Binance is one of the world’s largest crypto exchange platforms whereas, GMX is coming out to be gaining some decent popularity recently. Further, both platforms offer a series of products that makes them worthy competitors. Hence, through this Binance vs GMX article, we’d be delving deep into everything both the platforms have to offer.

Table of Contents

Binance vs GMX: Overview

What is Binance?

Binance is one of the most popular crypto trading exchanges among beginners as well as professional traders. Today Binance can process UPTO 1.4 million transactions per second (which would surely be beneficial in case there is a crash). Further, the platform charges minimal fees and provides a discount on using the BNB token. To learn more, read our Binance review.

However, the exchange has been facing a stringent regulatory crackdown from almost all major economies. Therefore it is better to keep alternatives of Binance ready, in case things go wrong.

What is GMX?

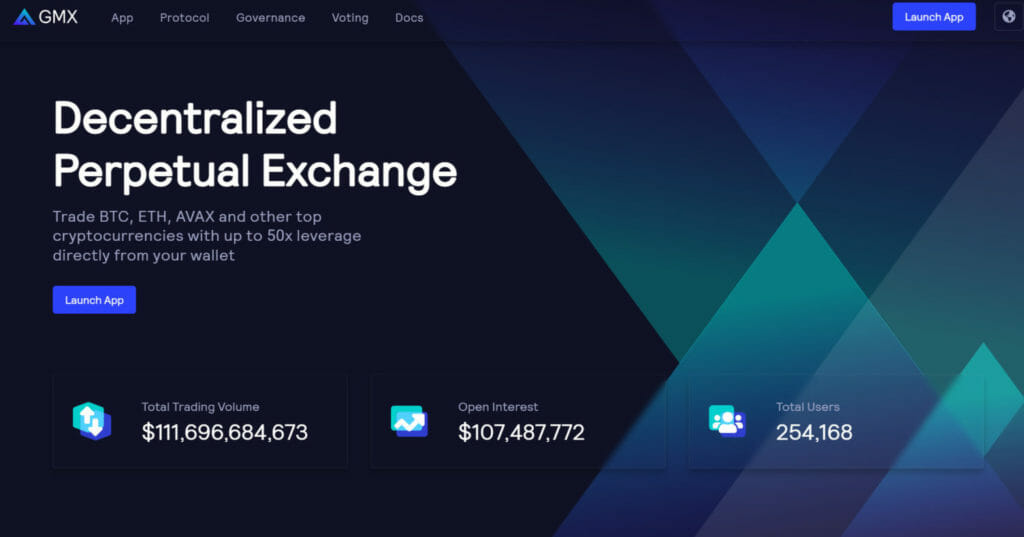

GMX is a decentralized perpetual exchange that came into the limelight after the FTX crash.

A decentralized perpetual exchange (or DEX) is a type of cryptocurrency exchange that operates on a blockchain network and allows for the trading of perpetual contracts.

Perpetual contracts are a type of derivatives contract that is similar to futures contracts but do not have an expiration date. This means the contract can be held indefinitely, and the holder can choose to close the position at any time.

Decentralized exchanges allow users to trade cryptocurrencies directly with each other, without the need for a central authority or intermediary. GMX is built on smart contract technology, which enables the execution of trades on the blockchain.

Binance vs GMX: Features & Products

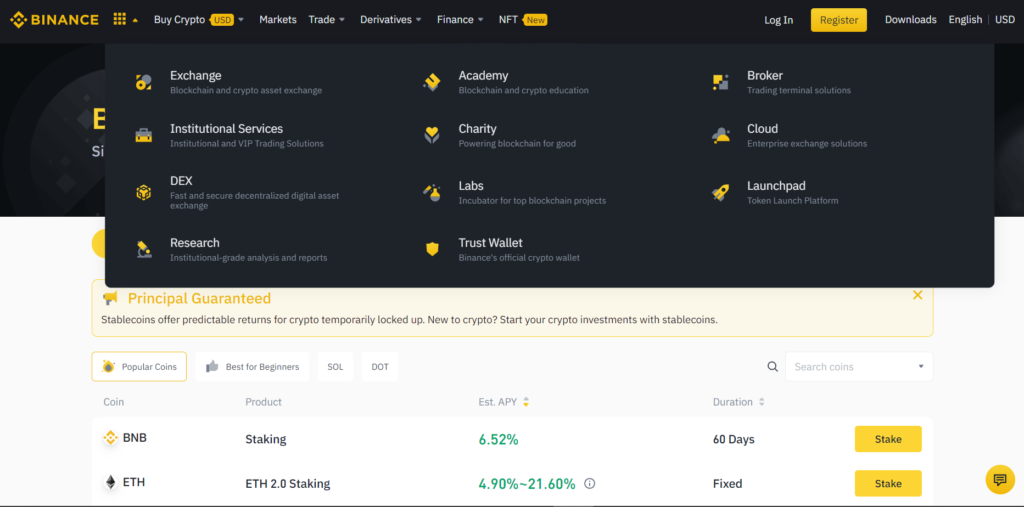

Binance offers a series of products that range from P2P trading to Crypto Lending. Below is a list of products offered by Binance:

