OnRe is an innovative on-chain reinsurance platform bridging traditional insurance with decentralized finance (DeFi). With 5,771 ONyc holders and a 33.8 million USD swap volume, OnRe is rapidly growing and offering new yield opportunities backed by real-world reinsurance risks.In this article, we will explore OnRe Review.

Table of Contents

What is OnRe?

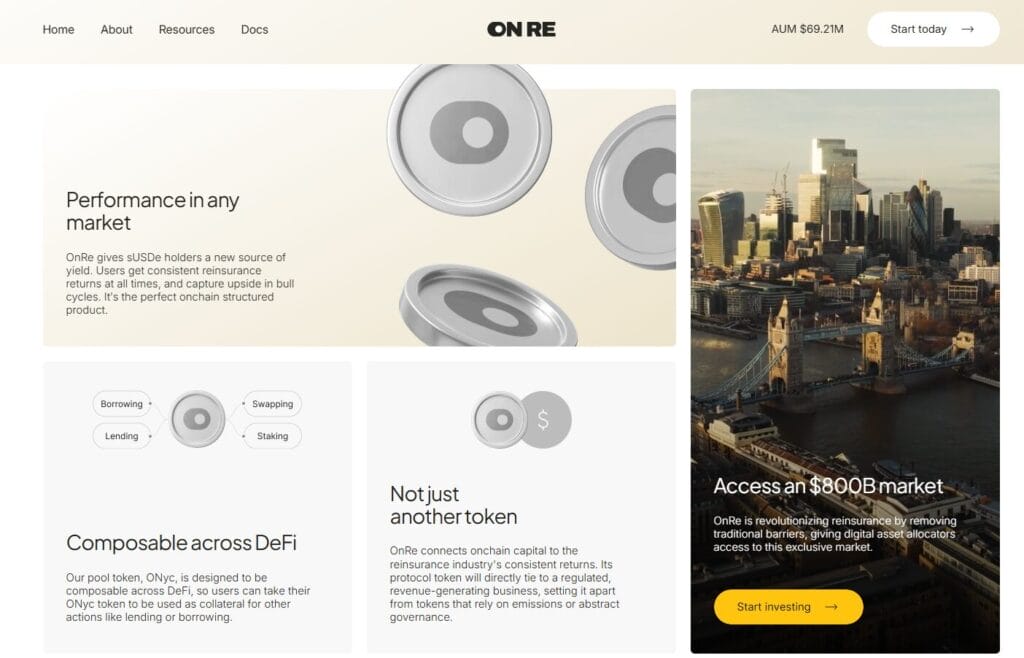

OnRe is the world’s first on-chain reinsurance company, bridging the gap between traditional insurance markets and decentralized finance (DeFi). It allows institutional on-chain capital to invest in real-world reinsurance risks, unlocking a new asset class. Through the ONyc token, OnRe connects regulated insurance programs with on-chain capital. Capital providers allocate funds to reinsurance pools and earn premiums, all while benefiting from blockchain’s transparency, low-cost transactions, and fast settlements. OnRe aims to offer stable, non-correlated yield through its innovative infrastructure.

Key Features of OnRe

- On-chain Reinsurance: OnRe offers an innovative approach by allowing capital providers to invest in real-world reinsurance risk via blockchain-based contracts. This enables the traditional reinsurance market to benefit from the transparency and security of decentralized technologies.

- Regulated Insurance Programs: OnRe connects regulated insurance programs with on-chain capital via its ONyc token. This ensures that all insurance programs adhere to compliance standards, providing a secure and trustworthy investment platform.

