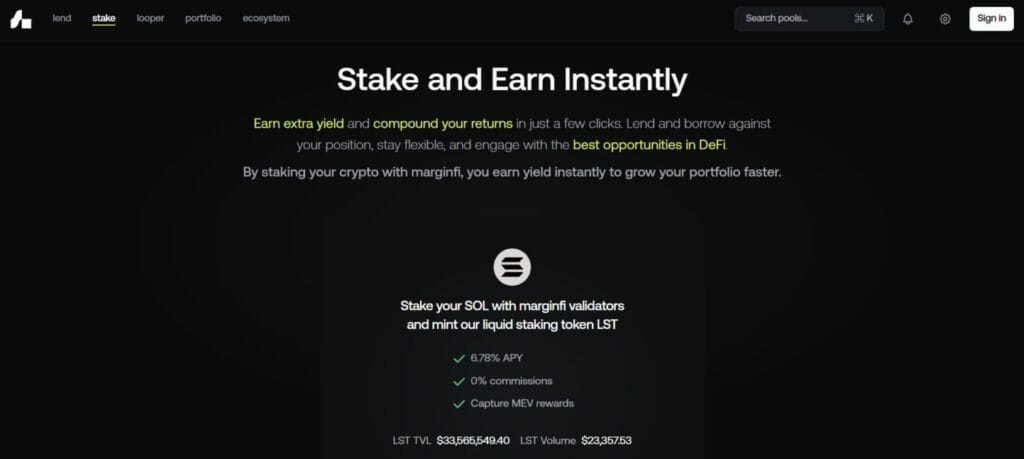

In the fast-evolving world of Solana DeFi lending, Marginfi (often accessed via its mrgnlend app that stands out as a decentralised, overcollateralized protocol designed for liquidity, yield, and leverage. In recent times, a major development has reshaped its trajectory: Project 0 (0.xyz) has acquired Marginfi, with plans for a token generation event (TGE). This integration promises to migrate user points 1:1, provided users maintain active deposits, potentially unlocking new cross-venue margining features with platforms like Kamino. This review dives into how Marginfi lending and borrowing work on Solana, covering key features, rates, risks, and more, to help you decide.

Table of Contents

What is Marginfi?

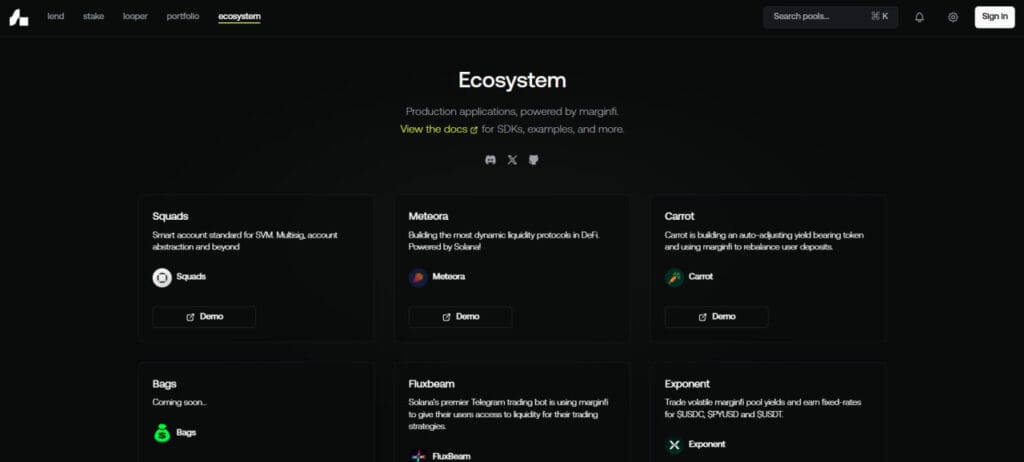

Marginfi is a leading Solana-native lending protocol that enables users to lend supported assets for variable yield and borrow against collateral in a fully on-chain, permissionless system. Its core value proposition lies in providing overcollateralized lending and borrowing with programmatic risk controls, eliminating intermediaries and leveraging Solana’s speed for seamless composability. The user-facing app, mrgnlend, serves as the primary interface for these operations, offering step-by-step flows for supplying assets, borrowing, and managing positions.

