Yo, traders! Altie here, ready to dive into the world of decentralized perpetual trading. If you’re familiar with MYX Finance but feeling curious about what else is out there, you’ve come to the right place.

In this article, we’re breaking down the best MYX Finance alternatives for 2025, from high liquidity platforms like Hyperliquid to low-fee champions like Paradex. Let’s see what else the DeFi world has to offer, and who knows, you might just find your next favorite platform!

MYX Finance is a decentralized platform that has made a strong impact in the world of perpetual trading.

Designed to offer high liquidity and low-fee execution, MYX Finance quickly became a go-to for traders looking to engage in perpetual contract trading. What sets MYX apart is its unique combination of liquidity depth and user-friendly interface.

By focusing on decentralized finance (DeFi), MYX has allowed traders to benefit from enhanced flexibility, better control over their funds, and access to perpetual trading without the need for a centralized intermediary.

With growing traction within the DEX space, MYX Finance is widely praised for its seamless trading experience, especially for those familiar with DeFi and blockchain environments. By enabling features such as zero slippage and deep liquidity, MYX Finance solidified its place as a platform traders could rely on for efficient perpetual trading.

Why Traders Look for Alternatives:

While MYX Finance offers robust features, there are several reasons why traders may look for alternatives. For example, some users may be concerned about the platform’s liquidity depth during high volatility.

Others might find themselves wanting cross-chain capabilities or access to a wider array of assets than MYX currently supports. In addition, traders often seek platforms that offer reduced fees, higher execution speeds, or more advanced trading features such as stop-loss or limit orders.

As the decentralized trading ecosystem continues to evolve, traders are naturally exploring alternatives that may offer more competitive advantages. These alternatives also promise better user experiences, further improvements in speed, and integrations with newer blockchain networks.

This article will explore five top alternatives to MYX Finance. These platforms, Paradex, Hyperliquid, Lighter, Aster, and Edgex, each bring distinct features, liquidity models, and user experiences. Whether you’re looking for higher liquidity, faster execution, or more robust cross-chain trading options, this article will give you a detailed comparison to help you choose the right platform for your trading style.

Table of Contents

What Makes a Strong MYX Finance Alternative?

To evaluate the strength of an alternative to MYX Finance, several factors need to be considered. A great alternative should stand out by excelling in the following areas:

- Non-custodial / On-chain Execution: Traders should have full control over their funds, without needing to trust centralized intermediaries.

- Low Fees & Competitive Pricing: Lower trading fees directly impact profitability. A strong platform should offer competitive pricing to reduce slippage costs and trading expenses.

- Strong Liquidity: Sufficient liquidity ensures smoother trades with less slippage, particularly during high market volatility.

- Cross-Chain Capabilities: With the growth of multiple blockchain ecosystems, cross-chain functionality is crucial to ensure that traders have access to a wider range of assets across different chains.

- Execution Speed and Efficiency: Speed is a significant factor, especially for traders dealing with volatile markets. A platform with high-speed execution and minimal latency ensures traders can act swiftly.

- Advanced Trading Tools: Features like limit orders, stop-loss functionality, and risk management tools are essential for advanced traders.

- Market Coverage and Supported Assets: A variety of assets, including both established tokens and emerging ones, is key to attracting a broader audience.

- User Experience (UI/UX): The interface should be intuitive, with easy navigation and seamless access to trading tools.

- Ecosystem Integration and Adoption: A strong platform must have deep integration with the DeFi ecosystem, including partnerships, liquidity provision, and broader adoption by the crypto community.

