Cryptocurrency is increasingly becoming a popular investment option for many individuals and businesses, but it comes with the responsibility of accurately reporting crypto-related income and gains for tax purposes.

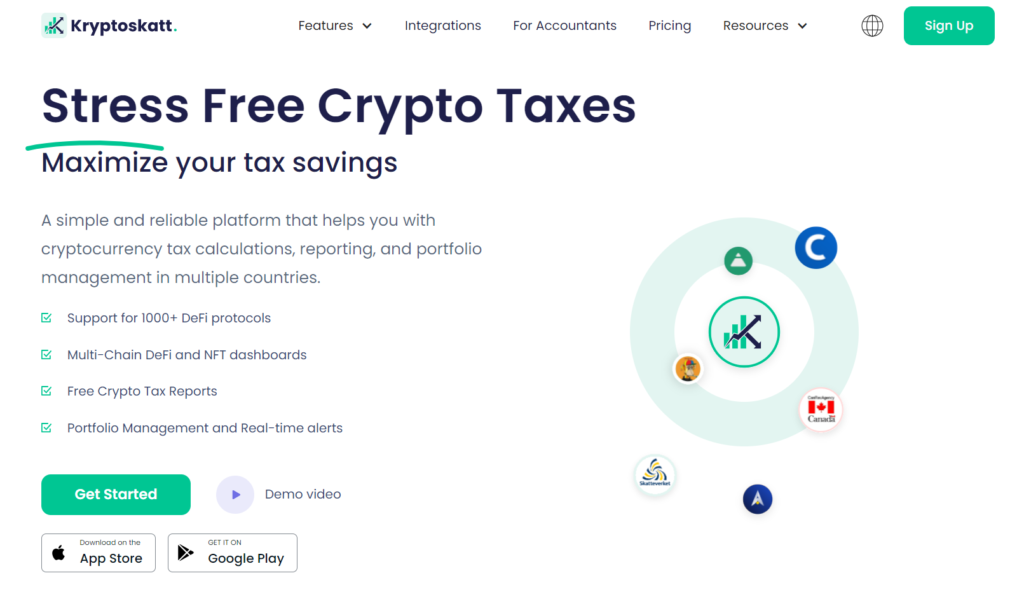

Kryptos is a promising solution for calculating your crypto taxes, designed to make the process as easy and stress-free as possible.

In this Kryptos review, we’ll take a closer look at the features and capabilities of the Kryptos app and evaluate its effectiveness as a crypto tax software for investors like you.

Table of Contents

Overview

Kryptos is a crypto tax software founded in 2020 by Sukesh Kumar Tedla, headquartered in Sweden. He is also one of the founding members of Telos Blockchain Network and led its growth to an ATH M.Cap of $300+ million.

Find all the information about the company on its LinkedIn page.

The platform allows you to import all your crypto transactions directly via API or through CSV files and automatically calculates your taxes in just a few minutes.

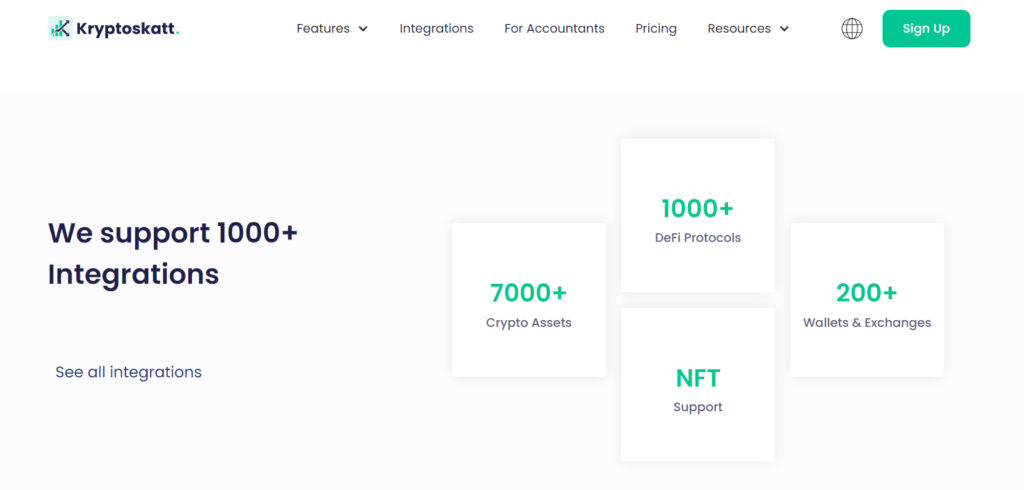

It has a wide range of integrations to choose from, so you don’t have to juggle between multiple platforms, and can manage all your transactions from one single dashboard. In fact, this platform has the highest number of integrations currently present in the market.