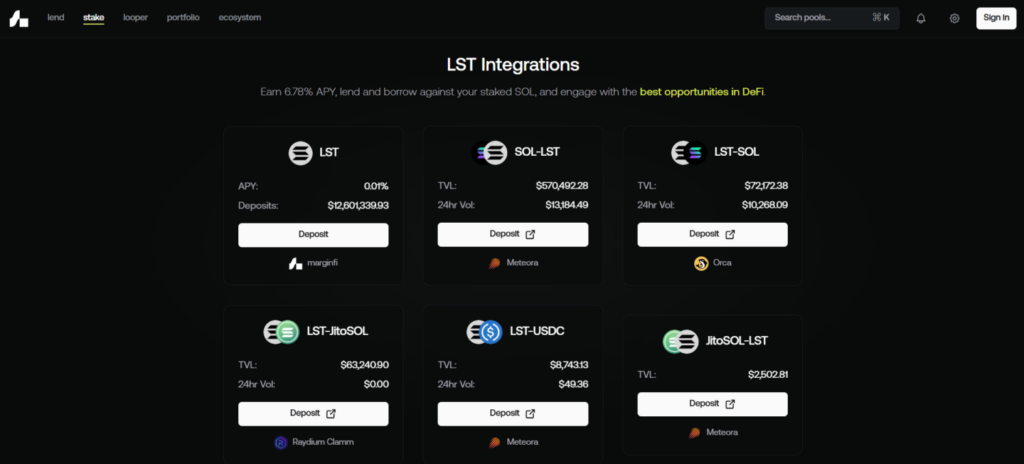

In the broader Solana DeFi lending landscape, Marginfi competes with protocols like Kamino and Save, but distinguishes itself through three market types: the interconnected Global Market for core assets, Isolated Markets for higher-risk tokens, and the Native Stake Market for liquid staking collateral like staked SOL. This setup balances capital efficiency with risk isolation, making it a go-to for Solana yield lending and borrowing.

How Marginfi Lending and Borrowing Work

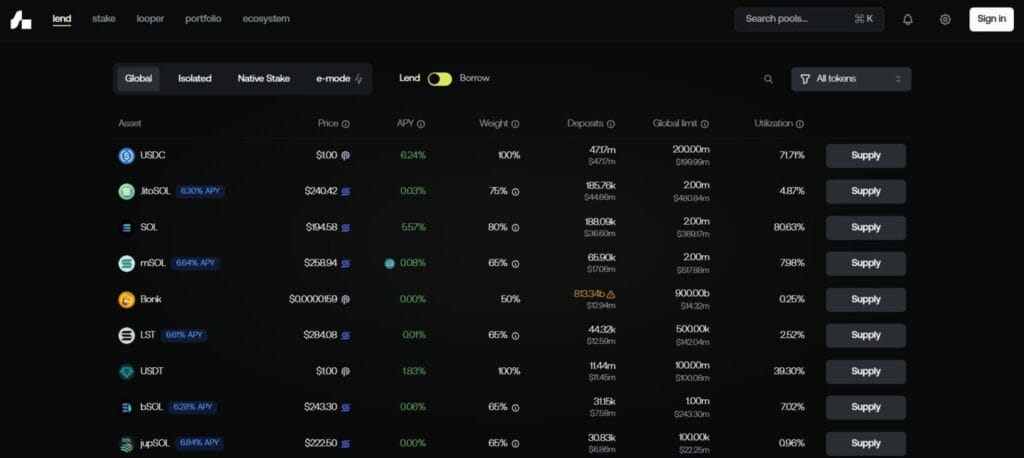

At its heart, Marginfi operates on an overcollateralized model: users supply assets to liquidity pools to earn interest as lenders, while borrowers post excess collateral (typically 150-200% of the loan value) to access funds. Supported assets include SOL, USDC, USDT, BTC, ETH, and liquid staking tokens (LSTs) like JitoSOL and mSOL, with oracle pricing from Pyth and Switchboard ensuring accurate valuations.

Once supplied, assets enter dynamic pools where interest accrues continuously. Borrowers can then leverage their collateral, but must maintain a health factor above 1.0—a weighted ratio of collateral value to liabilities, adjusted by asset-specific risk parameters like loan-to-value (LTV) ratios and liquidation thresholds. For example, supplying $10,000 in SOL at 80% LTV allows borrowing up to $8,000 in USDC; if SOL’s price drops, the health factor dips, triggering alerts.

Liquidations kick in below the threshold: partial liquidations sell off just enough collateral to restore health, with a 5% penalty—2.5% to the insurance fund and 2.5% to liquidators. This mechanism, powered by in-house and external bots, promotes solvency without full account wipes. Solana’s low fees and fast confirmations make active management feasible, even during volatility.

