The computer we use today has gone through several evolutions resulting in different generations of computers. For example, First Generation Computer (1940-1956) to Fifth Generation Computers (present and beyond). These generations tried to bring a new development that resulted in faster, cheaper, and efficient usage. Just like the evolution of computers, blockchain technology has evolved through time. You might be surprised to know that all the three blockchains we will discuss in this article belong to different generations. Therefore in this article, we will differentiate Ethereum, Cardano, and Solana according to several factors.

Table of Contents

Summary

- Vitalik Buterin and the team launched Ethereum in July 2015. Ethereum is a world computer for decentralized applications. The native cryptocurrency of Ethereum is ETH and is the second-largest cryptocurrency. with a market cap of $400.54B.

- Cardano was founded by Ethereum’s co-founder Charles Hoskinson and launched in 2017. The native cryptocurrency of Cardano is ADA. The market cap of Cardano is $76.901B. Whitepaper:

- Solana was launched in April 2020 by Anatoly Yakovenko and the team. The native cryptocurrency of Solana is SOL. The market cap of Solana is $47.487B.

Ethereum vs Cardano vs Solana: Generation

Let’s understand the different generations first.

- Bitcoin is a First Generation Blockchain. Bitcoin was the first mass-adopted implementation of Blockchain technology. The sole purpose of Bitcoin was to improve how traditional financial institutions worked, to make it decentralized yet secure. Bitcoin allows you to send, receive, and trade but doesn’t give you the freedom to impose conditions on a transaction. Example: Bitcoin can’t cater to a situation like “CoinCodeCap will pay 0.1BTC to Akansha only if she delivers the article on time”.

| Blockchain | Ethereum | Cardano | Solana |

|---|---|---|---|

| Generation | Second | Third | Fourth |

- Ethereum is a second-generation blockchain. Ethereum came up with the concept of smart contracts. Smart contracts can be thought of as a legal document where all the conditions are mentioned, and once they are met, the transaction can only be triggered. For example: now you can write a smart contract that will make sure that Akansha receives 0.1 BTC only after submitting the article. Ethereum also took a step further and became the platform on which developers can build applications.

- Cardano is a third-generation blockchain. While first and second-generation Blockchain gave the world a massive evolution in decentralization, innovation, and security, it majorly lacked scalability. The long-prevailing issue of scalability of Ethereum and Bitcoin alone led to the entry of blockchain-like Cardano. Cardano solved the scalability and interoperability issues. Read our Cardano Guide to learn more.

- Solana is a fourth-generation blockchain. As it leverages open infrastructure to provide greater scalability. Any blockchain can accomplish two of the three requirements –decentralization, security, or scalability. But Solana solved this trilemma by acing in all of the three.

Solana vs Cardano vs Ethereum: Consensus Mechanism

Blockchain has no boss! Everyone who is a part of the network is the boss! In a situation like this, it is essential to understand how decisions are made in a blockchain. The process by which the participant/ node of a blockchain network decides the current state of the network is known as a consensus mechanism. Different blockchains make use of other consensus mechanisms.

