top-performing traders and automate your strategy.

Advanced Charting: Built-in tools, technical indicators, and a fast, clean UI for streamlined analysis and execution.

Pros

- Ultra-high leverage (up to 200x on crypto, 1000x on forex)

- Access to multiple asset classes (crypto, forex, indices, commodities)

- Covesting copy trading for beginner-friendly automation

- No KYC required for basic account usage

- Competitive and transparent fee structure

Cons

- No spot trading (only derivatives and synthetic pairs)

- Limited selection of crypto assets compared to other platforms

- Restricted access in certain jurisdictions (including the U.S.)

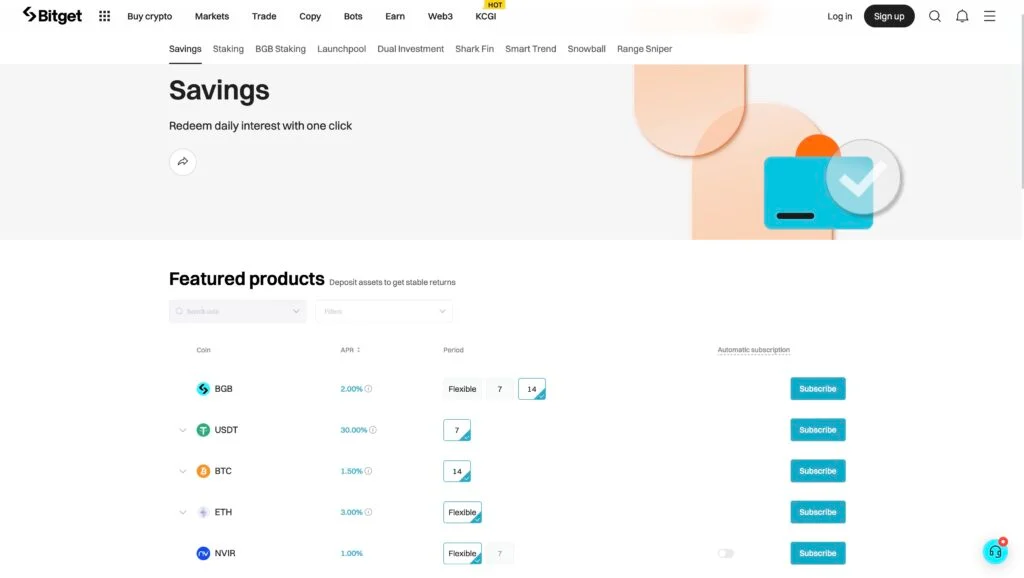

Bitget

Bitget is a Singapore-based exchange that was founded in 2018. Its main features include futures trading and copy trading. Bitget has been named one of the top five futures trading platforms and one of the top ten spot trading platforms. It has more than 8 million users across more than 100 countries and regions.

Bitget offers up to 125x leverage on its futures contracts, which are contracts that allow traders to buy or sell an underlying asset at a predetermined price in the future. Futures contracts are suitable for traders who want to hedge their risks or take advantage of price fluctuations.

Bitget also supports spot trading, margin trading, bot trading, NFT trading, Web3 wallet, prediction markets, guilds, and industry-leading security features. It has over 590 cryptocurrencies available for trading. It also has a sleek design and a mobile app that make it easy to use.

Pros:

- It offers various smart trading tools such as simulate mode, create mode, etc.

- It allows users to copy trade from elite traders with high performance

- It supports multiple fiat currencies for deposits and withdrawals

- It has a dedicated customer service team

Cons:

- It requires KYC verification for all features

- It does not support USDT deposits or withdrawals

- It does not have a native token or governance system

Also Read, Bitget Review – Trading Fees, Copy Trading and More

Binance

Binance is one of the most popular and widely used crypto exchanges in the world by volume. Binance was founded in 2017 by Changpeng Zhao (CZ), who is also known as CZ Binance. Binance operates as Binance Chain Ltd., which is registered in Hong Kong under the Companies Ordinance.

Binance offers up to 125x leverage on its futures contracts as well as perpetual swaps. Perpetual swaps are similar to perpetual contracts but they do not have an expiration date. They allow traders to speculate on any cryptocurrency pair without worrying about time decay or settlement issues.

