Prop firms have grown rapidly in popularity because they help talented traders overcome the capital barrier that limits many retail traders. Instead of accumulating thousands of dollars in personal funds, traders can demonstrate their skills through structured evaluations—commonly called challenges—and earn access to greater funding. PipFarm firm is one such firm among many others in space. Read on thid PipFarm Review to know more about it as a proprietary trading firm.

Table of Contents

What is PipFarm?

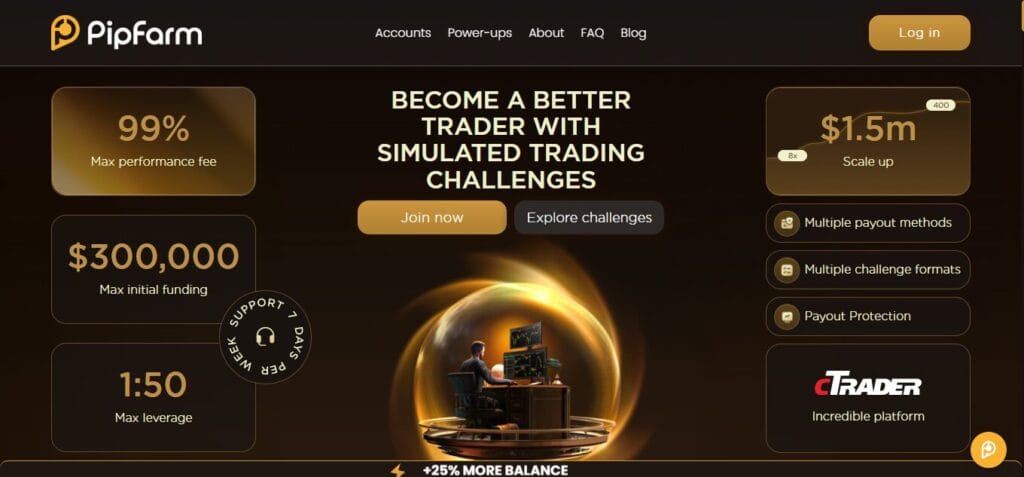

PipFarm is a contemporary prop trading firm designed to support aspiring and experienced traders in securing funded accounts through simulated challenge-based evaluations. Established by ECI Ventures Pte. Ltd. in Singapore, PipFarm emphasizes flexible challenge formats, scalable capital growth, and trader-focused reward systems. Rather than functioning as a broker, the platform operates as a funded trader program where participants trade on virtual accounts during the evaluation phase and, upon success, gain access to firm-provided capital to trade live markets.

Traders can pursue funding with capital allocations ranging from lower-tier accounts to more substantial sums, with the potential to scale positions up to $1.5 million in total capital through ongoing performance milestones. The firm also incorporates an experience-ranking and “power-up” system, where traders earn experience points (XP) and unlock enhanced conditions such as higher profit splits, greater drawdown limits, and other perks as they progress—adding a gamified dimension to the traditional prop firm model.

PipFarm: Key Features

1. Multiple Challenge Formats

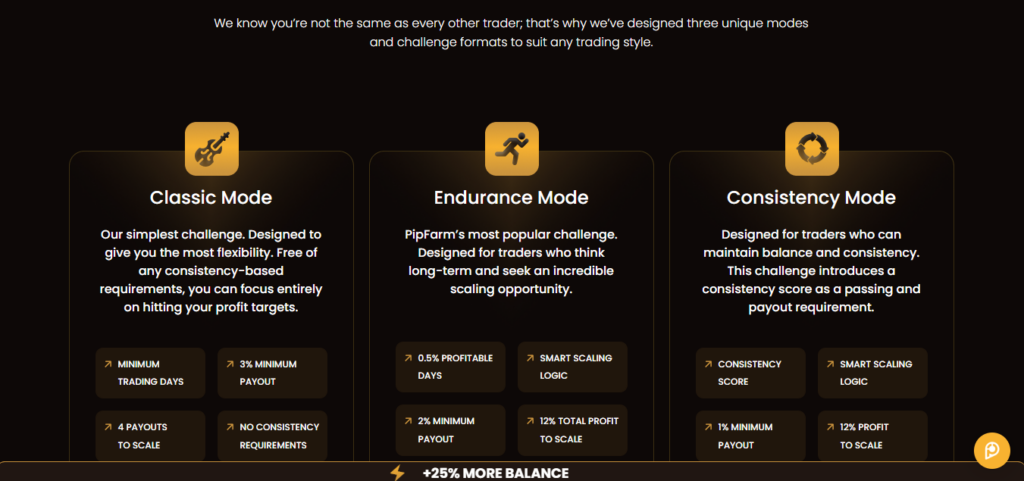

PipFarm offers a variety of evaluation formats tailored to different trading styles, including Classic Mode, Endurance Mode, and Consistency Mode. Each format has unique rules for profit targets, minimum profitable days, scaling logic, and payout thresholds.