Rates, APY/APR, and Utilisation on Marginfi

Interest rates on Marginfi are utilisation-based, adjusting dynamically via per-asset curves to reflect supply-demand balance. Lenders earn APY (annual percentage yield, accounting for compounding), while borrowers pay APR (annual percentage rate, simple accrual). As of October 2025, USDC offers consistent stablecoin yields around 5-8% APY for lenders, with SOL hitting 10-15% in bull markets but dipping near 0% in bears. Borrowing APRs for SOL can reach 20% during high utilisation.

Utilisation—the ratio of borrowed to supplied assets—drives these shifts: low utilisation (under 50%) compresses spreads, while high (over 80%) boosts borrower costs to attract more lenders. The protocol takes a spread fee of 12.5% on USDC/USDT/SOL differentials and 13.5% on others, funding operations and the insurance fund. Repayments can use standard flows or collateral swaps via Jupiter integrations, with no fixed borrow fees beyond interest.

For best assets to lend on Marginfi for APY, prioritize USDC for stability or LSTs for enhanced Solana native yield through staking rewards.

Health Factor, Risk Parameters, and Liquidations

Marginfi’s risk engine is a standout, aggregating positions into a single health factor for real-time monitoring. Risk parameters vary by asset: conservative for stables (e.g., 90% LTV for USDC) versus aggressive for volatiles (e.g., 50% for SOL). What triggers a liquidation on Marginfi? A health factor below 1.0 prompts partial liquidations, designed to minimize user impact—unlike full wipes on some platforms.

Partial liquidation mechanics on Solana lending sell 10-20% of undercollateralized positions at market rates, restoring health while incentivizing liquidators. To avoid it, maintain buffers: aim for 1.5+ health factor, especially with volatile collateral. Marginfi’s oracle pricing from Solana lending oracles reduces manipulation risks, but users should monitor for anomalies.

Security, Audits, and Program Transparency

Now the question aarise Is Marginfi safe on Solana and how are users protected?

The protocol’s open-source marginfi v2 program, deployed on Solana mainnet with public IDs, enables community verification via tools like solana-verify for binary hashes. Audits from OtterSec and internal reviews bolster its posture, with detailed instruction specs in the docs.

A notable incident in September 2025 involved a flash loan vulnerability that could have allowed unrepayable borrows, risking $160M—but it was privately disclosed by Asymmetric Research and patched pre-exploit, with no funds lost. This highlights Marginfi’s responsive bounty processes and security culture. How does mrgnlend set rates for lenders and borrowers? Through transparent, utilization-driven curves, audited for fairness. Oracle dependencies remain a DeFi risk, but Pyth/Switchboard integration adds redundancy.

Liquidity and TVL Context on Solana

Marginfi’s liquidity shines in Solana DeFi borrowing, with deep pools for majors like SOL and USDC enabling low-slippage trades. Where to check Marginfi’s TVL and market depth? DefiLlama tracks it live, showing historical trends— as of early October 2025, Solana lending TVL hit a three-year high above previous peaks, though Marginfi saw net withdrawals of ~$43M in recent months amid market shifts. Q1 2025 revenue hit $88.5M from $1.7B in liquidations, underscoring resilience despite a 42% TVL dip.

Funding-wise, early backers like Multicoin Capital provide context, but judge by on-chain metrics: utilization hovers 60-80% for key assets, supporting healthy spreads.

Pros, Cons, and Ideal Users

Strengths:

- Deep Solana integration for on-chain borrowing Solana-style, with composability for mrgnloop strategies and staked collateral marginfi.

- Robust DeFi risk management Solana via health factor and partial liquidations Solana.

- Transparent docs and verifiable builds, plus PWA marginfi mobile for on-the-go access.

Limitations:

- Overcollateralization limits efficiency versus undercollateralized models.

- Variable rates demand active monitoring; oracle pricing Solana lending risks persist.

- Recent acquisition introduces integration uncertainties, though points migration eases transition.

Ideal users? Yield-oriented lenders chasing marginfi APY on stables, or active Solana traders using Solana leverage lending without selling holdings. Which assets are best to lend or borrow on Marginfi? Stables for safety, LSTs for boosted returns.

| Aspect | Pros | Cons |

|---|---|---|

| Liquidity | Deep pools, low slippage | Occasional withdrawals in bears |

| Rates | Up to 20% APY in bulls | Volatile with utilization |

| Risk Tools | Health factor, partial liqs | Oracle dependencies |

| UX | Clean app, PWA support | Overcollateralization caps |

Getting Started: Wallet, Supply, Borrow, Manage

Step-by-step guide to using mrgnlend: Connect a Solana wallet like Phantom, supply a supported asset via the dashboard’s action box—review live APR/APY first. Borrow against it, eyeing health factor cues. Use the portfolio view to track interest accrual and headroom; set alerts for dips.

