Best Crypto Tax software solutions are tools that aim to simplify the process of calculating and filing your tax returns, considering gains/losses in crypto, and setting up the tax documentation automatically.

You should use this type of software when dealing with hundreds or thousands of transactions among different platforms/wallets or when you sell crypto assets, and you don’t want to mess up getting your tax reports.

On top of that, these tools help save you time and automate calculating taxable income across all your wallets.

Summary

- TaxBit: best for tax professionals, intended towards ETH users and enterprises.

- CoinTracker: One of the most user-friendly platforms and leaders in innovation, mainly for ETH*

- Koinly: Trendsetter in crypto tax reports and tax settings

- CoinTracking: Trailblazer in crypto tax reports and advanced settings

- Kryptos: The go-to platform for powerful, seamless crypto tax and financial management—built for individuals and enterprises alike!

What’s the best crypto tax tool for my money?

Kryptos offers the best deal in terms of value for your money, this includes the combination of cost, features, sustainability, and ease of use to meet customer needs. Due to its ease of use and the fact that all plans include the tax-loss harvesting feature, and you can generate as many reports as you want, the best choice you can make is to use their tool.

What is the Best tax software for Beginners?

These focus on the user, their UI & UX are incredibly intuitive, and the process of importing data and generating reports is inherent for most of them.

What to look for in a crypto tax solution?

You need to look out for: Automated Data Input, Flexibility, Pricing, Reliability, Features, Tax Reports Quality, Customer Support, and Ease of Use. If you’re new to the crypto space, don’t juggle between two tools to manage your crypto portfolio and taxes. Seek the one that focuses on the user, provides educational content, and offers a crypto tracker app and a crypto tax tool. Ensure that it delivers specific outputs per country and excellent customer support.

Does Crypto tax software work? If You use a Crypto Tax Software, do you still need a Tax Consultant?

Crypto tax software does work; they aim to automate importing transactions, find all market prices at the time of your trades, and calculate your gains and cost basis. While using these types of software, it is not necessary to have a tax consultant; in fact, you can file taxes alone, just making sure you generate a report accepted in your tax jurisdiction.

How do I know If I need to pay taxes on my crypto?

When you execute a trade/sell on crypto, you have to pay tax on the difference between the selling price and the price you bought it for (Capital Gains Tax), and it has to be paid in several countries, such as the UK, USA, Canada, Germany, among others. It is like “reporting your capital loss or gain over your trades.”

Top Crypto Tax Solutions

1. Kryptos

Kryptos is an advanced tax and financial management solution catering to both individuals and enterprises. With Binance Labs backing and partnerships with top brands such as Binance, Gate, Safepal, and Bitstamp, Kryptos provides unique features, from tax compliance and portfolio tracking to developer tools via Kryptos Connect. This platform also supports 5,000+ integrations and offers a free tax report for up to 100 transactions.

| Pros | Cons |

| Mobile app available (iOS & Android). | Higher-tier pricing for enterprise solutions. |

| Broad integration support (5,000+). | Extensive features may not be necessary for basic retail users. |

| Developer API and widget solutions. | |

| Supports American and international tax reports. | |

| Free tax reports for up to 100 transactions. |

2. CoinTracking

The software analyzes trades and generates reports on profit and loss, unrealized gains, taxes reports, etc. They support over 10k assets with full historical data and can create generic tax reports for over 100 countries.

Also read, CoinTracking Review – A Reliable Crypto Tax Software

| Pros | Cons |

|---|---|

| Mobile App. | No NFT support. |

| Diversity of features. | Complex website design. |

| Customizable dashboard. | Errors on portfolio tracking tool. |

| They accept crypto as a payment. | Problems while categorizing leveraged yield. |

| Lifetime subscriptions. | |

| Competitive pricing plans. |

Also, read CoinTracking vs Koinly: Simplify Your Crypto Taxes

3. Koinly

They calculate your cryptocurrency taxes and help you reduce them for next year, using a reliable & straightforward interface. They offer support for more than 20 countries and more than 300 exchanges and wallets.