2. Simulated Trading Challenges with Funding Access

Traders must pass practical trading challenges (one-stage, two-stage, or instant funding formats) using virtual accounts to qualify for managing firm capital upon success.

3. Performance-Based Profit Share

PipFarm provides a profit share system where traders keep a significant portion of the profits they generate. The percentage increases with rank and performance milestones.

4. Power-Ups and XP System

Traders earn Experience Points (XP) for completing milestones such as passing challenges, scaling accounts, and receiving payouts. XP contributes to rank promotions, unlocking power-ups, perks, and enhanced trading conditions.

5. cTrader Platform Integration

PipFarm uses the cTrader trading platform, providing traders with a professional environment equipped with advanced charting and analytical tools.

6. Dynamic Leverage

Leverage settings on PipFarm adjust dynamically. Traders start with defined leverage parameters that can evolve with their rank and trading exposure.

7. Scaling Program

Consistent performance allows traders to scale their funded accounts, increasing capital allocation and earning potential without the need to purchase additional challenges.

8. Affiliate Program

PipFarm offers an affiliate program that allows participants to earn commissions by referring new traders to the platform.

9. Multiple Payout Methods

The platform supports multiple payout methods, enabling traders to withdraw their profit share once eligibility conditions are met.

10. Flexible Account Sizes and Tradable Instruments

Traders can choose from multiple account sizes and access a range of tradable instruments across supported markets.

Also, you may read 10 Best Prop Trading Firms

How PipFarm works: A step-by-step guide

PipFarm follows a structured funded-trader model where traders demonstrate consistency and risk discipline through evaluation challenges before earning access to funded accounts. The process is designed to be straightforward, performance-driven, and scalable.

Step 1: Select a Challenge & Account Size

Traders begin by choosing a challenge type—such as one-stage, two-stage, or instant funding—and selecting an account size that suits their trading approach.

Step 2: Start Trading the Challenge

After purchasing the challenge, traders receive access to their trading account and begin trading under predefined rules, including profit targets and drawdown limits to trade in Forex currency pairs — majors, minors and possibly exotic pairs via the cTrader environment, Precious metals — such as gold and silver, Indices — major global stock indices, Cryptocurrencies — digital assets available 24/7 on the cTrader platform, Energy products — such as oil (included as part of broader tradable markets on the platform.

Step 3: Follow Risk Management Rules

During the evaluation phase, traders must adhere strictly to PipFarm’s risk parameters. Breaking any rules results in disqualification, regardless of profitability.

Step 4: Pass the Challenge

To pass, traders must reach the required profit target without violating any trading or risk management rules.

Step 5: Get Funded & Trade for Profit

Once the challenge is successfully completed, traders move to a funded stage where they earn a share of the profits generated on their account.

Step 6: Automated Payouts

PipFarm processes payouts automatically on Fridays. Traders are required to set up their preferred payout method in advance.

Step 7: Earn XP and Rank Up

Traders earn Experience Points (XP) for milestones such as passing challenges, receiving payouts, and scaling accounts. XP increases rank and unlocks long-term benefits.

Step 8: Unlock Power-Ups

Higher ranks unlock power-ups such as improved profit splits, faster payouts, and enhanced account conditions.

Step 9: Scale Your Capital

Consistent performance allows traders to scale their funded capital over time, increasing overall earning potential without purchasing new challenges.

Step 10: Increase Profit Share

Profit share starts at a base level and increases with rank progression, rewarding traders who maintain consistent performance.

Also, you may read FX2 Funding: Platform Review

PipFarm: Challenge Structure Overview

Challenges & trading conditions

- PipFarm runs “Challenges for every trader”, including a simplest challenge with no consistency requirements, a long-term scaling-focused challenge, and a consistency-based challenge that uses a score as a passing and payout condition.

- Core parameters shown include a 2% soft breach (no hard daily loss), 6% drawdown that resets on payout, 3% minimum trading days between stages/payouts, and payouts every Friday with variable leverage up to 30x by product.

- Profit targets highlighted are 12% to pass or scale, with examples like a 600 USD target and 450 USD maximum drawdown for smaller accounts, scaling up to 12,000 USD targets with either 6% static or 12% trailing drawdown on larger accounts.

Payouts, allocation & key benefits

- Payouts are processed every Friday, with traders needing to reach at least 25% of the profit target to qualify for a payout and scaling.

- PipFarm promotes up to 95% profit share, maximum initial allocation of 300,000 USD, and the ability to scale total funding up to 1.5 million USD.

