Cryptocurrency trading bots are convenient for automating trading on a cryptocurrency exchange. They strictly execute a predefined strategy without being misled by emotions. Most bot providers require the user to select a strategy and iteratively tune the parameters. These are based on quantitative analysis using big data and artificial intelligence (AI). In this article, we perform a live trading test with SmithBot AI Crypto Trading bots.

Table of Contents

Summary

- SmithBot is an easy-to-use, well-documented crypto trading bot.

- Customer support is very helpful.

- The profits earned were 8% during the 2-month test, despite the crypto market dropping by 14.5%.

- The reference performance provided for each bot in their app matched the real performance closely.

- Their appealing historical performance claims are trustworthy.

Also, read SmithBot Review: Earn UPTO 104% APY

[optin-monster-inline slug=”kypqbd8bxbsurarmqsxd”]Signup and Setup

I followed the online SmithBot user guide to set up the service. The first step is to sign up for their service, which starts with creating a free DEMO account. As I want to test trading with real money, I chose a BASIC subscription. When choosing more extended subscription periods, they offer discounts, so I ended up widening a 6-month subscription for $134.95.

It only accepts crypto payments in BTC, ETH, LTC, and BCH. However, a crypto exchange account is required to use this service. So the next step is to connect your crypto exchange account. I will use my Kraken account. Now, the next step is to create an API key for Kraken. After that, add your exchange to the dashboard tab. Other supported exchanges are Binance, Bitstamp, and Bitfinex.

Note on the API keys: To keep funds safe, do not grant withdrawal permission as trading bots need only check our balance and place orders.

Choosing the Bots

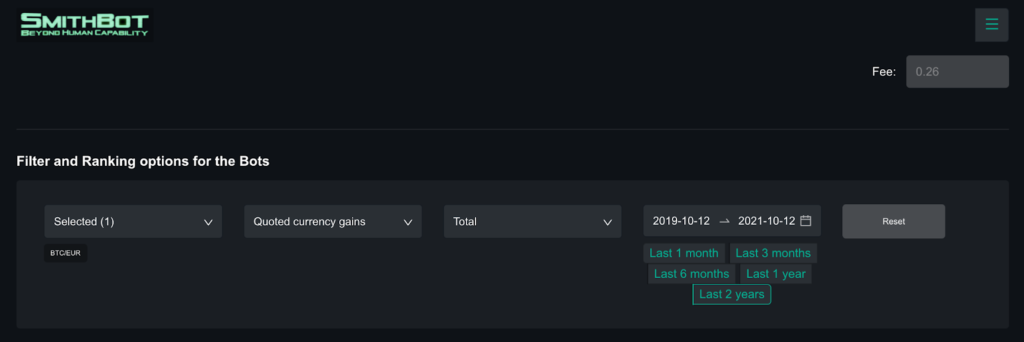

The “Bot Hall of Fame” tab is where to check and select a trading bot. SmithBot’s user guide recommends trading with a diverse bot portfolio with different pairs. This reason is to spread out the risk. But for this test, I chose only one pair, namely BTC quoted in EUR. I set up the taker fee that Kraken applied and ranked the bots by the past 2 years’ performance.