| Blockchain | Ethereum | Cardano | Solana |

|---|---|---|---|

| Consensus | PoW | PoS | PoH |

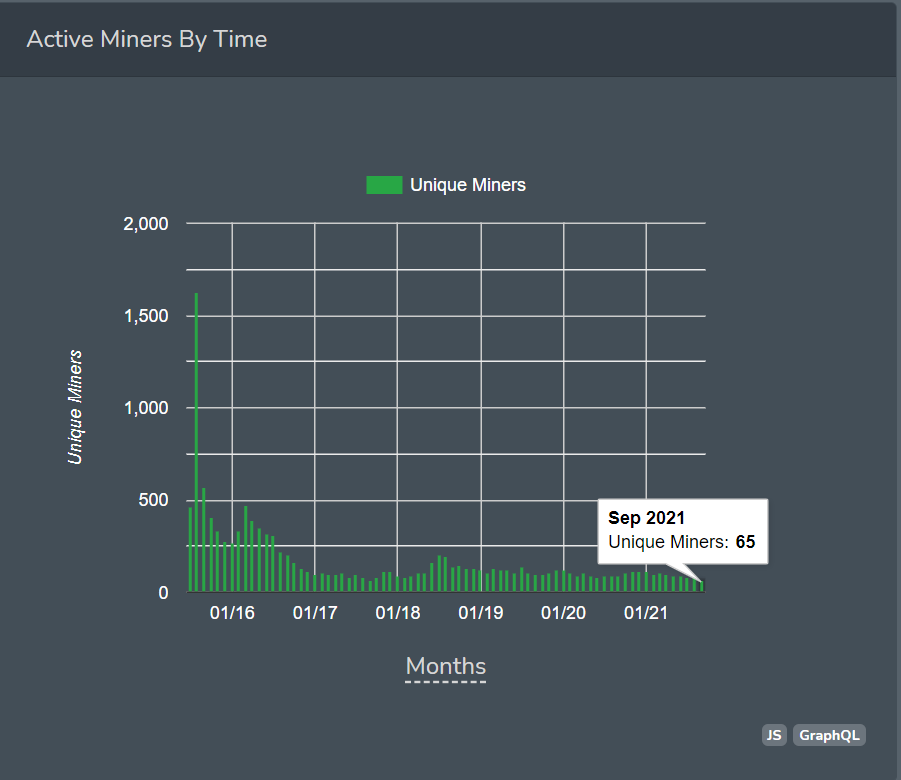

- Ethereum: Ethereum 1.0 currently uses a Proof of Work (PoW) consensus mechanism. But Ethereum will soon shift entirely to Proof of Stake (PoS). Compared to PoS, PoW is slower and demands a tremendous amount of energy and computation usage. The unique miners of Ethereum can be followed in the graph below:

- Cardano: Cardano uses a unique PoS called Ouroboros which is the first peer-reviewed blockchain protocol. Ouroborus establishes the same security level as Bitcoin and ensures that no past transactions are mutable. Cardano’s consensus drastically reduces the energy and computation usage as it doesn’t require particular mining. As per the stats, Cardano uses just 6-gigawatt hours of energy annually, while Bitcoin is estimated to use 115.85 terawatt-hours.

- Solana: Solana utilizes a blend of Proof of Stake (PoS) and Proof of History (PoH) as the consensus mechanism. PoH timestamps all the events/transactions that were occurring in the network at a specific time to create a history record. This record can be used to prove that the transaction happened in the past. PoS is used for voting and selecting the next PoH generator node and for punishing malicious validators that try to act against the network’s interest. The use of PoH helped Solana to improve the throughput and scalability drastically.

Transaction Throughput

Throughput is defined as the rate at which a blockchain processes transactions, it is measured in transactions per second (TPS).

