Imagine the crypto apocalypse of 2022: FTX in flames, Solana choking on its own success, and traders fleeing to centralised safe havens like rats from a sinking ship. Then, from the ashes of a humble hackathon, Zeta Markets bursts forth—a decentralised beast that devours $15 billion in perpetual futures volume, all while whispering sweet nothings of sub-second speeds and self-custody to a wary world. Fast-forward to October 2025, and Zeta has shed its skin, reborn as Bullet, Solana’s audacious Layer 2 trading layer, which has been live since late September with data availability and latencies that make CEXs blush at 1.2 milliseconds. This isn’t mere evolution; it’s a high-stakes heist on Wall Street’s turf, blending the unyielding trust of blockchain with the raw adrenaline of high-frequency trading. As DeFi claws toward maturity, Bullet doesn’t just follow Zeta’s blueprint—it shatters it, promising a future where derivatives flow freer than ever. Join me as we trace this saga from scrappy origins to sovereign supremacy, uncovering the tech, triumphs, and the trillion-dollar bets hanging in the balance.

Table of Contents

Zeta’s Hackathon Spark and Relentless Rise

Zeta Markets arrived like a thunderclap in Solana’s stormy skies, conceived during a 2021 hackathon where founder Tristan Frizza—a trader’s trader with code in his veins—rallied a cadre of visionaries, including designer Risiandi Jiang and marketer Imran Mohamad. Their manifesto? Rip the velvet gloves off centralised exchanges and arm DeFi with their lethal precision: lightning-fast executions, deep liquidity, and zero tolerance for the opacity that bred FTX’s downfall.

Fueled by a war chest from Jump Crypto, Amber Group, Wintermute, and a pivotal $5 million infusion from Electric Capital in May 2024, Zeta stormed Solana’s mainnet in January 2022. At its heart pulsed Serum’s open-source orderbook, married to Pyth’s oracle precision, birthing undercollateralized perps on BTC, ETH, SOL, and beyond—up to 20x leverage, USDC-settled, and utterly tamper-proof. In the bear’s maw, as rivals withered, Zeta seized 40% of Solana’s perp throne, tallying over 6 million trades and etching its name as the chain’s derivatives dynamo.

The timeline reads like a victory lap:

- 2022 Ignition: On-chain CLOB debut, banishing slippage to the shadows.

- 2023 Surge: Zeta FLEX unleashes tokenised options, auctioning bespoke hedges like digital black swans.

- 2024 Ignition Spark: ZEX airdrop ignites governance, pulling users into the protocol’s beating heart.

- 2025 Pivot: “Catalyst” phase rolls out lending yields; “Prevalence” teases the L2 dawn.

By mid-2024, Zeta wasn’t whispering—it roared, transforming Solana’s DeFi TVL with 30% quarterly leaps and luring institutions spooked by CEX scandals. Yet, glory carried thorns: Solana’s congestion spikes turned 400ms blocks into battlegrounds, where trades flickered out like faulty neon. Zeta’s architects, ever the tacticians, plotted their masterstroke: not retreat, but reinvention.

Zeta’s Tech That Tamed On-Chain Chaos

Peel back Zeta’s sleek facade, and you’ll find a symphony of Solana’s raw power—50,000 TPS humming beneath a fully on-chain central limit order book that Serum gifted to the gods. Orders matched atomically, prices discovered in transparent fury, all without the crutch of off-chain shadows. This was no AMM approximation; it was the real deal, echoing Chicago’s trading pits but etched in immutable code.