Binance also supports spot trading, margin trading, NFT marketplace, Web3 wallet, prediction markets, guilds, and industry-leading security features. It has over 500 cryptocurrencies available for trading. It also has a user-friendly interface and a mobile app that enable traders to access the platform anytime and anywhere.

Pros:

- It supports multiple fiat currencies for deposits and withdrawals

- It supports multiple blockchains such as Binance Chain, Binance Smart Chain, and Binance DEX

- It has a large user base and liquidity pool

Cons:

- KYC verification is a must

- Banned in some coutries

- Binance has gotten into regulatory trouble in several countries

Also Read, Binance Review | Everything you need to know

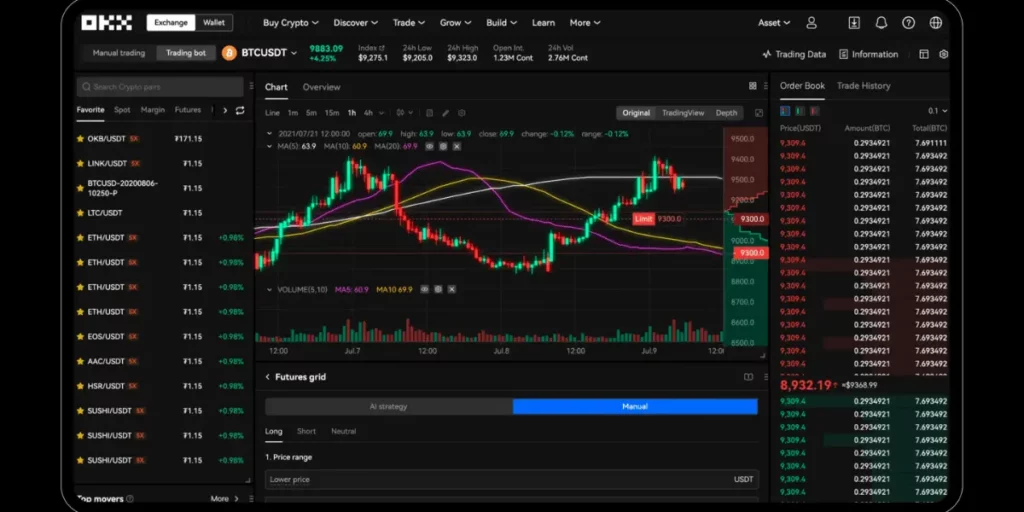

OKX

OKX stands out as a versatile cryptocurrency exchange, offering an array of financial services to its users. From spot trading to margin trading, derivatives trading, flexible futures, and even diving into the world of decentralized finance (DeFi) products, OKX caters to a wide range of crypto enthusiasts. With a global footprint spanning over 160 countries and supporting more than 320 cryptocurrencies, OKX has become a notable player in the crypto exchange arena.

Pros:

- Leverage Opportunities: OKX empowers users to trade with leverage, allowing up to 100x on futures and 10x on spot markets. This feature can significantly amplify profits in favorable market conditions.

- Cost-Effective Trading: The platform boasts a low and tiered fee structure, determined by the user’s trading volume and OKB holdings (the platform’s native token). Fees range from 0.230% to 0.000% for makers and takers.

- User-Friendly Interface: OKX offers a user-friendly and intuitive interface equipped with various trading tools and indicators, catering to both beginners and seasoned traders³. Additionally, it provides a demo account and a copy trading feature, enabling users to learn and follow successful strategies.

- Robust Security Measures: Security is a priority for OKX, featuring cold and hot wallets, multi-signature verification, and anti-DDoS protection. The platform reinforces transparency by publishing monthly Proof of Reserves reports, showcasing the solvency of its assets.

- Lucrative Returns: OKX incentivizes users with high returns through its staking and saving features. Additionally, users can explore new DeFi projects via liquidity mining. The mobile app even allows users to earn fractional amounts of Bitcoin through daily learning missions.

Cons:

- Geographical Restrictions: OKX imposes restrictions on residents in various countries, including the U.S., North Korea, Iran, and Syria. Users interested in fiat trading may find limited options, as OKX supports only a few fiat deposits and withdrawals⁴.