Platform Deep Dives

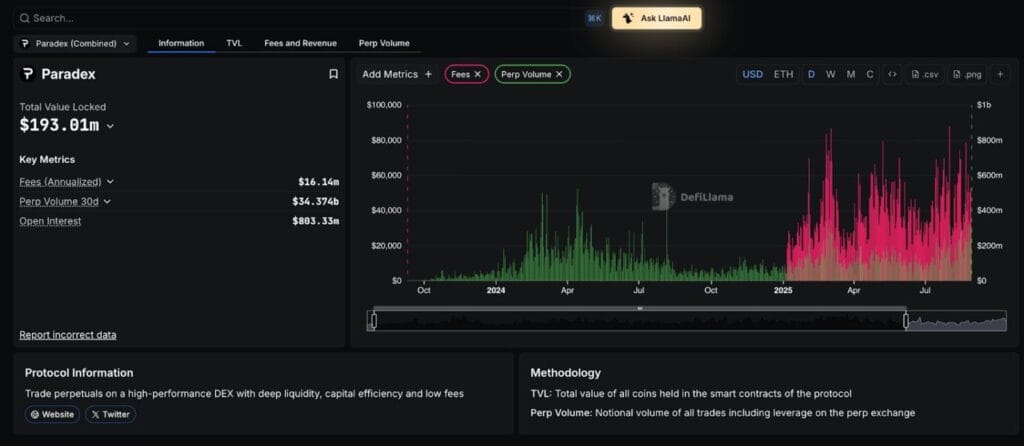

1. Paradex – Best MYX Finance Alternative

a) Description

- Key Stats:

- TVL: $193.01M

- Perp Volume (30d): $34.374B

- Fees (Annualized): $16.14M

- Platform Overview: Paradex is a high-performance DEX focused on facilitating perpetual trading with deep liquidity, capital efficiency, and low fees. The platform operates on Ethereum, allowing users to trade assets in a decentralized environment. Paradex integrates advanced trading algorithms and on-chain data routing to ensure optimal trade execution.

b) USP

Paradex’s standout feature is its high capital efficiency, allowing users to trade with minimal slippage even during volatile market conditions. The platform’s low fees and robust liquidity make it an attractive alternative for traders seeking an efficient, user-friendly decentralized exchange.

c) Key Features

- Orderbook-based liquidity model

- Cross-chain compatibility with Ethereum

- Competitive fee structure

- Advanced risk management tools including stop-loss

- User-friendly interface for both beginner and advanced traders

d) Why It’s a Good Alternative to MYX Finance

Paradex stands out by offering superior liquidity and a seamless user experience. While MYX Finance is great for many traders, Paradex offers a more efficient capital structure, making it ideal for users who prioritize liquidity during volatile market conditions. For traders seeking fast execution with low fees, Paradex is a top choice.

2. Hyperliquid – MYX Finance Alternative

a) Description

- Key Stats:

- TVL: $4.271B

- Perp Volume (30d): $144.809B

- Fees (Annualized): $707.67M

- Platform Overview: Hyperliquid is a cutting-edge decentralized exchange focused on providing high liquidity for perpetual contracts. The platform operates across multiple blockchains and integrates innovative liquidity routing to ensure traders get the best possible execution price. Hyperliquid is designed to minimize slippage while providing fast trade execution.

b) USP

Hyperliquid’s key selling point is its multi-chain liquidity routing and ability to offer high-speed trade execution. It is designed to serve high-frequency traders and large orders, ensuring minimal slippage and providing a seamless user experience even in volatile market conditions.

c) Key Features

- Multi-chain liquidity integration

- High-speed execution with minimal slippage

- Low-fee structure and fee rebates

- Advanced trading tools like stop-loss and limit orders

- Robust cross-chain support, particularly for Ethereum and other Layer-2 solutions

d) Why It’s a Good Alternative to MYX Finance

Hyperliquid’s multi-chain capabilities and high liquidity make it an excellent alternative for MYX Finance users looking for faster execution, reduced slippage, and broader asset coverage. The platform’s high liquidity makes it particularly appealing to high-volume traders and those with large orders who need low slippage during market swings.

