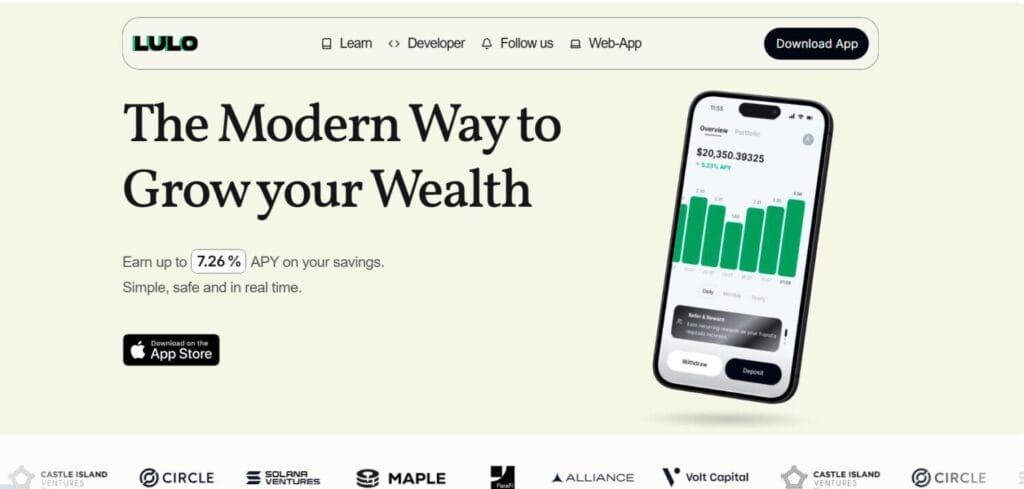

Lulo is a platform for saving stablecoins that helps you earn the best possible returns from different DeFi options. It tracks changing interest rates, automatically transfers your money to higher-yield accounts, and provides built-in protection to make DeFi safer and easier to use. Read this Lulo Review to know more about the platform.

Table of Contents

What is Lulo?

Lulo is a savings platform built on the Solana blockchain that allows users to earn interest on digital dollars, such as stablecoins like USDC and USDT, in a simple and automated way.

When users deposit their funds, Lulo distributes those deposits across multiple decentralized finance (DeFi) applications and continuously rebalances them to ensure the best possible returns.

The platform offers various savings options tailored to risk preferences. “Protected” deposits provide safer, steadier returns, while “Boosted” or “Custom” deposits enable users to take on higher risk for potentially greater rewards.

Lulo aims to make DeFi savings easy, transparent, and accessible for everyone, whether they are new to crypto or experienced investors looking for a smarter, automated way to grow their digital savings.

How does Lulo work?

Lulo automatically manages your savings to help you earn the best returns without doing any complex DeFi work.

When you deposit stablecoins like USDC or USDT, it spreads your money across trusted DeFi platforms that pay interest.

- The platform constantly tracks where the highest and safest yields are available. It then moves your funds automatically to those platforms, ensuring your money is always working efficiently.

- Lulo offers three savings modes to match your risk level. The Protected Mode gives safer, steady returns, the Boosted Mode offers higher but riskier earnings, and the Custom Mode lets you choose your own balance between risk and reward.

- The system regularly rebalances and compounds your earnings, so your savings keep growing automatically over time.

- You can withdraw your money anytime without any lock-in period. This gives you complete control and flexibility over your digital savings whenever you need them.

Also, you may read 6 Best Bitcoin Savings Account

Why Use Lulo?

- Transparent and Safe: Lulo shows exactly how your earnings are generated and how protection works. Everything is recorded on the blockchain and checked through audits.

- Flexible Options: You can choose between insured deposits for safety or go for higher returns by taking more risk. There’s also a custom option to set your own preferences.

- Easy and Automatic: Lulo manages your stablecoins automatically to get the best returns. Once set up, it keeps working without any extra effort.

Whether the goal is security or higher profits, Lulo adjusts to your comfort level. With smart automation, built-in protection, and a simple design, it makes saving with stablecoins easy and rewarding.

Lulo Review: Key Features

- Automated Yield Optimization: Deposited stablecoins are automatically spread across trusted DeFi platforms to earn the best possible returns.

- Protected and Boosted Deposits: “Protected” focuses on safer, steady returns, while “Boosted” offers higher potential earnings with more risk.

- Custom Strategy Option: Let users choose which protocols to invest in and set exposure limits to manage risk.

- Reward Accrual: Earn interest plus additional rewards and incentives on deposits.

- Transparency and Flexibility: All actions are on-chain, fully auditable, and users can withdraw anytime without restrictions.