- Complex Verification Process: The verification process on OKX can be cumbersome and confusing. Users are required to submit ID and proof of address for crypto deposits and withdrawals. Some users have reported delays and difficulties in completing the verification.

- Regulatory Uncertainty: Operating in an unlicensed and unregulated space, OKX navigates a legal gray area and may encounter regulatory challenges in the future⁵. The platform has also been involved in controversies, such as the suspension of withdrawals in 2020 following the arrest of its founder.

Also Read, Top OKX Alternatives for Crypto Trading

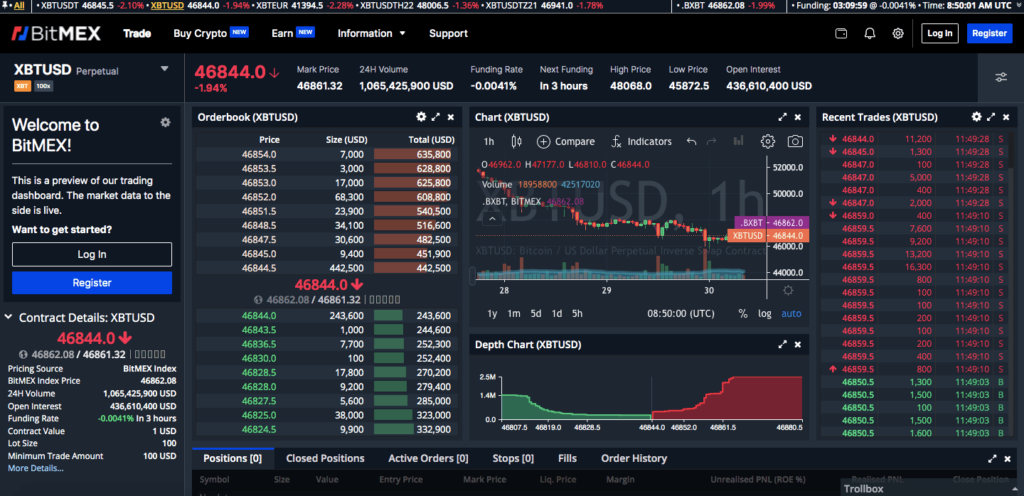

BITMEX

BitMEX is a Seychelles-based exchange that was founded in 2014 by HDR Global Trading Limited. It operates as BitMEX Ltd., which is registered in Hong Kong under the Companies Ordinance. BitMEX offers up to 100x leverage on its perpetual contracts and futures contracts, which are contracts that allow traders to buy or sell an underlying asset at a predetermined price in the future.

BitMEX also supports spot trading, margin trading, prediction markets, guilds, and industry-leading security features. It has over 100 cryptocurrencies available for trading. It also has a user-friendly interface and a mobile app that enable traders to access the platform anytime and anywhere.

Pros:

- It offers low fees compared to other exchanges

- It supports multiple fiat currencies for deposits and withdrawals

- It supports multiple blockchains such as Bitcoin Cash, Bitcoin SV, and Bitcoin Gold

Cons:

- Geographical Restrictions

- Complex Verification Process

- Regulatory Uncertainty

Also Read, 5 Best BitMEX Crypto Signals

Conclusion

Embarking on the world of crypto leverage requires a thoughtful examination of platform features and drawbacks. BYDFi, Bitget, Binance, OKX, and BitMEX each bring unique strengths and weaknesses to the table.

We recommend Bydfi as it suits almost all types of traders and has a wide variety of product offering.

Whether you prioritize low fees, diverse trading options, or a strong user community, the ideal choice hinges on your specific needs. Always conduct thorough research, practice risk management, and trade responsibly in this dynamic crypto market.

FAQs

What are the advantages of using a high leverage crypto exchange?

The main advantage is the potential for higher profits. Leverage allows traders to magnify gains in favorable market conditions. However, it comes with increased risk.

Is high leverage trading suitable for beginners?

High leverage trading is generally not recommended for beginners due to the increased risk. It requires a solid understanding of the market and risk management.

Which crypto exchange is best for high leverage trading?

Bydfi is the best crypto exchange for taking high leverage crypto trades with it offering upto 200X leverage.

For on-demand analysis of any cryptocurrency, join our Telegram channel.