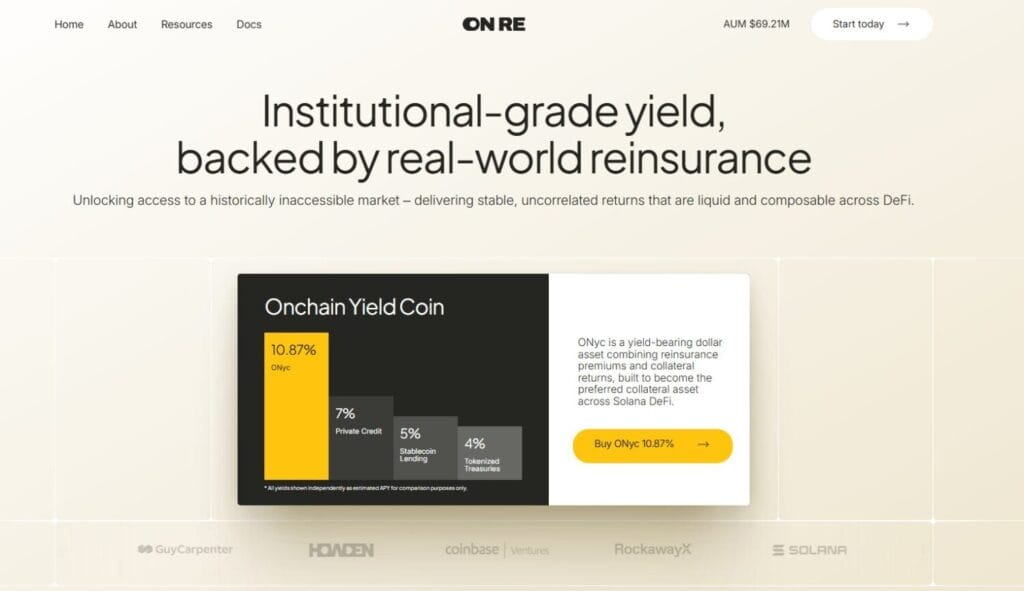

- ONyc Token: The ONyc token is a multi-collateral, yield-bearing asset used to back reinsurance investments. It is designed to generate returns for investors by utilizing reinsurance premiums and stablecoin collateral.

- Real-Time Transparency: OnRe offers real-time visibility into capital positions, premiums, and other key financial data. This transparency allows users to track their investments and make informed decisions based on real-time data.

- Low-Cost Blockchain: OnRe operates on Solana, taking advantage of its low transaction fees and fast settlement times. This makes it an attractive option for users looking to invest without incurring high costs.

- Institutional Access: OnRe is designed to cater to DAOs, accredited investors, and institutional investors, providing them with a stable, non-correlated yield opportunity. This expands the potential user base, ensuring that large-scale investors have access to diversified portfolios.

OnRe Review: Products and Services

- ONyc Token: ONyc is at the heart of the OnRe ecosystem. It is a multi-collateral token backed by stablecoins and used to underwrite real-world private placements. Investors earn yield from reinsurance premiums and stablecoin collateral returns. ONyc is designed to provide compound, multi-source returns that deliver steady performance while capturing upside from market evolution.

- Reinsurance Premiums: Capital providers earn yield from reinsurance premiums that are collected upfront and managed through segregated accounts. These premiums are distributed on-chain and tracked by smart contracts.

- Stablecoin Collateral: The ONyc token is also backed by stablecoin collateral, which adds an additional layer of yield generation. This collateral is invested in low-volatility assets, ensuring the safety and stability of the returns.

- Liquidity Pools: ONyc tokens can be traded on decentralized exchanges (DEXs) through liquidity pools, offering users a secondary market for their investments. This provides additional flexibility and liquidity to capital providers.

- Segregated Accounts: To ensure the safety and segregation of capital, OnRe uses legally segregated accounts. Each reinsurance program has its own account, ensuring that the assets of one program are never exposed to another.

- Reinsurance Coverage Types: OnRe supports a variety of reinsurance programs, including specialty lines such as cyber insurance, crypto-related risks, travel, and marine insurance. It also covers property catastrophe risks, like windstorm and earthquake insurance.

How Does OnRe Work?

- Capital Allocation: Cedents (insurance providers) submit reinsurance proposals, which are underwritten by licensed insurers. Capital providers allocate funds to the ONyc Pool, and in return, they earn a share of the premiums paid by cedents.

- ONyc Token Usage: Capital providers mint ONyc tokens using Solana-supported wallets, deposit assets like USDC, and then redeem their tokens when liquidity is available.

- Yield Generation: Yield is generated from three sources: reinsurance premiums, stablecoin collateral, and the ONyc token’s appreciation in value. These sources are distributed to ONyc holders and reflected in the token’s market value.

- Regulated Operation: OnRe is authorized and regulated by the Bermuda Monetary Authority, ensuring that all operations are compliant with international insurance and digital asset regulation.

OnRe Review: Fees

- Transaction Fees: OnRe charges minimal transaction fees due to its operation on the Solana blockchain, which offers low-cost transactions compared to other blockchains like Ethereum.