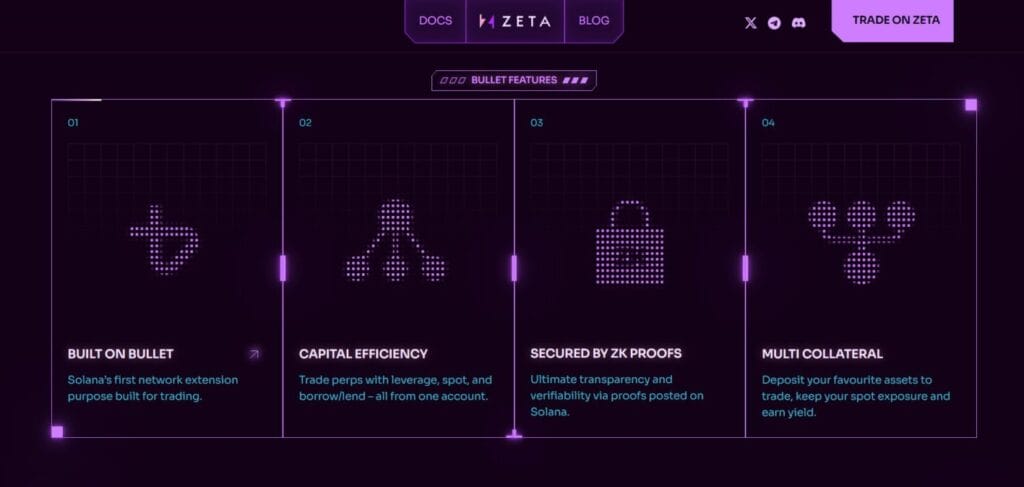

Risk danced on a knife’s edge, tamed by TradFi sorcery: cross-margining portfolios across SOL, ESOL, and USDC; sub-second mark-to-market pulses; and liquidations that struck like vipers, averting domino cascades. Security wrapped it all in cryptographic steel—self-custodial vaults, ZK proofs anchoring verifiability to Solana L1, and Pyth feeds warding off oracle oracles of doom. Jito’s MEV shields ensured fair play, no front-running phantoms in the machine.

The numbers seduced: Latencies plummeted from 400ms to a whisper-thin 5ms in Zeta X trials, revert rates capped at 72%—a gritty compromise for L1 purity that outshone Ethereum’s gas infernos. Developers feasted on the SDK and CPI hooks, weaving Zeta into lending behemoths and yield farms. Highlights of the stack gleamed:

- Liquidity Core: Serum DEX, a bottomless well of depth.

- Price Oracle: Pyth’s sub-second truth serum.

- Proof Engine: ZK verifications, unassailable as granite.

- Fairness Forge: Jito bundles, banishing predatory bots.

Through Solana’s 2023 meme maelstrom, Zeta stood unbowed, volumes swelling without a stutter. Institutions circled, drawn by the siren call of CEX parity minus the custody chains. But as ambition swelled, L1’s limits loomed like storm clouds—congestion’s chokehold demanding a bolder horizon.Zeta’s Arsenal That Empowered the Wild

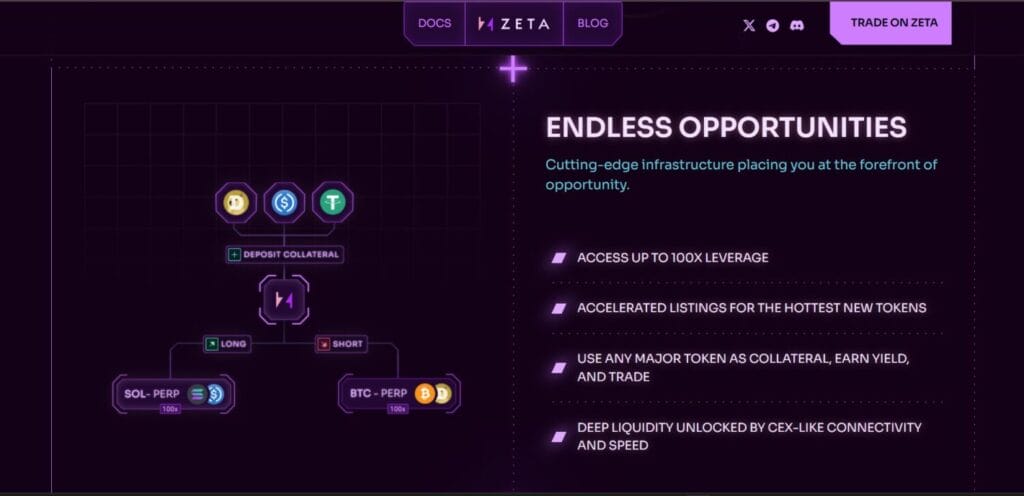

Zeta didn’t peddle promises; it delivered arsenals. Perpetual futures reigned supreme—long SOL moonshots or ETH crash cushions, leveraged 20x and undercollateralized for that sweet capital alchemy. No full collateral cages; just calculated risks, yielding efficiencies that left spot traders green with envy.

Zeta FLEX? Pure poetry in peril: Permissionless options tokenised and auctioned, crafting spreads, straddles, and condors from thin air—fully collateralised, tradeable like rare artefacts. Spot markets hummed alongside, while Zeta-Lend spun idle USDC into yield goldmines via borrow-lend bazaars.