You can track your portfolio, including DeFi and NFT transactions, and leverage multiple inbuilt tax-saving techniques to save thousands in taxes.

The app also allows you to generate free tax reports that comply with your country’s laws and has its own accountant network if you want help in filing taxes. To make it more convenient for users, they have a free mobile app available both for Android and iOS.

Kryptoskatt Review: Key Features

Kryptos app is packed with multiple features to simplify your crypto tax journey and maximise your savings. Here are some of the key features of the platform that you should consider.

- Wide Range Of Integrations– In comparison with other solutions present in the market, Kryptos provides the most extensive integrations for you crypto transactions and this also includes DeFi and NFTs. It has over 1000+ DeFi protocols, 50+ blockchains, 200+ wallets and exchanges, and even supports multiple NFT standards.

- Automated Data Import– Importing all your transaction data on Kryptos is as simple as inserting the API key of your accounts or wallet address on the platform. The platform auto-syncs all your data directly via API or you can use CSV files to upload your transactions.

The app has smart features to categorise your transactional data based on specific variables and even find out transactions between all your wallets so you don’t have to do any complex maths manually.

- Built-in Tax-saving Techniques– This crypto tax software is built to save you time and money that you would have otherwise spent on your taxes. For this, the app is loaded with automated features and built-in mechanisms like Tax Loss Harvesting so that you never lose any tax-saving opportunity.

The best part is the platform is smart enough to read all your data and detect all tax-saving opportunities automatically. All you have to do is feed the app with your transaction data, which practically takes care of the rest.

- Multi-Country Support– Kryptos supports different countries including Canada, Sweden, the UK, USA, and is constantly working on expanding its support to other countries. Refer to their website for a detailed list of supported countries.

- Free Tax Reports– If you are just starting with crypto, the app lets you generate free tax reports based on local laws. Just select the country where you need the report, and the platform takes care of all the legal compliance.

- Extensive Security– Thanks to their strong security, your funds are completely secure with Kryptos. They do not ask for your private keys and only read the data you share with them to calculate the crypto taxes. Their client/server communication is SSL certified, and the data is completely encrypted to provide security to all its users.

- Customer Support– They provide super fast customer support, so you always have someone solving your problems in real-time. You can opt for their paid packages if you want extra guidance throughout your crypto tax journey.

- Accountant Network– Kryptos not only makes calculating your crypto taxes stress-free but also helps you beyond that. In case you are finding it hard to file your taxes, the platform gives you access to their professional accountant network which can help you with the same.

Kryptoskatt Review: Pros & Cons

Should you choose Kryptos to calculate your crypto taxes? Is it the best choice for you? Now that we have discussed the features of the Kryptos app, let’s look into the pros and cons of using this platform.

Pros

The platform is packed with a bunch of helpful features yet pretty straightforward. You have a single dashboard to easily track and manage all your transactions. Here are a few pros of using Kryptos for portfolio management and tax calculations:

- Automatic import of transaction data from various exchanges and wallets

- Maximum number of integrations present in the market for managing different types of crypto assets, including 3000+ DeFi protocols and even NFTs

- Easy error handling and accurate analysis of capital gains and losses

- Support for multiple tax forms such as Schedule D and 8949.

- Customizable tax reporting options, including options for wash sales and cost basis adjustments

- User-friendly interface with clear, step-by-step instructions

- Available as a mobile app to let you manage your crypto taxes on the go.

- Great customer support to solve real-time issues

Cons

The only con that I noticed was that the platform supports only 30+ jurisdictions as of now. But the good news is: they are working on expanding their support to more regions and will be available there very soon.