- Minting and Redemption Fees: Users may incur fees when minting ONyc tokens or redeeming them back to USDC. These fees are subject to redemption windows and liquidity availability.

- Liquidity Pool Fees: Participating in liquidity pools may involve fees associated with trading or providing liquidity. These fees are generally minimal but can vary depending on market conditions.

- Platform Fees: While OnRe does not charge high fees for accessing its platform, users should expect small service fees that help maintain the ecosystem’s operations and ensure smooth functionality.

OnRe Review: Mobile App

- Mobile App Access: Currently, OnRe does not have a standalone mobile app. However, users can access the platform via any Solana wallet, which includes mobile compatibility through WalletConnect.

- User Interface (UI): OnRe features a user-friendly, intuitive interface that allows investors to easily interact with the platform. The design is sleek and simple, providing users with an easy-to-navigate experience for minting tokens, managing capital, and viewing real-time data.

- User Experience (UX): The user experience on OnRe is enhanced by its integration with Solana’s fast transaction speeds and low fees. The transparency provided by the platform, coupled with the ability to track investments in real time, creates a seamless and efficient experience for all users.

Security

- On-Chain Transparency: OnRe’s entire operation is built on blockchain technology, which offers unmatched transparency and security. All capital movements, premiums, and yield distributions are tracked and verifiable via smart contracts.

- Regulation and Compliance: As a fully licensed platform, OnRe adheres to international insurance and digital asset regulations. It is regulated by the Bermuda Monetary Authority, providing users with an added layer of trust and security.

- Smart Contracts: OnRe uses secure and audited smart contracts to manage all transactions. This minimizes the risk of human error and external manipulation.

- Segregated Accounts: The platform ensures that each insurance program’s assets are segregated, which provides added security to capital providers and ensures the safety of their investments.

OnRe Review: Affiliate/Referrals and Rewards

- Referral Program: OnRe offers a referral program where users can earn a percentage of their referees’ ONyc activity. When a user refers to someone who meets the minimum exposure threshold, they begin earning rewards based on the referee’s ONyc balance and activity.

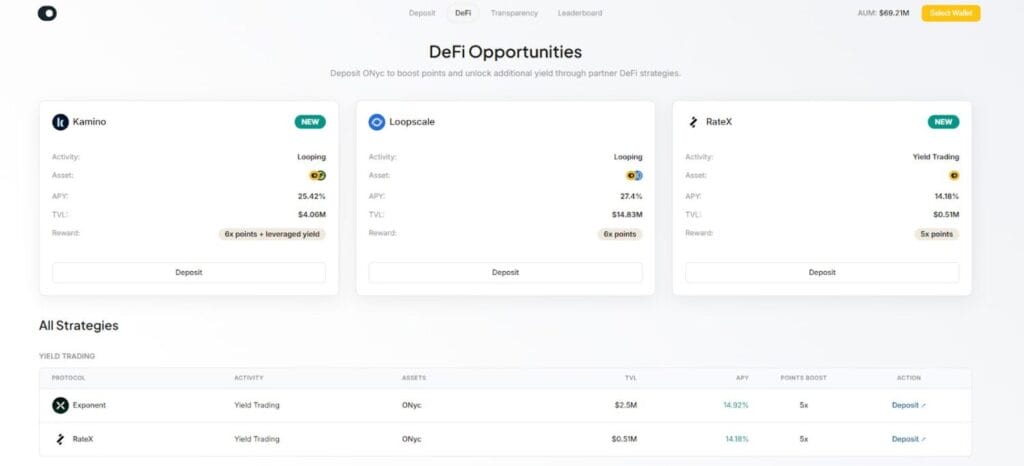

- OnRe Points Program: This program rewards users for deploying ONyc across DeFi protocols. The points earned help improve rankings on the OnRe leaderboard, offering users the chance to unlock future rewards and incentives.

- Ambassador Program: OnRe also runs an Ambassador Program, designed to reward individuals who actively contribute to the platform by educating others, creating content, and driving community engagement. Ambassadors receive seasonal rewards and recognition within the community.

- Incentives for Long-Term Contribution: The referral and ambassador programs are aimed at fostering long-term participation and growth within the OnRe ecosystem, with rewards tied to active contributions such as lending, borrowing, and trading ONyc.

