Can one platform unify the fragmented DeFi landscape without compromising speed or security? Arca aims to do just that, launching in early 2025 as an all-in-one, non-custodial trading solution on Solana and Base. Promising a CEX-like experience with DeFi’s freedom, it tackles gas fees, bridges, and UX challenges with 30ms transactions, up to 15% APY yields, and no-KYC trading. Integrating protocols like Hyperliquid and Morpho, Arca offers perpetuals, memes, RWAs, and rewards. This review explores its mechanics, features, user experience, security, and future potential, assessing its role in revolutionising on-chain trading.

Table of Contents

Evolution of Arca

Arca emerged in the first quarter of 2025 as a response to the growing pains of DeFi’s maturation. Founded by a pseudonymous team of blockchain developers with roots in Solana and Base ecosystems, the platform was conceived during the 2024 bull run, when users increasingly complained about the hassle of navigating disparate protocols. While specific funding details remain under wraps—common in early-stage DeFi projects—Arca’s sophisticated integrations suggest backing from ecosystem grants or venture interest in chain abstraction tech. The team’s expertise is inferred from the platform’s robust use of account abstraction (AA) and Privy providers, technologies popularised by projects like Safe and Argent.

Post the 2024 crypto winter, Solana’s resurgence with high TPS and low fees made it an ideal base, while Base’s Ethereum Layer 2 scalability added cross-chain appeal. Arca’s evolution mirrors the broader DeFi trend toward aggregation—think Jupiter for swaps but expanded to full trading suites. Initially a beta in March 2025, it quickly iterated based on user feedback, adding RWA trading and prediction markets by summer. Unlike standalone tools like Pump.fun for memecoins or Hyperliquid for perps, Arca unifies them under one roof, abstracting away the technical barriers that plague multi-app workflows.

Traction has been steady but understated; as a non-custodial platform, it prioritises privacy over flashy metrics. Early adopters praise its anonymity and speed on social channels, with integrations driving organic growth. In a market where DeFi TVL hovers around $100 billion (per DefiLlama estimates), Arca carves a niche by targeting the “casual trader” segment frustrated by Ethereum’s gas wars or Solana’s occasional outages. Its positioning as a “human-first” app—eschewing complex seed phrases for email-based onboarding—signals a push toward mainstream adoption, potentially rivalling wallets like Phantom in usability.

How Arca Works: A Deep Dive into the Mechanics

At its heart, Arca operates as a non-custodial aggregator, leveraging advanced blockchain abstractions to deliver a frictionless trading experience. Unlike traditional DeFi apps that require users to manage multiple connections, Arca uses account abstraction (AA) wallets powered by Privy, a leading embedded wallet provider. This means no seed phrases or private keys to handle—users sign up with an email or social login, and the system generates a secure, programmable wallet on the fly. The mechanics are built on an air-gapped architecture, where keys are sharded across devices and the cloud for recovery without compromising security. Multi-signature support and hardware wallet integration (e.g., Ledger) add layers for high-value users, ensuring “your funds, your keys” while eliminating common pitfalls like lost phrases.

Onboarding is the first showcase of Arca’s simplicity: Upon visiting arcax.xyz and clicking “Start Earning,” users create an AA wallet in seconds. Privy’s tech handles the backend, deploying a smart contract wallet on Solana or Base that supports ERC-4337 standards for gasless transactions. No initial deposit is needed; fiat on-ramps via Circle (USDC) or other partners allow instant funding. Once set up, the unified dashboard appears—a clean, dark-themed interface with tabs for Perpetuals, Yields, Memes, RWAs, and Rewards. All actions route through this single account, abstracting chain-specific details.

Trading mechanics revolve around chain and gas abstraction, Arca’s secret sauce for 30ms latency. When you initiate a trade—say, opening a leveraged perpetual on Hyperliquid—the platform uses Relay for bridging and sponsored transactions. Here’s how it unfolds step by step:

- Order Placement: Select an asset (e.g., BTC perp) from the dashboard. Arca pulls liquidity from integrated DEXs/AMMs like Jupiter on Solana. For cross-chain moves (e.g., SOL to Base ETH), it employs atomic swaps via Relay, bundling the transaction into a single, sponsored bundle. No manual bridging— the system detects the chain, converts assets, and executes without popups or confirmations beyond a simple biometric sign (fingerprint or Face ID).

- Execution Engine: Transactions are batched using AA’s user operations. Gas is sponsored by Arca’s protocol fees (a small percentage of trades), so users pay nothing upfront. The backend routes to the relevant protocol: Hyperliquid for perps (leveraged positions up to 50x with real-time charts), Morpho for yields (auto-allocating stables to optimal pools for 15% APY), or Pump for memecoin sniping. Oracles from Chainlink ensure accurate pricing, preventing front-running via private mempools.