Kryptoskatt Pricing

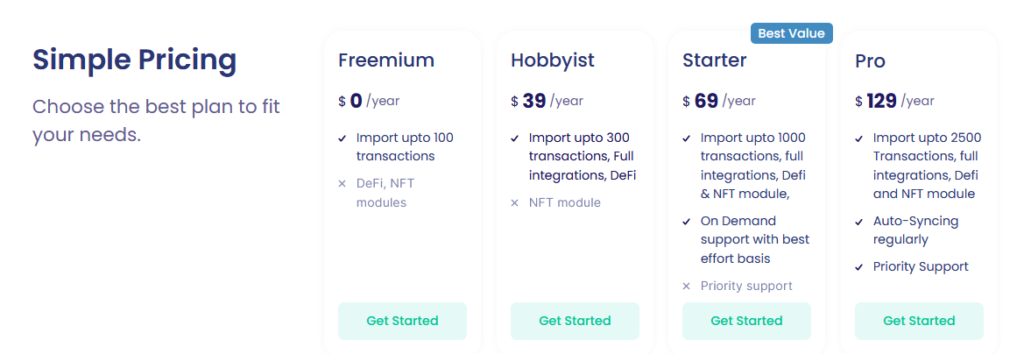

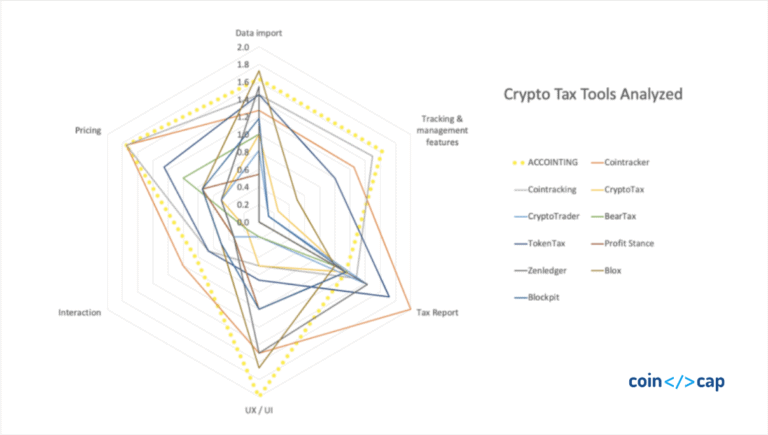

One of the biggest advantages of using this tax software over its competitors is its price point. All of their packages are much cheaper than the available rates in the market but provide all the support you need in your crypto tax journey.

They also have a free package which is great for beginners as well as for exploring their platform before making any commitment.To get a better idea of all the available packages, you can check out the plans here.

To get a better idea of all the available packages, you can check out the plans here.

How To Get Started With Kryptoskatt App?

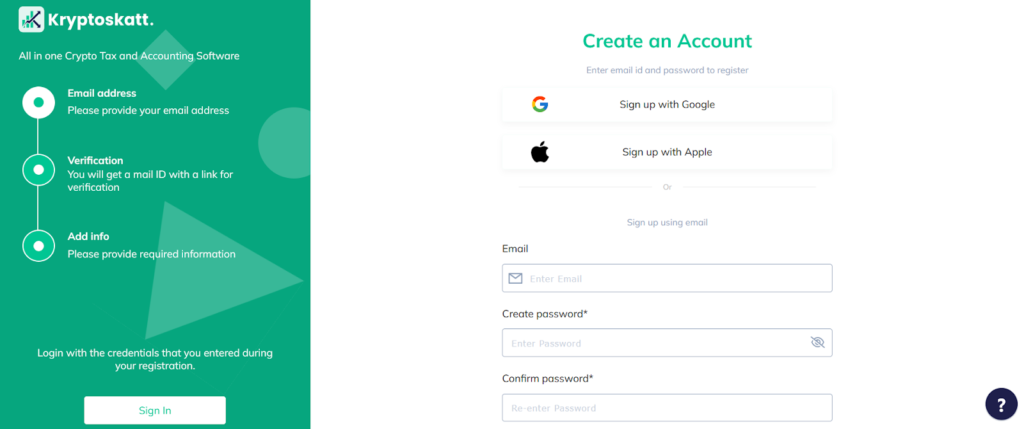

- To get started, you first need to sign up on Kryptos here. You can directly link your Google/Apple account or use your email address to create your account on the platform.