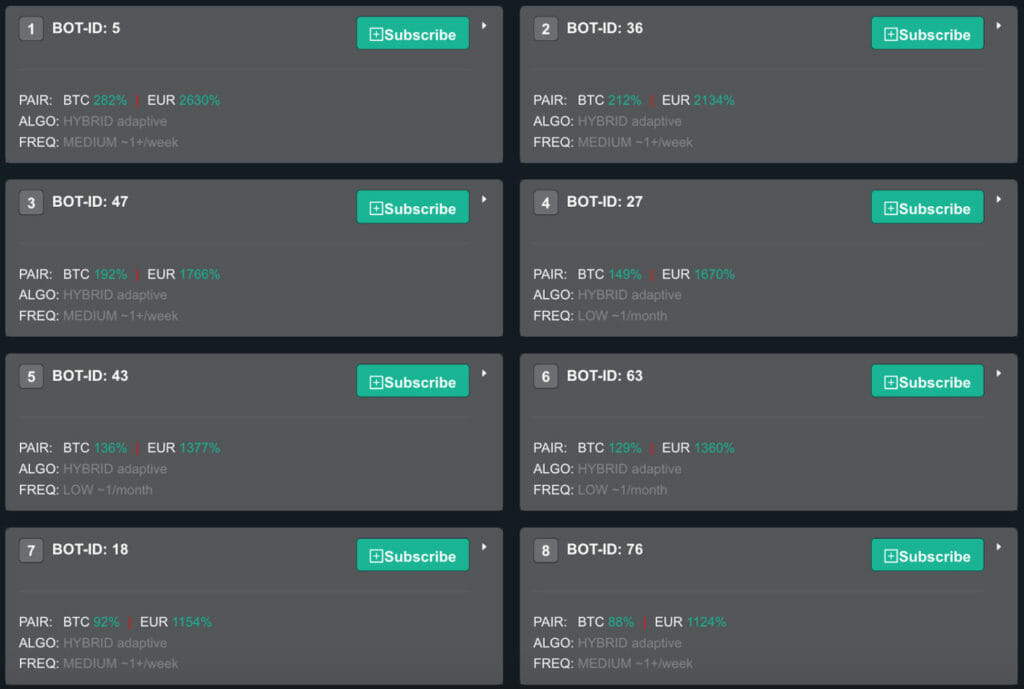

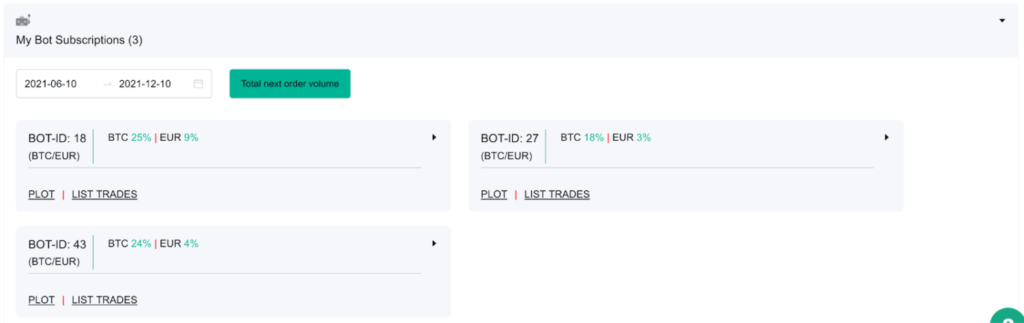

The section below displays a list of all BTC/EUR bots sorted by the EUR denominated profits during the last 2 years. I am more interested in the average bot’s performance, so I chose the bots with IDs 18, 27, and 43.

When clicking the subscribe button, a dialogue window appears to assign my exchange and enter the initial trading volume, a maximum, and a minimum limit. I chose to assign a 100 EUR starting volume to each of these bots. Actually, my exchange account balance was 200 EUR in BTC. Each of the three trading bots started trading on 10/13/2021, and I checked their results about two months later.