Also read, Koinly Review – Is It Really a Good Tax Software?

| Pros | Cons |

|---|---|

| Smart transform matching technology. | No NFT support. |

| Defi support. | Expensive for frequent tradersLate response levels from customer support. |

| Easy data import and export. | You need to get a higher plan to get access to a considerable support level. |

| Accept crypto payments. | |

| Supports + 20 countries. |

4. Cointracker

They offer a portfolio manager while monitoring your moves and giving daily updates on your allocation. Also, they got a crypto tax tool to generate tax reports. The software gathers your transactions from + 250 exchanges and classifies them.

| Pros | Cons |

|---|---|

| Mobile App. | Portfolio tracking and Crypto Taxes tool are billed separately (can get expensive). |

| Defi and NFT support (for ETH). | Does not support margin trading. |

| Extremely user-friendly. | Restricted blockchains support. |

5. TaxBit

Pioneer platform on crypto tax software is designed by CPAs and tax attorneys and supports +200 wallets/exchanges. TaxBit allows you to calculate taxable income based on real-time exchange rates focusing on security and customer support.

Also read, Taxbit Review: Simplify Your Crypto Taxes

| Pros | Cons |

|---|---|

| Automated tax solution (*ETH). | No mobile platform. |

| Services for enterprises and customers. | Restricted blockchains support. |

| Excellent customer support. | Limited auto-sync capability. |

| Extremely user-friendly. | No fully Defi support. |

| Ease of use. |

Deep diving into each tax software…

1. Price Comparision

Accointing.com and CoinTracking offer one of the best packages in terms of value for your money (taking into consideration pricing, (and transactions). Even though CoinTracking supports up to 20k transactions, their platform is hard to use, even for advanced crypto users, so this is time-consuming in the long term if you are importing several wallets. On the other hand, TaxBit plans include unlimited transactions. Their software functionality is restricted to ETH mainly, so if you are an active Defi user, it won’t suit your needs. Moving into Koinly and CoinTracking, they offer a free trial, and their pricing per tax year can get higher if you are dealing with a huge amount of transactions.

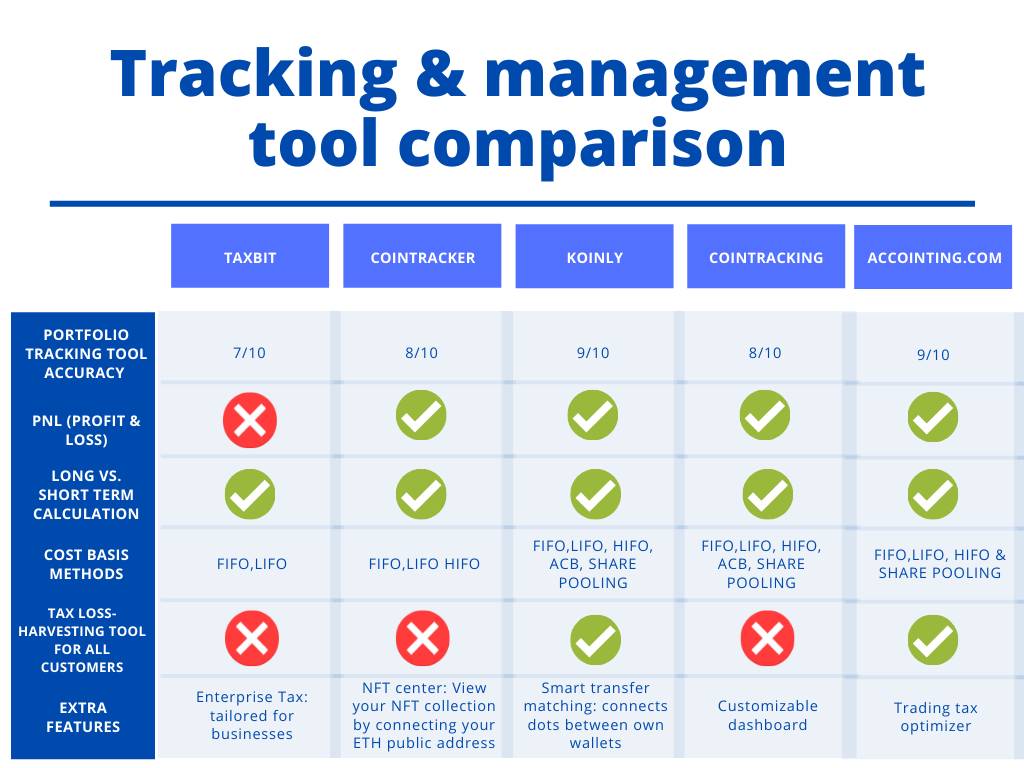

2. Tracking & management tool comparison among all platforms

Taking into consideration the tracking and management tool comparison, Accointing.com and Koinly offer the best deal, judging by their portfolio tracking accuracy and tax loss harvesting tool available for all customers.