- Settlement and Monitoring: Trades settle onchain instantly due to Solana’s speed or Base’s rollups. The dashboard’s P&L tracker updates in real-time, with visualisations for positions, yields accrued, and rewards earned. For RWAs, tokenised stocks (e.g., via integrations like RealT) are traded as ERC-20s, abstracted from regulatory hurdles—no KYC needed for crypto-native users.

A practical tutorial scenario: Trading memecoins. User A wants to buy a Solana-based meme from Base holdings. They search the asset in the “Trade Memes” tab, set slippage (default 0.5%), and hit execute. Arca’s aggregator scans Jupiter and Pump for the best rates, swaps Base ETH to SOL via Relay (gas sponsored), and completes the purchase in under 100ms. Cashback (0.1-0.5% of trade value) is auto-credited as ARCA points. For yields, depositing USDC triggers Morpho to lend it across optimised pools, compounding daily with auto-reinvest.

Security: All interactions use session keys for temporary approvals, revocable anytime. Sharding splits private keys mathematically, stores them client-side and encrypts. Integrations are audited protocols only—Hyperliquid’s perp engine, Polymarket’s predictions (for event-based trades), Circle’s stablecoins—to minimise smart contract risks. However, mechanics rely on these third parties; a Hyperliquid outage could pause perps, though Arca’s fallback routing mitigates this.

Pros of these mechanics include unparalleled speed and UX—truly “CEX in DeFi”—but cons involve centralisation in abstraction layers (Privy/Relay as potential single points). Overall, Arca’s design democratises advanced trading, making it accessible without deep technical knowledge.

Flagship Features and Products

Arca’s features are interconnected, forming a cohesive trading suite that extends beyond basic swaps.

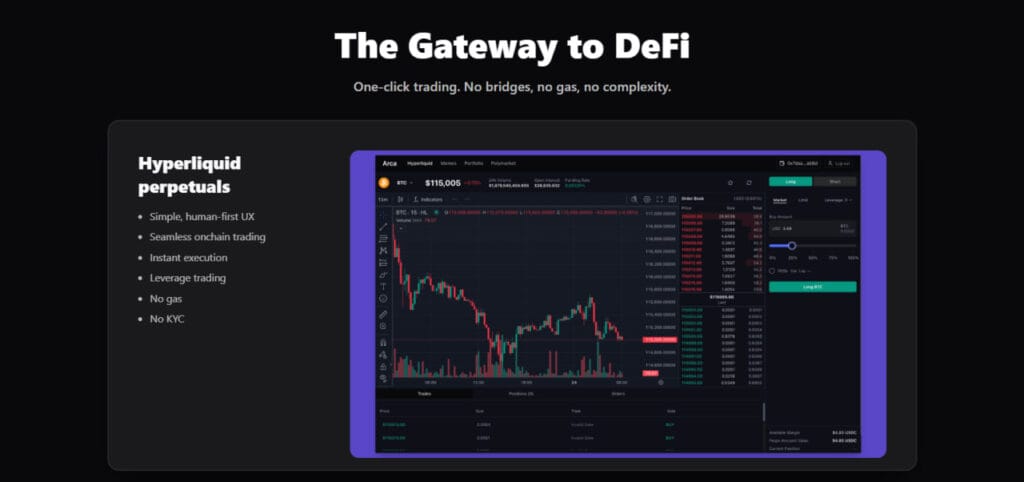

- Perpetuals stand out via Hyperliquid integration: Users access leveraged futures (up to 50x on majors like BTC/ETH) with an intuitive UI featuring candlestick charts, order books, and one-click entries. No gas or KYC—positions open instantly, with liquidation warnings via on-screen alerts.

- Yields focus on passive income: Deposit stables or blue-chips into Morpho-powered vaults for up to 15% APY. The system auto-optimises across lending markets, with risk tiers (low for USDC, medium for LSTs). Unlike standalone yield farms, Arca’s dashboard shows projected earnings and auto-compounds.

- Trading Memes targets volatile plays: Cross-chain access to Solana’s Pump.fun or Base memes, with sniper tools for new launches. One-click buys/sells abstract routing, ideal for degens chasing 10x pumps.

- RWAs open traditional finance: Tokenised equities (e.g., Apple shares via onchain wrappers) trade anonymously with crypto collateral. This bridges DeFi to stocks, bonds, and commodities without brokers.

Additional tools include Polymarket predictions (bet on events like elections) and fiat on-ramps. Uniqueness shines in unification—switch from perps to yields seamlessly—versus fragmented apps like Hyperliquid (perps-only). Site visuals, like trading interface screenshots, reinforce the polished UX.