Data Analytics and Performance

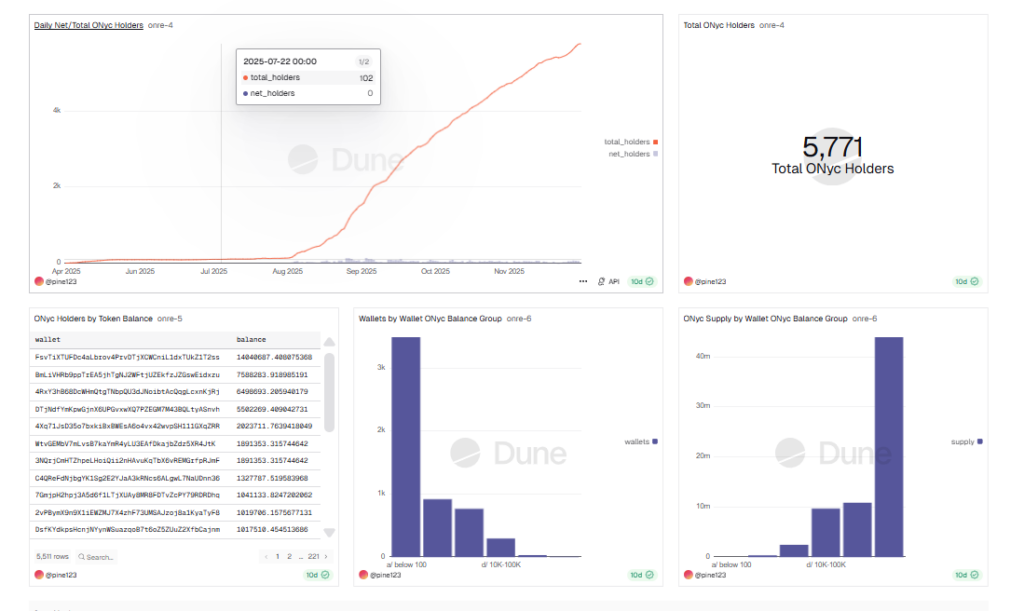

- Rapid Growth in ONyc Holders: The number of ONyc holders has reached 5,771, indicating strong community engagement and increasing investor trust in the platform.

- Surge in Swap Volume: OnRe’s daily swap volume has skyrocketed to 33.8 million USD, reflecting a significant increase in market activity. This surge indicates heightened interest in ONyc and the platform’s capacity to handle large-scale transactions, positioning it as a solid liquidity hub in the DeFi space.

- Growth in Active Traders: With 2,585 active ONyc swap traders, OnRe has established a vibrant and growing user base. The data shows a consistent upward trajectory in trader participation, suggesting that the platform is attracting a diverse group of crypto-native traders and institutional players.

- Explosive Growth in Swap Events: OnRe has experienced 32,463 ONyc swap events, highlighting the high frequency and volatility of trading activity on the platform. This further underscores the growing adoption and liquidity of the ONyc token within decentralized exchanges.

- Diversification of Wallets and Supply: A significant portion of the ONyc supply is concentrated in wallets holding between 10K-100K ONyc, with the largest proportion of wallets belonging to smaller holders. This suggests that the platform has broad appeal across different wallet sizes, from retail to institutional investors, contributing to a well-diversified investor pool.

OnRe Review: Conclusion

OnRe has firmly positioned itself as a trailblazer in the DeFi and reinsurance sectors by offering institutional capital the opportunity to invest in real-world reinsurance risks through its ONyc token. With over 5,700 ONyc holders, the platform’s rapid adoption showcases its potential as a stable and non-correlated yield-generating solution. The 33.8 million USD swap volume and 2,585 active traders demonstrate the increasing liquidity and user engagement within its decentralized exchange. Additionally, the 32,463 swap events highlight the platform’s growing market activity, further validating its appeal to crypto-native funds, accredited investors, and DAOs. As it continues to scale, these metrics suggest a bright future for the platform.

What happens if the ONyc token's value fluctuates?

The value of ONyc tracks the overall performance of the reinsurance pool. Fluctuations in value are driven by the performance of the reinsurance programs and stablecoin collateral yield, ensuring returns are linked to real-world performance, not speculative token inflation.

How can I become an OnRe partner?

To become an OnRe partner, you must complete a Terms of Business Agreement and meet specific operational and jurisdictional criteria. You can also contact OnRe’s team directly for more details on becoming a broker or partner.