Nevertheless, Cointracking and Cointracker follow the lead by their integrated features; Cointracking offers an advanced settings option plus a customizable dashboard to make the experience as unique as possible.

On the other hand, Cointracker’s extremely intuitive UI and NFT centre demand many traits to call out. Finally, Taxbit is intended for ETH users. Their platform is helmed by tax experts and comes with intelligent optimization tools for smart tax calculation.

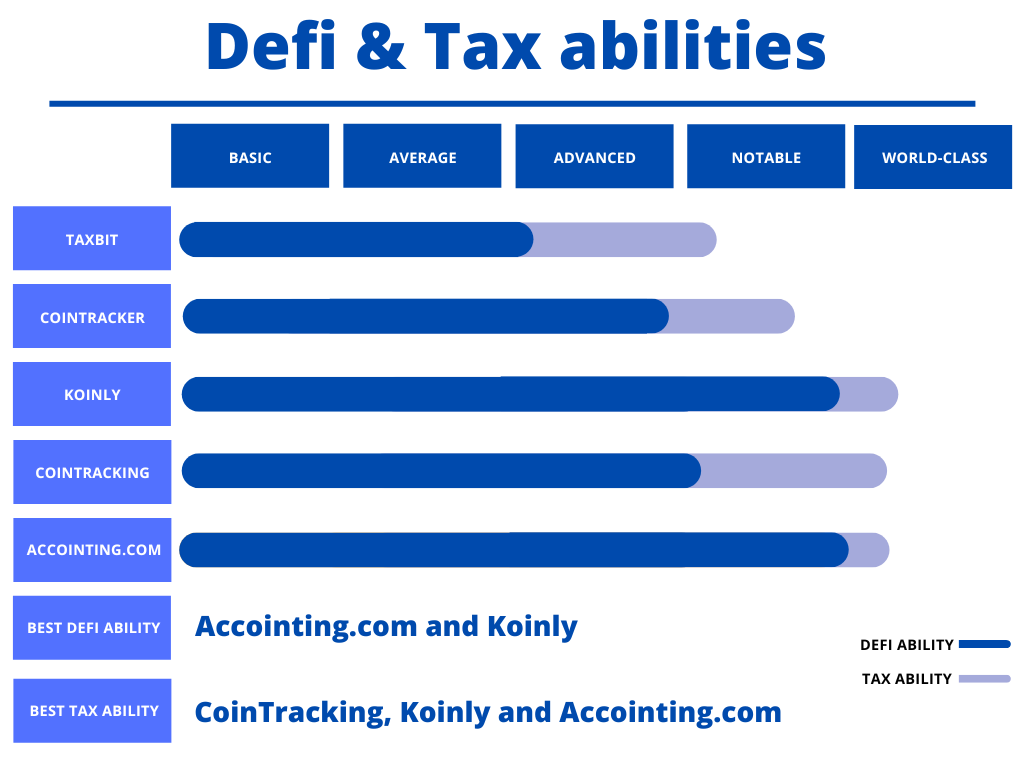

3. Defi & Tax abilities

For the following chart, these factors were taken into consideration: data compilation, formatting into crypto tax reports template, tracking the current year’s gains and losses, and capital gains and loss calculation.

Accointing.com and Koinly offer the best Defi ability among all platforms (capability of classifying/recognizing complex Defi transactions properly), while the most complete software in terms of tax capabilities is Cointracking due to the various cost basis methods managed and the number of reports available.

Conclusion

With crypto and profits, come tax liabilities as well. Understanding cryptocurrency taxes is not as simple as it may seem. To save time and reduce the risk of messing up your yearly crypto taxes, we have explained the best crypto tax software solutions to make it easy and get you all covered with the best features to avail and make your crypto tax filing journey as smooth as possible.

Also read,