| Blockchain | Ethereum | Cardano | Solana |

|---|---|---|---|

| TPS | ~30 | ~257 | ~57K |

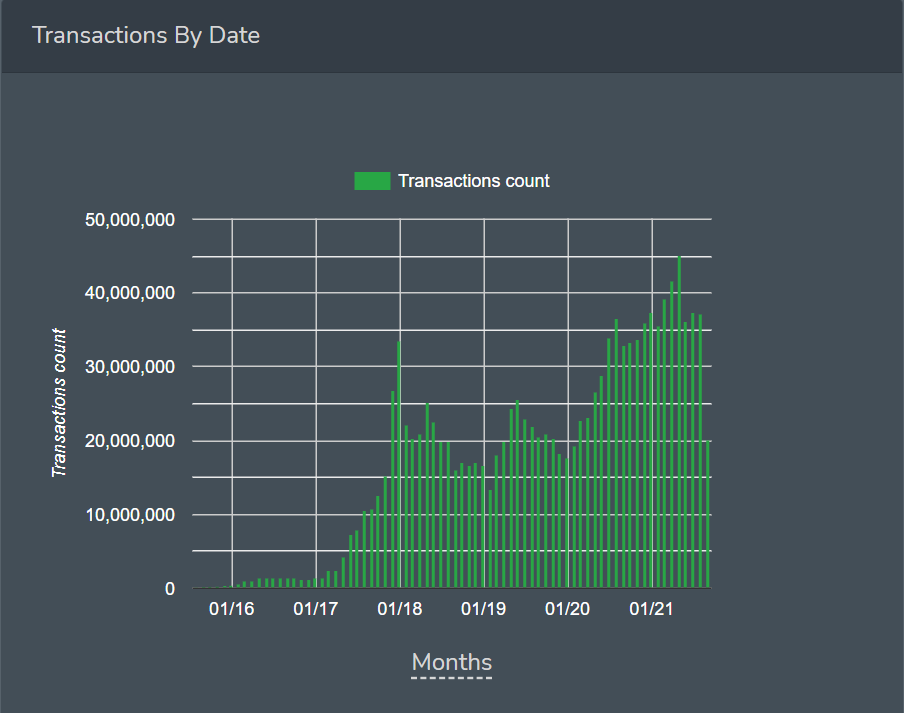

- Ethereum can only handle around 30 transactions per second. But Ethereum 2.0 aims to scale to as many as 100,000 transactions per second using sharding and other layer 2 scaling solutions. Further, you can also gain staking rewards by ETH 2.0 Staking.

- Cardano can process approximately 257 TPS.

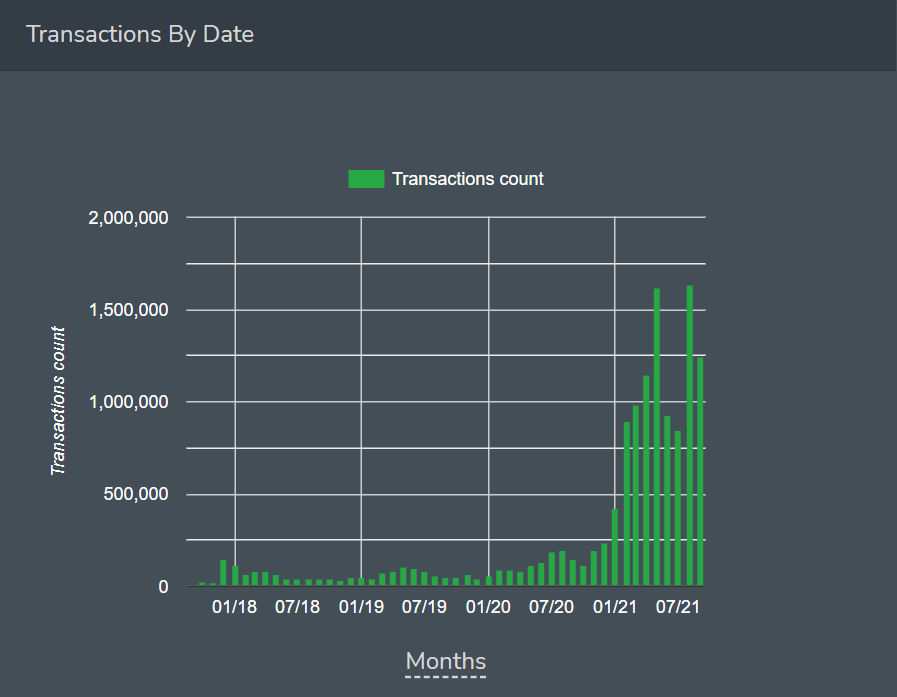

- Solana can process approximately 50k TPS. Solana is comparatively a new blockchain with not so many DApps running on top of it. A simple question arises: “How can a small DeFi produce that many transactions? There’s a simple explanation to this: According to Solana’s consensus mechanism, validator nodes vote to approve/ confirm the status of the Blockchain (transactions). Each vote is also considered a transaction, and also since the transaction in Solana is cheap, there is a high number of canceled transactions in the network, which is also counted as transactions. So, ~50k TPS is a valid number. The founder of Solana also answered this same question a couple of months ago: About 40% votes, 40% are serum order messages, cancels/ bid/ ask.