- P2P Trading

- Buy Crypto with debit/ credit card

- Spot/ Margin Trading

- Futures Trading

- Binance Vanilla Options

- USDT-M Futures

- Staking/ Lending/ Loan

- Liquid Swap

- Binance Visa Card

- Institutional services

- Binance DEX

- Trust Wallet

- Binance academy

- Binance Leveraged Token

Some of the main features of GMX are as follows:

- 30x maximum leverage (with 50x in alpha)

- Liquidation risks are decreased (price oracles prevent “scam wicks” seen on CEXs).

lower prices (minimal spread and zero price impact on orders) - A straightforward user interface free of the ambiguity regarding margin, debt, collateral, etc.

- Occurrence of several chains on low-fee networks.

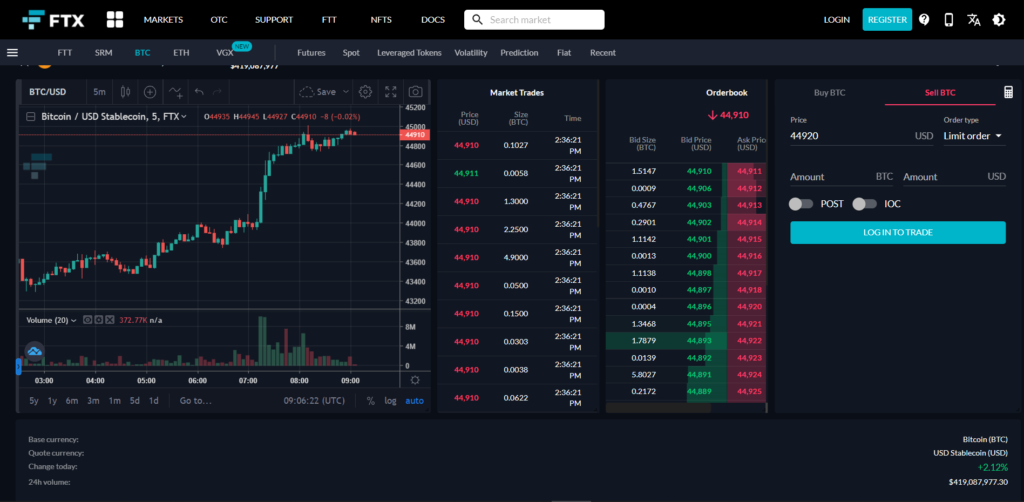

GMX vs Binance: Trading Options

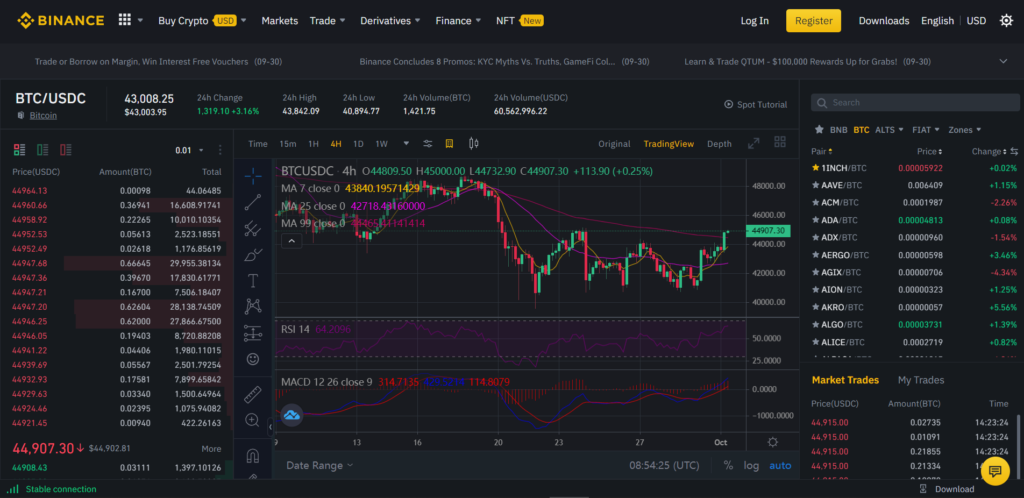

Under Binance Classic, you will have various trading options like market, limit, and stop-limit order. Also, it has a unique feature called “One cancels the other,” which is used to place stop-limit and limit orders simultaneously, if either of the order pairs is triggered the other one is cancelled. Moving ahead, Binance also offers margin trading options to its users. Furthermore, you can invest in the Binance leveraged tokens; however, recently Binance applied Leveraged tokens Limitation.