- Highlighted reasons to join include the fastest scaling program, Friday “payday”, cTrader platform, multiple payout methods, static or trailing drawdown options, ability to trade any strategy, over 2,000,000 USD in payouts, more than 100 five-star reviews, no hidden rules, in-house technology, 24/7 support, and a Kill Switch to protect accounts.

Experience Program & ranks

- The Experience Program lets traders earn experience points (XP) and progress through ranks 0 to 6, unlocking lifetime rewards such as faster payouts, higher profit share, more drawdown, higher leverage, larger scaling increments, lower commissions, and permanent discounts.

- Profit share increases from 70% at Rank 0 to 99% at Rank 6, while scaling increments rise from 10% to 60%; commissions drop from 6 USD to 0, and maximum leverage improves from 1:30 to 1:50 as ranks increase.

- Daily loss limits are 3% at lower ranks and 4% at higher ranks, maximum loss tolerance increases slightly (+1%) from Rank 2 upward, and traders receive gifts (0 to 1,000 USD) and lifetime discounts from 0% up to 6% as they climb ranks, with 200k and 300k accounts reserved for higher-rank traders.

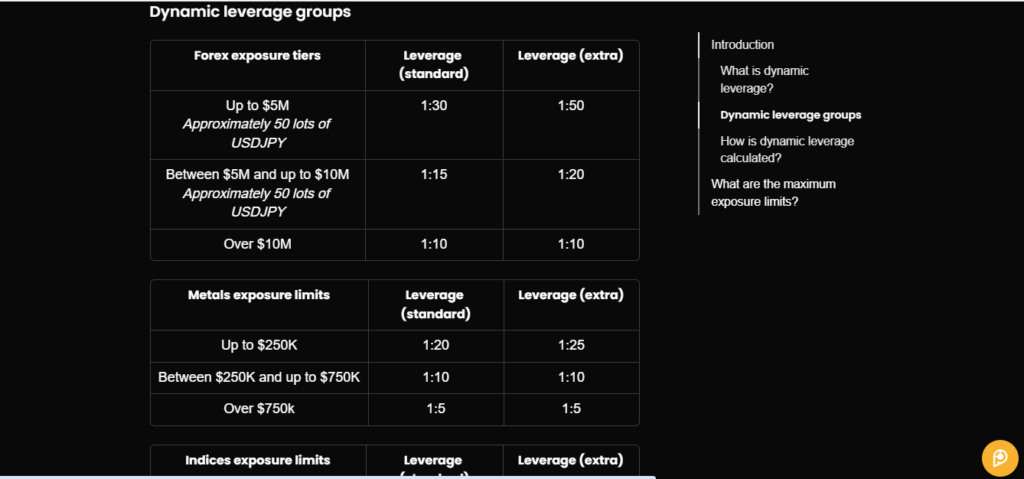

Dynamic Leverage & Exposure Limits

PipFarm uses dynamic leverage, meaning leverage decreases and margin requirements increase as your net exposure per symbol grows. This system is applied per instrument, not across the entire asset class, and is consistent across all accounts. Smaller accounts (below $100k) are unlikely to be affected.

Dynamic Leverage by Asset Class (Standard / Extra):

- Forex: up to $5M → 1:30 / 1:50, $5M–$10M → 1:15 / 1:20, over $10M → 1:10

- Metals: up to $250K → 1:20 / 1:25, $250K–$750K → 1:10, over $750K → 1:5

- Indices: up to $500K → 1:20 / 1:25, $500K–$1M → 1:10, over $1M → 1:5

- Oil: up to $250K → 1:20 / 1:25, $250K–$1M → 1:10, over $500K → 1:5

- Crypto: up to $100K → 1:2 / 1:3, over $100K → 1:1

How it’s calculated:

Exposure tiers are based on USD value per symbol. Different portions of the same position can be margined at different leverage levels, resulting in a blended effective leverage.

Maximum exposure per symbol:

- Forex: $20M

- Metals: $3M

- Indices: $2M

- Oil: $1M

- Crypto: $500K

This structure helps manage risk as position sizes scale while keeping leverage flexible for smaller trades.

PipFarm: Security & Safety

PipFarm implements multiple security and safety measures covering data protection, trading risk controls, and payout integrity. User information is handled under its published Privacy Policy, with defined consent, access, and correction rights. Trading programs include built-in risk management features such as equity-based loss limits, maximum risk thresholds, and an equity kill switch designed to prevent excessive drawdowns. Eligible traders may also benefit from payout protection, subject to conditions outlined in the Terms.

All trading is conducted via the cTrader platform, which provides professional-grade execution and risk tools. PipFarm operates transparently as a funded trader program (not a broker), follows applicable consumer protection standards, and applies identity verification procedures to support account security and prevent misuse.