Cardano vs Ethereum vs Solana: Transaction fees

The fee charged by a user to perform a specific cryptocurrency transaction is known as a transaction fee.

| Blockchain | Ethereum | Cardano | Solana |

|---|---|---|---|

| Transaction fees | $4-12 | $0.02 | $0.0002 |

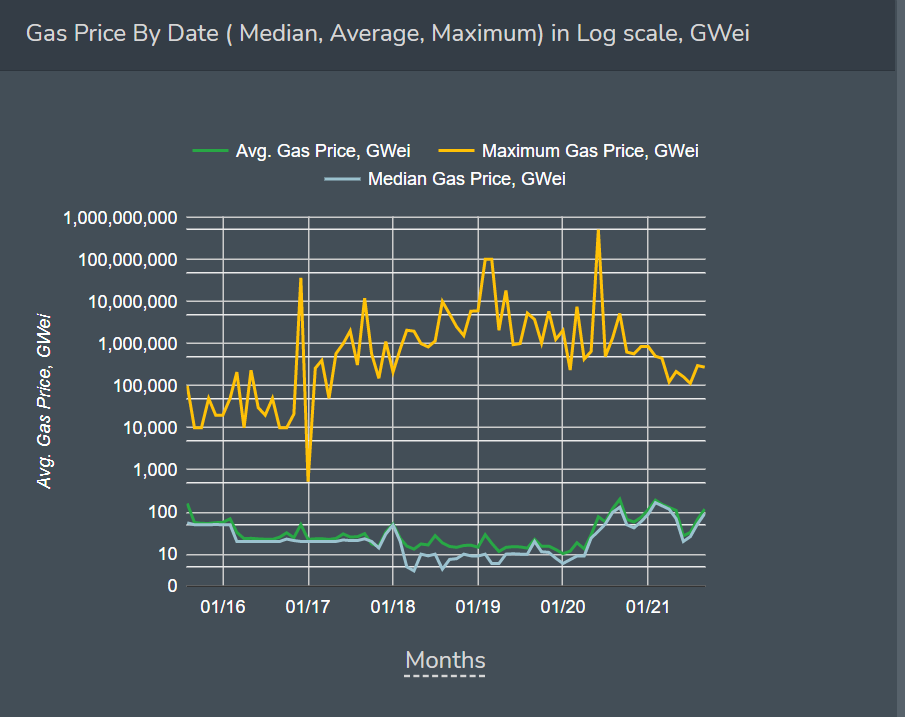

- Ethereum: Ethereum is not a good performer when it comes to transaction/ gas fees. Gas fees reached as high as $60 in mid-May 2021. The average transaction fee of Ethereum ranges from $4-12. With the integration of Etherem 2.0, gas fees are said to decrease, but gas fees are skyrocketing. Due to this factor, more developers are leaving Ethereum’s platform to look for cheaper blockchains. In the below graph, we can study the average gas fee per transaction in Ethereum. (1 ETH represents 1 billion gwei)