The main feature of GMX, a decentralized perpetual and spot exchange, is that it allows anyone to trade margin without having to meet the KYC or Professional Investor standards that you may see on a CEX. Margin trading is the practice of borrowing money to trade with, using the debt for this transaction as security. The borrowed money is subsequently utilized to buy or sell an asset; the leverage is the proportion between the size of the position and the amount of the collateral (margin). In comparison to buying a spot asset, this results in bigger profit or loss.

GMX vs Binance: Fees

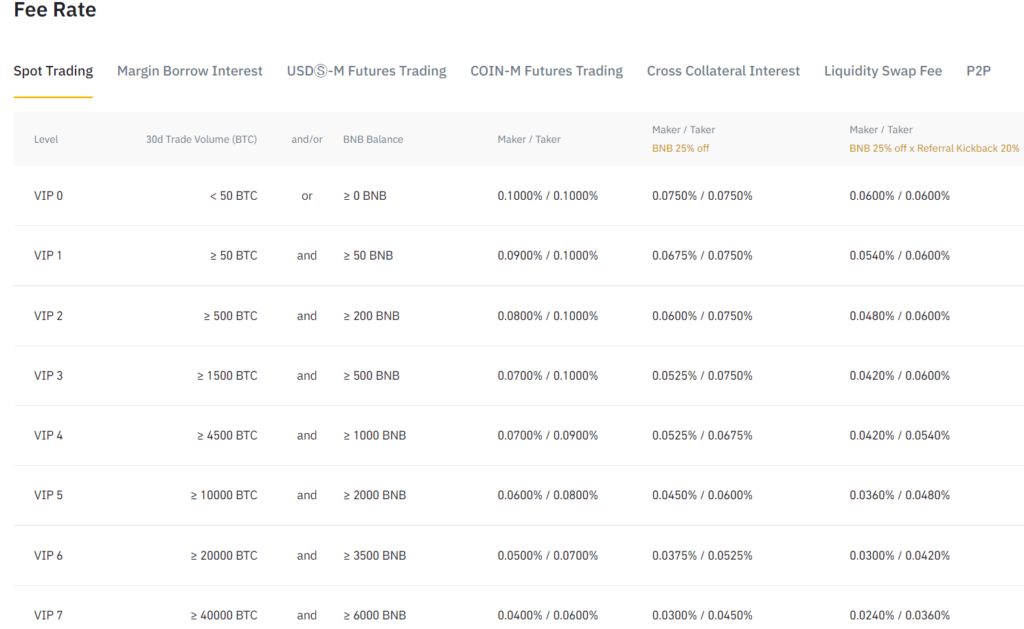

Binance and Binance US have completely different fee’s structure. However, deposits in Binance are entirely free of cost. Talking about the withdrawal fees, it depends on the underlying blockchain network. Also, for charging the trading fees, Binance follows a maker-taker fee structure as shown in the table below. For having an in-depth analysis of Binance costs and pricing structure, click here.

Now, talking about GMX fees. The cost to open or close a position at GMX is 0.1% of the position size.

For long positions, the collateral is the token being longed; for example, for ETH long positions, the collateral is ETH, for BTC long positions, the collateral is WBTC, etc. Any supported stablecoin, such as USDC, USDT, DAI, or FRAX, can be used as collateral for short positions.

The usual swap cost, which ranges from 0.2% to 0.8% of the size of the collateral and is determined by whether the swap increases or decreases balance, would be charged if a swap is required while opening or closing a position.

Binance vs GMX: Customer Support

Binance offers live chat functionality to solve critical issues instantly. Besides this, Binance has a separate channel dedicated to special announcements. You can connect to them through their various social media channels on Youtube, Twitter, etc. Telegram channels are currently available in Chinese and English languages only.

On the other hand,

If you need customer support for GMX, you can contact their support team through their Telegram channel, Medium, Twitter and Discord.

Binance vs GMX: Conclusion

Binance and GMX are among the leading crypto exchanges in the world. Binance offers a dozen options that you will ever need to trade in different ways and several crypto products. Talking about GMX, it is quite famous for its leverage trading. Both the platforms can turn out to be decent choices for you. However, since Binance has been facing certain regulatory crackdowns recently, it would be better to go with a platform of lesser pressure from regulatory authorities. However, I’d still recommend that if you’re trading more than 4 digits, use a hard wallet and store your funds offline.

Frequently Asked Questions

How long does Binance Verification take?

On submitting all of the documents for KYC verification, it can take time from a couple of minutes to a day, depending on the number of applications the platform receives.

When is Binance withdrawal suspended?

Whenever you change your Binance account password, your Binance withdrawal is suspended for the next 24 hours.

Also, read