Ethereum is trading around $3,170.11, showing a period of consolidation as the broader crypto market faces volatility and mixed sentiment.

ETH is holding key support levels but remains sensitive to macroeconomic factors and market liquidity.

For on-demand analysis of any cryptocurrency, join our Telegram channel.

ETH Next Target

- Price: $3,170.11

- Market Cap: Approximately $383 billion

- Circulating Supply: About 120.7 million ETH

- Total / Max Supply: No fixed cap (dynamic issuance via Proof-of-Stake)

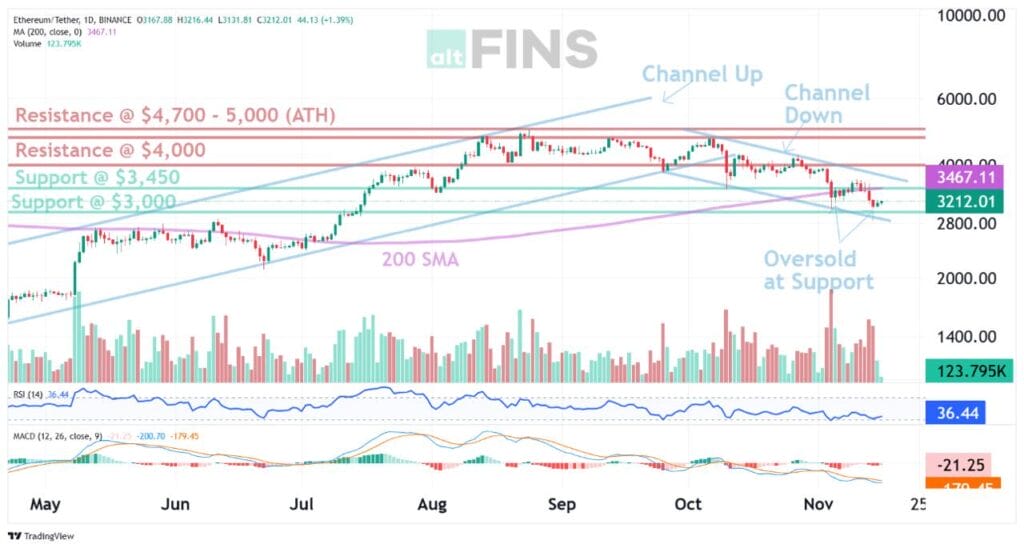

Price is in a downtrend, trading in a Channel Down pattern, which typically resolves in a bullish breakout and a trend reversal. We wait for such a breakout, ideally above $3,450, with +15% potential upside to $4,000 thereafter.

Meanwhile, price has broken back below 200 SMA, which is a sign of downtrend and could revisit $3,000 support next. That’s also the Channel support trendline where price could find support and bounce up.

Key Indicators & Market Signals

- ETH is currently hovering in the $3,100–$3,200 support zone.

- Immediate resistance stands around $3,400–$3,500.

- On-chain activity remains healthy with strong gas usage and consistent user transactions.

- Whale accumulation and dropping exchange reserves indicate confidence among long-term holders.

- Short-term direction depends heavily on rate-cut expectations, institutional flows, and broader risk-on sentiment in global markets.

Latest News Highlights

- A major corporate treasury (ETHZilla) has adopted Ethereum as part of its long-term asset strategy, signaling increased institutional interest.

- Robert Kiyosaki reiterated a bullish stance on ETH, calling it a “hot” long-term play.

- Citigroup maintains a year-end price target of $4,300 for Ethereum, citing strong fundamentals, staking, and network usage.

Summary

As of November 16, 2025, Ethereum trades at $3,170, moving sideways but supported by strong network activity and improving institutional sentiment. A breakout above $3,500 could open the path toward $3,800–$4,000, while a drop below $3,100 may trigger a retest of the $2,900–$3,000 region.

Despite short-term volatility, long-term indicators remain positive, reinforcing ETH’s position as a top-performing Layer-1 ecosystem.

For on-demand analysis of any cryptocurrency, join our Telegram channel.