Also, you may read the Solstice Finance Review

Lulo Review: Security Measures

- Automated Smart Contract Risk Protection: Lulo Protect provides automated coverage for deposits made into supported decentralized finance (DeFi) applications. This protection is built directly into deposit allocations, eliminating the need for manual claims processes.

- Diversification Across Multiple Protocols: Deposits are spread across multiple integrated Solana-based protocols, including Kamino, Drift, MarginFi, and Save, to reduce risk exposure.

- Transparent and On-Chain Protection Mechanics: The protection mechanics are visible on-chain, removing the need for claim filing or reliance on off-chain approvals.

- Automated Balancing and Coverage Enforcement: Lulo regularly monitors the ratio of Protected to Boosted Deposits to ensure adequate coverage at all times. If needed, Lulo limits new Protected Deposits to maintain sufficient coverage.

- Data Protection and Privacy: Lulo implements appropriate security measures to prevent unauthorized access, alteration, or disclosure of personal data, and complies with applicable data protection laws.

Lulo Review: Lulo Protect

Lulo Protect lets users adjust their stablecoin savings based on preferred risk and reward. It offers a simple way to choose between safer, steady returns or higher earnings with more risk.

Protected deposits

- Protected deposits are for users who want safety and steady growth. Lulo’s system keeps these funds safe, even if some risky strategies don’t do well.

- It spreads money across trusted platforms to lower risk and earn stable interest. This option suits users who prefer secure stablecoin savings.

Boosted Deposits:

- Boosted deposits are for users who accept a higher risk to earn greater returns. They help protect safer deposits by taking on more risk.

- Lulo keeps checking and adjusting these deposits across different lending platforms to get the best returns while controlling risk. This option suits users who want higher earnings and are comfortable with DeFi risks.

Lulo Review: Custom Feature

- Lulo’s Custom Deposits provide users with personalized control over their stablecoin investments, moving beyond the standard “one-size-fits-all” approach common in DeFi vaults.

- Users can select exactly which decentralized applications (DApps) to allocate their funds to and set a cap on the maximum amount assigned to any single protocol.

- This feature allows for fine-tuned strategies, letting users limit exposure to riskier platforms while targeting higher yields from preferred pools.

How It Works:

With Custom Deposits, users can choose which DeFi apps and pools to use and set a limit on how much money goes into each one, like 100%, 50%, or 33%. For example, with a 50% limit, only half the funds go to one app, and the rest are spread across others. Lulo then tracks rates and adjusts automatically to keep getting the best returns without manual effort.

Fees:

Using Custom Deposits is largely free, with only a one-time initialization fee of 0.005 SOL plus transaction costs. There are no recurring management fees or hidden charges, making it cost-effective for hands-on users.

Lulo Rewards

Lulo automatically collects lending rewards for users. Each user gets a unique blockchain address used for deposits, where rewards like points, tokens, or airdrops are added.

When Lulo moves funds between Solana apps, those deposits earn the same rewards as if the user had deposited directly. This means one deposit through Lulo can earn rewards from several different platforms at the same time.

Lulo Risks

Lulo uses smart contracts to transfer money between Solana dApps. If those contracts were ever hacked, user funds could be affected.

To reduce this risk, Lulo limits how long deposits stay in its own smart contracts. Most transfers and deposits happen directly with trusted Solana apps. This helps lower the chances of attacks and keeps user funds safer.

Conclusion

Lulo stands out as a user-friendly and versatile platform for earning yields on stablecoins within the Solana ecosystem. Its automated allocation system, combined with options like Protected, Boosted, and Custom Deposits, allows users to balance risk and reward according to their preferences.

The platform also simplifies reward collection by consolidating interest, tokens, and airdrops into a single on-chain address, making DeFi more accessible for both beginners and experienced users.

With robust security measures, transparent operations, and multiple support channels including Discord, Telegram, Twitter, and email, Lulo offers a reliable and flexible solution for anyone looking to grow their digital savings while engaging safely in decentralized finance.

Frequently Asked Questions

Can I withdraw anytime?

Yes for certain deposit types (e.g., “Protected” or “Custom”). However, for “Boosted” deposits there is a 48-hour withdrawal cooldown.

How is yield generated in Lulo?

Lulo aggregates funds and automatically allocates your deposit across integrated lending protocols (on Solana) to seek the highest yield. It monitors and rebalances approximately hourly.

Does Lulo cover funds in case an integrated protocol fails?

In the case of Protected deposits: yes, a portion of the overall system (e.g., from Boosted deposits) is used to cover losses in Protected deposits. For Custom/regular deposits, the risk is not fully mitigated.