3. Lighter – MYX Finance Alternative

a) Description

- Key Stats:

- TVL: $1.219B

- Perp Volume (30d): $140.517B

- Fees (Annualized): $78.72M

- Platform Overview: Lighter is a decentralized trading platform that provides unmatched security and scalability. It is designed to facilitate decentralized perpetual contracts while maintaining a high level of matching and liquidity management. Lighter operates on multiple chains and focuses on providing verifiable trade matching to enhance the user experience.

b) USP

Lighter’s USP lies in its ability to offer high-scale decentralized trading with verifiable matching and liquidations. The platform is optimized for both security and scalability, offering a strong alternative for traders who prioritize transparency and execution reliability.

c) Key Features

- AMM-based liquidity model with low slippage

- Supported assets from multiple blockchains

- Advanced risk management including customizable stop-loss features

- Verifiable matching and liquidations

- High security and scalability with cross-chain interoperability

d) Why It’s a Good Alternative to MYX Finance

Lighter’s high security, scalability, and transparency make it a perfect alternative for traders who are looking for a more transparent trading experience. Compared to MYX Finance, Lighter focuses heavily on matching and verifiable liquidations, which could be ideal for traders who prioritize security and long-term stability over short-term speed.

4. Aster – MYX Finance Alternative

a) Description

- Key Stats:

- TVL: $1.237B

- Perp Volume (30d): $138.723B

- Fees (Annualized): $341.66M

- Platform Overview: Aster is a decentralized perpetual trading platform that focuses on offering advanced trading features, risk management tools, and high liquidity. Aster operates on multiple blockchain networks and is built to provide institutional-grade trading solutions to both retail and professional traders.

b) USP

Aster stands out for its robust risk management tools, such as advanced stop-loss options, and its focus on providing a near-instant settlement mechanism. For institutional traders, Aster’s advanced features like complex order routing and liquidation models make it an appealing choice.

c) Key Features

- Advanced order routing and execution

- Strong risk management features like stop-loss and dynamic liquidation models

- Multi-chain support with Ethereum, Polkadot, and Solana

- High liquidity with reduced slippage

- Seamless user experience with a professional-grade interface

d) Why It’s a Good Alternative to MYX Finance

Aster’s professional-grade tools and focus on institutional-grade risk management make it an excellent alternative for MYX Finance traders looking for more complex trading strategies. While MYX Finance offers a strong, streamlined experience, Aster caters to traders looking for deeper control over risk and advanced trading tools.

5. EdgeX – MYX Finance Alternative

a) Description

- Key Stats:

- TVL: $379.87M

- Perp Volume (30d): $83.367B

- Fees (Annualized): $330.7M

- Platform Overview: Edgex is a high-performance decentralized perpetual exchange that integrates an orderbook-based model with liquidity routing for improved trading experience. The platform operates across various blockchains and is focused on providing traders with near-instant execution and low fees.

b) USP

Edgex’s standout advantage is its advanced orderbook structure, which allows for highly efficient matching and execution. The platform is optimized for fast execution and low latency, making it a great choice for traders who require tight spreads and fast settlement.

c) Key Features

- Orderbook-based liquidity model

- Fast execution and low latency

- Advanced trading tools like limit orders and stop-loss

- Multi-chain support with strong liquidity integration

- Low fee structure with incentives for liquidity providers

d) Why It’s a Good Alternative to MYX Finance

Edgex excels in execution speed and tight spreads, making it a strong contender for MYX Finance users who prioritize these features. The platform’s orderbook-based model allows for highly competitive pricing, particularly in high-volume trades, which can be a significant advantage over MYX Finance.

Quick Comparison Table

| Platform | Chain Support | Liquidity Model | Fee Structure | Supported Assets | Cross-Chain Compatibility | Ideal Trader Type |

| Paradex | Ethereum | Orderbook | Low fees | Limited | Yes | All traders |

| Hyperliquid | Ethereum, L2 | Liquidity routing | Low fees | Wide | Yes | High-volume traders |

| Lighter | Ethereum, Multi-chain | AMM-based | Low fees | Wide | Yes | Traders seeking security |

| Aster | Ethereum, Polkadot, Solana | Liquidity pool | High fees | Wide | Yes | Institutional traders |

| Edgex | Multi-chain | Orderbook | Low fees | Wide | Yes | Fast traders |

Risks & Trade-Offs

Smart Contract Risk:

All decentralized platforms, including the alternatives mentioned, inherently carry the risk of vulnerabilities within smart contracts. These contracts, while designed to be transparent and trustless, are not immune to bugs or exploits.