Reference Performance

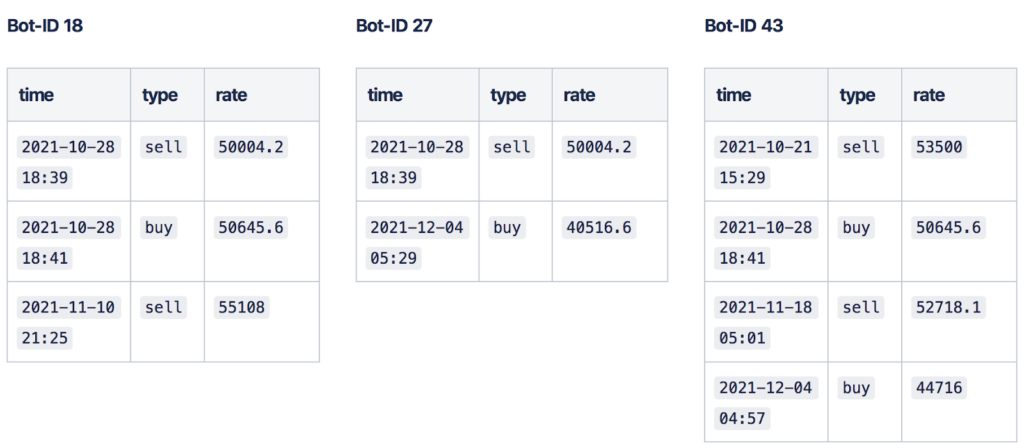

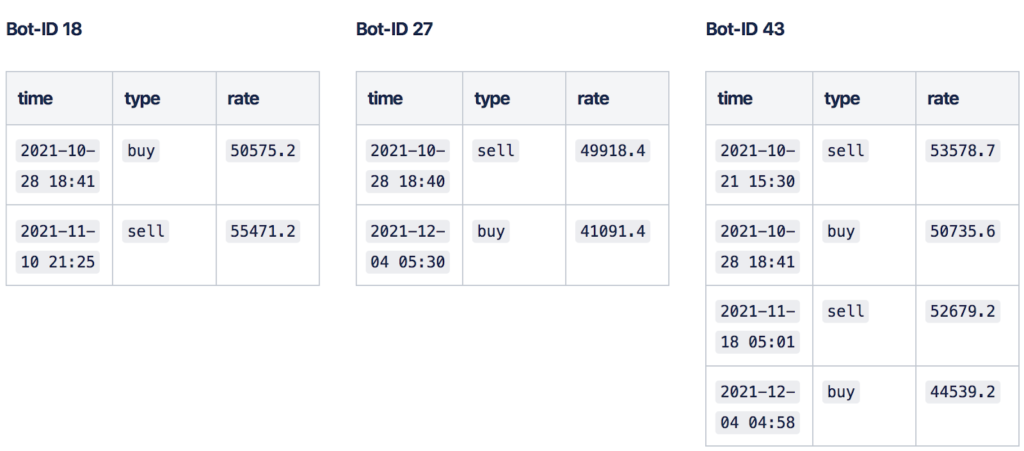

The SmithBot app calculates the data in the “Bot Hall of Fame” tab by applying a market average reference rate and statistics of real-world effects to a simulated trade signal execution. While it might differ from what you get in reality, the results should be at least very close. The table below shows the details of each trade signal generated for the three bots during the two-month test period.

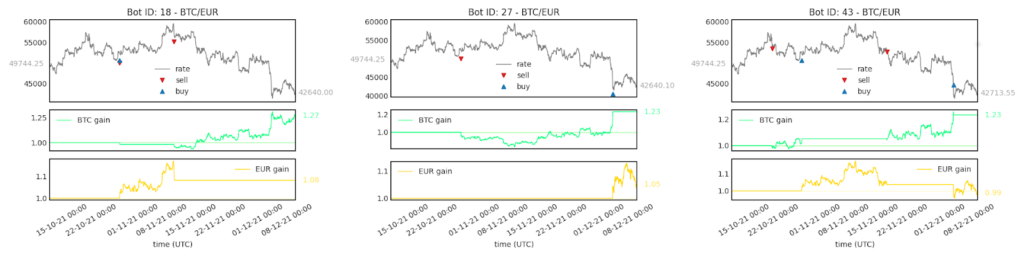

The performance plots of the bots ID 18, 27, and 43 show EUR denominated profits of 8%, 5%, and -1%, respectively. That is, while the market price of BTC dropped by almost 15%. All bots are sold somewhere at the price plateau. The corresponding BTC-denominated profits tell you how much your Bitcoin balance increased by 27%, 23%, and 23%.

Actual Performance

Now, let’s look at the real profits the bots generated with my 200 EUR over the last 2 months. The dashboard in the SmithBot app shows the performance.