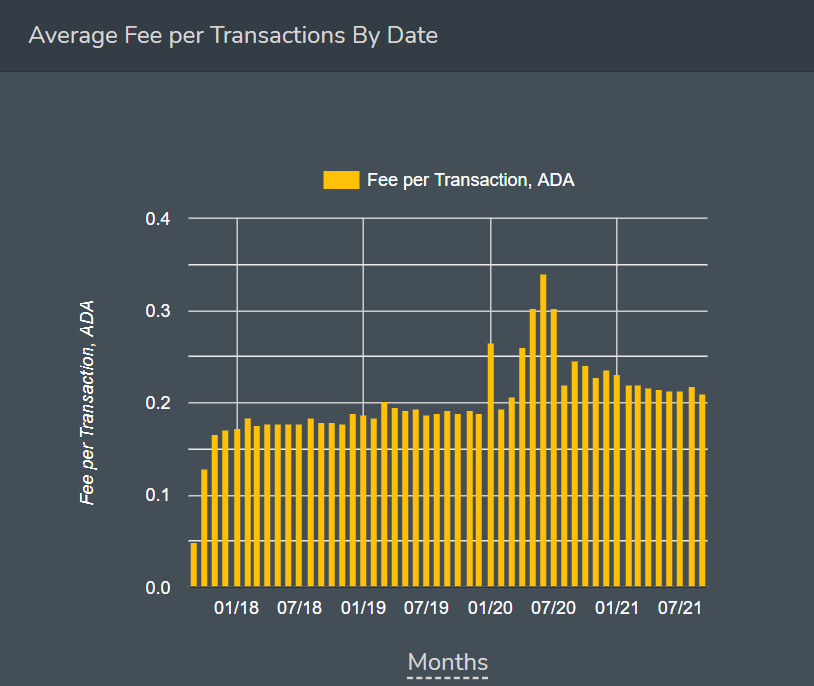

- Cardano: The average fee for a transaction is about 0.16-0.25 ADA, which in USD is about a penny or two. Cardano enforces a minimum transaction fee.

- Solana: You might be surprised to know that Solana’s transaction fee is ~60 times lower than that of Ethereum. Solana fees are $0.00025 per transaction, but they fluctuate over time.

Cardano vs Ethereum vs Solana: Adoption

It is a significant factor for Blockchains to have a large, active, and vibrant community. How widely developers have adopted the Blockchain all around the globe to build applications plays an essential factor in its development. A good user base also indicates that many people are willing to adopt the ecosystem provided by a blockchain. Basically, how much impact does a blockchain have on making the webspace more impactful and secure? At the same time keeping environmental aspects in mind also let to its success.

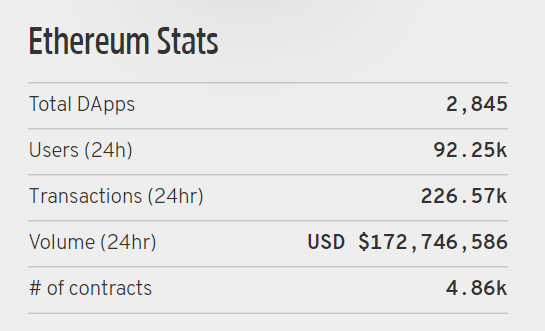

- Ethereum: Ethereum retains its position as the most widely used decentralized app platform. It is not going to change any time soon. Over 2845 Decentralised Apps (DApps), ranging from decentralized exchanges, NFT marketplace, and online gaming to social media platforms, are currently running on the Ethereum network. More than 221 DeFi projects are now live on the Ethereum network. Some of the most famous Ethereum Dapps are Uniswap, Chainlink, Aave, Compound, OpenSea, etc. Ethereum also acts as a platform to create native tokens (ERC-20, ERC-721, etc.). Few examples of Ethereum Blockchain Tokens are BAT, ZRX, OMG, etc.

