Are you tired of getting it wrong in the world of crypto trading? Imagine a situation where you identify at least the best price to buy or sell but before you click the button, there is rapid market acceleration and just like that, it is gone. Frustrating right? Well no more worries! There’s a new tool called Chase Limit Order that helps you catch such fleeting moments.

Let me put it this way; You set your dream trade price as if placing an ordinary order. The Chase Limit Order on the other hand, adjusts its order price whenever the market goes against you! It is basically having your own personal shopping buddy who always gets you the best deal.

The benefit is:

Effortless entries and exits: No more glued to the screen, refreshing and adjusting orders. The Chase Limit Order does all this enabling one to pounce on those short term opportunities.

Less stress, more smarts: Forget about worry regarding prices going up or down. That will be handled by Chase Limit Order hence giving one freedom to concentrate on his/her trading strategy.

Precision targeting: For instance when a specific coin dips, would you wish to buy it then? Even though markets become slightly insane, there are chances for the Chase limit order getting one into that particular buy point.

Table of Contents

Is it for you?

• Day traders: They capture short-term market moves without being glued to your screen.

• Swing traders: Confidently set entry and exit points, even if the market bounces around.

• New investors: Avoid missing buying opportunities because of market swings.

Let’s explore some scenarios that show off the Chase Limit Order:

Scenario 1: The Dipping Dream

Let’s say you’re eyeing Ethereum (ETH) and believe it’s due for a correction. You identify a potential support level at $2,000.

- Scenario: You set a buy limit order at $2,000. The market dips slightly to $1,980, then starts climbing back. With a traditional limit order, you miss the chance to buy at $2,000.

- Chase Limit Order: You set your buy target at $2,000. If the price dips to $1,980, the Chase Limit Order automatically adjusts down to $1,980. Once the price reaches $1,980 (or very close), the order gets filled, allowing you to buy ETH at a discounted price.

Scenario 2: The Blazing Rocket

You own XRP that’s been on a tear, currently priced at $0.80. You have a profit target of $1.00, but don’t want to miss out on further gains if the price keeps surging.

- Scenario: You set a sell limit order at $1.00. The price explodes to $1.20. With a traditional limit order, you miss the chance to sell at your target of $1.00 and potentially capture even higher profits.

- Chase Limit Order: You set your sell target at $1.00. If the price jumps to $1.20, the Chase Limit Order automatically adjusts upwards to $1.20. This ensures you lock in profits at a favourable price, even if the market momentum surpasses your initial target.

Scenario 3: The Careful Way

You’re interested in Solana (SOL) for the long term, but want to buy during a temporary dip to improve your entry price. You believe a good entry point might be around $40.

- Scenario: You set a buy limit order at $40. The price dips slightly below to $38, then starts recovering. With a traditional limit order, you miss the chance to buy at your desired price point.

- Chase Limit Order: You set your buy target at $40. If the price dips to $38, the Chase Limit Order automatically adjusts down to $38. Once the price reaches $38 (or somewhere within your acceptable range, like $39), the order gets filled, securing your desired entry point for SOL.

Remember: You can also set a maximum chase distance for your Chase Limit Order. This acts as a safety net, ensuring the order doesn’t follow the price too far away from your initial target in case of unexpected market movements.

These are some of the uses for the Chase Limit Order demonstrating that it is advantageous to have it in your array of weapons when trading cryptocurrencies. Having insight into all its features and using this a tool appropriately, one can enhance the efficiency of trades and manage to implement them in this constantly evolving world of cryptocurrencies.

Above all, there is no magic tool in investing that can guarantee that one will get rich. It’s imperative to always conduct your research, make sure you understand risks, and trade with capital you can afford to lose.

The Chase Limit Order:

What you are about to see: the future of trading with crypto money! It is getting closer to the kind of tools that make those user decisions distill and capture those market opportunities. In conclusion, if you are thinking about a new crypto trade, the Chase Limit Order works as a great option. Could be the game changer today that takes your gambling in cryptocurrency to the next level!