The user alchemy was irresistible: Gamified leaderboards crowned volume kings; referrals snowballed communities; epochs doled rewards like confetti. One wallet ruled them all—perps, spots, lending in harmonious chaos. Onboarding? Effortless as a wallet whisper: Phantom or Backpack connect, USDC infusion, and into the fray—leverage dialled, directions locked, dashboards alive with PNL symphonies.

Slippage? A relic of lesser DEXs, slain by liquidity oceans. Composability courted protocols like Aave for oracle symbiosis. By 2024’s zenith, 100,000 monthly actives swarmed, their trades a testament to UX that rivalled Bybit’s gloss with DeFi’s diamond-hard transparency. Retail revolutionaries wielded quant-grade tools, flipping the script on who commands the markets.

The Token That Forged Zeta’s Tribal Bond

In DeFi’s grand bazaar, tokens aren’t trinkets—they’re oaths. ZEX, Zeta’s SPL talisman, airdropped in June 2024 like manna to the faithful, debuted at $0.09 and wove utility with unyielding governance. Stake for fee elixirs and yield amplifiers; collateralise for leveraged leaps; governance votes that shaped the protocol’s soul—forums to forges, proposals to permanence.

Epoch emissions rewarded the bold, 20% of fees recycled into trader coffers, a flywheel of fervour. The final rite, April-May 2025, scattered remnants before the rebrand rite—ZEX morphing into BULLET, gas for the L2 realm and stake for its armoured heart. No mere re-skin; this evolution captured accrued value, priming the pump for Bullet’s ascent.

Zeta’s Alliances That Wove Solana’s Web

Zeta thrived not in isolation, but in 1entanglement. Liquidity titans—Jump, Amber, Wintermute—poured depth into orderbooks, while Ribbon Finance scripted structured symphonies and Notifi whispered alerts in real-time. Solv Foundation bridged Bitcoin‘s bastions, and the FuZe open-source vault invited alchemists to brew options elixirs.

Solana’s sinews strengthened: $5 million infusions in 2024 turbocharged TVL surges, 30% quarterly in Q2 2025 alone. Communities crackled on X (@bulletxyz_ now) and Discord, docs a treasure trove of tactical tomes. Pillars of partnership:

- Depth Providers: Solana natives, 24/7 sentinels.

- Chain Spanners: Ribbon’s Ethereum echoes.

- Builder Bait: SDKs embedding Zeta’s pulse.

From solo spark to ecosystem ember, Zeta kindled fires that burn brighter still.

Heights and Hurdles

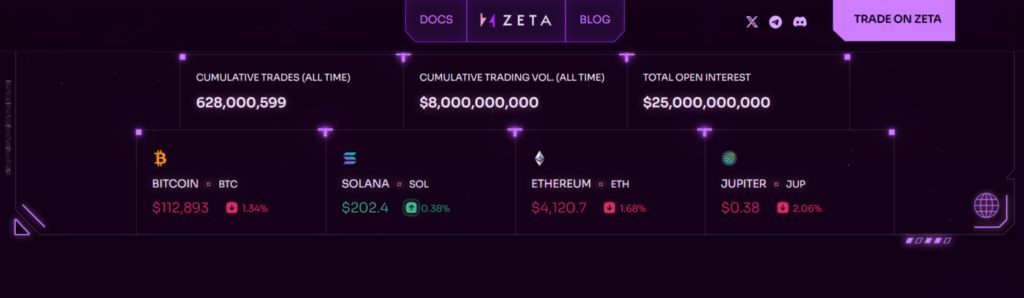

Zeta’s chronicle? A blaze of glory: $15 billion volumes, Solana’s perps sovereign, a CLOB codex for copycats. Institutions flocked, TVL tides rose, birthing a derivatives dawn untainted by CEX spectres.

Perils prowled: 72% reverts from congestion’s grip, AMM upstarts nipping heels, regulatory mists veiling perps’ path. The 2025 sundown, May 1st’s solemn close, wasn’t an elegy—it was an exodus to excellence. Resources rerouted to Bullet, L1’s shackles shattered for L2 liberation.

In trials, truths emerged: DeFi’s forge favours the adaptive, where pivots propel paradigms.