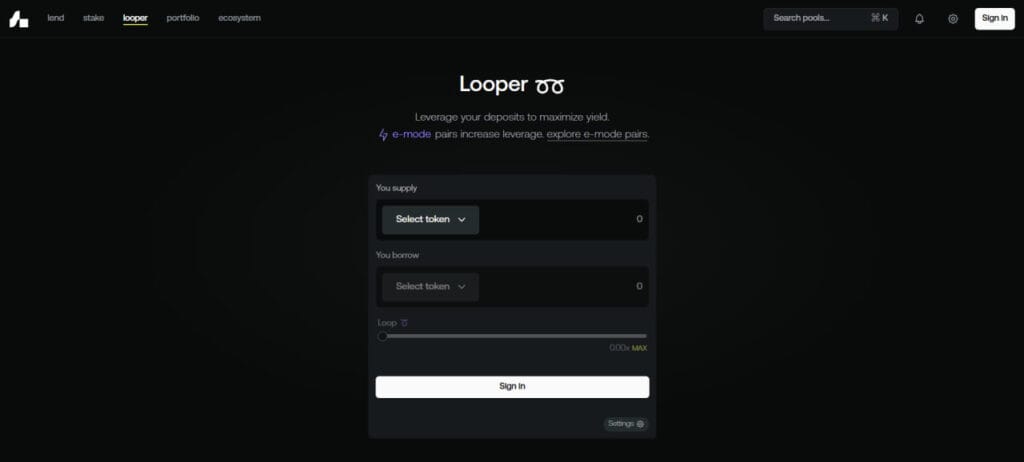

Does Marginfi support mobile or PWA-style access? Yes, it’s a progressive web app that installs like a native for monitoring. For looping, mrgnloop automates leverage via flash loans. Always review margin liquidation rules explained and fees before scaling.

Risk Management Tips

Maintain conservative health buffers (1.5+) for volatile assets to manage health factor on marginfi safely. Prefer deeper liquidity pools to cut slippage in liquidations. Track marginfi incentives overview and utilization shifts daily—tools like DefiLlama help. Diversify across global/isolated markets for balanced exposure.

Conclusion

Marginfi delivers a capable, security-conscious Solana lending protocol with robust risk tooling, active maintenance, and transparent documentation that suits yield seekers and leverage traders alike. Its strengths in Solana composability, lending and partial liquidation mechanics are balanced by DeFi risks and overcollateralization constraints—pair with disciplined monitoring for best results. Post-acquisition, the upcoming TGE and Kamino integration could elevate it further; deposit now to secure points.

Frequently Asked Questions(FAQs)

Is Marginfi safe on Solana and how are users protected?

Marginfi prioritizes safety through open-source code, OtterSec audits, and verifiable program deployments on Solana mainnet. Users are shielded by an insurance fund, partial liquidation mechanics, and redundant oracles like Pyth and Switchboard. The September 2025 flash loan vulnerability was patched pre-exploit, with no funds lost, demonstrating proactive bounty-driven security.

How does mrgnlend set rates for lenders and borrowers?

Mrgnlend uses utilization-based interest rate curves that dynamically adjust APY for lenders and APR for borrowers based on supply-demand ratios. Low utilization keeps rates stable, while high demand (over 80%) increases borrower costs to incentivize more lending. Protocol spreads (12.5-13.5%) fund operations, ensuring transparent, on-chain fairness across assets like USDC and SOL.

What triggers a liquidation on Marginfi and how to avoid it?

Liquidation triggers when the health factor drops below 1.0 due to collateral devaluation or over-borrowing, prompting partial sales to restore balance with a 5% penalty. Avoid it by maintaining a 1.5+ buffer, diversifying assets, and monitoring oracle prices closely during volatility—Solana’s speed aids quick adjustments for safer positions.

Which assets are best to lend or borrow on Marginfi?

For lending, USDC offers a stable 5-10% APY with low risk, ideal for conservative yields; LSTs like JitoSOL provide boosted returns around 0.04% base plus staking rewards. Borrow SOL for leverage at 1.79-20% APR depending on utilization, or stables for liquidity—prioritize deep pools to minimize slippage in volatile markets.

Does Marginfi support mobile or PWA-style access?

Yes, Marginfi’s progressive web app (PWA) enables mobile-installable access, mimicking a native app for wallet connections and position monitoring on the go. Users can supply, borrow, and track health factors seamlessly via iOS or Android browsers, leveraging Solana’s low fees for efficient on-chain interactions without dedicated downloads.