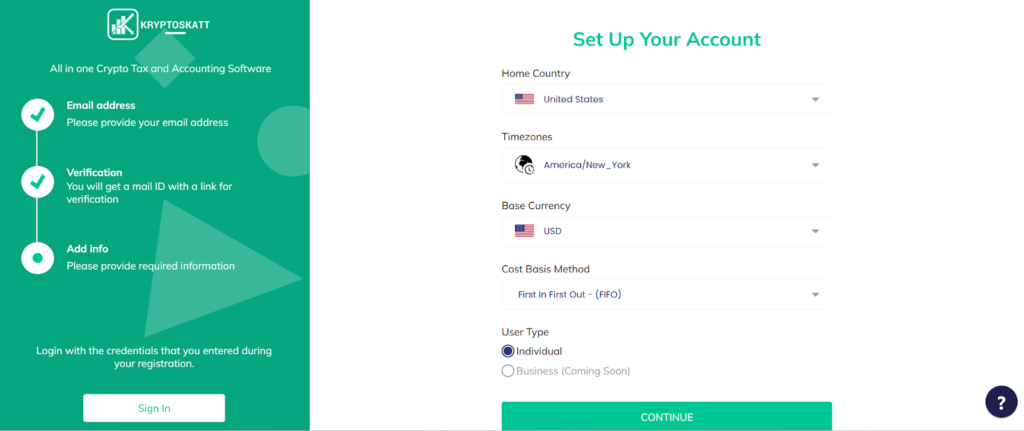

- Choose your home country and currency for accurate analysis and calculation of taxes. This also ensures the tax reports are generated in compliance with your local laws.

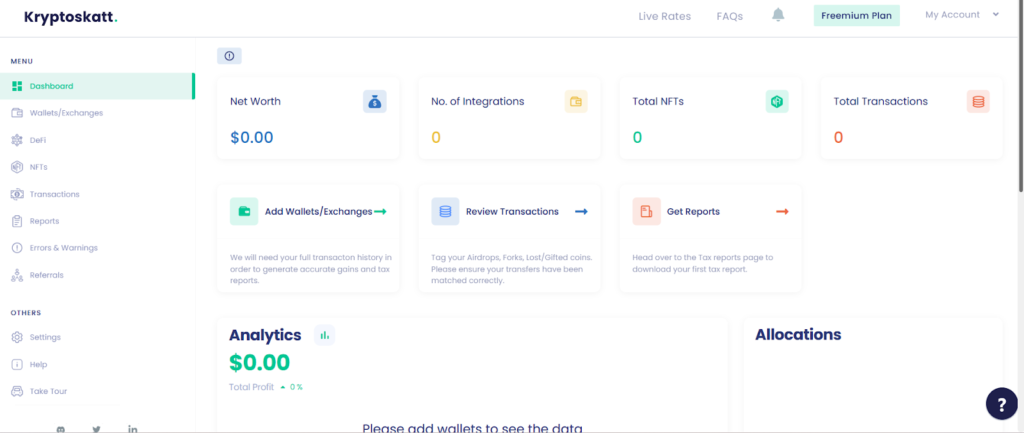

- You can track and manage your crypto portfolio through a single dashboard. Add your wallet or exchange directly via API or CSV files and import your transaction data. Choose the plan that fits your needs the best and calculate your crypto taxes in minutes.

Kryptoskatt Review: Conclusion

Kryptos app is a user-friendly, all-in-one solution for calculating your crypto taxes while reducing your tax bill. Its automatic import of transaction data, accurate calculations, and customizable tax reporting options make your crypto tax process a breeze.

The crypto tax software is reasonably priced, and the customer support team is always there for you. So is it the best choice for you?

![Cryptocurrency Tax - 5 Questions You Need To Be Asking [Bitcoin Tax] 15 Cryptocurrency Taxes](https://coincodecap.com/wp-content/uploads/2020/03/tax-on-bitcoin-768x432.png)