A closer look at the orders executed on my exchange reveals that they are very similar to the reference signals shown in the previous section. In fact, orders are executed within less than a minute after the reference trade signal, in most cases within less than 20s. The actual filling price of the orders usually deviated by less than 0.1% from the reference. But in rare cases, it reached up to 0.7% when placing orders during periods of very fast-moving prices.

Sometimes the price was more, and sometimes it was less favorable than the reference. The differences between the reference and accurate rates are mainly due to slippage and price differences between exchanges. According to the support, the order model statistically considers these effects on average, but individual orders sometimes deviate slightly from this average.

The first reference trade signal of bot #18 was not executed. The reason for this is that it was a sell signal, and at the time, there wasn’t sufficient BTC balance on the exchange after the two other bots executed sell orders. Consequently, the bot skipped this trade signal, which is the correct response in this situation, according to SmithBot.

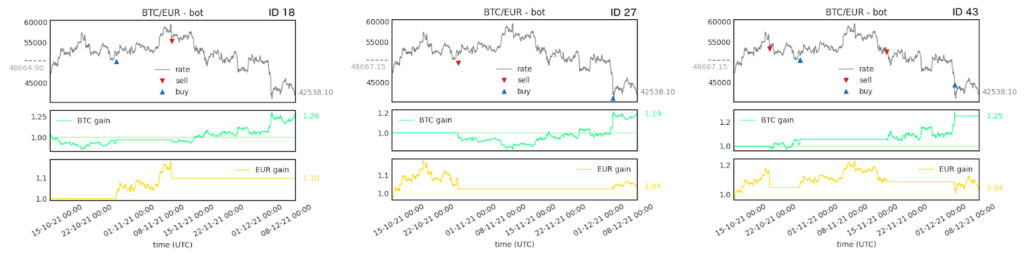

Looking at the performance plots, we find quoted EUR profits of 10%, 4%, and 4% for bots ID 18, 27, and 43, respectively. The corresponding BTC profits were 26%, 19%, and 25%.

Comparison and Result

The actual profits are close to the reference profits but not identical. The slightly different rates between the reference and correct orders do not fully explain the deviation. So I reached out to SmithBot support again and received the following descriptions from them to find out what was going on.

- The computation of profits uses different initial conditions for the personal performance compared to the reference performance. As you might use your exchange account for trading manually and with various bot providers, SmithBot has no way of knowing how you want to allocate your funds to each bot. So, the bots assume you assigned only EUR funds if the first order actually executed by a bot was “buy.” If the first filled order was “sell,” it assumes you assigned only BTC funds to the bot.

- Because there is a slightly different rate at the end of the interval the app is using for computing the profits, some minutes passed between each plot.

- The last buy order of bot ID 27 was only partially filled as you had insufficient EUR balance on the exchange at the time of execution.

I guess I should have put more BTC into my exchange to avoid the problem with the unfilled and partially filled orders. Overall, given the explanations above, SmithBot performed quite accurately as expected.

Finally, what was my final balance on the exchange after this test? Remember, I started with 0.00411 BTC, worth almost 200 EUR. After the 2-month test, my balance was 0.00485 BTC and 9.40 EUR. So the final real-world profit converted with the final rate of 42538.1 EUR/BTC was:

- quoted: 200 EUR → 216.10 EUR. Profit: 8%

- base: 0.00411 BTC → 0.00508 BTC. Profit: 23.6%

SmithBot AI Crypto Trading bots: Conclusion

The 2-month test with 3 bots delivered excellent profits of 8% in EUR. This is particularly remarkable as the BTC market was down by 14.5% over the same period. As reference results in SmithBot matched the actual performance within a minimal margin of error, the historical performance in the ‘Bot Hall of Fame’ can be considered accurate. I’d also like to acknowledge SmithBot’s excellent customer service, which included patiently addressing all of my concerns and providing me with a high-resolution solution.

Frequently Asked Questions

Also read,