Bullet’s Thunder: The L2 Surge That Redefines the Battlefield

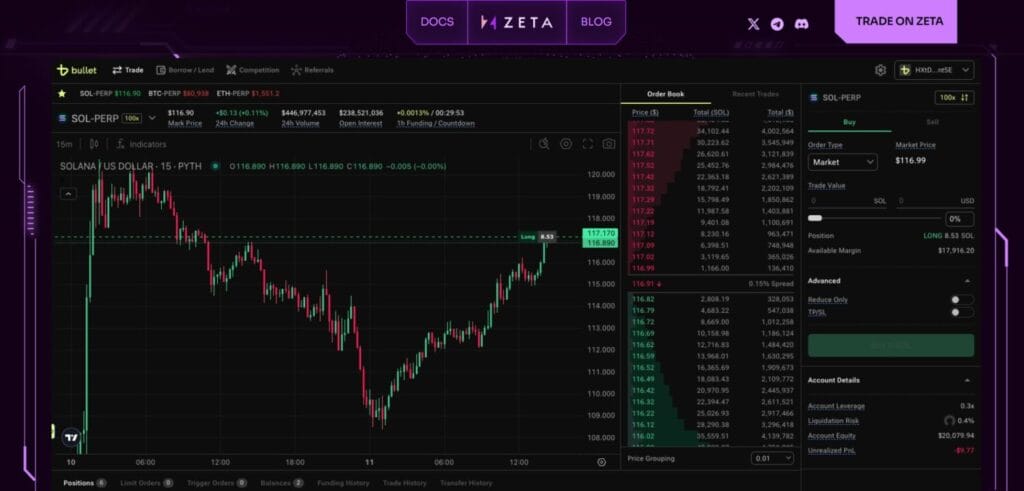

September 29, 2025 crowned the coronation: Bullet mainnet ignites at Token2049 Singapore, Solana’s first network extension, Celestia DA weaving data’s web for unyielding scale. Co-founder Frizza’s decree? “Beyond 400ms lies conquest.” Now, October’s light reveals 1.2ms miracles, ZK proofs Solana-anchored, multi-collateral embracing BTC via Solv.

Zeta X resurrects as flagship forge—perps reborn, yields farmed, lending labyrinths. BULLET token commands: governance thrones, staking shields, gas for the grind—ZEX migrants seamless in the shift. The Trading Cup Blitz, September’s salvo, drew hordes; integrations with Morpho and Uniswap beckon swaps and loans anew.

Chronicle of conquest:

- Q1 2025: Testnet triumphs, ZK whispers.

- Q3 Apex: Mainnet majesty, DApp deluge.

- Horizon Haze: $100 billion perps pursuits, CEX crowns toppled.

Bullet transcends sequel; it’s Zeta’s unchained id, velocities vaulting toward velocity’s zenith.

Conclusion

Zeta’s saga, forged in the crypto winter’s crucible, blazes into Bullet’s unyielding dawn—a defiant chronicle of DeFi’s ascent from Solana’s perps frontier to L2 sovereignty. With $15 billion in volumes etched in blockchain eternity, Zeta shattered CEX illusions, birthing a realm of sub-second trades and self-custodial might. Now, on October 16, 2025, Bullet’s 1.2ms heartbeat accelerates Solana’s pulse, empowering traders to eclipse titans in a derivatives deluge unbound. This evolution whispers an eternal truth: In Web3’s forge, bold pivots crown the unchained, where futures aren’t wagered—they’re wielded, inviting every soul to seize the stars.

Frequently Asked Questions (FAQs)

What happened to Zeta Markets after its 2025 shutdown?

Zeta Markets ceased operations on May 1, 2025, to pivot resources toward Bullet, its successor L2 on Solana. This allowed focus on resolving L1 congestion issues like high revert rates, enhancing speed for perpetuals trading.

How does Bullet improve on Zeta’s trading experience?

Bullet, Solana’s first trading-optimized L2, delivers 1.2ms latencies via Celestia DA and ZK proofs, slashing Zeta’s 400ms delays. It supports multi-collateral perps, yields, and lending with congestion-proof scalability for CEX-like efficiency.

What is the BULLET token, and how does it relate to ZEX?

BULLET is Bullet’s governance and utility token, handling gas fees, staking for security, and rewards. ZEX holders migrated seamlessly during the rebrand, capturing value for enhanced roles in the L2 ecosystem.

How can users participate in Bullet’s trading and rewards?

Connect a Solana wallet like Phantom, deposit SOL/USDC, and trade perps on Zeta X DApp. Join events like the Trading Cup Blitz for airdrop eligibility through volume and testnet activity.

Is Bullet safe for institutional traders post-Zeta?

Yes, Bullet inherits Zeta’s self-custodial vaults, ZK verifiability, and Pyth oracles, plus Jito MEV protection. Its L2 design minimizes reverts, offering deep liquidity from partners like Jump Crypto for secure, high-frequency trades.