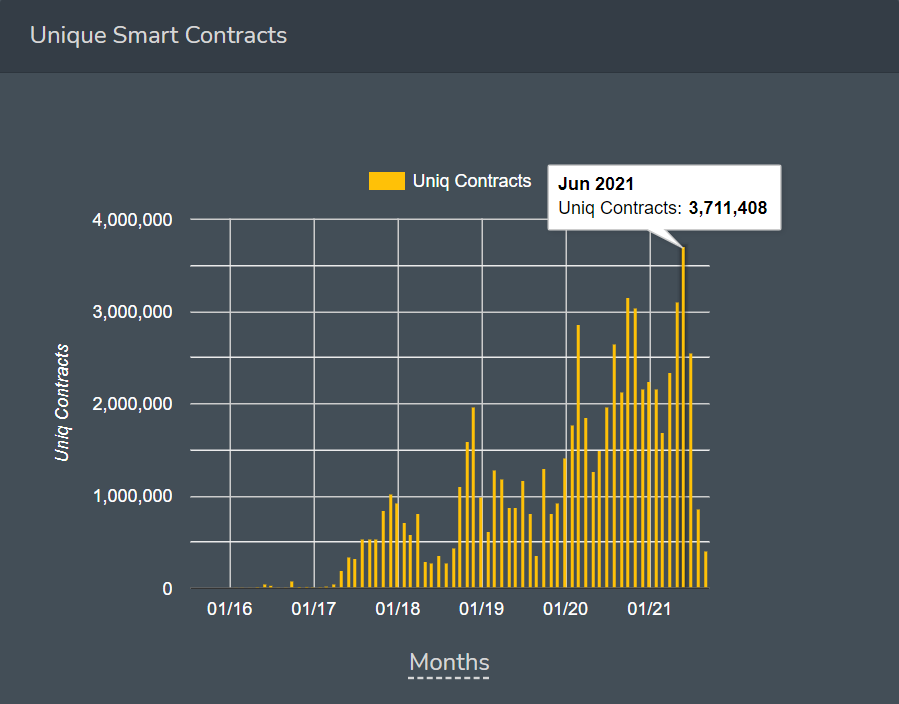

The number of unique smart contracts in the graph below also suggests that developers build and users use the Ethereum ecosystem.

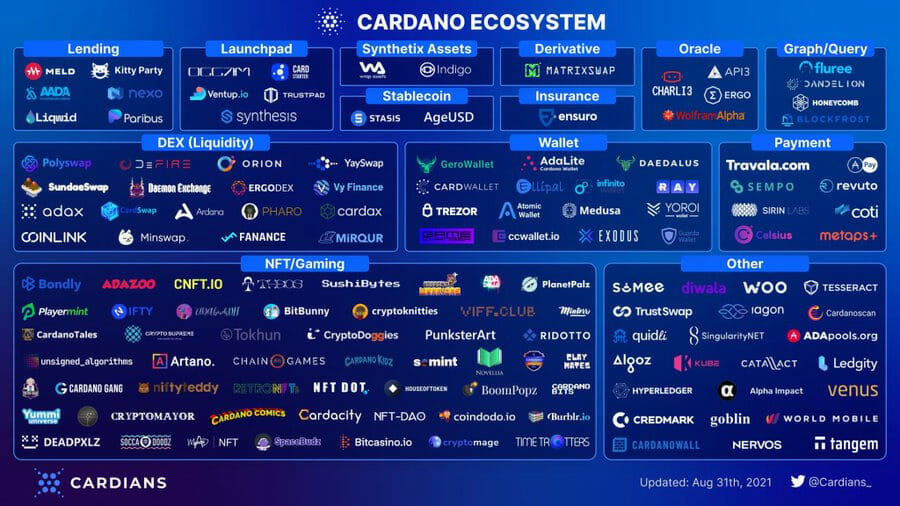

- Cardano: Cardano is still behind in the adoption point of view. With the success of “Alonzo Hard Fork” in September 2021, Cardano introduced smart contract functionality in its network, which means now developers can build DApps on the Cardano blockchain. Within 24 hours of the announcement, the platform saw more than 100 smart contracts run on the network, with its first decentralized application also already deployed. Cardano can now also mint NFTs.

- Solana: Solana is a fast and low-fee blockchain designed to enable developers to deploy and scale applications to billions of users globally quickly. Within a brief period, Solana successfully managed to attract many developers to build DApps on top of it. Solana organized Hackathons that allowed developers to experiment and leverage Solana blockchain to create several projects ranging from DeFi, gaming, NFT, etc. Currently, about 338 Dapps are running on the Solana network.