PipFarm Vs Alpha Capital Group Which Prop Firm Fits You Best?

| Aspect | PipFarm | Alpha Capital Group |

|---|---|---|

| Type of Platform | Prop trading firm offering funding challenges with access to funded accounts after passing evaluations. | Proprietary trading firm providing funded accounts and profit sharing for qualified traders. |

| Trading Evaluation / Challenge | Offers one-stage, two-stage, and instant funding challenges with defined profit targets and risk rules. | Provides trader evaluation and qualification programs with structured rules. |

| Funding Amounts | Initial funding up to $300,000 with scaling potential up to $1.5 million based on performance. | Offers scalable capital allocation for qualified traders, subject to account plan. |

| Profit Share | Profit share increases with rank, reaching up to 95%. | Standard profit share is 80%, depending on account type. |

| Leverage | Leverage varies by account and instrument within defined limits. | Leverage varies by account plan and traded instruments. |

| Trading Rules / Consistency | Includes consistency metrics, profitable day requirements, and strict risk management rules. | Applies rules such as best-day profit limits and performance consistency conditions. |

| Payouts | Payouts are processed automatically on Fridays according to eligibility. | Offers on-demand payouts subject to defined eligibility rules. |

| Trading Platforms | Uses the cTrader platform. | Supports professional trading platforms as specified by account type. |

| Risk Management | Enforces drawdown limits, loss controls, and equity-based safety mechanisms. | Enforces maximum drawdown limits and restricts prohibited trading strategies. |

| Tradable Markets | Provides access to multiple markets via cTrader, including major asset classes. | Allows trading across supported markets depending on the account plan. |

| Support & Resources | Offers a help center, educational content, and community resources. | Provides a dedicated help center with detailed rule and account documentation. |

| Legal & Operations | Operates as a funded trader program with clear terms and policies. | Operates as a proprietary trading firm headquartered in the UK with published terms. |

Also, you may read Alpha Capital Review

Partnership and Affiliate Programs

- High Commission Structure– Earn up to 20% commission per sale, making it one of the highest-paying funded trader affiliate programs.

- No Ranks or Tiers– Affiliates receive the maximum commission rate from the first referral, No level progression, volume targets, or tier-based restrictions.

- Lifetime Commissions– Earn recurring commissions for the lifetime of every trader you refer, not just a one-time payout.

- Exclusive Discounts for Referrals– Offer your audience discounts of up to 50%, designed to increase conversion rates.

- Affiliate Tools & Tracking– Receive unique referral links and coupon codes, track clicks, conversions, and revenue through the affiliate dashboard.

- Regular Promotions & Campaigns– PipFarm runs ongoing promotions and campaigns to support affiliate sales and boost earnings.

- Dedicated Relationship Manager– Access a direct point of contact within PipFarm for affiliate support and coordination.

- Simple Onboarding Process– Apply to join the affiliate program, get approved and access your affiliate tools.

- Weekly Payouts– Earnings can be withdrawn weekly once eligible.

- Low Minimum Payout Threshold– Minimum payout $50.

- Multiple Payout Methods– Payments supported via bank transfer, PayPal, Skrill, and Binance.

Support and Community Ecosystem

PipFarm provides a multi-channel support system designed to assist traders efficiently at every stage. Users can reach the team through live chat, email support, and a helpdesk/ticket system, ensuring structured and timely issue resolution. In addition, PipFarm maintains a comprehensive Help Center and FAQ section, allowing traders to quickly find guidance on rules, challenges, and platform features without waiting for direct support.

Alongside direct support, PipFarm actively nurtures its trader community through an official Discord server, where members can interact, ask questions, and stay informed in real time. The platform also uses official social media channels to share announcements, updates, and ecosystem news, helping traders remain connected and engaged with ongoing developments.

Also, you may read FundedFast: A Quick Analysis

Conclusion

PipFarm is positioned as a performance-driven funded trader program that enables traders to demonstrate their skills through structured evaluation challenges and earn access to capital managed on their behalf. Built around flexible challenge formats and a scalable funding model, the platform is particularly well suited for remote traders who want to showcase strategy, risk management, and consistency without risking personal capital.

With features such as a variety of challenge types, experience-based progression, and profit share up to 95%, PipFarm appeals especially to traders seeking long-term growth and rewards, those who prefer structured risk rules and clear payout processes, and individuals looking for community support and tools like cTrader to refine their trading approach.

Who founded PipFarm?

PipFarm is led by James Glyde, a former cTrader executive with over a decade of experience in the online trading industry.

Can I trade multiple strategies on PipFarm?

Yes. PipFarm allows a wide range of trading approaches provided traders adhere to the challenge and risk management rules.

Does PipFarm offer community support?

Yes. Traders are encouraged to connect through the official PipFarm Discord server and follow social channels for updates and interaction with the community.