User Experience and Practical Applications

- Arca’s interface is a breath of fresh air: The Arca’s homepage loads with a minimalist hero section—”DeFi with One Seamless Account”—followed by product cards and an FAQ. Dark mode dominates, with intuitive navigation tabs and zero clutter. Mobile responsiveness ensures trading on the go, with biometric signs for quick actions.

- Practical applications abound: A day trader might open BTC perps on Hyperliquid, hedge with RWA bonds, then park profits in 15% yields—all in one session. Passive users deposit USDC for automated earnings, monitoring via push notifications. Global investors access RWAs without borders, trading tokenised stocks 24/7.

- Onboarding takes under a minute: Email signup creates the wallet; tutorials pop up for first trades. FAQ covers essentials like “How secure is it?” (non-custodial details) and yields. Community engagement via referrals and quests fosters loyalty, with X buzz around easy meme flips.

For novices, it’s empowering; pros appreciate the depth without overhead. Drawbacks: Limited customization in advanced orders, but overall, Arca excels in “human-first” design.

Security, Risks, and Limitations

Arca prioritizes “Secure by Default” with its non-custodial AA model: Privy’s encryption and sharding prevent key theft, while air-gapped recovery avoids single-point failures. Multi-sig and hardware support add robustness; no funds are held by Arca, shifting risk to users’ devices.

Yet, risks persist: Integrations like Hyperliquid are exposed to protocol exploits (e.g., oracle manipulations). Volatility in perps/memes can lead to liquidations, and abstraction layers (Relay) introduce centralisation vectors—if Privy goes down, trades pause. No on-site audits mentioned; users must trust battle-tested partners. Regulatory risks loom for RWAs, as tokenised assets could face scrutiny in jurisdictions like the US.

Limitations include chain focus (Solana/Base primary; Ethereum secondary) and no advanced analytics yet. Mitigation: Diversify positions, enable 2FA, and monitor integrations. For most, the pros outweigh the cons, but DYOR is essential.

Rewards System and Economics

Earn ARCA points via volume (e.g., 1 point per $100 traded), quests (daily logins, referrals), and ranks (bronze to diamond for multipliers). Cashback (0.1-1%) refunds as USDC or points; lifetime referral profits share 20% of invitees’ fees.

Examples: A $10K trade yields +$50 SOL equivalent in points; high-rankers get boosted yields. Points may be redeemed for airdrops or governance, incentivising retention. Economics sustain via 0.05-0.2% trade fees, split between liquidity providers and the rewards pool. It’s a strong user acquisition tool, but point dilution risks exist if adoption surges without caps.

Future Outlook and Ecosystem Impact

Arca’s roadmap hints at expansions as per the Q4 2025 targets Ethereum mainnet integration, more RWAs (e.g., bonds), and AI-driven trade suggestions. Enhanced quests and token launches could boost liquidity.

Impact: By abstracting complexities, Arca lowers DeFi barriers, potentially onboarding millions to Solana/Base. It challenges dex aggregators like 1inch by adding full trading, fostering composability. Challenges include scaling abstractions amid chain congestion, but success could accelerate “Internet Capital Markets.”

Conclusion

Arca transforms DeFi trading with its seamless, non-custodial platform, delivering 30ms trades, 15% yields, and ARCA rewards across Solana and Base. Its innovative mechanics and user-friendly design make it a standout, bridging novices and pros while maintaining security. Though risks like integration vulnerabilities linger, the zero-KYC appeal and reward system shines. As Arca is a promising evolution in on-chain finance. Visit arcax.xyz to “Start Earning,” but exercise caution—research thoroughly to navigate its potential and pitfalls effectively.

Frequently Asked Questions (FAQs)

What is Arca?

Arca is a non-custodial, all-in-one DeFi trading platform on Solana and Base. It offers CEX-like speed, 30ms transactions, 15% yields, and zero-KYC trading through integrated protocols like Hyperliquid, Morpho, and Relay.

How does Arca ensure security?

Arca uses account abstraction wallets powered by Privy, combining encryption, key sharding, and multi-signature support. Funds remain user-controlled, minimizing custodial risk while integrations rely only on audited DeFi protocols for safer transactions.

What assets can I trade on Arca?

Users can trade perpetuals, memecoins, RWAs (tokenized assets), and participate in yield farming. The unified dashboard allows seamless switching between products with cross-chain support for Solana and Base ecosystems.

Is KYC required to use Arca?

No. Arca offers a zero-KYC experience using email-based onboarding through Privy wallets. It maintains privacy while ensuring compliance via non-custodial, decentralized architecture and secure smart contract operations.

When will Arca launch?

Arca is set to launch in early 2025, beginning with Solana and Base integration. Future updates will expand to Ethereum and introduce AI-driven trading insights, enhanced rewards, and broader RWA markets.