It’s essential for users to understand the security audits and testing the platforms have undergone to mitigate these risks. Platforms like Edgex and Lighter invest heavily in security, offering advanced auditing processes to ensure smart contracts are robust and secure.

Chain Reliability Risk:

Each decentralized platform operates on different blockchain networks. The reliability of these chains, especially during high traffic periods, can impact trade execution quality. For example, Hyperliquid’s reliance on Ethereum and Layer 2 solutions makes it prone to Ethereum network congestion, which could result in slower transactions during peak times.

On the other hand, Aster, which operates across Ethereum, Polkadot, and Solana, provides users with the flexibility to trade across multiple blockchains but still faces risks based on individual chain performances.

Liquidity Depth Variations:

Liquidity depth varies from platform to platform and can significantly affect the trading experience.

Platforms like Paradex and Edgex offer more robust liquidity and deeper orderbooks, which can reduce slippage. However, Aster and Lighter, while offering competitive liquidity, may experience higher slippage during times of increased volatility or lower trade volume. Traders should carefully assess liquidity levels, especially for larger trades, to minimize slippage.

Regulatory Uncertainty:

Decentralized exchanges face increasing regulatory scrutiny across jurisdictions. The evolving regulatory landscape can lead to compliance issues, which might affect platform operations or result in restrictions on certain assets.

Traders should be aware of potential regulatory risks, especially if using platforms like Hyperliquid or Aster, which operate on multiple chains and are subject to varying regulations globally.

How to Choose the Right Alternative for Your Trading Style

Given the diverse features of each platform, here’s a simple guide for choosing the right alternative to MYX Finance based on different trading preferences:

- For Cross-Chain and High Liquidity → Hyperliquid: If you’re seeking seamless multi-chain trading with high liquidity across assets, Hyperliquid is the way to go.

- For Advanced Risk Management → Aster or Edgex: Traders looking for advanced risk management tools like stop-loss and liquidation models should consider Aster or Edgex, which offer sophisticated features for managing trades and capital risk.

- For Simplified Trading with Low Fees → Paradex or Lighter: If you prefer low-fee trading and a simplified user interface, Paradex and Lighter provide the most straightforward experiences without sacrificing liquidity.

- For Fast Execution and Tight Spreads → Edgex: If you’re a high-frequency trader or need ultra-fast execution, Edgex excels in providing tight spreads and minimal latency.

Conclusion

MYX Finance continues to serve a significant portion of the decentralized perpetual trading market, offering liquidity and low-fee trading options. Its focus on user experience and decentralized execution has cemented its position as a go-to platform for many traders.

However, the rise of alternative platforms has introduced traders to a wider variety of choices, each offering unique features such as advanced risk management tools, cross-chain trading, and higher liquidity.

As with any decentralized platform, traders should approach new alternatives with caution. It’s always wise to start with smaller trades and thoroughly evaluate the platform’s performance and security before committing larger amounts.

The decentralized trading landscape is continually evolving, and no platform is without its trade-offs.

MYX Finance remains a solid choice for many, but platforms like Paradex, Hyperliquid, Lighter, Aster, and Edgex offer compelling alternatives for traders seeking improved features, liquidity, or execution speeds. Explore these options and find the one that aligns best with your trading style and needs.

And there you have it! Whether you’re looking for tight spreads, advanced risk management, or a smoother trading experience, there’s a MYX Finance alternative ready to match your style.

Don’t rush it, though, start small, test the waters, and find what feels right for you. The decentralized trading world is full of options, so why settle for just one? Stay sharp, keep exploring, and remember, Altie’s got your back through every dip and pump in the market. Happy trading!