Solana is considered a direct competitor to Ethereum. But that’s a straightforward claim in a brief period. On September 14, 2021, Solana suffered a spike in transactions causing network congestion, and as a result, Solana suffered an 18-hour protracted instability. This had a significant impact on the DApps running on top of Solana. Solana is considered the fastest Blockchain globally and among the cheapest, but a blockchain is not supposed to go down for such a considerable period. This created a sense of scepticism for Solana fans all around the world.

Performance of native cryptocurrencies

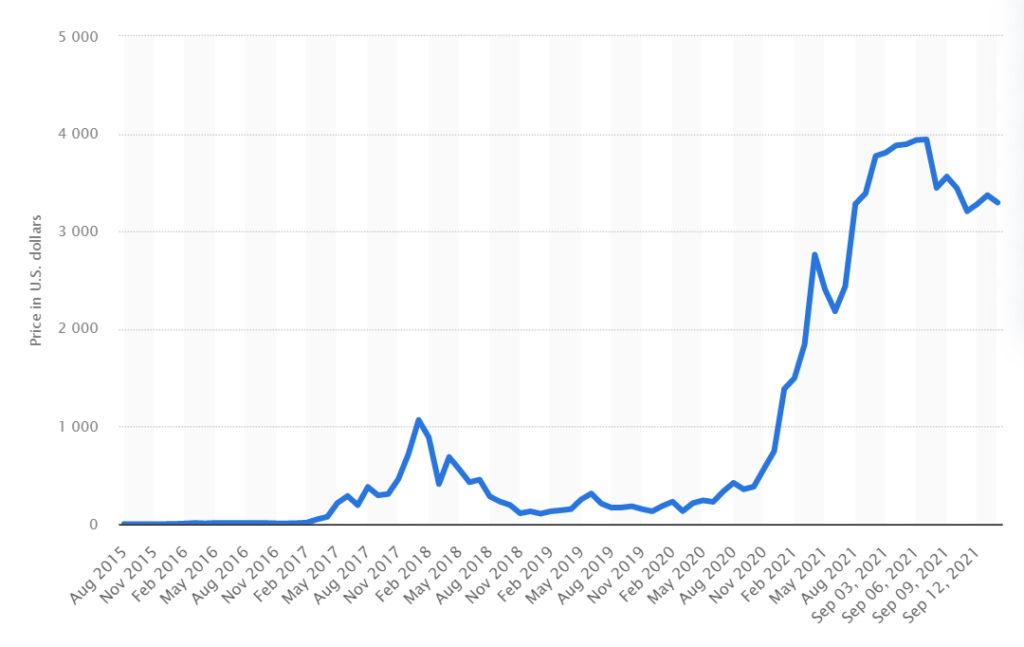

- Ethereum (ETH): Ethereum has no limit on the total number of ETH coins minted; approximately 18 million ETH are mined every year. The trading volume of ETH at the time of writing this article is $34.82B. Ethereum marked its first trading in August 2015. The price of 1 ETH in Aug ’15 was just 67 cents. Ethereum saw its first significant spike in mid-June 2017, reaching an all-time high of $343.42. In Jan ’18, ETH rushed at $1,972. Three months after ATH in 2018, ETH drastically dropped to $379.75. Following years ETH grew slow and steadily until, in 2021, ETH stood tall at $4,180.57 all-time high to date. You can earn more ETH from ETH 2.0 Staking.