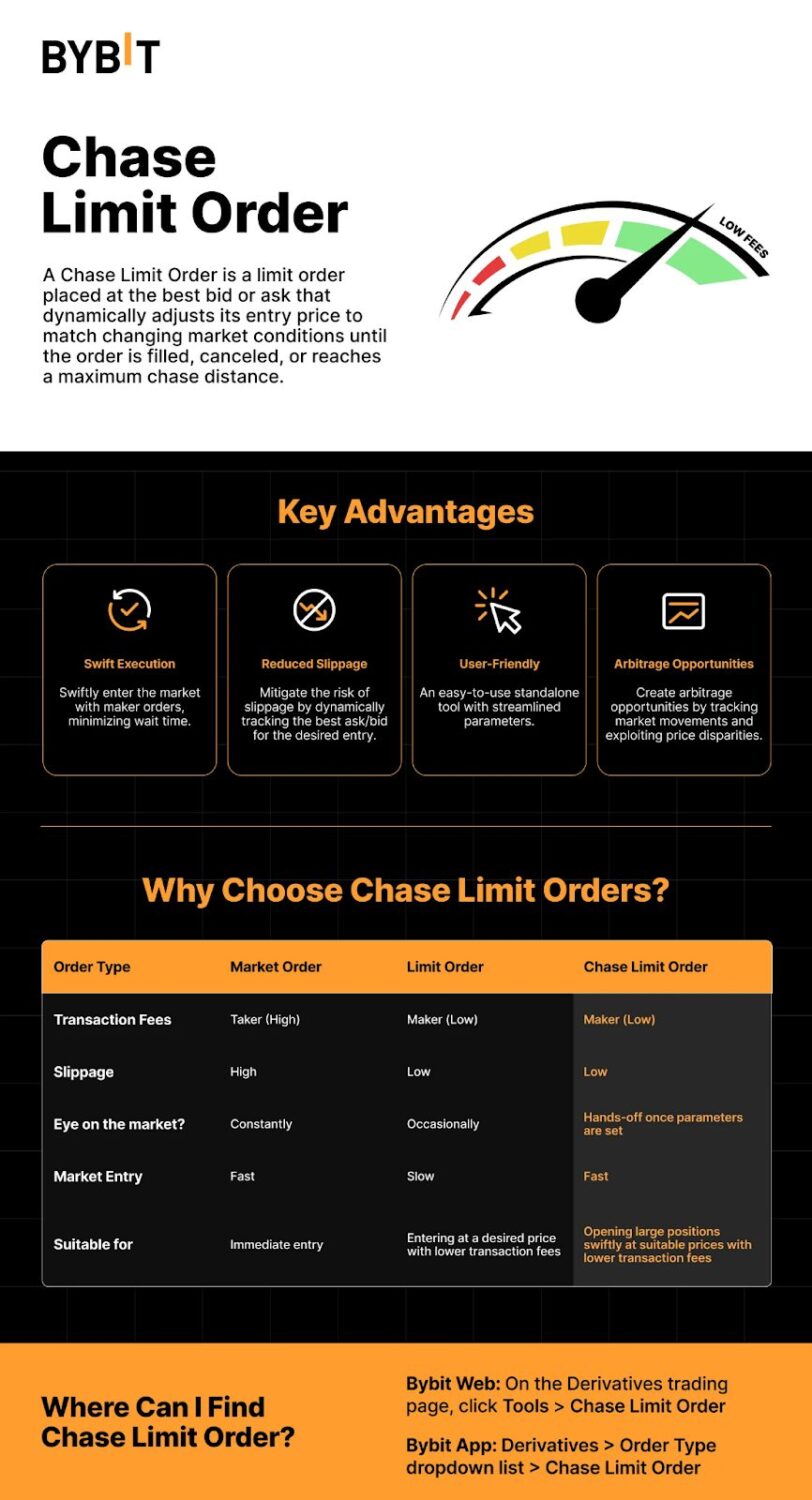

Bybit currently offers this innovative tool. If you’re curious to explore the power of Chase Limit Orders, consider signing up and experiencing the future of crypto trading!

Bybit is one of the leading cryptocurrency exchanges that offer chase limit orders. Known for its user-friendly interface and advanced trading features, Bybit has integrated this feature to cater to traders who need more flexibility and control over their orders in volatile markets.

Some other exchanges:

1. Binance: It is also worthy of noting that chase limit orders are available on Binance – the world’s largest cryptocurrency exchange by trading volume. One of their offerings enable traders to set the rules of chasing the price that is set within certain limits of how far the price can be chased, and the duration within which it can be chased affordably.

2. Huobi: Huobi is another popular exchange that includes features of chase limit orders. Huobi particularly has a strong trading platform, as well as multiple order types such as chase limit orders, which indicates why it is favored by many people.

3. Kraken: Kraken has the strongest security and supports numerous cryptocurrencies, and it provides special chase limit orders to the traders to have a smoother experience in the volatile crypto market.