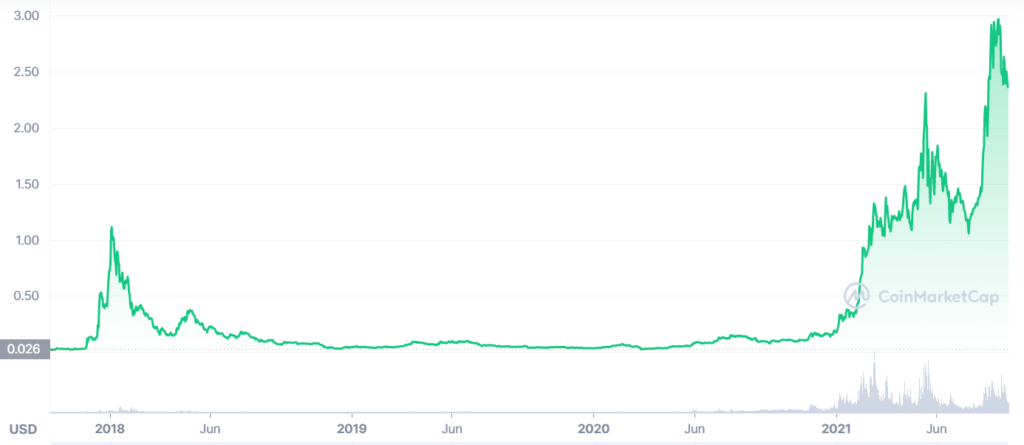

- Cardano (ADA): Cardano marked its first trading in Nov ’17. The trading volume of ADA at the time of writing this article is $4.62B. ADA started with a price of $0.01735. ADA reached an all-time high of $2.9677 in Sept ’21. ADA cannot be mined but staked. The maximum supply of ADA is 45 billion and you can buy ADA/ Stake ADA.

- Solana(SOL): The native cryptocurrency of Solana, SOL, was trading at $0.5052 in May 2020 and is now worth more than $160 with an all-time high of $214.96. The trading volume of SOL is $3.16B. However, since SOL doesn’t follow the PoW consensus mechanism, it is not minable. Therefore, one can only participate in staking Solana and receive SOL coin rewards. The maximum supply of SOL is 488,630,611 SOL. You can invest in the project by reading our guide to buy SOL.

How can you trade ETH, ADA & SOL?

There are two types of exchanges- Centralised Exchanges (CEX) and Decentralised Exchanges (DEX). According to one’s preferences, they can choose which business is suitable.

Here’s a list of five DEX and CEX where you can buy/sell/trade ETH, ADA, and SOL:

Conclusion: Ethereum vs Cardano vs Solana

Ethereum, Cardano, and Solana have their vision of solving a pertaining issue and becoming the most widely used Blockchain. Ethereum is the most preferred Blockchain for building DApps because of the ecosystem it provides, but the scalability and a high gas fee sets a barrier for Ethereum. With Ethereum 2.0, let’s hope to see the better version of Ethereum altogether. On the other hand, Cardano’s early adoption of PoS sets the Blockchain apart.

Cardano aims to be a more scalable and sustainable platform to run smart contracts, build DApps and improve traditional blockchains like Ethereum. . In contrast, Solana primarily aims to solve the scalability issue of blockchain keeping decentralization and security as the focus. Solana aims to be a fast and more effective network than Ethereum, Cardano, and all the other blockchains out there. So, it comes down to one preference.

Frequently Asked Questions

How is Solana different from Ethereum and Cardano?

Solana is cheaper and faster than Ethereum & Cardano.

The recent Alonzo Hard fork update empowered Cardano smart contract capabilities and other functionalities i.e developers can build DApps on top of Cardano now.

What problem does Proof of History (PoH) have over Proof of Work (PoW)?

Proof of History presents a fundamental move forward in the structure of blockchain networks in regards to speed and capacity.

Which Blockchain provides the best ecosystem for developing DApps?

Each of these blockchains has its own pros and cons but as of now, Ethereum is the most preferred choice for developing DApps. Other blockchains might need to work for a few more years to get into competition with what Ethereum has already achieved.

Which blockchain’s transaction fee is comparatively low?

Solana

Also, read